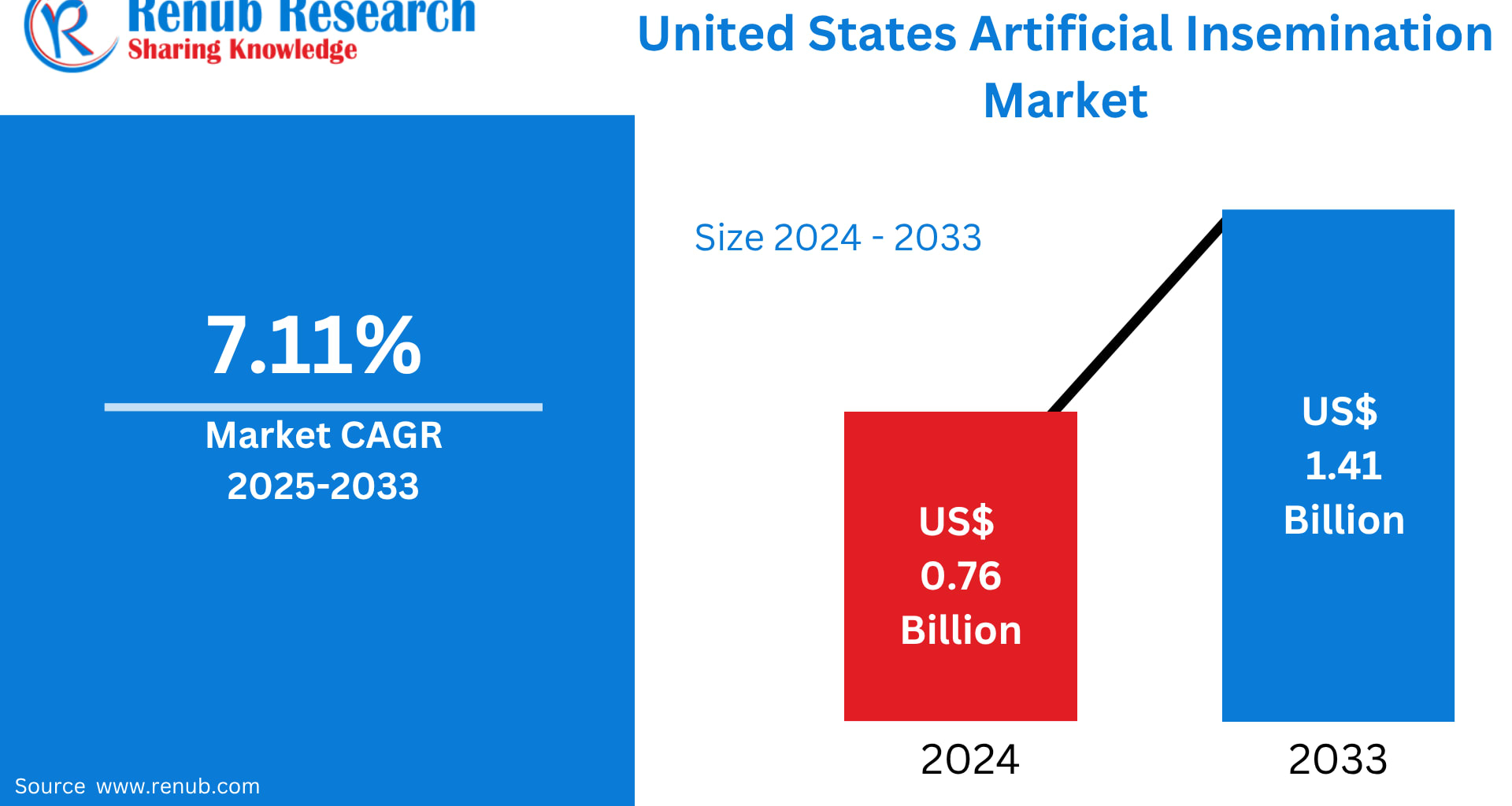

The United States Artificial Insemination Market is on a strong upward trajectory, expected to grow from US$ 0.76 billion in 2024 to US$ 1.41 billion by 2033, registering a CAGR of 7.11% during 2025–2033, according to Renub Research. This surge reflects a significant societal and healthcare shift: Americans are increasingly turning to medically assisted reproductive techniques due to rising infertility rates, lifestyle factors, technological advancements, and broader social acceptance of alternative family-building paths.

Artificial insemination (AI), once seen as a niche medical intervention, is now a mainstream, minimally invasive assisted reproductive solution adopted by a diverse demographic—infertile couples, single parents by choice, LGBTQ+ families, and individuals facing medical challenges. With sophisticated reproductive infrastructure and expanding insurance support, the U.S. landscape for fertility services continues to mature rapidly.

United States Artificial Insemination Industry Overview

Artificial insemination involves the intentional placement of sperm into a woman’s reproductive tract—typically the cervix, uterus, or fallopian tubes—without sexual intercourse. Depending on clinical requirements, the procedure is performed as:

Intrauterine Insemination (IUI)

Intracervical Insemination (ICI)

Intravaginal Insemination (IVI)

Intratubal Insemination (ITI)

Patients may use either partner sperm (AIH) or donor sperm (AID). The procedure is often combined with hormonal stimulation or ovulation tracking to increase pregnancy success rates.

Over the past decade, AI has transformed into a widely used fertility treatment with improved success rates, driven by innovations in:

Sperm washing and preparation

Cryopreservation

Timing optimization

Hormonal protocols

At-home insemination kits

Rising awareness of ART methods and more open societal attitudes are pushing artificial insemination into the mainstream. Fertility clinics nationwide are expanding accessibility, while supportive insurance coverage in several states is helping reduce financial barriers.

Key Growth Drivers in the U.S. Artificial Insemination Market

1. Rising Infertility Rates

Infertility has become a major public health concern in the United States. According to CDC data, the general fertility rate dropped to 54.5 births per 1,000 women aged 15–44 in 2023, down from 56 in 2022—a continuing downward slide.

Reasons for this trend include:

Increased maternal age due to delayed parenthood

Hormonal disorders such as PCOS

Lifestyle factors: stress, obesity, smoking, environmental pollutants

Male infertility linked to declining sperm quality

As natural conception becomes more challenging for many couples, reliance on assisted reproductive technologies—including artificial insemination—has increased substantially. Advances in reproductive medicine, improved success rates, and growing public education are further reinforcing demand.

2. Growing Awareness of Assisted Reproductive Technologies (ART)

Media coverage, celebrity disclosures, social campaigns, and improved healthcare communication have brought fertility treatments into everyday conversation. This heightened visibility has fueled demand for methods such as IUI and IVF.

Key factors contributing to rising awareness include:

Educational campaigns by fertility clinics

Increasing presence of fertility conversations on social media

LGBTQ+ advocacy promoting family-building options

Accessible webinars, community outreach, and online consultations

Trust-building through patient success stories and testimonials

As myths surrounding ART diminish, more couples and individuals are willingly exploring medical fertility options earlier and with greater confidence.

3. Rise in Accessible Fertility Clinics Across the U.S.

The growth of fertility clinics—both independent and hospital-based—has drastically improved access to reproductive healthcare. Clinics now offer:

Advanced diagnostic equipment

Patient-centric fertility programs

Sperm and embryo handling expertise

Counseling and emotional support services

Tailored protocols based on individual reproductive profiles

Furthermore, suburban and semi-urban regions are witnessing the emergence of new fertility chains, reducing the strain on large metropolitan clinics. Telehealth consultations and remote tracking technologies have widened access in rural populations as well.

With increased accessibility comes increased adoption, fueling market expansion across states.

Major Challenges in the U.S. Artificial Insemination Market

1. High Treatment Costs

Despite advancements, the affordability of fertility treatments remains a significant barrier.

Artificial insemination procedures involve expenses such as:

Diagnostic tests

Hormonal medications

Multiple insemination cycles

Ultrasound monitoring

Sperm preparation

Travel and clinical fees

Insurance coverage varies widely, and many plans cover fertility services only partially. For some patients, the high cost prevents completion of multiple cycles—often required to achieve pregnancy. Expanding reimbursement and offering flexible financing solutions remain crucial to boosting access.

2. Regulatory and Ethical Considerations

The artificial insemination industry faces a complex network of federal and state regulations governing:

Donor screening and consent

Sperm and embryo handling

Genetic testing

Storage procedures

Reporting compliance

Patient rights and confidentiality

Ethical issues—especially surrounding donor anonymity, parental rights, genetic selection, and embryo handling—add additional layers of complexity. Clinics must balance innovation with strict oversight, which can increase operational costs and lengthen adoption time for emerging technologies.

State-Level Market Insights

California: A National Leader in Artificial Insemination

California stands as one of the most advanced fertility markets in the U.S., driven by:

High public awareness

Liberal family-building policies

A diverse population including single parents and LGBTQ+ couples

World-renowned fertility specialists and research centers

Urban hubs such as Los Angeles, San Diego, and San Francisco offer state-of-the-art ART technologies, strong counseling frameworks, and supportive health programs. The state’s progressive outlook and steep adoption curve make it a powerhouse within the national market.

Texas: A Rapidly Rising Fertility Hub

Texas is emerging as one of the fastest-growing markets, powered by:

Expanding metropolitan centers like Houston, Dallas, and Austin

A booming young population

Increased acceptance of assisted reproduction

Growing networks of fertility clinics

As telehealth and mobile diagnostic services reach rural communities, access continues to widen. Awareness campaigns, lower stigma, and cutting-edge reproductive technologies are propelling strong growth in this region.

New York: A Major Urban Fertility Powerhouse

New York, especially New York City, is a prime market due to:

Dense population

High infertility awareness rates

Easy access to premium medical centers

Adoption of fertility benefits among corporate employers

Career-driven lifestyles often lead to delayed parenthood, directly increasing demand for ART procedures. With a rich ecosystem of specialists, telemedicine consultations, and strong patient support services, New York remains a significant contributor to overall U.S. growth in artificial insemination.

Florida: Expanding Market with Strong Medical Infrastructure

Florida’s artificial insemination market is shaped by:

Diverse communities

High awareness of fertility treatments

Strong healthcare infrastructure

Fast-growing urban regions like Miami, Orlando, and Tampa

Comprehensive patient care, improved rural accessibility, and rising adoption among LGBTQ+ families support sustained market expansion. Personalized treatment programs and advanced reproductive technology integration make Florida an important state in the national fertility landscape.

Recent Developments Shaping the U.S. Artificial Insemination Market

October 2024: Femasys partnered with Boston IVF to introduce FemaSeed, expanding access across nearly 30 clinics in the U.S. The collaboration aims to enhance treatment success through precision insemination technology and expanded education efforts.

March 2024: Femasys Inc. reported positive results for its pivotal FemaSeed trial, with pregnancy rates hitting 24% in severe male-factor infertility cases, outperforming standard IUI. This breakthrough paves the way for wider commercialization.

December 2023: The FDA approved Mosie Baby, the first OTC at-home artificial insemination kit, enabling consumers to perform insemination at home using fresh or frozen sperm. This innovation democratizes access and may redefine the future of low-complexity fertility treatments.

U.S. Artificial Insemination Market Segmentation

By Type

Intrauterine Insemination (IUI)

Intracervical Insemination (ICI)

Intravaginal Insemination (IVI)

Intratubal Insemination (ITI)

By Source Type

AIH – Husband

AID – Donor

By End Use

Hospitals & Clinics

Fertility Centers

Other End Users

By States (29 Viewpoints)

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, Rest of United States.

Key Players Covered (5 Viewpoints Each)

Company Overview | Key Persons | Recent Development & Strategies | SWOT Analysis | Sales Analysis

Vitrolife

Genea Pty Limited

Rinovum Women’s Health, LLC

Pride Angel

HI-TECH SOLUTIONS

FUJIFILM Irvine Scientific

Kitazato Corporation

Rocket Medical plc

Conceivex, Inc.

Final Thoughts

The United States artificial insemination market is entering a transformative era powered by increasing infertility prevalence, advanced technological innovation, and growing public acceptance of assisted reproductive methods. With the market set to reach US$ 1.41 billion by 2033, the future of fertility care in America is defined not only by medical breakthroughs but also by shifting cultural narratives around family-building.

As more states expand insurance coverage, as more clinics adopt precision-based fertility technologies, and as at-home insemination solutions become widely accessible, artificial insemination is poised to become one of the most inclusive and rapidly evolving segments in the reproductive healthcare sector.