Shares of Chinese chip companies, including Semiconductor Manufacturing International Corp. (SMIC), Hua Hong Semiconductor, Cambricon Technologies Corp Ltd., and ASMPT fell on Monday following reports that the U.S. is considering easing chip export restrictions on Nvidia (NVDA). The White House is reportedly weighing the possibility of allowing Nvidia to sell its H200 artificial intelligence (AI) chips to China.

TipRanks Black Friday Sale

This move could diminish the significance of China’s domestic chip industry, as Nvidia’s chips are regarded as the most advanced globally for AI training, inferencing, and other applications. The news comes just after Nvidia reported record-breaking results for its fiscal third quarter and provided a strong outlook, supported by robust performance in its data center segment.

What Is the H200 Chip?

The H200 chip is about twice as powerful as the H20, which is the most advanced AI chip the U.S. currently allows to be exported to China. Both use the older Hopper technology, unlike Nvidia’s latest Blackwell chips sold in the U.S. The H200 has better memory and speed, making it more advanced, but the H20 was made specifically for the China market under export limits. However, China had reportedly refused the H20 because of security concerns.

Moreover, the H200 chip boasts almost double the high-bandwidth memory (HBM) and about 40% faster memory compared to the H100 chip, enabling it to process data much faster and handle larger, more complex AI tasks better.

Nvidia Faces Evolving Export Controls

The Trump administration is considering loosening some chip export rules to China to improve trade relations and secure better rare earth mineral deals. However, a decision regarding Nvidia’s chip sales to China remains distant, with the White House still debating the issue amid calls from U.S. lawmakers to tighten chip export regulations. A new bipartisan bill, the GAIN AI Act, would require U.S. chipmakers to supply American customers first before they can get permission to sell chips to China.

If Nvidia is allowed to sell its more advanced H200 AI chip in China, it could create tougher competition for Chinese chipmakers that are trying to build their own AI chips. Buying the H200 could also reduce demand for local chips and weaken Beijing’s push to be fully self-reliant in AI.

Analysts suggest China may still reject the H200 chips or direct major state-owned firms to continue purchasing local chips to support self-sufficiency. Experts suggest that China cares more about getting advanced chip-making machines so it can boost its ability to make powerful AI chips at home.

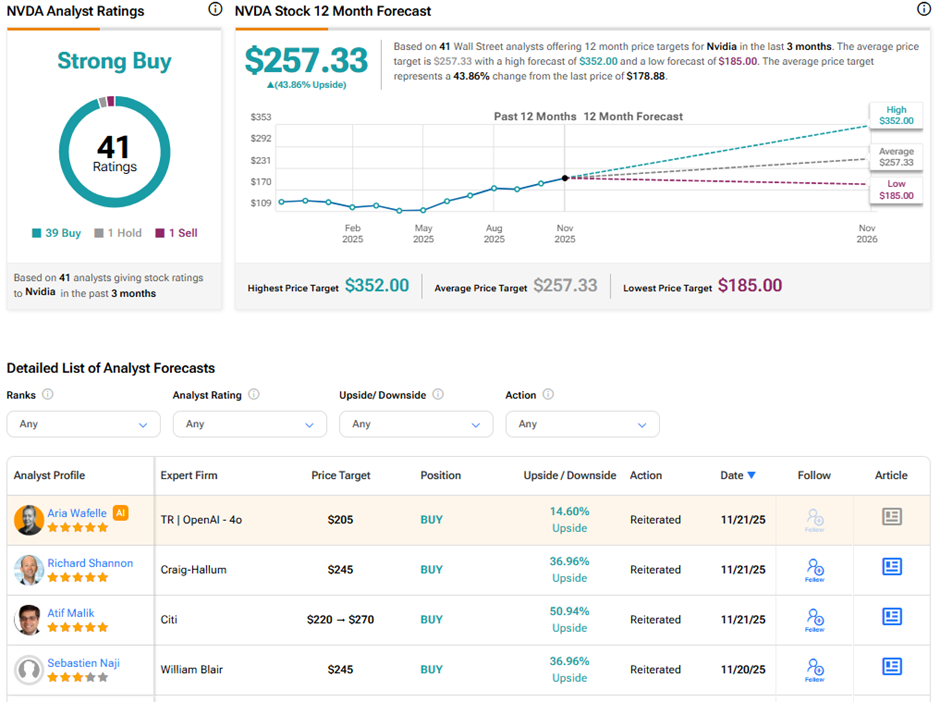

Is NVDA Stock a Strong Buy?

Analysts remain highly optimistic about Nvidia’s long-term outlook. On TipRanks, NVDA stock has a Strong Buy consensus rating based on 39 Buys, one Hold, and one Sell rating. The average Nvidia price target of $257.33 implies 43.9% upside potential from current levels. Year-to-date, NVDA stock has surged 33.2%.