Imagine, for a moment, America without the Bureau of Labour Statistics (BLS). To some wonks, few scenarios are more terrifying. After President Donald Trump threw a tantrum over weak job figures and sacked the head of the largely apolitical body in August, putting forward EJ Antoni, a partisan figure, to replace her, such a scenario also looked worryingly plausible.

PREMIUM U.S. President Donald Trump speaks to reporters upon his return to Washington at Joint Base Andrews in Maryland, U.S., November 9, 2025. REUTERS/Kevin Lamarque(REUTERS)

Chart.

Chart.

So far, the results have not been reassuring. Jerome Powell, chair of the Federal Reserve, has compared the experience to “driving in the fog”. A sharp, material shift in the economy would still be visible, he suggests, but beyond that it is hard to say anything with much certainty. The problem is not a shortage of private-sector data alternatives—there are plenty—but their consistency, reliability and breadth.

Take non-farm payrolls, which count jobs created each month and are the most likely release to move markets. Indeed, their decline over the summer was critical in persuading the Fed to cut interest rates, even as inflation crept up. The longest-standing alternative series is produced by ADP, an employment-technology company. Since 2006, it has released an estimate of private-sector payrolls a day or two ahead of the official figures. In theory, the firm should be uniquely well-placed to calculate such figures, since a sixth of American jobs pass through its software.

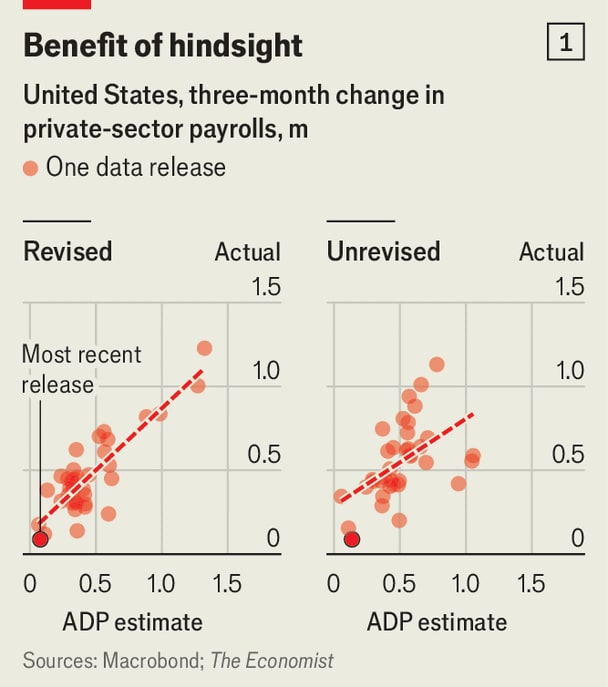

At first glance, ADP’s figures track the BLS’s. Since 2022, when ADP updated its methodology, monthly moves in its data have been about 60% correlated with the equivalent BLS series; three-month changes have been 90% correlated. But these figures are illusory: both ADP and the BLS revise their numbers. The initial releases—a better measure of their usefulness when tracking the economy in real-time—are much less correlated: 50% for three-month changes and only 10%, essentially uncorrelated, for monthly changes (see chart 1).

Another problem is that private-sector sources disagree. And without long track records, it is difficult to know which to trust. Some rely on web-scraping; others on in-house data. Payrolls figures for both September and October have gone unpublished. ADP’s numbers point to a decline in September, followed by a rebound in October. Those of Revelio Labs, a competitor, point to a rise in September and a decline in October (see chart 2). The trickle of remaining official data, such as unemployment-support claims, which are collected at the state level and so continue despite the shutdown, have not budged much.

Some measures are especially challenging for the private sector. Decent alternatives exist for employment, housing and goods prices. But services, which make up the bulk of spending, are varied and harder to measure. Jed Kolko, who oversaw several statistical agencies under Joe Biden, fears policymakers may fixate on areas where private-sector data is more plentiful. Focusing on weak job figures, where there is more data, instead of, say, inflation, could tilt them in the direction of interest-rate cuts. And the longer the shutdown continues, the worse the private-sector data will get. Statistical models that turn unwieldy inputs into a set of representative figures are almost always trained on, and benchmarked to, official releases.

True, official figures have their own problems. Survey response rates have been falling, particularly since the covid-19 pandemic. Recent revisions, including those over the summer that provoked the president, have been unusually large. Staffing cuts at statistical agencies are already causing issues. A BLS memo in July said that it had stopped collecting about 15% of the prices in its usual sample, up from 5% during the worst of the pandemic. The next few months will be particularly bad, since the shutdown has now stretched on for long enough that decent figures will be tough to reconstruct; in some cases, doing so might be impossible.

Yet the continued importance of official data can be seen in how the market responds to them. Derek Lemoine of the University of Arizona finds that the market’s expectation of stock volatility falls after releases, suggesting investors find them clarifying.A rough-and-ready calculation by The Economist indicates that markets’ sensitivity to official data has risen substantially in recent years—the exact opposite of what would have happened if private-sector figures were supplanting government ones (see chart 3).

Fortunately, it looks like the shutdown will come to an end in the next fortnight, bringing this particular no-data experiment to an end. Reassuringly, too, the White House has yet to put up a new candidate to replace Mr Antoni. The president’s attention seems to have moved elsewhere. Perhaps that will allow a degree of normality to return to American data.

Get the latest headlines from US news and global updates from Pakistan, Nepal, UK, Bangladesh, and Russia get all the latest headlines in one place with including 3I/ATLAS Liveon Hindustan Times. Get the latest headlines from US news and global updates from Pakistan, Nepal, UK, Bangladesh, and Russia get all the latest headlines in one place with including 3I/ATLAS Liveon Hindustan Times.

Get the latest headlines from US news and global updates from Pakistan, Nepal, UK, Bangladesh, and Russia get all the latest headlines in one place with including 3I/ATLAS Liveon Hindustan Times. Get the latest headlines from US news and global updates from Pakistan, Nepal, UK, Bangladesh, and Russia get all the latest headlines in one place with including 3I/ATLAS Liveon Hindustan Times.

See Less

All Access.

One Subscription.

Get 360° coverage—from daily headlines

to 100 year archives.

E-Paper

E-Paper  Full Archives

Full Archives  Full Access to

Full Access to

HT App & Website  Games Subscribe Now Already subscribed? Login

Games Subscribe Now Already subscribed? Login