Gambling has moved from entertainment to a necessity for those in financial distress, says Jaco van Jaarsveldt, head of commercial strategy and innovation at Experian.

“While all consumers remain under financial distress, consumers who partake in gambling activity exhibit higher levels of financial distress than those who do not partake in gambling activities,” Van Jaarsveldt adds.

With access to 55 million consumer records, Experian has deep insights into spending patterns and levels of financial distress in SA.

This, overlain with some 800 000 transactional records from Vault22, gives us perhaps the best picture yet of SA’s out-of-control gambling problem.

There is a clear correlation between gambling activity and financial distress. One group that can scarcely afford gambling – those that have just enough to cover the basic necessities – have shown a massive increase in financial distress levels. On average, they can spend up to 40% of their gross income on gambling each month.

Some categories are using up to half of their South African Social Security Agency (Sassa) grants on bets. That alone has the potential to annul the social compact between the state and the poor.

The same is true of the middle market segment, which spends 38-50% of its income on gambling, 30% more than on groceries.

Even the affluent groups are spending 10-12% on gambling, though their behaviour appears to be more controlled.

This report should be required reading for every politician in the country. It’s a depressing lens into the frightful economic conditions facing many South Africans and how they are trying to cope.

Online gambling as a national crisis is beginning to receive the kind of attention it deserves, with companies like Pick n Pay, Capitec and Famous Brands highlighting its crushing impact on consumer spending.

Unemployment and gambling

There’s also a correlation between unemployment and gambling, says Experian.

Consumers are under financial distress despite interest rate cuts of 1.25 percentage points and inflation stabilising around 3.4%. The demand for credit to supplement monthly income has shot past pre-COVID levels, but the banks aren’t interested.

That’s perhaps understandable, given the risk of lending to consumers who already have entrenched gambling habits and are trying to make ends meet. This has forced many consumers to seek other ways to supplement their monthly income, such as through gambling and online trading.

SA spent more on betting in the last financial year than on education, social development and health combined.

A total of R1.5 trillion – nearly 20% of GDP – was spent on bets over the last year, with 3-5% of this being retained by the house.

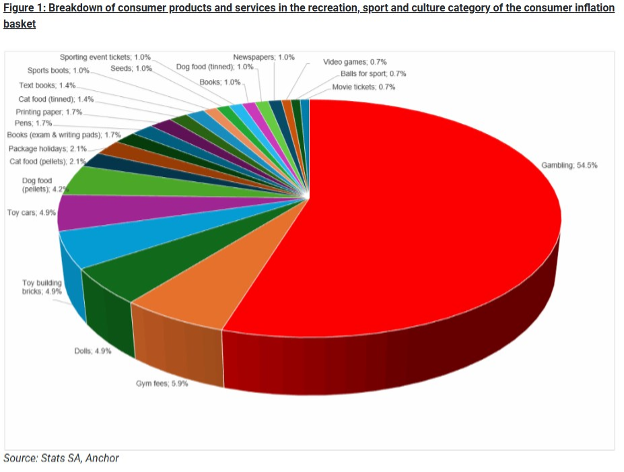

Statistics SA’s September Stats Biz shows that gambling accounts for 1.6% of household spending and nearly 55% of all spending on recreation, sport and culture.

The National Gambling Board (NGB) released statistics two weeks ago showing R74 billion was being siphoned out of the economy, mostly to online gambling platforms such as Betway and Hollywoodbets. The NGB has welcomed a recent court judgment that found it unlawful for bookmakers in Gauteng to offer casino-style games, such as roulette.

Though the NGB says the ruling applies to all provinces, MyBroadband reports that online gambling platforms Hollywoodbets and Betway have indicated they will refuse to comply with the directive, which was limited to Gauteng.

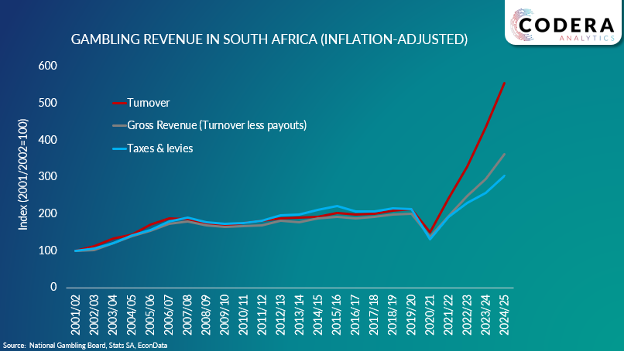

Source: National Gambling Board, Stats SA, EconData

The reluctance of online gambling platforms to toe the NGB line is perhaps understandable, given the financial windfall they have enjoyed since Covid.

As the chart above from Codera shows, gambling is one segment of the ‘economy’ that is booming, with gross gambling revenues (GGR) growing at more than 25% a year. This appears to have outraged many, leading to calls for tougher laws around advertising for gambling.

Online gambling platforms contribute little to the economy in the way of jobs and social betterment – despite their PR to the contrary.

This new research by Experian and Vault22 examines gambling at a segmental level, and the problem appears even worse than previously thought, particularly among some categories of the poor.

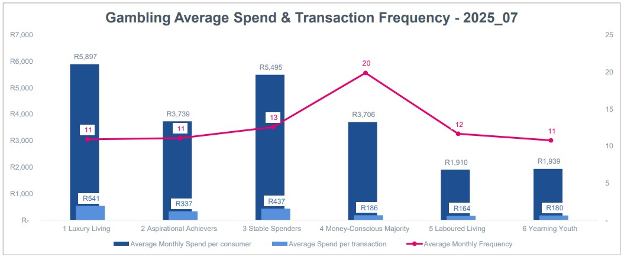

But the biggest punters are from the more affluent categories, as the following chart shows.

Source: Experian Africa Gambling Insights 2025

Experian divides the country into financial affluence segments, based not just on affluence but also on financial behaviour and distress levels.

The largest category is the money-conscious majority (42%), comprising older people who are careful about where and how they spend their money.

The next-largest is the ‘laboured living’ category (24%), comprising those below the national tax threshold who spend their money on basics such as food and shelter.

The ‘yearning youth’ category (15%) comprises labourers and working students with limited funds for non-essential spending. Aspirational achievers (10%) are young and middle-aged professionals who can afford property and a higher standard of living.

Stable spenders (6%) and luxury living (4%) make up the balance.

What’s notable in the chart above is the red line, which represents the number of bets per month. This comes to 20 for the money-conscious majority, with an average monthly spend of R186. Even the laboured living category, who are living on the edge, are making 12 bets a month on average, with an average monthly spend of R164.

The luxury living and aspirational achievers have more disposable income, and their monthly bet tally comes to between R3 739 and R5 897. Both categories are placing an average 11 bets a month.

The Generation X category (aged 45-60) has increased its gambling activity massively, almost doubling in recent months in terms of total gambling spend.

The stats also show that online GGR now accounts for more than 60% of all gambling revenue.

Is there a solution?

“The way around it is not to ban it – that drives it underground. We need to explain that the house always wins,” says Van Jaarsveldt.

What’s needed above anything else, he says, is mass education on the consequences of gambling.

If left unchecked, the nation’s gambling and digital betting boom could morph from an engine of growth into a drag on household resilience, says Anchor economist Casey Sprake.

Source: Stats SA, Anchor

“Balancing these forces will require updated regulation, stronger financial education, and a renewed focus on responsible gambling as a matter of both social policy and economic stability,” says Sprake.

“In the absence of more decisive policy intervention and financial literacy initiatives, the industry’s expansion risks entrenching a pattern of consumption-led liquidity extraction, rather than contributing to inclusive, long-term economic resilience. Sustainable returns will depend not just on market momentum, but on the sector’s ability to balance innovation with responsibility.”

This article first appeared in Moneyweb.