Bouncing from plan to plan for Medicare coverage has become an inadvertent, annual tradition for Becky Beerwald.

When she moved to Essex Junction from the Connecticut coast in 2023, she selected a Medicare Advantage plan before it was discontinued for the following year. Then she enrolled in a Vermont Blue Advantage plan, only for the insurer to announce in October that it would not offer the plans in 2026. This fall, she went back to the drawing board but in an insurance landscape almost entirely stripped of the Medicare Advantage plans that nearly 51,000 people in the state had relied on.

Beerwald is just one of the thousands of Vermonters trying to make sense of the coverage that remains available now that Medicare Advantage has essentially left the state.

READ MORE

by Olivia Gieger

October 1, 2025, 1:01 pmOctober 2, 2025, 11:18 am

This year’s open enrollment period for Medicare, which runs through Dec. 7, has been a “challenging one,” said Sam Carleton, who directs the State Health Insurance Program, a state entity that provides guidance for Medicare beneficiaries. The small office has been flooded with inquiries since the start of October, when BlueCross Blue Shield and United Healthcare’s departures from the Advantage market became public. Agewell, the elderly support agency Carleton leads in Northwestern Vermont has also seen a surge in interest for the webinars they offer to explain how Medicare works and how people can get the coverage they need under it.

Medicare is the federal health insurance program for people 65 and older and those with certain disabilities.

Medicare has four parts: Part A covers inpatient care while Part B broadly covers outpatient care, medical devices and preventative care, among other things. Together, these two are regarded as original Medicare. It generally covers 80% of the cost of services, meaning many people who opt for traditional Medicare coverage also opt for something known as a Medigap plan, or supplemental insurance, sold by a private insurer that can help cover the remaining 20% of costs.

Medicare Part D offers prescription drug coverage, which is also provided by a private insurer.

Part C plans bundle all of that — and often include additional benefits like dental, or vision. These plans, known as Medicare Advantage plans, are offered by private insurers.

While many people like their Advantage plans, others can feel trapped in them because they require approval before covering some drugs and services and often require people to see in-network providers.

When the insurers providing Medicare Advantage plans in Vermont announced the end to their coverage, it gave some people a welcomed exit ramp from plans that are otherwise difficult to leave, explained Kaj Samsom, the commissioner of the Department of Financial Regulation, the state office that regulates insurers.

“This event, as really truly unfortunate as it is for folks who are no longer in Medicare Advantage and no longer have other options, there are some people who are probably happy,” Samsom said.

Tax Commissioner Kaj Samsom. File photo by Mike Dougherty/VTDigger

Tax Commissioner Kaj Samsom. File photo by Mike Dougherty/VTDigger

When an insurer withdraws a plan, it triggers something called a special enrollment period, which comes with different privileges than the regular open enrollment period.

In particular, it means people searching for new plans get something called “Guaranteed Issue Rights.” These rights mean that insurance companies cannot charge someone more for their insurance based on pre-existing health conditions — things like diabetes or cancer — that would make care more expensive for the insurer to pay out.

When someone is new to Medicare and enrolling for the first time, they are also protected from this type of underwriting. But after that initial enrollment, Medigap plans can reject or charge sicker patients more based on their health history. Samsom referred to this as the “one way street” of Medicare Advantage, where individuals can’t switch to traditional Medicare without the massive cost of a Medigap supplement plan looming over them.

Now, nearly all Vermonters who bought Medicare Advantage plans will need to opt into original Medicare, with the option to buy the supplemental Medigap plans — protected from underwriting during this special enrollment.

The issue of underwriting became particularly concerning to Beerwald. As she scoured the best Medigap plan, she said some insurers asked for her health history, despite her guaranteed issue rights.

When open enrollment began, Beerwald said she started calling the insurers offering the least expensive Medigap plans for 2026: Medco, State Farm and Aflac.

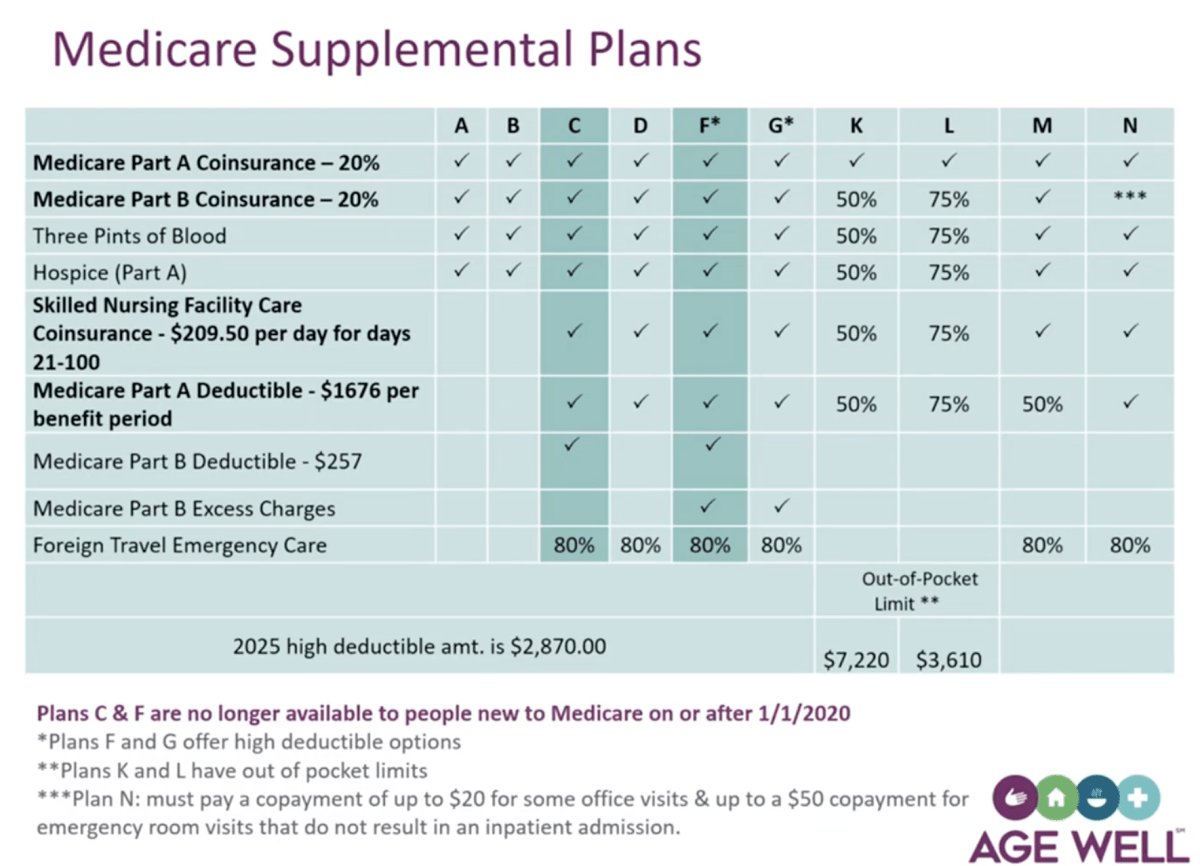

Each insurer offers a selection of Medigap plans: A, B, C, D, F, G. These letter plans are standardized, so that plans with the same letter include the same benefits, no matter which insurer sells them. Price should be the only difference.

Beerwald said she wants a G plan because it offers the best coverage with the most diverse beneficiary pool — because of a 2015 law, people who became eligible for Medicare after 2020 can’t buy Medigap plans C or F. That restriction effectively leaves plans’ pool older. Plans D and G now offer similar coverage, without the age restriction.

A slide from a webinar titled “Age Well Medigap” organized by the State Health Insurance Assistance Program on Tuesday, Nov. 25. Screenshot via YouTube

A slide from a webinar titled “Age Well Medigap” organized by the State Health Insurance Assistance Program on Tuesday, Nov. 25. Screenshot via YouTube

“My mother lived until almost 102 my dad was 87, so I’ve got a long life ahead of me,” Beerwald said. “I don’t want to be in the older pool, I want to be in the younger pool.”

She said she worries that as the pools under plans C and F grow older and smaller over time, their premiums will soar or the plans could disappear altogether.

“I don’t want to be in the lurch again. I want to be in the popular plan with the popular kids,” she said.

Insurers she found that honored the guaranteed issue rights for plan G charged higher premiums. She did notice, however, that insurers would honor these rights for C and F plans.

Eventually, she bought a TVHP Medigap Blue Plan G from BlueCross BlueShield of VT, for about $258 per month, she said.

Still, the fact that she encountered some insurers who would not honor the guaranteed issue for every letter plan conflicted with her understanding of how the law should protect that right.

Beerwald’s quest to understand and rectify this issue offers a window onto the maelstrom that can arise when private insurers are tasked with delivering a government service. She said she reached out to the state office tasked with regulating insurers, their consumer protection line, U.S. Rep. Becca Balint’s office, SHIP and Carleton, in an attempt to make sense of it all.

“I certainly feel that frustration. I mean, you’re in a circumstance where you’ve lost your insurance, you received notice from the federal government that you are getting a special enrollment period, and you’re able to get another plan. You’ve done the legwork. … You’ve made a choice, and you then call this insurance company, those insurance companies say sure we’ll sell you a policy, but only if you send us all your medical records. That stinks,” Carleton said.

However, Carleton and the Department of Regulation told Beerwald — and confirmed to VTDigger — that it is legal for insurers to not apply guaranteed issue rights to every letter plan.

It comes down to one small matter of wording in the regulation that applies to Medigap plans: “It’s a ‘must’ for (plans) A, B, C, F,” Department of Regulation Deputy Commissioner Mary Block said. “It’s a ‘may’ for G, for people before that 2020 date.”

“So some insurance companies will offer it, some will not,” she added.

There’s nothing the state can do to rectify this frustration, according to Block, since federal law dictates Medigap plan regulations.

“In Vermont, we don’t have the discretion to say Plan G is always going to be available to everybody,” she said.

Block added that other consumers have run into confusion when dealing with insurance brokers, who may not be aware of which customers are receiving guaranteed issue rights and may mix up forms.

The best way to combat that, Samson said, is for people to advocate for themselves and make it very clear when they are on the phone that they need the guaranteed issue rights.

Beerwald remains unsatisfied with their explanation.

Now, the only remaining Medicare Advantage plans in the state are Humana plans in six counties — including Orange, Windham and Windsor, where many of the available care comes from providers in the Dartmouth Health network. However, Dartmouth Health has long been out of network for Humana. During a Nov. 19 town hall with the Vermont congressional delegation, Balint raised particular concern over this and cautioned beneficiaries in those counties to choose new plans.

Carleton assured that even in the counties where Humana remains, if people have lost their other Advantage plan, they should still receive guaranteed issue rights for Medigap plans if they chose to buy one and opt into original Medicare.

“What prompts the special enrollment period is your plan leaving, not necessarily the loss of all Medicare Advantage plans,” he said.

Carleton said he worries about the overall sticker shock that comes with Medigap plans, and fears some people will opt into original Medicare and forgo supplemental plans, leaving them vulnerable to the 20% of costs that original Medicare doesn’t cover.

Beerwald said she’s going to end up paying more than $7,500 for insurance this year. After her Medigap plan, she said she’s buying a drug plan, vision and hearing plans, as well as a dental plan, to cover the cost of extensive dental work she needs

She said she worries not just for herself but for other older adults who are not as savvy as navigating all the pitfalls of the insurance system. But for now, she is locked in to her BlueCross BlueShield’s plan for at least a year and whatever 2026 may have in store.