54m agoTue 22 Jul 2025 at 2:42amMarket snapshotASX 200: +0.1% at 8,673 points (live values below)Australian dollar: flat at 65.20 US centsAsia: Nikkei +0.4%, Hang Seng -0.2%, Shanghai -0.3%Wall Street: S&P500 +0.1%, Dow flat, Nasdaq +0.4%Europe: DAX +0.1%, FTSE +0.2%, Eurostoxx -0.1%Spot gold: -0.2% at $US3,388/ounceBrent crude: -0.8% to $US68.64/barrelIron ore: +2.7% to $US103.60/tonneBitcoin: +0.5% at $US117,608

Prices current around 12:40pm AEST

Live updates on the major ASX indices:

6m agoTue 22 Jul 2025 at 3:30am

Australian dollar eyes 67 US cents: Deutsche

It wasn’t long ago the Australian dollar was flirting with trading in the 50s against the US dollar.

At the time, Deutsche Bank said the “risk” the AUD was to the downside.

While it did fall a touch further, the Aussie dollar has appreciated against the greenback for much of the first half of this year.

Now, Deutsche Bank sees the local currency rising further.

“AUD/USD remains on-track to meet or exceed our year-end target of 0.67,” Macro Strategist Lachlan Dynan wrote in a note.

“A potential rise in Super funds’ hedge ratios stands as an upside risk, while the market’s recent turn to net short AUD is helping clear the road for gains.”

While it’s not great news for travellers, it’s certainly not bad news.

22m agoTue 22 Jul 2025 at 3:14am

Why does the RBA care about market pricing?

Why does the RBA board take note of market expectations? It’s supposed to be independent and make decisions to achieve its inflation and employment objectives, not kowtow to the market

– Alex

Hi Alex,

The RBA takes note of market expectations for the future path of interest rates because it uses them for its official forecasts.

It doesn’t mean the RBA agrees with the pricing. It just uses the pricing as an input to make its forecasts, and then the Board’s discussions of different policy scenarios are based on how deviations from the implied market path affect the economic outlook.

As Michelle Bullock said in November:

“We use the market pricing as our assumption for the cash rate target when we do our forecasts.

“I’m not saying that’s our forecast for the cash rate because, as I’ve said a number of times before, we have to make forecasts, we have to do them to try and guide ourselves.”

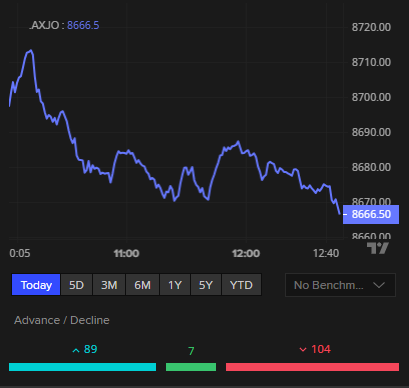

26m agoTue 22 Jul 2025 at 3:11amASX flat as miners gain and banks slump

The ASX 200 has seen its opening gains pared back to be flat at 8,666 points at 12:50pm AEST.

ASX 200 today (LSEG, ASX)

ASX 200 today (LSEG, ASX)

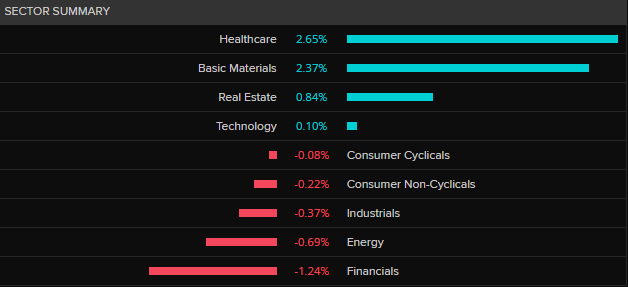

Gains and losses are spread across the sectors, with the miners and banks pulling in opposite directions.

ASX 200 by sector (LSEG, ASX)

ASX 200 by sector (LSEG, ASX)

The big miners have been buoyed by a jump in iron futures.

BHP, Rio Tinto and Fortescue are all up between 2% to 3%.

Champion Iron has bounced 4.8% after selling a 49% stake in a Canadian mine to Japanese interests.

ASX major miners (LSEG, ASX)

ASX major miners (LSEG, ASX)

The selling in the banks has rolled on from yesterday’s slump as investors continue to bail out, taking some handsome profits with them.

Heavyweight CBA has dropped another 2.6% (down to a 2-month low) and NAB is down 2.1%

ASX banks (LSEGH, ASX)

ASX banks (LSEGH, ASX)

Gold stocks are having a good day despite a small slide in the spot price of the metal.

ASX major gold stocks (LSEG, ASX)

ASX major gold stocks (LSEG, ASX)

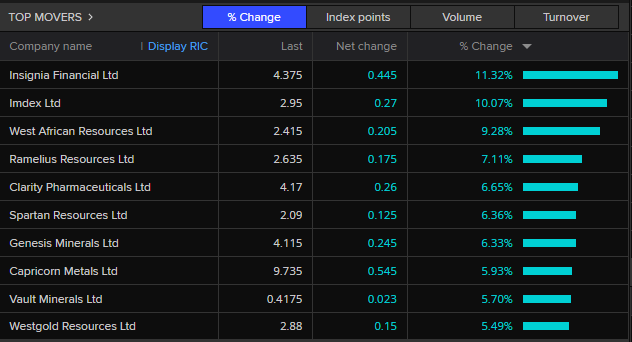

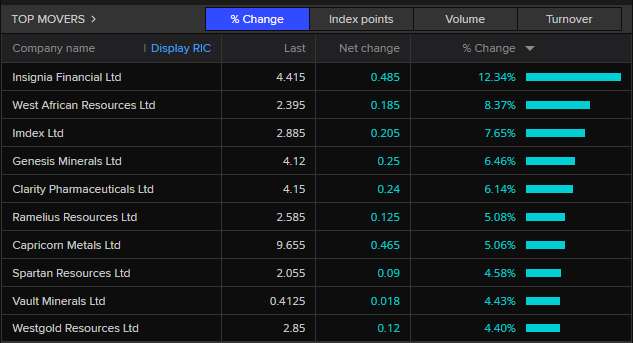

Wealth manager Insignia is the biggest winner so far after announcing it had agreed to a $3.3 billion takeover offer, while gold miners such as West African Resources and Ramelius, have also been well bid.

ASX 200 top movers

ASX 200 top movers

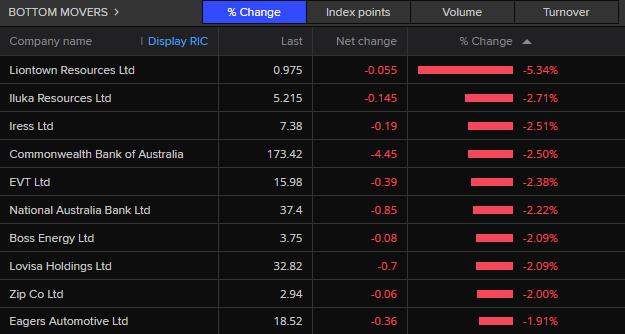

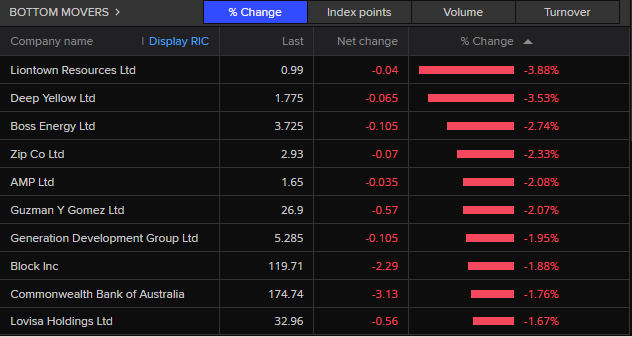

At the other end of the scale, lithium miner Liontown Resources (-5.3%) is out of favour, while mineral sands miner and rare earths wannabe Iluka (-2.7%) is giving back some of its recent gains.

ASX 200 bottom movers (LSEG, ASX)

ASX 200 bottom movers (LSEG, ASX)

38m agoTue 22 Jul 2025 at 2:58am

RBA Board discusses the likely impact of Trump’s tariffs on the US economy

The RBA Board minutes show members spent a lot of time, in their discussion about international economic conditions, talking about Donald Trump’s tariffs and war in the Middle East.

Members noted that developments in trade policy settings overall had been broadly consistent with the assumptions in the staff’s baseline forecasts published in May.

These assumptions were for tariffs to settle at lower rates than had been announced in early April, but significantly higher than prior to the escalation of trade tensions.

Measures of global economic uncertainty had fallen somewhat, as reflected in a narrower range of expectations among professional forecasters for US GDP growth in late 2025, but the outlook remained highly unpredictable.

In part, that reflected continued uncertainty over future trade policy. The US President had begun to send letters to trading partners setting out new tariff rates to be applied from 1 August and suggesting that these rates could be adjusted subject to progress on trade negotiations.

The global outlook had also been clouded by the 12-day Iran–Israel war. While the conflict in the Middle East had de-escalated significantly and the overall effects on the global economy had been limited, members noted that more persistent shocks to energy prices, should they occur, would affect the prospects for global growth and inflation.

The RBA Board members discussed the possibility that it could take quite a long time before we see the full negative effect of Trump’s tariffs on US growth and inflation:

Members noted that trade policy developments thus far had had a limited effect on momentum in the global economy.

Household consumption and business conditions in the United States had been fairly resilient amid muted pass-through of higher tariffs to prices.

However, the central case remained for US inflation to increase and output growth to slow in the second half of 2025 as inventories are run down and firms’ capacity to absorb higher tariffs diminishes.

Members noted that it was possible that the effects could in fact be slower to emerge but more persistently adverse, as had occurred following some other changes to global trading arrangements in prior years.

The Act was expected to support US economic activity in the short term but lead to structurally wider fiscal deficits and higher government debt in the long term.

To be continued..

58m agoTue 22 Jul 2025 at 2:38am

A global tax floor was meant to stop profit shifting. Then, the G7 ‘caved’

Australia could miss out on significant revenue from US multinational companies operating here, after the G7 “caved” to Donald Trump, says the man who spearheaded negotiations on a global minimum tax rate.

The Organisation for Economic Cooperation and Development’s (OECD) former director of tax, Pascal Saint-Amans, says Australia will no longer be able to apply a top-up tax if a US firm pays less than a 15 per cent tax rate.

It comes after the US president undid more than a decade of progress towards multinationals paying their fair share of tax, striking a deal to exempt America from a worldwide corporate tax floor.

Read more about how Australian start-ups are reacting and the broader fallout in this piece from Nassim Khadem:

1h agoTue 22 Jul 2025 at 2:24amRBA Board members note that RBA decisions that buck market expectations are not unprecedented

In the same discussion of financial conditions, the minutes show the RBA Board members knew they’d been upsetting (my words) financial markets by bucking expectations for a rate cut.

Expectations for the cash rate had moved a bit lower since the previous meeting; around half of that move had followed the communication of the Board’s decision in May and the remainder largely reflected market interpretations of the subsequent flow of economic data.

Members noted that a 25 basis point reduction in the cash rate at the current meeting was almost fully priced in by market participants and was also expected by most market economists.

Market pricing implied that a further two reductions in the cash rate over the remainder of the year were expected, one more than had been anticipated prior to the May meeting.

Members acknowledged that there had been previous occasions when market participants had been very confident about the outcome of a monetary policy decision but the (Reserve Bank) Board had decided on an alternative course.

Having said that, they noted that current monetary policy settings were still “modestly restrictive.”

Members discussed how best to assess the ‘neutral’ cash rate in Australia.

The forecasts in the May Statement on Monetary Policy– which provided the staff’s most recent comprehensive assessment of the outlook – suggested that underlying inflation would stay around the midpoint of the 2–3% range and the labour market would remain close to full employment, assuming that the cash rate followed the then-prevailing market path, which was for a gradual decline to a little over 3 per cent by mid-2026.

Those forecasts therefore suggested that the current setting of monetary policy was modestly restrictive.

They said the average of a range of alternative model estimates of the neutral cash rate pointed to a broadly similar conclusion too.

And interestingly, they said some of the public discussion about the necessity of a rate cut may have been led astray by some of those alternative models.

Members observed that estimates from these models are subject to considerable dispersion and uncertainty and the average is sensitive to the choice of models included in the range.

Against that backdrop, public discussion of the stance of monetary policy had possibly overemphasised the inferences that could be drawn from these alternative models, especially for the near term.

To be continued…

1h agoTue 22 Jul 2025 at 2:05am

Red and green arrows

When you show the price and movement of individual shares, what do the little red and green arrows mean? They don’t align with increases or decreases in price. Thank you.

– Jonathan

Hi Jonathan, those little red/green arrows on individual share prices in the market updates note the momentum of the trade (at that specific moment).

Green: the last movement in the share price was up.

Red: the last movement was down.

1h agoTue 22 Jul 2025 at 2:03am

RBA board’s discussion of financial conditions

In the minutes, the RBA board’s discussion of financial conditions had a lot of territory to cover:

The members noted that, after the craziness in financial markets that followed Donald Trump’s shock tariffs announcement on April 2, things had largely settled down:

Members commenced their discussion of financial conditions by observing that financial market pricing continued to imply a relatively benign outlook for global growth and inflation.

Corporate bond spreads had fallen back to levels close to those prevailing immediately prior to the US Administration’s tariff announcements in early April.

Equity prices were at or near record highs, and measures of equity risk premia were low.

The improvement in market conditions in preceding weeks appeared to reflect an expectation that the most extreme outcomes for US tariffs were likely to be avoided.

By the time of the meeting, global stock markets had started rising again and were back near record highs.

The members discussed the possibility that financial markets were improperly pricing risks in the system, or whether market participants had been overly pessimistic immediately after Trump’s tariffs were announced.

However, the final scope of tariffs and policy responses in other countries remained unknown; there were persistent geopolitical tensions, including conflict in the Middle East and Ukraine; and increasing concerns about long-run fiscal sustainability in a number of major advanced economies.

Members discussed whether current financial market pricing reflected a degree of complacency on the part of market participants about the impact of these factors on the outlook for the global economy or suggested that earlier pessimism might have been overstated.

They said, despite the craziness in global markets since April, the value of Australia’s dollar remained relatively stable.

The Australian dollar had been little changed on a trade-weighted basis since the start of 2025, despite significant global developments.

The decline in yield differentials between Australia and the rest of the world since the turn of the year had placed downward pressure on the Australian dollar, but this had been offset by the broad-based depreciation of the US dollar from the historical highs reached in 2024.

They said the RBA index of commodity prices had also been little changed since the previous meeting.

Members noted that a combination of the higher supply of iron ore and the recent decline in Chinese steel production had weighed somewhat on iron ore prices.

But this had been offset by rises in the prices of gold, rural and other commodities.

Model estimates of the Australian dollar exchange rate suggested that the trade-weighted exchange rate was close to its long-run equilibrium level.

To be continued..

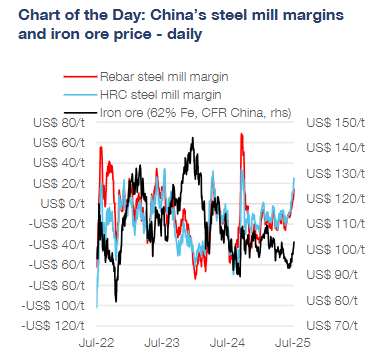

1h agoTue 22 Jul 2025 at 1:45amIron ore prices at 3-month high, but is the rally sustainable?

A bit more on the rebound in iron prices, with the spot price now at about $103/tonne — the highest price since early April.

The spot price has now rallied more than 10% since dipping below $US93/tonne three weeks ago.

CBA mining and commodities analyst Vivek Dhar says demand hopes, particularly around stimulus for China’s property sector, have played a role in the bounce, however, government reforms to the steel sector are likely to have had an even larger impact.

And while iron ore miners are benefiting now, longer-term supply cuts could well mean lower prices.

“Over the weekend, the launch of the RMB 1.2 trillion ($260 billion) hydropower project on the Yarlung Tsanpo river in Tibet also boosted demand expectations,” Mr Dhar said.

“However, given policymakers are yet to announce any substantial property stimulus package, and China’s economy has proven resilient so far this year, demand alone is unlikely to be the reason that iron ore prices have tracked back above $US100/t.”

Mr Dhar says most of the price increase can be attributed to supply-side reforms in the steel sector.

“These reforms primarily aim to curb ‘involution,’ whereby intense competition and overcapacity has crushed margins across several industries,” he said.

Mr Dhar says it is noteworthy how much steel mill margins in China have expanded despite the absence of any substantial stimulus policy.

Steel production is down almost 10% compared to a year ago, continuing an often-used policy tactic of imposing output cuts to curb over-capacity or reduce greenhouse emissions.

However, the supply-side cuts may mean the current bounce is a short-term phenomenon, according to Mr Dhar.

“Steel output cuts mean weaker iron ore demand.

“This typically translates through to higher steel mill margins and subdued iron ore prices.

“It is this logic that underpins our view that the recent rally in iron ore prices is unsustainable.”

China steel margins vs iron ore sport price (Platts, Bloomberg, CBA)

China steel margins vs iron ore sport price (Platts, Bloomberg, CBA)

1h agoTue 22 Jul 2025 at 1:43am

RBA board minutes released

The minutes of the most recent Reserve Bank Board meeting have been published.

At its meeting two weeks ago, the board surprised financial markets and plenty of economists when it decided to keep the cash rate target on hold (rather than delivering a cut).

The decision was not unanimous.

The board voted by majority, 6-3, to leave the cash rate target unchanged at 3.85%.

That means six board members chose to keep rates steady and the other three (we presume) opted for a rate cut.

Members present:

Michele Bullock (governor and chair)Andrew Hauser (deputy governor and deputy chair)Marnie Baker AMRenée Fry-McKibbinIan Harper AOCarolyn Hewson AOIain Ross AOAlison Watkins AMJenny Wilkinson (Treasury secretary)

The minutes of the RBA Board meeting are usually arranged in sections with these subheads: “Financial conditions”, “International economic conditions”, and “Domestic economic conditions”.

Then there’s a final subsection where they discuss their “considerations for monetary policy”.

We’ll look at them in more detail in the next post.

2h agoTue 22 Jul 2025 at 1:07amASX marginally higher, miners up as banks continue to slide

The ASX 200 has seen its opening gains pared back to be up just 0.1% to 8,668 points at 10:45 am AEST.

Gains and losses are spread across the sectors, with the miners and banks pulling in opposite directions.

ASX 200 by sector (LSEG, ASX)

ASX 200 by sector (LSEG, ASX)

The big miners have been buoyed by a jump in iron futures.

BHP, Rio Tinto and Fortescue are all up between 2.7% and 3%.

Champion Iron has bounced 5% after selling a 49% stake in a Canadian mine to Japanese interests.

ASX major miners (LSEG, ASX)

ASX major miners (LSEG, ASX)

The selling in the banks has rolled on from yesterday’s slump as investors continue to bail out, taking some handsome profits with them.

Heavyweight CBA has dropped another 2.2% and Westpac is down 1%

ASX banks (LSEG, ASX)

ASX banks (LSEG, ASX)

Wealth manager Insignia is the biggest winner so far after announcing it had agreed to a $3.3 billion takeover offer, while gold miners such as West African Resources and Genesis Minerals, have also been well bid.

ASX 200 top movers (LSEG, ASX)

ASX 200 top movers (LSEG, ASX)

At the other end of the scale, lithium miner Liontown Resources (-3.9%), as well as a uranium miners Deep Yellow (-3.5%) and Boss Energy (-2.7%), are out of favour.

ASX 200 bottom movers (LSEG, ASX)

ASX 200 bottom movers (LSEG, ASX)

2h agoTue 22 Jul 2025 at 12:40am

The other side of the petrol spike, as prices fall sharply

Hi team,

Just jumping in to give you a bit of the small picture — petrol prices at the bowser.

The national average price of a litre of unleaded petrol fell 8.1 cents to 177.5 cents in the week to Sunday, July 20.

Weekly data from the Australian Institute of Petroleum details the slide, which puts the average back under the 12-month average figure of 180.7 cents.

It has been a rollercoaster few weeks for retail prices.

The weekly changes have been significant (and these are averages, not the prices at individual stations).

Here are the weekly changes, in cents:

National metro average: -11.3 centsFive cap city average: -7.6Sydney: -19.1Canberra: -1.8Melbourne: -15Brisbane: -16.5Adelaide: +13.9 (a rise)Perth: -1.2Darwin: -1.3Hobart: -0.5

3h agoTue 22 Jul 2025 at 12:22am

Market snapshotASX 200: +0.4% at 8,705 points (live values below)Australian dollar: flat at 65.23 US centsAsia: Nikkei +0.4%, Kopsi -0.1%Wall Street: S&P500 +0.1%, Dow flat, Nasdaq +0.4%Europe: DAX +0.1%, FTSE +0.2%, Eurostoxx -0.1%Spot gold: -0.1% at $US3,392/ounceBrent crude: -0.2% to $US69.06/barrelIron ore: 2.7% to $US103.60/tonneBitcoin: +0.5% at $US117,527

Prices current around 10:15am AEST

Live updates on the major ASX indices:

3h agoTue 22 Jul 2025 at 12:16amASX up 0.4pc on opening

The ASX 200 is up a better-than-expected 0.4% to 8,705 points on opening (10:15am AEST).

The bounce has been led by the big miners following a jump in iron ore futures.

3h agoTue 22 Jul 2025 at 12:11am

Insignia jumps 14pc on takeover agreement

Financial services firm Insignia Financial has jumped 14% on opening after announcing it agreed to a takeover offer from CC Capital, which values it at $3.3 billion.

The company, formerly known as IOOF, says the US-based investment firm will acquire all shares for $4.80 per share in cash.

Shares were trading at $4.48/share, still well below the offer price, at 10:05am AEST.

3h agoTue 22 Jul 2025 at 12:04am

Champion Iron signs funding agreement for Canadian project

Junior iron ore player Champion Iron has sold 49% in its Canadian Kami project to Japanese interests.

In a statement to the ASX, Champion said it had entered a definitive framework agreement to sell the stake to Nippon Steel and the Japanese trading house Sojitz Corporation for $245 million.

Champion CEO David Cataford says the deal will enable the project to advance without impacting the miner’s liquidity.

Champion acquired the Kami project in 2021.

It is in Newfoundland, near Quebec’s eastern border, not far from another Champion project, the Bloom Lake mine.

3h agoMon 21 Jul 2025 at 11:52pm

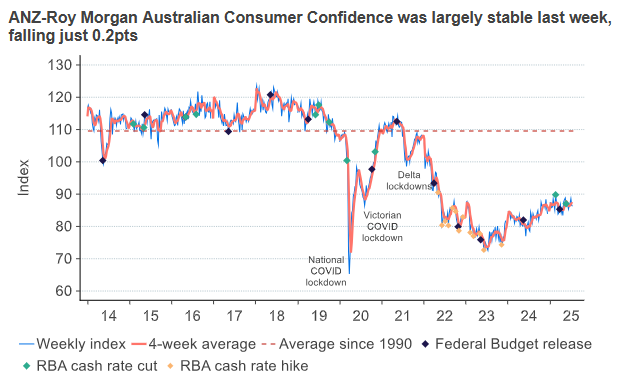

Consumer confidence stable despite RBA’s surprise decision

The mood of Australian consumers appears to have been largely unaffected by the RBA’s surprise decision earlier this month not to cut rates.

The ANZ-Roy Morgan weekly measure of consumer confidence fell only marginally after the announcement and continues to track along a month-long trend.

ANZ economist Sophia Angala says, “consumer confidence series largely moved sideways last week.”

The result was driven by a mixture of outcomes across the subindices.

“While household confidence in financial conditions weakened, confidence in economic conditions improved despite soft labour market data last week,” Ms Angala said.

“Confidence amongst mortgage holders is up, compared to two weeks ago, despite the RBA’s surprise decision to hold the cash rate at 3.85%.

“Confidence amongst renters declined to a 10-month low, with renters the least confident housing cohort.”

ANZ-Roy Morgan Consumer Confidence (ANZ-Roy MOrgan, Macrobond)3h agoMon 21 Jul 2025 at 11:43pmIron ore futures lift on massive Chinese hydro project

ANZ-Roy Morgan Consumer Confidence (ANZ-Roy MOrgan, Macrobond)3h agoMon 21 Jul 2025 at 11:43pmIron ore futures lift on massive Chinese hydro project

Iron ore futures have continued to push higher on the news of a massive new Chinese hydropower project.

Futures lifted 0.6% to a five-month high of $US97.84/ tonne after China’s Premier Li Qiang announced construction had begun on what will be the world’s largest hydropower dam, on the eastern rim of the Tibetan Plateau.

The 1.2 trillion yuan ($260 billion) dam will be the world’s largest hydropower project.

Premier Li described the dam as “the project of the century”.

However, it is not without its critics, with both India and Bangladesh raising concerns, while NGOs say the dam will irreversibly harm the Tibetan Plateau and hit millions of people downstream.

ANZ commodities analyst Daniel Hynes says the project promises to deliver a positive economic boost for construction materials such as concrete and steel.

“It also triggered hopes that the government is returning to its old handbook of fiscal stimulus measures to support economic growth,” Mr Hynes said.

“Sentiment (in iron ore) was also supported by the continued push to curb excess competition and overcapacity in the steel industry.

“Such moves could have a positive impact on mill margins, which would ultimately lift steel-making raw materials such as iron ore.”

4h agoMon 21 Jul 2025 at 11:30pm

Perpetual assets under management lift despite fund outflows

Wealth manager Perpetual has reported a 2.5% increase in assets under management for the fourth quarter.

Total assets under management on June 30 were reported at $227 billion, up from $221 billion at the end of March.

In a statement to the ASX, Perpetual said the increase was primarily driven by favourable market movements of $14.6 billion, which was offset by net outflows of $3.9 billion, and negative currency movements of $5.1 billion.

Perpetual also said it was facing impairment charges of between $195-to-$205 million in its 2025 full year results relating to a write-down in goodwill and other intangibles.

The company also says it is continuing to pursue the sale of its wealth management business and is “engaged in discussions with interested parties”.

ASX 200: +0.1% at 8,673 points (live values below)Australian dollar: flat at 65.20 US centsAsia: Nikkei +0.4%, Hang Seng -0.2%, Shanghai -0.3%Wall Street: S&P500 +0.1%, Dow flat, Nasdaq +0.4%Europe: DAX +0.1%, FTSE +0.2%, Eurostoxx -0.1%Spot gold: -0.2% at $US3,388/ounceBrent crude: -0.8% to $US68.64/barrelIron ore: +2.7% to $US103.60/tonneBitcoin: +0.5% at $US117,608

ASX 200: +0.1% at 8,673 points (live values below)Australian dollar: flat at 65.20 US centsAsia: Nikkei +0.4%, Hang Seng -0.2%, Shanghai -0.3%Wall Street: S&P500 +0.1%, Dow flat, Nasdaq +0.4%Europe: DAX +0.1%, FTSE +0.2%, Eurostoxx -0.1%Spot gold: -0.2% at $US3,388/ounceBrent crude: -0.8% to $US68.64/barrelIron ore: +2.7% to $US103.60/tonneBitcoin: +0.5% at $US117,608