United States Security Market Size

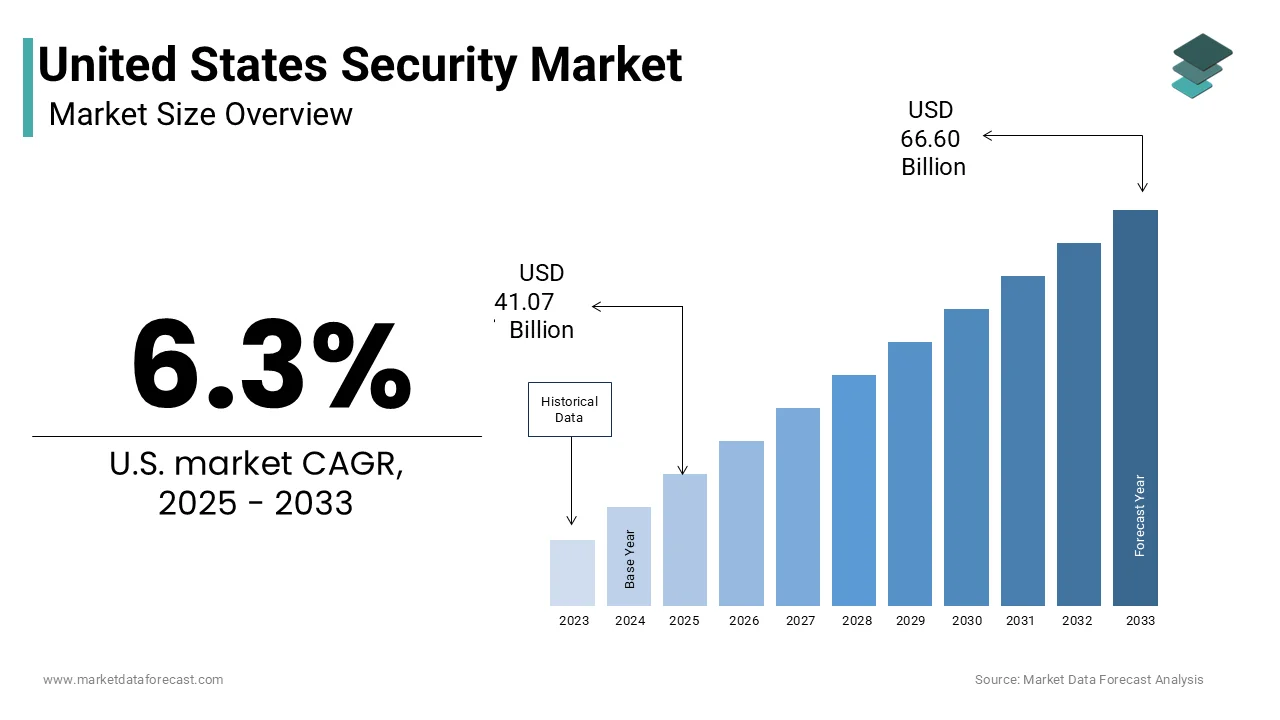

The U.S. security market was valued at USD 38.43 billion in 2024, is expected to reach USD 41.07 billion in 2025, and is projected to grow at a CAGR of 6.3% from 2025 to 2033 and reach USD 66.60 billion by 2033.

The security is a complex, technology-driven ecosystem designed to protect physical assets, digital infrastructure, and human safety across public and private domains. According to the Federal Bureau of Investigation, over 7.5 million property crimes were reported in 2023, with burglary and larceny accounting for nearly 80% of incidents. As per the Cybersecurity and Infrastructure Security Agency, infrastructure sectors, including energy, transportation, and healthcare, faced over 2500 confirmed cyber-physical breaches in the same year. The National Institute of Standards and Technology has published over forty frameworks guiding security system interoperability, underscoring the demand for standardized yet adaptive solutions.

MARKET DRIVERS

Escalating Frequency of Cyber Physical Attacks Is Forcing Convergence of Physical and Digital Security Systems

Organizations are no longer defending against isolated digital breaches or physical intrusions but against integrated threats that exploit vulnerabilities across both domains. According to the Cybersecurity and Infrastructure Security Agency, 63% of physical security breaches in 2023 originated from compromised access control systems linked to corporate IT networks. As per the Federal Bureau of Investigation’s Internet Crime Complaint Center, ransomware actors increasingly target building management systems, with documented cases of HVAC and elevator controls being locked until cryptocurrency payments are made. Insurance underwriters such as Chubb and AIG now require integrated intrusion detection and network monitoring as a condition for coverage on commercial properties exceeding 10 million dollars in value.

Regulatory and Insurance Mandates Are Compelling Institutional Adoption of Advanced Security Infrastructure

Compliance with federal, state, and insurer-driven security standards is transforming security from a discretionary expense to a legally enforceable operational requirement. The regulatory and insurance mandates are compelling institutional adoption of advanced security is additionally propelling the growth of the United States security market. According to the Occupational Safety and Health Administration, failure to implement adequate workplace violence prevention systems resulted in over one hundred twenty million dollars in fines in 2023 alone. As per the Department of Education, all K through twelve public schools receiving federal funding must now conduct annual security vulnerability assessments and deploy entry control systems compliant with the Partnering Against Violence in Education Act. The National Fire Protection Association’s Standard 731 mandates that all commercial buildings over fifty thousand square feet install intrusion detection systems integrated with emergency lighting and evacuation routing. The Centers for Medicare and Medicaid Services requires all healthcare facilities to implement biometric access logs and duress alert systems for staff, citing Joint Commission safety benchmarks.

MARKET RESTRAINTS

Persistent Shortage of Certified Security Systems Integrators Is Constraining Deployment and Performance Optimization

The ability to implement and maintain advanced security solutions is severely hampered by a deficit of trained professionals capable of designing, installing, and managing converged systems, which is negatively impacting the expansion of the United States security market. According to the Security Industry Association, fewer than 15,000 technicians in the United States hold certifications in both physical security hardware and cybersecurity protocols. As per the Bureau of Labor Statistics, employment in electronic security installation grew by only 2.1% annually over the past five years, while demand for integrated systems surged by over 12% annually. The Department of Homeland Security’s Infrastructure Protection Division found that 42% of security system failures during active threat simulations were attributable to misconfigured analytics or unpatched firmware, directly linked to installer knowledge gaps. This labor vacuum inflates project costs, increases vulnerability windows, and undermines the reliability of even the most advanced security technologies.

Fragmented Data Privacy Regulations Are Creating Compliance Uncertainty and System Design Inefficiencies

The absence of a unified federal framework governing the collection, storage, and use of security-generated data forces organizations to navigate a labyrinth of conflicting state laws, stifling innovation and increasing legal risk. The fragmented data privacy regulations are creating compliance uncertainty, and system design is another attribute hindering the growth of the United States security market. According to the International Association of Privacy Professionals, businesses operating in more than three states must comply with over twenty different biometric data handling statutes, each imposing distinct consent, retention, and breach notification requirements. The Government Accountability Office found that federal agencies themselves apply at least seven different privacy standards to security camera systems, depending on facility type and location. This regulatory inconsistency forces manufacturers to develop region-specific firmware and forces integrators to maintain multiple system configurations, increasing costs and reducing scalability.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence With Edge-Based Security Sensors Is Enabling Predictive Threat Detection

The fusion of machine learning algorithms with localized processing at the sensor level is transforming security from reactive monitoring to anticipatory intervention. This factor greatly influences the growth of the United States security market. According to the National Institute of Standards and Technology, AI-enabled edge devices can reduce false alarm rates by up to 92% by distinguishing between genuine threats and environmental anomalies such as shadows or wildlife movement. As per the Department of Homeland Security’s Science and Technology Directorate, pilot programs at mass transit hubs using AI-driven behavioral analytics reduced response times to unattended objects compared to human-monitored systems. The Federal Aviation Administration now mandates AI-enhanced perimeter intrusion detection at all commercial airports. Startups, such as Deep Sentinel and Athena Security, have deployed edge-based systems that analyze audio and visual inputs in real time to detect aggression, breaking glass, or forced entry, triggering alerts before incidents escalate. This technological evolution shifts value from hardware volume to algorithmic intelligence by creating premium revenue streams for vendors who can deliver verified, real-time threat prediction without cloud dependency.

Adoption of Zero Trust Architecture Principles Is Redefining Access Control Across Physical and Digital Realms

Security frameworks are abandoning legacy perimeter-based models in favor of continuous verification of identity and intent at every access point, whether digital or physical. According to the National Institute of Standards and Technology, organizations implementing Zero Trust for physical access reduced insider threat incidents by 68% by requiring step-up authentication for high-risk zones such as server rooms or pharmaceutical storage. As per the Cybersecurity and Infrastructure Security Agency, federal facilities now mandate that all employee and visitor credentials be dynamically validated against real-time threat intelligence feeds before granting door access. Commercial real estate leaders, including Boston Properties and Hine, now embed Zero Trust protocols into tenant access systems by using mobile credentials that expire after each use and require geofenced reauthentication. The International Organization for Standardization recently published ISO 30580 to formalize physical Zero Trust implementation, enabling third-party certification. This paradigm shift is not theoretical but operational, compelling investment in identity orchestration platforms that unify badge readers, biometrics, and network logins under a single policy engine.

MARKET CHALLENGES

Interoperability Gaps Between Legacy and Modern Security Systems Are Impeding Unified Threat Response

Many organizations operate with fragmented security architectures where new AI-driven platforms cannot communicate with decades-old alarm panels or access controllers, creating dangerous visibility blind spots. According to the Security Industry Association, commercial buildings in the United States still rely on proprietary access control systems installed before 2010 that lack application programming interfaces for integration. Manufacturers such as Honeywell and Johnson Controls now offer gateway devices to bridge legacy protocols, but the National Institute of Standards and Technology estimates that full system convergence adds an average of eighteen months to deployment timelines and increases costs by 35%. This technological debt prevents real-time correlation of threats and undermines compliance with modern incident command standards, leaving organizations vulnerable despite significant investment in next-generation tools.

Public Distrust of Surveillance Technologies Is Limiting Deployment Scope and Triggering Regulatory Backlash

Growing societal concern over privacy, bias, and mission creep is constraining the adoption of advanced security tools even where technical and economic justification exists. As per some reports, litigation against retailers using emotion recognition or demographic profiling in surveillance systems increased by 220% between 2022 and 2024. As per the Government Accountability Office, 53% of federal agencies delayed or canceled AI security pilot programs due to community opposition or ethical review board rejections. The National Retail Federation acknowledges that shrinkage prevention technologies are being deprioritized in favor of less invasive alternatives despite proven efficacy, due to brand reputation risks.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

Segments Covered

By Component, End Use, and Region.

Various Analyses Covered

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Countries Covered

New York, Massachusetts, Pennsylvania, Illinois, Ohio, Michigan, Texas, Florida, Georgia, California, Washington, Colorado.

Market Leaders Profiled

ADT Inc., Honeywell International Inc., Johnson Controls International plc, Cisco Systems, Inc., Bosch Security Systems, Inc., Stanley Black & Decker, Inc. (Stanley Security), Securitas AB, Brinks Home Security, Allegion plc, ASSA ABLOY AB, Tyco Integrated Security, G4S Limited (part of Allied Universal), Motorola Solutions, Inc., Vivint Smart Home, Inc., Axis Communications AB, FLIR Systems, Inc. (part of Teledyne Technologies), Siemens AG, Fortinet, Inc., Palo Alto Networks, Inc., Hikvision USA Inc..

SEGMENTAL ANALYSIS

By Component Insights

The system segment dominated the United States security market with a significant share in 2024, with the foundational requirement for hardware infrastructure cameras, access readers, intrusion panels, and sensors. According to the Federal Bureau of Investigation, over 90% of commercial crime deterrence and investigation relies on recorded video evidence by compelling continuous investment in high-resolution, analytics-enabled camera systems. The Department of Homeland Security mandates that all federally regulated infrastructure sites deploy intrusion detection and perimeter surveillance systems compliant with the National Infrastructure Protection Plan, affecting over 50,000 facilities nationwide. Fire and life-safety system integration with access control and video management is now required in all new commercial buildings exceeding 20,000 square feet.

The service segment is projected to expand at a CAGR of 11.3% throughout the forecast period, with the complexity of maintaining converged security ecosystems, regulatory compliance burdens, and the shift toward managed security as a service models. The Department of Defense’s Physical Security Enterprise Modernization initiative now requires all military installations to contract third-party threat assessment and system health auditing services, generating over one point two billion dollars in annual service contracts. The National Institute of Standards and Technology’s Cybersecurity Framework Revision 2.0 mandates continuous vulnerability scanning and access log auditing for all federal contractors, a requirement fulfilled through subscription-based security orchestration platforms. Commercial real estate investment trusts, such as tenant security agreements, now include managed detection and response clauses, shifting capital expenditure to operational expenditure.

By End Use Insights

The commercial sector was the largest by capturing 46.3% of the United States security market share in 2024, with the density of high-value assets, liability exposure, and regulatory obligations concentrated in retail, office, hospitality, and healthcare environments. Commercial properties accounted for over 3.8 million reported burglaries and thefts in 2023, driving mandatory deployment of video surveillance and electronic article surveillance systems. The National Fire Protection Association’s Life Safety Code requires all commercial buildings with public occupancy to integrate fire alarm systems with video verification and automated door release by affecting over eight hundred thousand facilities. Insurance Services Office data reveals that commercial property policies now deny coverage for losses exceeding five hundred thousand dollars unless intrusion detection and remote monitoring are certified by a nationally accredited central station. Real estate developers report that Class A office buildings now allocate over seven percent of construction budgets to integrated security systems to meet tenant expectations and leasing benchmarks set by BOMA International.

The transportation sector is estimated to witness the fastest CAGR of 13.1% throughout the forecast period, with federal mandates, rising passenger volumes, and the uninterrupted mobility infrastructure. As per the Transportation Security Administration, all commercial airports are now required to deploy AI-enhanced perimeter intrusion detection and unattended baggage recognition systems. The Federal Transit Administration mandates that all urban rail systems receiving federal funding implement real-time video analytics and duress alert systems for station personnel by 2025, which is impacting over one hundred twenty agencies. The rise of autonomous freight and drone delivery pilots, overseen by the Federal Aviation Administration, demands embedded security telemetry and geofenced access protocols by creating new demand vectors beyond traditional physical infrastructure.

COUNTRY LEVEL ANALYSIS

California Security Market Analysis

California was the top performer by holding 20.8% of the United States security market share in 2024, with structurally embedded in its demographic density, regulatory stringency, and concentration of critical infrastructure. The California Public Utilities Commission mandates that all investor-owned energy facilities implement cyber-physical intrusion detection systems capable of real-time anomaly correlation, which is affecting over three hundred substations and generation sites. As per the California Department of Education, every K through twelve public school campus is required to conduct annual security vulnerability assessments and install entry control systems with visitor management integration under Senate Bill 1203. The Los Angeles World Airports Authority invested over four hundred million dollars in 2023 to upgrade perimeter surveillance and biometric screening at LAX, aligning with TSA directives for Category X airports. Municipalities, including San Francisco and San Diego, enforce strict surveillance transparency ordinances, requiring public notice and data retention limits, which in turn drive demand for forprivacy-preservingg analytics and on-premises storage solutions.

COMPETITIVE LANDSCAPE

The United States security market is defined by intense rivalry among global technology conglomerates, specialized analytics innovators, and regional integrators competing across hardware, software, and managed services. Incumbents leverage decades of regulatory compliance experience and entrenched government contracts to defend positions while aggressively acquiring startups to embed artificial intelligence and Zero Trust capabilities. New entrants disrupt through privacy-preserving architectures, edge-based processing, and subscription pricing models that appeal to cost-conscious commercial clients. Price competition is constrained by performance-based procurement in critical infrastructure and insurance-mandated specifications that reward reliability over cost. Regulatory fragmentation across fifty states creates both barriers and opportunities as companies tailor data handling and biometric features to local statutes. Labor shortages in certified integration drive investment in plug-and-play systems and remote diagnostics. Differentiation increasingly hinges on predictive analytics accuracy, cross-domain interoperability, and demonstrable reduction in incident response time rather than sensor count or resolution alone.

KEY MARKET PLAYERS

Some of the companies that are playing a dominating role in the global United States security market include

ADT Inc. Honeywell International Inc. Johnson Controls International plc Cisco Systems, Inc. Bosch Security Systems, Inc. Stanley Black & Decker, Inc. (Stanley Security) Securitas AB Brinks Home Security Allegion plc ASSA ABLOY AB Tyco Integrated Security G4S Limited (part of Allied Universal) Motorola Solutions, Inc. Vivint Smart Home, Inc. Axis Communications AB FLIR Systems, Inc. (part of Teledyne Technologies) Siemens AG Fortinet, Inc. Palo Alto Networks, Inc. Hikvision USA Inc.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Leading security providers prioritize the convergence of physical and cybersecurity platforms to meet federal mandates and enterprise demand for unified threat management. They embed artificial intelligence at the edge to reduce latency and preserve privacy while enhancing detection accuracy. Strategic acquisitions of niche analytics and identity management firms accelerate platform completeness and interoperability. Partnerships with cloud infrastructure providers ensure scalable deployment and remote system health monitoring. Compliance engineering teams continuously adapt firmware to evolving state-level privacy statutes and industry certification requirements. Training academies certify integrators in both hardware installation and cyber hygiene to close workforce gaps. Subscription-based managed services replace one-time sales with recurring revenue tied to system performance. Open application programming interfaces encourage third-party development and ecosystem expansion. Real-time audit logging and automated compliance reporting tools are now standard to satisfy insurance and regulatory audits. Marketing increasingly emphasizes measurable risk reduction and liability mitigation over feature lists.

MARKET SEGMENTATION

This research report on the United States security market is segmented and sub-segmented into the following categories.

By Component

By End Use

Commercial Transportation Residential Government & Defense Industrial Others

By Country

California Texas New York Florida Illinois Rest of the United States