U.S. Fence Construction Market Growth Potential

Key Highlights

Study Period 2019 – 2032

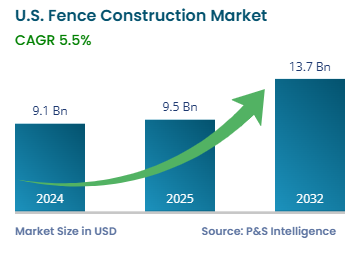

Market Size in 2024USD 9.1 Billion

Market Size in 2025USD 9.5 Billion

Market Size by 2032USD 13.7 Billion

Projected CAGR 5.5%

Largest RegionSouth

Fastest Growing RegionWest

Market Structure Fragmented

Market Size

Major Companies

Important Takeaways

Market Size and Forecast

Industry Trend

Regulatory Landscape

Demand Trend Analysis

Companies Recent Strategical Developments

Key Stakeholders

Voice of Industry Experts/KOLs

Future Opportunity

Explore the market potential with our data-driven report Get Sample Pages

U.S. Fence Construction Market Analysis

This U.S. fence construction market size was USD 9.1 billion in 2024, which is expected to reach 13.7 billion by 2032, growing at a CAGR of 5.5% during the forecast period (2025– 2032).

More people and businesses are investing in fence construction for securing properties, with a focus on stylish designs. Homeowners construct new houses, which leads them to install fences primarily for safety functions along with pet containment and visual enhancement purposes. Businesses, schools, and industrial facilities depend on fencing for better security alongside controlled entry access.

The need for safety, along with property protection, has raised residential and commercial fencing requirements which continue to grow steadily. The market receives additional growth from the need to repair or replace aged fences that sustain weather damage and normal deterioration. The market expands because property owners choose long-lasting fencing materials such as vinyl, metals, and composites. Building owners, along with private householders, find this long-lasting material superior to wood since they need less maintenance.

Government infrastructure projects that require fencing contribute to market expansion because of their widespread implementation of parks and public facilities and highway construction. The growing pattern of home renovation and security investment trends will maintain steady demand for fences over the coming years.

U.S. Fence Construction Market Segmentation and Category Analysis

Insights by Type

Metal is the largest category, with a market share of 55% in 2024, because they provide remarkable strength, long service life, and minimal upkeep needs compared to wooden fences. The market chooses metal fences primarily for commercial and industrial applications and residential purposes because they provide security benefits at affordable prices. Businesses, schools, and public institutions commonly use chain-link fences as their security solution because these fences provide cost-efficient boundary protection for extensive areas. Homeowners typically choose ornamental metal fences because they offer both durability and a sophisticated appearance.

Plastics & composites are the fastest-growing category, with 6.3% CAGR, because consumers appreciate its durability, low weight, easy availability and installation, and cost-efficient maintenance. Plastic fencing stands out from wood since it does not decay and remains free of staining while featuring multiple design options. People are selecting sustainable, long-lasting materials at an increasing rate which drives up their popularity.

The following types are studied in this report:

Metal (Largest Category)

Wood

Plastics & Composites (Fastest-Growing Category)

Concrete

Others

Insights by Product

Welded fences are the largest category, with a market share of 30%, in 2024 because consumers require increased security and livestock management capabilities. Welded fences are popular in the U.S. for their durability, security, and low maintenance. Commonly used in residential, agricultural, and industrial settings, they offer a strong barrier with clean aesthetics. Their rigid structure resists damage and deformation, making them ideal for both perimeter protection and controlled-access applications across various sectors. As per the USDA, the country had 1.88 million farms in 2024.

Electric fences are the fastest-growing category, with 6.5% CAGR, because modern security and livestock management needs continue to expand. The fencing solution finds its primary use among farmers and ranchers for animal containment, but businesses and high-security facilities deploy them to deter trespassers. The advancement of technology brought forth electric fences that are efficient in operation, easier to maintain, and safer for users than the traditional models. People are selecting electric fences because of rising security concerns while recognizing their reliable and effective characteristics. Electric fences serve both purposes of animal enclosure for farmers and business facility protection. Better technological development has resulted in electric fences that are safer and at the same time they offer better efficiency and easy maintenance.

Here are the categories of this segment:

Hinge-Joint

Electric (Fastest-Growing Category)

Welded (Largest Category)

Others

Insights by End User

Residential is the largest category, with a market share of 55% in 2024. Homeowners seek security and privacy in addition to appealing property appearance, which drives them to purchase fences for residential use. The growth of house construction and home remodeling trends continue to sustain high demand for fences. People construct fences to provide both safety measures for children and pets and to achieve attractive home design while increasing security protection. As per studies, over 85 million single-family homes exist in the country, and a large proportion of those are fenced.

Commercial is the fastest-growing category, with 6.8% CAGR, because businesses, schools, and public facilities are increasing their spending on security and property protection measures. Rising security fears have led commercial properties to install fences, as well as gates and high-security barriers. Retail stores, office buildings, and warehouses require fencing installations primarily for access regulations and to prevent theft. The expanding cities and growing businesses create an expanding requirement for commercial fencing.

Here are the end users studied in this report:

Residential (Largest Category)

Commercial (Fastest-Growing Category)

Industrial

Agriculture

Drive strategic growth with comprehensive market analysis Preview With a Free Sample

U.S. Fence Construction Market Regional Market Performance

The southern region is the largest, with a market share of 45% in 2024, because it contains the most people, fast-growing cities, and numerous new residential properties. Texas, Florida, and Georgia maintain continuous residential and commercial construction expansion, which drives up fence requirements. Due to its warm weather conditions, southern residents frequently allocate greater financial resources to outdoor areas that require fencing to achieve privacy, security, and enhance home aesthetics. The market receives additional support from South-based ranches and farms that need fencing to contain their livestock. As per the USDA, Texas leads the U.S. agricultural sector with 230,662 farms in 2022 spanning 125.5 million acres.

The West is the fastest-growing region. More property owners and business operators, are making investments in durable fencing systems because of their growing interest in protecting homes from security threats and wildfires. The market for metal and composite materials continues to grow because customers want environmentally sustainable and fireproof fencing options. The number of people migrating to Western urban and suburban locations boosts the rapid expansion of fencing requirements.

Here are the categories of this segment:

Northeast

Midwest

West (Fastest-Growing Category)

South (Largest Category)

U.S. Fence Construction Market Competitive Landscape

The market is fragmented because large-scale industry domination remains rare. The fencing business operates on a local level, and regional contractors perform most of the installations. The national market is controlled by large manufacturers and distributors who supply fencing materials across the country, yet local businesses handle all actual construction tasks. One company faces challenges in controlling the entire market because different regions select different fence types according to their climate conditions, regulatory requirements, and customer taste preferences. The market remains competitive and diverse because the demand originates from homeowners, businesses, farms, and government projects, which prevents any one company from gaining full market control.

Key U.S. Fence Construction Companies:

Trex Company, Inc. Allied Fence Co. American Fence Company Master-Halco, Inc. Superior Fence Eaton Long Fence Anchor Fence Peerless Fence Fenceworks LLC Saddleback Fence and Vinyl Products United Fence & Construction Co., Inc.