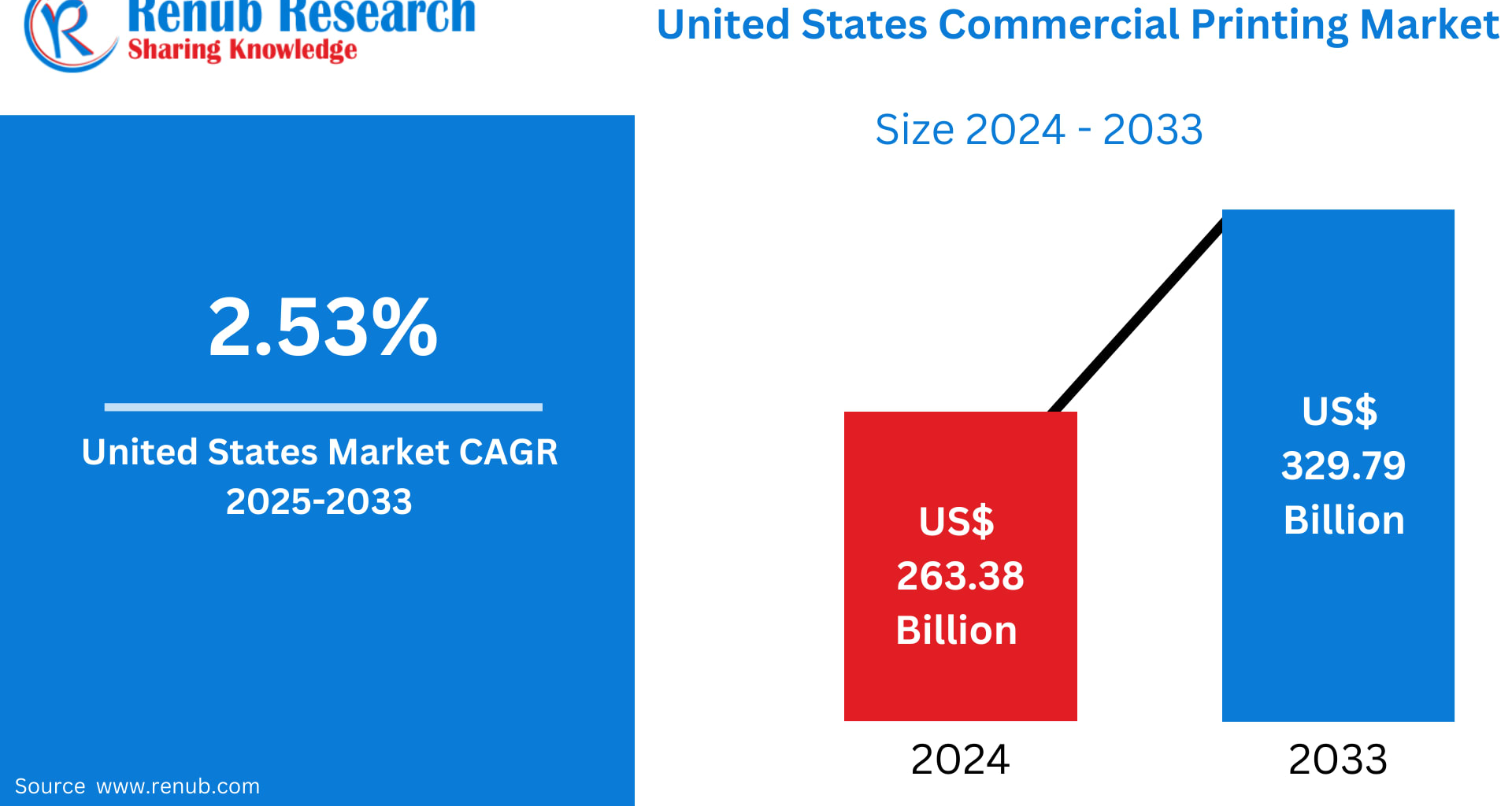

The United States Commercial Printing Market is entering a decade of measured but meaningful expansion—despite structural challenges and evolving communication habits. According to Renub Research, the market is projected to rise from US$ 263.38 billion in 2024 to US$ 329.79 billion in 2033, reflecting a CAGR of 2.53% between 2025 and 2033. While modest at face value, this trajectory highlights how print remains integral across packaging, marketing, compliance, and décor—even as digital communication accelerates.

Commercial printing today is no longer defined merely by brochures, catalogs, or business cards. It has evolved into a multifaceted ecosystem blending digital print, variable data capability, sustainable production, short-run agility, and brand-level customization. From e-commerce packaging to programmatic direct mail and hyper-personal marketing materials, print continues to adapt, proving its relevance in an increasingly digitized commercial landscape.

United States Commercial Printing Market Outlook

Commercial printing encompasses the production of printed materials such as packaging, posters, flyers, manuals, labels, business cards, catalogs, and promotional kits. The U.S. market serves a diverse matrix of industries including retail, publishing, pharmaceuticals, education, logistics, and entertainment.

While digital communication has transformed how businesses interact with customers, print maintains a distinctive advantage: tangible impact. Brands continue to rely on print for:

Product launches

Retail promotions

Educational materials

Corporate communication

Regulatory documentation

Packaging and labeling

Direct mail and omnichannel marketing

Modern commercial printing embraces digital workflows, AI-led design, on-demand print, variable data personalisation, and automated finishing—allowing brands to deliver targeted messaging with speed, accuracy, and creative variety.

Key Growth Drivers in the U.S. Commercial Printing Market

1. E-Commerce Packaging & Short-Run Flexibility

E-commerce remains a force reshaping the U.S. printing landscape. Unlike traditional mass-run packaging, online-selling brands require frequent, rapid-turn, low-volume print formats such as:

Mailers & shippers

Insert cards

Branded tissue

Labels & belly bands

Influencer kits

Short-run prototypes

Digital and inkjet printing have become essential, enabling micro-batch packaging that changes weekly—or even by region or influencer.

Automation is at the heart of this growth. Cloud-based RIPs, imposition bots, and web-to-print storefronts allow small merchants to order packaging without holding inventory. August 2025 developments like McKernan Packaging Clearing House’s new e-commerce platform show how the supply chain is becoming increasingly customer-driven and efficiency-focused.

Sustainability compounds this shift. Right-sized cartons, recyclable labels, recycled content fiber, mono-material structures, and water-based inks help brands meet environmental commitments while reducing DIM weight shipping costs.

2. Direct Mail Delivers Measurable ROI in Omnichannel Campaigns

As digital ads saturate consumer attention, marketers in the U.S. are rediscovering direct mail’s potency—especially when powered by data-driven personalization.

Modern direct mail uses:

Variable images

Customized offers

QR-to-digital bridges

Geo-contextual messaging

Programmatic print triggered by online behaviour

“Programmatic mail” has emerged as a powerful tool. Actions such as cart abandonment or product browsing can trigger an automatically printed and mailed piece—timely, personalized, and trackable via QR codes and PURLs.

Printers who integrate with marketing clouds and CDPs have shifted from vendors to strategic partners, offering full-service capabilities including:

Data hygiene & deduplication

Audience segmentation

Automated A/B/C creative

Postal optimization

Commingling services

Tactile enhancements—soft-touch lamination, raised UV, cold foil—boost print memorability in ways digital screens cannot replicate.

3. Compliance, Security & Domestic Reliability

Regulated sectors such as pharmaceuticals, medical devices, cosmetics, and food & beverage require highly controlled printed materials. These include:

Multi-panel labels

UDI/GS1 barcoded inserts

Tamper-evident components

Serialization

Microtext & braille

Multilingual IFUs

Such work demands precision, secure prepress, and validated production environments. As global logistics uncertainties and counterfeiting risks grow, U.S. brands increasingly prefer on-shore printing partners capable of certified compliance and FDA-aligned documentation.

Security printing is also rising. Hidden inks, taggants, forensic substrates, and serialized QR codes help brands fight product diversion and fraud.

A notable development came in November 2024, when Nelipak opened its first North American flexible packaging site in North Carolina—signaling continued investment in U.S.-based regulated print capacity.

Challenges Facing the U.S. Commercial Printing Market

1. Volume Declines in Legacy Applications

Traditional print categories such as newspapers, mass catalogs, directories, and transactional mail continue to contract. This affects:

Press utilization

Unit economics

Inventory forecasting

Labor optimization

Paper mill consolidation and longer lead times amplify difficulties. Logistics—fuel prices, driver shortages, transit delays—introduce further planning complexity.

To survive, many printers diversify into:

Packaging

Labels

Large-format

Direct mail

Specialty décor

Success depends on crew retraining, investing in digital/inkjet technologies, and reengineering estimating models to reflect the value of speed and complexity.

2. Input Cost Volatility & Rising ESG Compliance Pressure

Paper remains the highest-cost input, with frequent fluctuations. Beyond paper, costs rise across:

Inks

Coatings

Plates

Energy

Logistics

Skilled labor

Meanwhile, customers increasingly demand strong sustainability performance:

FSC/PEFC chain-of-custody

Recycled content verification

VOC compliance

Scope 1–3 emission reporting

Waste reduction

Circular design options

Investments in LED-UV curing, water-borne inks, heat recovery systems, electric forklifts, and solvent capture are necessary—but costly.

Operators best positioned are those who combine procurement hedging, smart energy monitoring, waste dashboards, and real-time stock-linked estimating tools.

Segment-Specific Market Overviews

United States Commercial Image Printing Market

The image printing category includes photo books, wall décor, canvas prints, metal prints, acrylic displays, calendars, and personalized gifts. Driven by life events and home refresh trends, this segment has grown through:

Mobile-first ordering

AI-powered image curation

Automatic upscaling & layout tools

On-demand printing

Premium substrates (metal, fabric, acrylic)

B2B expansion is strong across hospitality, museums, retail spaces, and corporate décor. Color consistency, scratch resistance, drop-ship logistics, and mass personalization workflows are competitive differentiators.

United States Commercial Pattern Printing Market

Pattern printing spans textiles, soft signage, apparel, upholstery, and interiors. Digital roll-to-roll inkjet (dye-sub, pigment, reactive) is rapidly replacing rotary screen printing, driven by fashion’s need for quick collection cycles.

Brands now demand:

Zero-setup digital workflows

High fidelity across fabrics

3D garment simulation

Compliance with flame resistance & wash fastness

Custom wallpaper & commercial interiors

Print-on-demand marketplaces link designers with micro-factories, helping avoid overproduction and long freight cycles.

United States Commercial Packaging Printing Market

Packaging printing is the fastest-growing commercial printing segment, led by:

Labels and shrink sleeves

Folding cartons

Flexible pouches

Corrugated packaging

Digital hybrid presses enabling inline embellishment (tactile varnish, cold foil, metallization) dominate short-to-mid production runs.

Additionally:

E-commerce accelerates the need for protective, right-sized materials

Food & pharma packaging require migration-safe inks

Smart packaging (QR, NFC, traceability) is becoming mainstream

Sustainability creates demand for mono-material, PCR, and recyclable structures

Printers offering LCA (life cycle assessment) tools and VMI (vendor-managed inventory) gain additional advantage.

United States Commercial Books Printing Market

The U.S. book printing sector has migrated to short-run and print-on-demand models. High-speed inkjet enables economical production for runs ranging from dozens to thousands.

Publishers optimize inventory by printing “to signal”—triggered by real-time sales data. POD supports backlist titles, self-published authors, and academic coursepacks.

Critical capabilities include:

Offset-like inkjet quality

PUR binding & sewn binding

Lamination, foil, and specialty finish

Automated metadata & ISBN management

United States Commercial Newspapers Printing Market

Newspapers face long-term circulation declines, but contract printing and diversified products create stability.

Industry trends include:

Reduced publication days

Consolidated regional print hubs

Improved coldset quality

Glossy wraps for retail advertisers

Special edition “collectible” publications

Logistics optimization remains essential for accurate in-home delivery timing.

State-Level Market Snapshots

California

A blend of tech, entertainment, lifestyle, and agriculture creates demand for:

High-end event collateral

Studio promotional kits

Luxury OOH printing

Wine labels & food packaging

FSC-certified, low-VOC printing

Strict environmental regulations make California a leader in green printing technologies.

New York

Fast-paced industries—finance, fashion, media—dominate New York’s printing demand.

Typical requirements:

Overnight pitch books & lookbooks

Boutique, color-perfect fashion prints

Secure financial documents with chain-of-custody

Union & MWBE-certified suppliers

Pop-up event graphics & installations

Space constraints foster hybrid models with city-based digital shops supported by suburban offset facilities.

New Jersey

One of the nation’s strongest hubs for pharmaceutical and CPG printing, New Jersey excels in:

Validated IFUs

Camera-inspected labels

Folding cartons

Retail POS materials

Kitting & fulfillment

Port access and skilled labor create major competitive advantages.

Market Segmentations

Print Type

Image

Painting

Pattern

Others

Application

Packaging

Advertising

Publishing

Books

Magazines

Newspapers

Other publishing

Other applications

Top States Covered

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, Rest of U.S.

Key Companies (5 Viewpoints Each: Overview, Key Person, Developments, SWOT, Revenue)

ACME Printing

Cenveo Worldwide Limited

R.R. Donnelley & Sons Company

Vistaprint (CIMPRESS PLC)

Toppan Co. Ltd (Toppan Inc.)

Transcontinental Inc.

LSC Communications US LLC

Quad/Graphics Inc.

Dai Nippon Printing Co. Limited

Quebecor World Inc.

Final Thoughts

The United States commercial printing market is not merely surviving a digital world—it’s reinventing itself. Powered by e-commerce, personalized marketing, sustainable materials, and short-run digital agility, the industry continues to expand into high-value sectors such as packaging, security printing, and regulated labeling.

While legacy print faces decline, new categories—smart packaging, on-demand books, programmatic direct mail, custom décor, and digital textiles—are thriving. With a projected value of US$ 329.79 billion by 2033, commercial printing remains an indispensable force across American business.