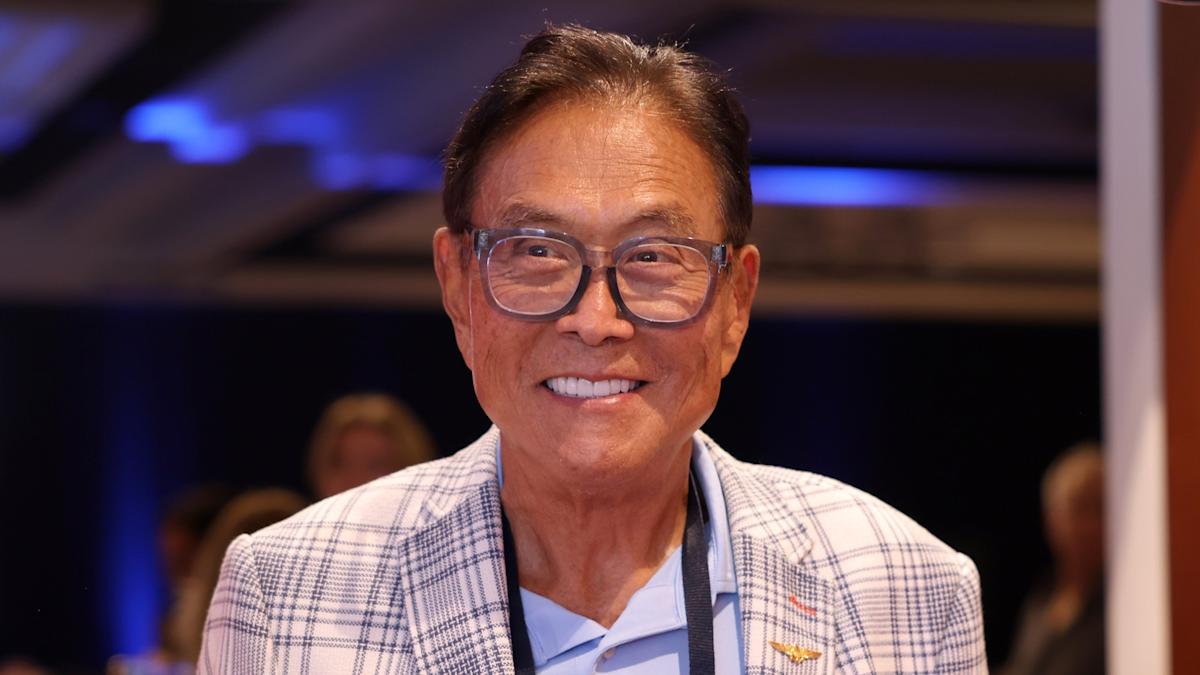

No one knows Robert Kiyosaki’s exact income, net worth or Social Security benefits. Even so, the “Rich Dad, Poor Dad” author claimed in an Instagram video that he has $1.2 billion in debt, and Celebrity Net Worth estimates his net worth at $100 million.

Explore More: How Much Is Michael Bloomberg’s Social Security Check?

For You: 6 Things You Must Do When Your Savings Reach $50,000

Kiyosaki’s savvy use of debt and tax-advantaged real estate investments could leave him with a lower Social Security benefit than you might expect.

In 2025, Social Security pays a maximum monthly benefit of $5,108. But to collect that theoretical maximum, you’d have to earn above the FICA tax cap for your entire career and wait until 70 before taking benefits.

“Many wealthy people actually get less due to the way they earn money,” explains financial planner Jay Zigmont of Childfree Trust. “Social Security is based on your earned income and does not count capital gains, so it is possible that people can have a lot of money but a very low earned income.”

So, Robert Kiyosaki likely has a more average Social Security check. It’s possible that he collects none at all, depending on how many years he showed net losses on his tax returns.

Find Out: 5 Ways You Can Reduce Your Tax Bill Like a Millionaire, According to Robert Kiyosaki

Robert Kiyosaki doesn’t rely on his Social Security check to make ends meet. You shouldn’t either.

This year, the Social Security Administration recalculated its OASI Trust Fund insolvency date, and it moved even closer: Just a several years away in 2032. Solving that problem will require massive Social Security reform, likely involving lower benefits, a higher full retirement age, and higher FICA taxes.

Take a page from Kiyosaki’s book (literally) and build your own diversified income streams. Consider adding tax-advantaged real estate income from passive investments like REITs, syndications or private partnerships, perhaps with a co-investing club to allow smaller minimum investments.

If you want to collect a larger Social Security check each month, plan to work later in life.

“Continue working as long as possible to max out your highest 35 years of working income,” advises financial planner Chad Gammon of Custom Fit Financial. “Most workers earn more today than they did 20 to 30 years ago, so adding more years of higher income helps.”

It also helps to delay taking Social Security benefits for as long as possible.

“Taking Social Security at 62 can reduce your benefits by up to 30%,” adds Gammon. “Delaying from your full retirement age to age 70 can increase your benefits by 8%.”