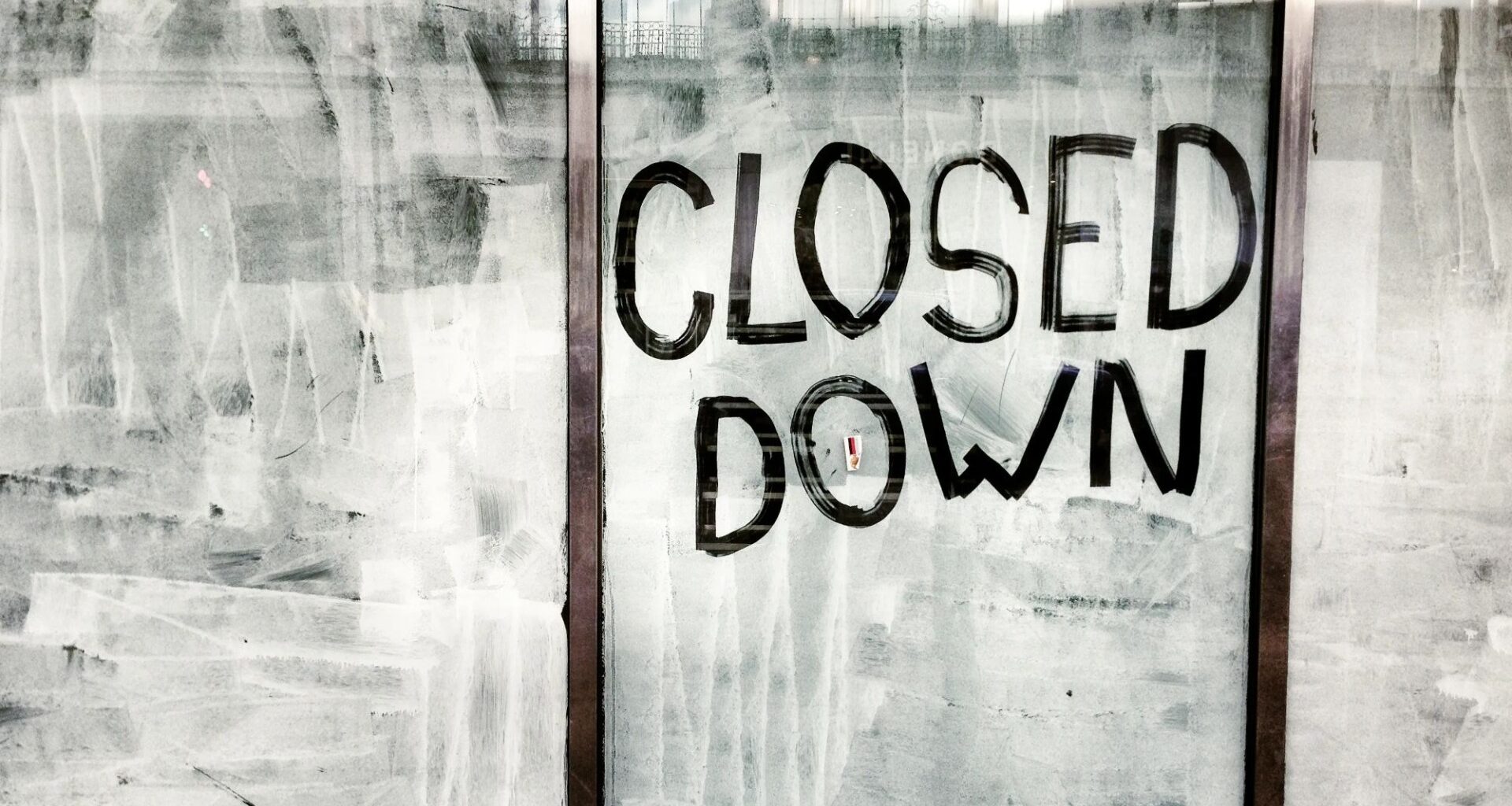

A BANKRUPTCY wave is set to continue into 2026, experts have warned American shoppers.

This year has been a damaging one for many major companies, as Joann, Forever 21 and Bargain Hunt closed all of their US locations.

Sign up for the Money newsletter

Thank you!

Several brands have exited the US this year following bankruptcy filingsCredit: Getty

The outlet Forbes recently reported its retail predictions for 2026, and a bankruptcy wave has been forecast among speciality retailers.

It said that the combination of high interest rates and AI disruptions will crate a challenging environment.

Forbes thinks that three retailers will declare bankruptcy next year, and pointed out Dick’s Sporting Goods and Best Buy as ones that need to change their strategies.

But it’s already too late for five retailers, who have faced tough times in 2025.

POURED OUT

Bankrupt brewery rescued at last minute as buyer snaps up seven closed locations

HATCH A PLAN

Chick-fil-A wastes no time as it fills gap left by bankrupt chain

1. JOANN

Joann filed for Chapter 11 for the second time since March 2024 earlier this year.

The first bankruptcy saw Joann emerge with a smaller footprint, but the second in May 2025 was the final nail in the coffin.

Joann closed all of its stores in the US after it took on $615 million in debt, with monthly costs of $26 million.

Since then, chains like Burlington have been sweeping up old Joann locations for themselves.

Burlington bought 45 expiring leases, while other chain like Hobby Lobby and Boot Barn took over some expiring Joann leases, too.

2. FOREVER 21

Forever 21 closed all of its stores in the US back in May after a bankruptcy filing in March.

The company searched for a buyer at the time, but was unable to find one, as confirmed by Brad Sell, the CFO of F21 OpCo.

Sell claimed that competition from fast fashion brands like Shein hurt Forever 21.

Court filings showed that its liabilities were between $1 billion and $10 billion.

In September, a spokesperson for the parent company of Forever 21, Authentic Brands, told The US Sun that they were in discussions with an operator to bring back Forever 21.

BRANDS HARD HIT BY BANKRUPTCIES

Many chains have struggled to adapt to a post-Covid retail landscape, with several companies filing for bankruptcy

3. BARGAIN HUNT

Bargain Hunt filed for Chapter 11 in February and closed all of its 92 US stores shortly after.

Around 300 employees lost their jobs as a result of the mass closure.

There was some confusion at the time over exactly what would close, as Bargain Hunt closed its main distribution center, too.

This signaled to shoppers that the chain wouldn’t be coming back.

4. PARTY CITY

Party City spent the early months of 2025 closing its corporate-owned stores in the US.

At the time, Party City’s CEO Barry Litwin said that the company had done all it could to avoid the outcome.

The chain had previously filed for bankruptcy in January 2023, and exited in the September, which canceled the nearly $1 billion in debt it had accrued.

Party City closed more than 80 stores between the end of 2022 and August 2024.

But the second bankruptcy proved that the party was over, but in October, Party City was bought by New Amscan PC LLC.

5. CLAIRE’S

Finally, the mall favorite Claire’s filed for bankruptcy over the summer, and had all of its 1,300 US location put at risk.

It came despite valuable deals with Macy’s and Walmart in recent years.

CHILLING TWIST

Teen suspect was ‘drinking on cruise before step-sister cheerleader’s death’

SPEED TRAP?

New ‘automatic’ $340 speeding fine sparks major u-turn & drivers need take note

This saw mini Claire’s opening in 21 Macy’s stores.

It was sold to a private equity firm that pledged to keep some of the chain’s retail footprint.

Joann filed for Chapter 11 for the second time since March 2024 earlier this yearCredit: Alamy

Forever 21 closed all of its stores in the US back in May after a bankruptcy filing in MarchCredit: Getty

Party City spent the early months of 2025 closing its corporate-owned stores in the USCredit: Getty