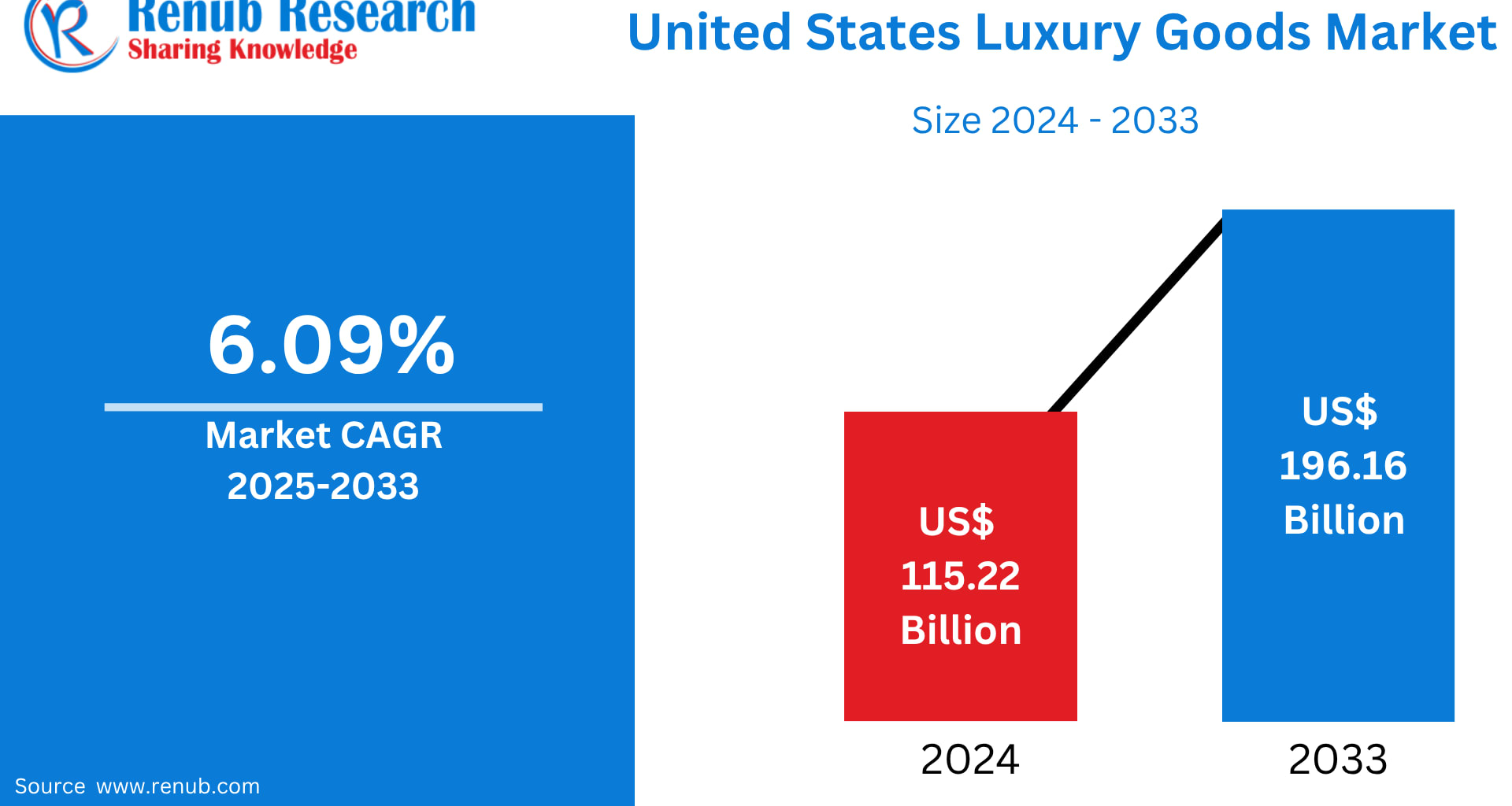

The United States Luxury Goods Market is entering one of its most transformative phases, defined by evolving consumer identities, digital-first spending patterns, and an expanding appetite for exclusivity. According to Renub Research, the United States Luxury Goods Market is expected to reach US$ 196.16 billion by 2033, rising from US$ 115.22 billion in 2024. This growth reflects a compound annual growth rate (CAGR) of 6.09% between 2025 and 2033, underscoring America’s continued dominance in the global luxury ecosystem.

Luxury goods in the U.S. encompass an increasingly diverse range of products—from jewelry and high-end watches to designer apparel, premium cosmetics, handbags, accessories, and even luxury automobiles. These products carry more than just their material value; they symbolize craftsmanship, emotional engagement, cultural expression, and social identity. In a marketplace driven by rising disposable incomes, digital sophistication, and aspirational consumption, the demand for premium goods continues to accelerate.

An Overview of the United States Luxury Goods Industry

Luxury goods represent a sector rooted in exclusivity, artistry, innovation, and long-standing heritage. While mass-market products compete on price and availability, luxury goods thrive on scarcity, craftsmanship, and a sense of personal identity. American consumers purchase luxury goods not only for functional use but also for investment value, self-expression, and social recognition.

As demographic shifts reshape consumer behavior, millennials and Gen Z—once perceived as price-sensitive cohorts—have emerged as major drivers of luxury demand. Their motivation differs from older generations: they value authenticity, brand storytelling, sustainability, and digital access. Their preferences have pushed luxury brands to adopt richer omnichannel experiences, experiential retail concepts, and online-first strategies.

Simultaneously, traditional wealth holders—Baby Boomers and affluent Gen X buyers—continue to make up a major segment of luxury spending. However, their preferences are also evolving toward personalization, high-quality craftsmanship, and exclusive services.

In addition, the U.S. remains a major destination for international tourists, who significantly bolster luxury sales. High-spending travelers from Europe, China, the Middle East, and Latin America frequent luxury hubs like New York, California, and Florida, reinforcing the sector’s resilience and global loop.

Growth Drivers of the U.S. Luxury Goods Market

1. Digital Influence, Social Media, and Celebrity Endorsements

The digital landscape has revolutionized how luxury brands communicate with their audiences. Platforms like Instagram, TikTok, YouTube, and Snapchat have made luxury more visible and aspirational, influencing millions of consumers daily.

Celebrity partnerships are no longer limited to advertisements. They now extend to creative leadership roles, shaping brand identity. A striking example came in February 2025, when Ray-Ban appointed ASAP Rocky as its first Global Creative Director, signaling a cultural shift: luxury brands are aligning themselves with cultural icons, not just fashion designers.

This shift reflects a new reality: luxury is now a cultural currency, shaped by music, sports, entertainment, and digital influence. For younger consumers especially, celebrity-led brand storytelling holds enormous appeal.

2. Rising Demand for Sustainability and Ethical Consumption

Sustainability has become a non-negotiable value in the U.S. luxury goods market. Consumers, especially young buyers, demand transparency, ethical sourcing, and environmentally conscious production.

A Stifel survey (October 2023) found that:

20% of Millennials

22% of Gen Z

purchase exclusively from brands aligned with their ethical or environmental values.

Luxury houses have responded decisively:

Stella McCartney leads the charge with circular materials and eco-friendly textiles.

Rolex, in December 2024, unveiled sustainable watch packaging made from recycled plywood and cardboard, blending premium feel with ecological responsibility.

Brands increasingly adopt regenerative materials, recycled textiles, and carbon-neutral manufacturing.

As environmental awareness grows, luxury brands must innovate responsibly to remain relevant and competitive.

3. Product Innovation in Design, Material Science, and Functionality

Innovation has become a core competitive differentiator.

Luxury fashion designers are embracing mycelium-based leather, organic materials, and biodegradable textiles. One standout example comes from Koio, a sustainable luxury footwear label that launched 99% biodegradable shoes in October 2023, including leather sourced from regenerative farms in the Swiss Alps.

In beauty and cosmetics, multifunctionality is becoming key. With rising living costs, even affluent consumers seek value and utility in luxury products. High-end brands now incorporate skincare, cosmetic performance, and environmental protection into a single formulation.

Luxury goods are evolving rapidly—balancing craftsmanship with modern innovation, sustainability, and performance.

Challenges in the United States Luxury Goods Market

1. Counterfeiting and Gray Market Competition

The luxury industry faces persistent threats from counterfeit products and unauthorized resale channels. Counterfeit goods erode brand integrity, damage consumer trust, and reduce legitimate sales. Meanwhile, gray market sellers disrupt pricing and exclusivity by selling genuine products outside approved channels.

Luxury brands are strengthening anti-counterfeiting measures through:

Blockchain authentication

RFID-enabled packaging

Secure supply-chain monitoring

Consumer education campaigns

Ensuring authenticity remains one of the most critical challenges for luxury companies in the U.S.

2. Growing Price Sensitivity Among Consumers

Consumers are increasingly evaluating the true value of luxury goods, especially after multiple price hikes across leading fashion and accessory brands. Aspiring luxury buyers—primarily millennials and Gen Z—are delaying purchases or opting for resale and rental platforms. Even affluent households are reconsidering high-ticket discretionary spending due to broader economic concerns.

This shift signals a reevaluation of the luxury consumer base, requiring brands to innovate in pricing, loyalty programs, and consumer experience.

Regional Insights: Key U.S. State Markets for Luxury Goods

California

California stands as one of America’s largest and most influential luxury markets. Cities like Los Angeles, Beverly Hills, and San Francisco are home to premium shopping districts, celebrity culture, and affluent demographics. High-end fashion, automobiles, jewelry, accessories, and beauty products perform exceptionally well here. California’s strong tourism ecosystem further boosts luxury sales, while sustainability and artistic design have become defining regional preferences.

Texas

Texas is one of the fastest-growing luxury markets in the country. With economic growth, rising incomes, and booming cities like Dallas, Houston, and Austin, luxury demand continues to surge. High-end vehicles, designer fashion, accessories, and luxury home décor are especially popular. Younger buyers in Texas are drawn to exclusive editions and personalized luxury, making it a prime market for brand expansion.

New York

New York—especially New York City—remains the beating heart of the American luxury economy. Iconic retail districts like Fifth Avenue and Madison Avenue are global attractions. The city enjoys strong luxury consumption from local elites, global tourists, and fashion-forward professionals. New York Fashion Week and other cultural events solidify the city’s influence on global luxury trends.

Florida

Florida’s luxury market thrives on a combination of affluent residents, celebrities, seasonal visitors, and international tourists. Areas such as Miami, Orlando, and Palm Beach are hotspots for luxury shopping. High-end beauty, jewelry, cars, accessories, and resort wear all see strong demand. Florida’s wellness-focused lifestyle also boosts premium beauty and personal care categories.

Recent Developments in the U.S. Luxury Goods Market

February 2025: Tacori opened 15 new premium shop-in-shop retail concepts to enhance visibility and exclusive consumer experience.

April 2024: Gucci expanded its U.S. retail presence with a 17,500-square-foot flagship store in Southern California, offering apparel, shoes, accessories, and fine jewelry.

January 2024: Prada launched Prada Beauty in the U.S., featuring advanced skincare formulations with its proprietary “Adapto.gn Smart Technology.”

Market Segmentation

By Product Type

Watches & Jewellery

Perfumes & Cosmetics

Clothing

Bags/Purses

Others

By Distribution Channel

Offline

Online

By End User

Women

Men

By States (29 Viewpoints)

Includes: California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and the Rest of the United States.

Key Players in the U.S. Luxury Goods Market

Kering S.A.

Ralph Lauren Corporation

Valentino S.p.A.

Gianni Versace S.r.l

Hermès International S.A.

Compagnie Financière Richemont S.A.

Giorgio Armani S.p.A

LVMH Moët Hennessy Louis Vuitton

Prada S.p.A.

The Swatch Group Ltd

Each company profile includes:

Company Overview

Key Persons

Recent Developments & Strategies

SWOT Analysis

Sales Analysis

Final Thoughts

The United States luxury goods market is in the midst of a dynamic evolution. Powered by younger consumers, digitization, sustainable innovation, and cultural influence, the sector is poised for sustained growth through 2033. While challenges such as counterfeiting and price sensitivity remain, brands that adapt—prioritizing personalization, authenticity, sustainability, and technological innovation—will continue to thrive.

Luxury is no longer just about owning something exclusive; it’s about experiencing identity, value, culture, and craftsmanship. In a nation as diverse and forward-thinking as the United States, the appetite for premium goods is set to remain resilient, aspirational, and deeply influential.