Dublin, Nov. 26, 2025 (GLOBE NEWSWIRE) — The “United States Artificial Insemination Market Report by Type, Source Type, End Use, States and Company Analysis 2025-2033” report has been added to ResearchAndMarkets.com’s offering.

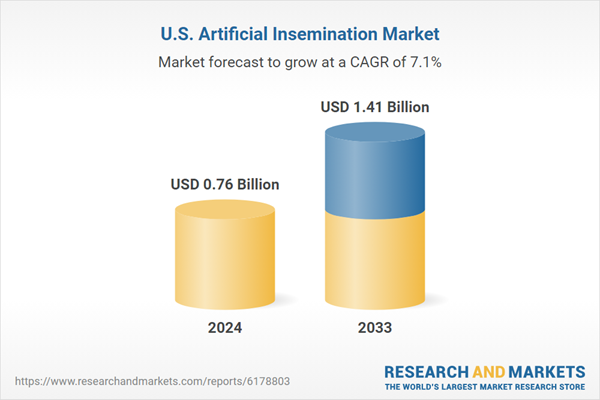

The United States Artificial Insemination Market is expected to reach US$ 1.41 billion by 2033 from US$ 0.76 billion in 2024, with a CAGR of 7.11% from 2025 to 2033.

Key factors driving the U.S. artificial insemination market include rising infertility rates, growing awareness of assisted reproductive technologies, postponed parenthood, sophisticated reproductive healthcare infrastructure, technological advancements in handling sperm and embryos, supportive insurance coverage, and expanding adoption of fertility treatments.

The market for artificial insemination in the United States is growing as a result of greater awareness of assisted reproductive technologies (ART) and rising incidence of infertility among couples. Medical issues, lifestyle choices, and delayed motherhood all increase the need for fertility treatments. Adoption has increased due to greater success rates brought about by technological developments in cryopreservation, handling sperm and embryos, and monitoring methods.

Accessible treatment choices are offered by fertility clinics and specialty medical facilities, and financial obstacles are lessened by reimbursement schemes and insurance policies that are supportive. The need for artificial insemination treatments is also being driven nationwide by the increasing acceptance of ART among a variety of demographics, such as same-sex couples and single parents.

Growth Drivers for the United States Artificial Insemination Market

Rising Infertility Rates

One major factor propelling the artificial insemination (AI) market is the rising incidence of infertility in the US. The general fertility rate in 2023 was 54.5 births per 1,000 women aged 15-44, down from 56 in 2022, according to the Centers for Disease Control and Prevention (CDC). This suggests that fertility rates are continuing to drop.

Numerous variables, such as delayed parenthood, lifestyle decisions, and fertility-affecting medical issues, are blamed for this trend. In order to become pregnant, more people and couples are turning to assisted reproductive technologies like artificial intelligence. Improvements in reproductive medicine, greater understanding, and easier access to fertility treatments all contribute to the rising demand for AI services. It is anticipated that this confluence of elements will support the ongoing expansion of the AI sector in the United States.

Awareness of Assisted Reproductive Technologies (ART)

The market for artificial insemination in the United States is mostly driven by rising knowledge of assisted reproductive technologies (ART). Intrauterine insemination (IUI) and in vitro fertilization (IVF) are two treatment options that couples, single parents, and LGBTQ+ people are now more aware of thanks to increased education and media coverage on infertility remedies. The success stories, advantages, and safety of ART are highlighted in public debates, social media campaigns, and community health initiatives, which helps to dispel myths and social stigma.

In order to overcome reproductive difficulties, more people are actively seeking fertility services. Additionally, patients are receiving education from healthcare experts regarding enhanced reproductive procedures, individualized treatment programs, and early treatments. Growing understanding and improvements in reproductive medicine lead to increased use of artificial insemination treatments, which boosts the industry as a whole and makes fertility services available to a wider range of Americans.

Accessible Fertility Clinics

The market for artificial insemination is growing as a result of the opening of more fertility clinics and specialized reproductive healthcare facilities across the US. Fertility services are now more widely available, making them more accessible to urban, suburban, and increasingly rural people. Patients can obtain individualized care in convenient settings thanks to modern clinics’ state-of-the-art facilities, skilled doctors, and extensive fertility programs.

Furthermore, the overall experience and success rates of artificial insemination operations are improved by the incorporation of cutting-edge technologies, patient counseling, and support services. Additionally, accessibility eases patients’ travel and logistical burdens, increasing the number of people who can afford fertility treatments. Because of this, more people and couples are inspired to seek assisted reproductive technologies, which increases the uptake of artificial insemination and supports the market’s steady expansion in the United States.

Challenges in the United States Artificial Insemination Market

High Costs

In the US market for artificial insemination, high treatment costs continue to be a major obstacle. Intrauterine insemination (IUI) and related fertility treatments are costly procedures that frequently call for several cycles, certain drugs, and diagnostic testing. Patients must pay for assisted reproductive technologies out of pocket because many insurance plans cover them only partially or not at all.

Couples and individuals may be deterred from pursuing therapy or finishing the several cycles required for a healthy pregnancy by this financial strain. Even with partial coverage, the total cost is increased by related expenses including travel, consultation fees, and monitoring. In order to make artificial insemination available to a larger population, encourage market growth, and guarantee that more people can take use of fertility services, it is imperative to lower costs, increase insurance reimbursement, and provide financing options.

Regulatory and Ethical Considerations

One of the biggest obstacles facing the US artificial insemination sector is ethical and regulatory issues. Complex federal and state laws controlling donor screening, processing of sperm and embryos, consent processes, and reporting obligations apply to fertility treatments. Adherence to these regulations raises operating expenses and could impede the adoption of novel technologies or creative processes.

Public opinion and acceptability may also be impacted by ethical issues pertaining to genetic screening, donor selection, embryo preservation, and the rights of all parties. Clinics have to navigate regulatory frameworks while upholding high ethical standards, which can be administratively taxing. To maintain patient safety, legal compliance, and public confidence while promoting the development and accessibility of assisted reproductive technologies, these issues need to be carefully managed.

Key Attributes:

Report AttributeDetailsNo. of Pages200Forecast Period2024 – 2033Estimated Market Value (USD) in 2024$0.76 BillionForecasted Market Value (USD) by 2033$1.41 BillionCompound Annual Growth Rate7.1%Regions CoveredUnited States

Key Players Analysis: Company Overview, Key Persons, Recent Development & Strategies, SWOT Analysis, Sales Analysis

VitrolifeGenea Pty LimitedRinovum Women’s Health, LLCPride AngelHI-TECH SOLUTIONSFUJIFILM Irvine ScientificKitazato CorporationRocket Medical plcConceivex, Inc.

United States Artificial Insemination Market Segments:

Type

IntrauterineIntracervicalIntravaginalIntratubal

Source Type

End Use

Hospitals and ClinicsFertility CentersOther End Users

States – Market breakup in 29 viewpoints:

CaliforniaTexasNew YorkFloridaIllinoisPennsylvaniaOhioGeorgiaNew JerseyWashingtonNorth CarolinaMassachusettsVirginiaMichiganMarylandColoradoTennesseeIndianaArizonaMinnesotaWisconsinMissouriConnecticutSouth CarolinaOregonLouisianaAlabamaKentuckyRest of United States

For more information about this report visit https://www.researchandmarkets.com/r/7tcn2n

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

U.S. Artificial Insemination Market