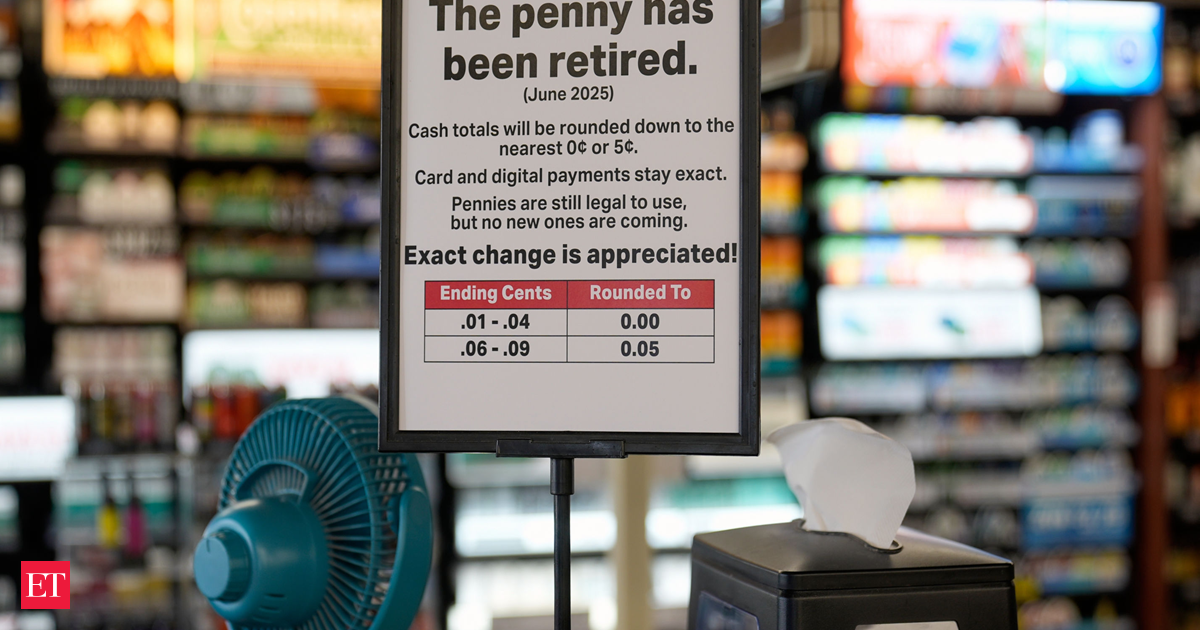

Is America running out of pennies? US President Donald Trump’s decision to stop producing the penny earlier this year is now showing real implications for the nation’s commerce. Many stores in the United States are now rounding their cash sales down to the nearest five cents, saying there are no federal guidelines on how to proceed.

In February, President Donald Trump said producing the coin was wasteful and too expensive and called on social media to “rip the waste out of our great nation’s budget, even if it’s a penny at a time”. The US Mint officially stopped making pennies in May.

The Treasury Department estimated shortages would start in early 2026 but it came too early. Banks can’t get pennies from the federal government, so businesses can’t get them from the banks. The penny problem started in late summer and is only getting worse as the country heads into the holiday shopping season.

ALSO READ: ‘Vance announces divorce, marries Charlie Kirk’s widow by end of 2026’: NYT author’s chilling prediction amid hug row goes viral

Merchants in US run out of pennies

According to a report by NBC Washington, multiple merchants in various regions of the country are facing the shortage of pennies and are unable to produce exact change. Banks are unable to order fresh pennies and are rationing pennies for their customers. One store chain, Sheetz, got so desperate for pennies, that it even tried to lure the coins back into circulation by offering customers a free soda in exchange for 100 pennies. Another business has warned that the shortage will cost millions this year because it is rounding transactions down to avoid legal challenges.

“It’s a chunk of change,” said Dylan Jeon, senior director of government relations with the National Retail Federation. “We have been advocating abolition of the penny for 30 years. But this is not the way we wanted it to go,” said Jeff Lenard with the National Association of Convenience Stores.

Live Events

Live Events

Banks said that they received little warning. Troy Richards, president of Guaranty Bank & Trust Co in Louisiana, told AP that penny deliveries abruptly stopped in August. “We got an email announcement from the Federal Reserve that penny shipments would be curtailed. Little did we know that those shipments were already over for us,” Richards said.ALSO READ: The mystery of ’67’: Why Dictionary.com chose a number instead of a word and why is everyone talking about it

Retailers and banks don’t want the penny to stick around because pennies, especially in bulk, are heavy. It has limited use. But the abrupt decision to get rid of the penny has come with no guidance from the federal government. Many stores have been left pleading for Americans to pay in exact change.

“We have been advocating abolition of the penny for 30 years. But this is not the way we wanted it to go,” said Jeff Lenard with the National Association of Convenience Stores.Why did pennis go away?Trump announced on February 9 that the U.S. would no longer mint pennies, citing the high costs. Both the penny and the nickel have been more expensive to produce than they are worth for several years, despite efforts by the U.S. Mint to reduce costs. The Mint spent 3.7 cents to make a penny in 2024, according to its most recent annual report, and it spends 13.8 cents to make a nickel.

ALSO READ: JD Vance becomes his own meme on Halloween: US Vice-President’s hilarious costume breaks the internet. Watch video

“Let’s rip the waste out of our great nation’s budget, even if it’s a penny at a time,” Trump wrote on Truth Social. A major challenge with pennies has been their limited recirculation. Most Americans keep them in jars or as decorative items, leading the Mint to continuously produce new coins to replace those kept out of circulation.

Beyond public hoarding, logistical barriers also hinder penny circulation. The Federal Reserve System manages coin distribution through about 170 coin terminals operated by armored carrier companies. Currently, nearly one-third of these terminals are closed to penny deposits and withdrawals, which has created regional imbalances in supply.

Bank representatives have said that restrictions on penny deposits worsen shortages, as areas with excess coins cannot send them to regions where they are needed. “As a result of the U.S. Department of the Treasury’s decision to end production of the penny, coin distribution locations accepting penny deposits and fulfilling orders will vary over time as (penny) inventory is depleted,” a Federal Reserve spokeswoman said.

The end of penny production is also creating legal challenges for retailers. In several states and cities, rounding up cash transactions to the nearest nickel or dime is prohibited. These rules are meant to ensure equal pricing for both cash and card-paying customers.