Source: LPL Research, Ramp Economics Lab 11/12/25

While data from Ramp Economics Lab suggests small and medium-sized firms have slowed the pace of AI adoption, this is unlikely to last for long. In the months before the government shutdown, the corporate sector was developing the economic outlook. It’s possible the temporary concerns about growth and inflation put a damper on adoption rates, but as the tailwinds to growth reemerge, we should expect renewed interest in protecting margins, preparing for expansion, and managing headcount through greater AI adoption. The number of AI products and services is growing, the ecosystem is maturing, and AI tools are becoming better aligned with the needs of businesses. The question “What’s your AI strategy?” is no longer just a buzzword, it’s a serious expectation from investors, executives, and advisors who now see long-term investment in AI as essential to scaling operations and staying competitive.

Fixed Income: Fed, Debt and Deficits, and Spreads to Remain in Focus

Heading into 2026, the Fed’s policy stance will be the dominant force shaping fixed income markets in general and Treasury yields in particular. With inflation easing but still above the 2% target, the Fed is expected to maintain a “slightly restrictive” posture rather than cutting aggressively. Current market pricing suggests the rate-cutting cycle could end by mid-2026, near 3%. A more accommodative stance — fed funds meaningfully below 3% — would be required for Treasury yields to fall notably from current levels. As such, an unexpected slowing of economic growth or further declines in inflation are needed to justify a more aggressive easing cycle.

Fiscal deficits and increasing debt issuance will likely also be, at times, notable drivers for Treasury yields in 2026. The U.S. government is expected to run fiscal deficits in the 6–7% range of GDP for the foreseeable future, so cost cutting initiatives (yeah right) and/or additional revenue sources could directionally impact yields. And while tariffs are a bad word in some circles, they are a welcome development for the Treasury market. With tariff collection expected to increase revenues/decrease deficits by $4 trillion over 10 years (per Congressional Budget Office estimates), the Treasury Department can scale back its bond issuance accordingly. This reduced supply of new Treasuries, all else equal, tends to support bond prices and can help contain yields. For a government managing substantial debt levels, this revenue diversification provides fiscal flexibility that markets generally view favorably.

Within credit markets, corporate credit spreads suggest that all is (generally) well in corporate America. Defaults, payment-in-kind issuance, and high-profile bankruptcies, such as Saks and New Fortress Energy, have picked up of late, potentially suggesting otherwise. And Zombie firms — those with interest costs exceeding income — further elevate idiosyncratic risk. Despite these challenges, systemic risk appears contained, but valuations are stretched: credit spreads remain near 20-year lows, offering limited compensation for growing risks. For credit spreads to remain tight, corporate America needs to continue to meet lofty expectations and the economy needs to stay out of a recession (we think it will).

Bottom line: A lot has been priced into fixed income markets already, so the interest rate environment will likely be the key driver of returns in 2026. And with a Fed expected to undergo compositional changes next year, the market’s bias may be toward lower yields. But with inflation still expected to be above the Fed’s 2% target, there is still a lot of uncertainty regarding how low the Fed can take the fed funds rate without disrupting inflation expectations, which remain anchored for now.

Technicals: Respecting the Uptrend, But Watching Rotation Dynamics

Volatility came back into U.S. equity markets last week as investors derisked across several crowded trades. Intraweek selling pressure was most pronounced in select mega cap names, retail favorites, profitless tech, heavily shorted stocks, and other pockets of high momentum. Hawkish commentary from Fed officials dampened rate-cut expectations and exacerbated Thursday’s decline. Fed funds futures now imply less than a 50% probability of a 0.25% cut next month, down from 66% last week.

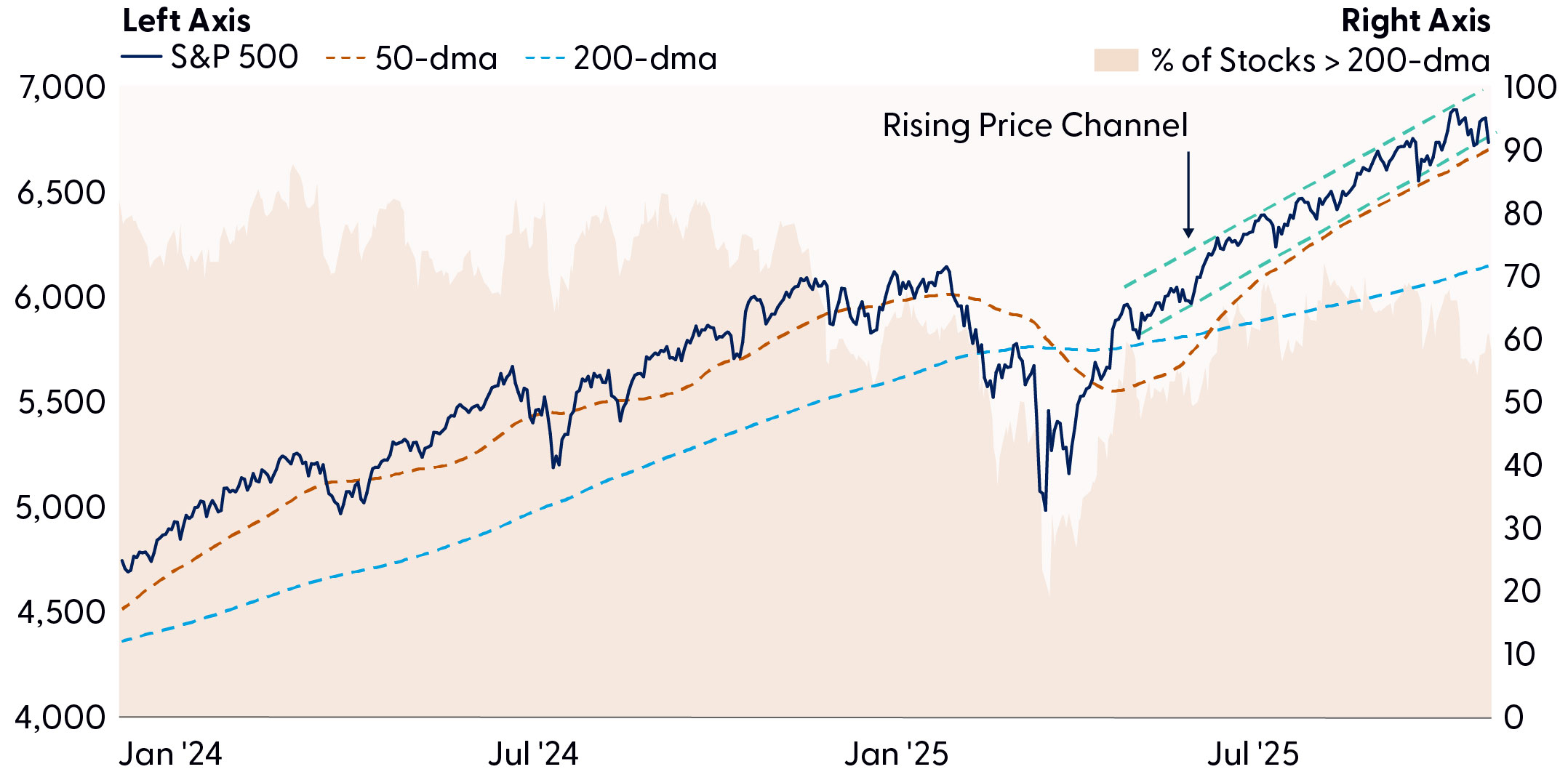

By Friday, however, buy-the-dip sentiment had resurfaced as investors stepped in at key technical support. The S&P 500 survived another retest of its 50-day moving average (dma), which coincidentally overlaps with the lower end of its rising price channel. A break below this channel would expose downside risk toward the November and October lows (6,631 and 6,550, respectively).

While we remain respectful of the uptrend, the recent deterioration in market breadth and momentum is notable. The Relative Strength Index (RSI) — a momentum oscillator used to measure the velocity of price action to determine trend strength — has posted consecutive lower highs and deviated from price action, suggesting buyer fatigue may be setting in. Participation in the latest breakout to new highs has also been underwhelming. Fewer stocks remain above their 200-dma since August, and our trend model now shows more S&P 500 constituents in downtrends than uptrends for the first time since May. Important to note, diverging breadth can persist for extended periods, particularly in a mega-cap-driven market, but continued negative deviations between price and participation underscore rising concentration risk and structural fragility if key support levels fail.

Slowing Participation Hasn’t Stopped the S&P 500