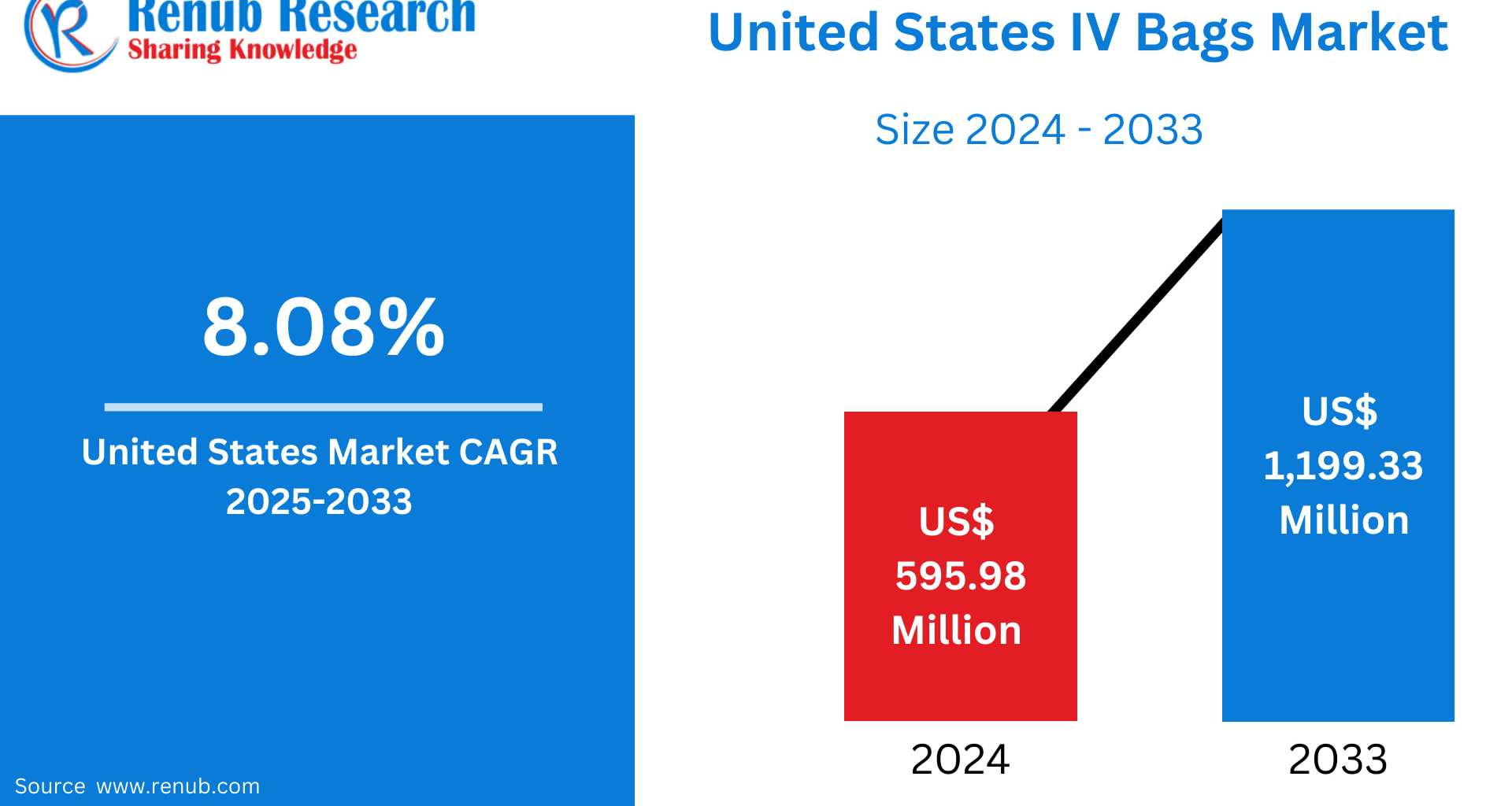

The United States IV Bags Market is entering a decade of transformative expansion. According to Renub Research, the market is projected to surge from US$ 595.98 million in 2024 to US$ 1,199.33 million by 2033, reflecting a strong CAGR of 8.08% between 2025 and 2033. This upward trajectory is powered by a stronger healthcare infrastructure, rising cases of chronic illnesses, advancements in IV delivery systems, and the growing shift toward home-based and outpatient infusion therapies.

Beyond hospitals, IV bags are now seen across wellness clinics, sports recovery centers, and even boutique health spas offering hydration and vitamin drips. As patient expectations evolve, and as the country’s aging population expands, IV therapy is quickly becoming one of the most relied-upon clinical tools across medical and wellness segments.

Understanding the Importance of IV Bags in Modern Healthcare

IV bags—or intravenous bags—are essential medical containers used to deliver fluids, medicines, electrolytes, and nutrients directly into a patient’s bloodstream. Designed using flexible plastics such as polyethylene, polypropylene, and PVC, these bags come in various capacities and chamber configurations depending on the medical requirement.

They are indispensable in treating:

Dehydration

Electrolyte imbalances

Chemotherapy administration

Post-operative recovery

Parenteral nutrition

Critical emergencies

The most widespread use is still inside hospitals and surgical centers. However, IV therapy has expanded significantly into home healthcare, thanks to portable pumps and trained visiting nurses. Even wellness spas now use IV drips to offer energy-boosting and hangover relief solutions, demonstrating how the sector is adapting to lifestyle-oriented demands.

Key Growth Drivers of the U.S. IV Bags Market

1. Rising Burden of Chronic Diseases

The United States is witnessing an unprecedented rise in chronic illnesses. Nearly 129 million Americans—more than one-third of the population—suffer from at least one major chronic condition such as heart disease, diabetes, hypertension, or cancer. Many of these conditions require ongoing infusion therapy for hydration, nutrition, or medication.

For instance:

Cancer patients rely on IV bags for chemotherapy and supportive fluids.

Kidney disease patients often require regular fluid management.

Diabetic patients undergoing acute episodes often need IV insulin or hydration.

With the population aging rapidly, the prevalence of these conditions will only rise, directly increasing the demand for sterile IV solutions and high-quality IV bags. Advanced therapies like biologic infusions and parenteral nutrition also require sophisticated IV administration systems.

2. Accelerated Shift Toward Non-PVC IV Bags

The industry is undergoing a shift away from PVC-based IV bags due to concerns about plasticizer leaching, especially DEHP (Di-2-ethylhexyl phthalate). As healthcare institutions and regulators push for safer, environmentally friendly materials, manufacturers are innovating rapidly.

In April 2022, Fresenius Kabi launched Calcium Gluconate in Sodium Chloride Injection in ready-to-administer freeflex (polyolefin) bags—a landmark move as these bags contain no DEHP and no PVC.

This trend toward polyolefin, polyethylene, and polypropylene bags creates new growth opportunities while supporting patient safety and sustainability.

3. Expanding Homecare & Outpatient Infusion Therapies

The U.S. healthcare model is shifting from hospital-centric care to cost-effective, convenient care at home. Several trends feed this boom:

Rise of home infusion companies

Increasing insurance coverage for home-based treatments

Chemotherapy and dialysis shifting toward outpatient settings

Elderly population preferring at-home recovery

For example, cancer remains one of the biggest drivers of home infusion therapy. In 2022, the U.S. saw:

268,490 new prostate cancer cases

151,030 colorectal cancer cases

These patients often need ongoing IV support, creating consistent demand for portable, easy-to-administer IV bags.

As value-based care accelerates in the U.S., homecare-focused IV bags—especially mid-sized and multi-chamber formats—will continue to gain momentum.

Challenges Impacting Market Growth

1. Raw Material Supply Chain Constraints

Most IV bags are made from medical-grade polymers, and any disruption in the raw material supply chain can severely affect production. The COVID-19 pandemic revealed the vulnerability of global medical supply lines—IV bags were among the products most affected.

Manufacturers today are under pressure to:

Manage polymer price volatility

Ensure uninterrupted sourcing

Maintain sterile production environments

Balance rising material costs without increasing prices drastically

Any weakness in raw material supply threatens market stability, especially during public health emergencies.

2. Stringent FDA Regulations

The U.S. healthcare system is among the most regulated in the world. Because IV bags directly influence patient health outcomes, they must undergo:

Rigorous sterility testing

Material safety evaluations

Toxicology review

FDA quality and labeling approvals

Ongoing facility inspections

The high cost of compliance creates a competitive divide—large companies can meet regulatory requirements with ease, while smaller manufacturers struggle to keep pace, limiting new entrants.

Material Insights: What the U.S. Market Prefers

Polyethylene IV Bags

Polyethylene is gaining fast acceptance due to its non-PVC, non-toxic composition, making it ideal for:

Chemotherapy drugs

Antibiotics

Electrolyte solutions

Sensitive medications

Lightweight, recyclable, and safe, polyethylene aligns with modern healthcare sustainability goals. Expect this segment to expand significantly through 2033.

Polypropylene IV Bags

Polypropylene bags offer:

High thermal resistance

Compatibility with sensitive drug formulations

Ability to withstand advanced sterilization processes

Mechanical durability

Their use is increasing in oncology, parenteral nutrition, and critical care therapies, especially as hospitals move away from DEHP-containing PVC bags.

Capacity-Based Insights

250–500 ml IV Bags: Dominating the U.S. Market

IV bags in the 250–500 ml category account for a major share due to their versatility. They are widely used for:

Antibiotic administration

Fluid correction therapies

Electrolyte replenishment

Outpatient infusions

Home-based treatments

Their moderate size reduces wastage and makes them cost-efficient—ideal for clinics and emergency care units.

Chamber Type Insights

Single-Chamber IV Bags: The Market Mainstay

Single-chamber bags remain the backbone of IV therapy, used for:

Dextrose

Saline

Electrolyte solutions

Basic infusions

They are inexpensive, easy to transport, and compatible with most infusion protocols.

Multi-Chamber IV Bags: Rising in Demand

Multi-chamber bags are gaining traction, especially in:

Parenteral nutrition

Oncology care

ICUs

Their ability to keep ingredients separate until administration reduces contamination risks and ensures precise drug formulation. This technology also decreases preparation time for pharmacists and clinicians.

Geographical Insights: Key U.S. Markets

Washington

Washington’s IV bags market is expanding due to:

Heavy investment in healthcare infrastructure

Growth in outpatient centers

State-level sustainability initiatives promoting non-PVC medical supplies

The region’s aging population further drives consistent demand for infusion therapies.

California

As one of the most populous and healthcare-advanced states, California leads in IV bag consumption. Key factors include:

High prevalence of cancer and diabetes

Strong adoption of green healthcare alternatives

Major biotech and medical device innovation hubs

California is also at the forefront of implementing non-PVC IV solutions.

New York

New York’s dense urban population and extensive hospital networks contribute heavily to IV bag demand. Emergency rooms, trauma centers, and advanced cancer treatment facilities generate continuous consumption across all product segments.

The state is also an innovation leader, supporting faster adoption of multi-chamber and specialty IV bags.

Market Segmentation Overview

By Material Type

Polyethylene

Polyvinyl Chloride (PVC)

Polypropylene

Others

By Capacity

0–250 ml

250–500 ml

500–1000 ml

By Chamber Type

Single Chamber

Multi Chamber

Top States

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, Rest of U.S.

Competitive Landscape: Key Companies (5 Viewpoints Each)

Each company includes: Overview, Key Person, Recent Developments, SWOT Analysis, Revenue Analysis

Baxter International Inc.

Kraton Corporation

Technoflex

B. Braun Medical Inc.

Sippex IV Bags

Polycine GmbH

ICU Medical Inc.

Fresenius Kabi

Haemotronic

MedicoPack

These players are focusing on product innovation, sustainability, expansion into homecare supplies, and advanced polymer development to gain competitive advantage.

Final Thoughts

The United States IV Bags Market is standing at the threshold of robust expansion. As chronic disease rates continue to rise and patient preferences shift toward home-based care, the demand for safer, eco-friendly, and technologically advanced IV bags will only intensify. Innovations in material science, the transition away from PVC, and increasing investments in healthcare infrastructure are shaping a future where infusion therapy becomes more efficient, accessible, and sustainable.

With a projected market size of US$ 1.19 billion by 2033, IV bags will remain one of the most essential—and fastest-growing—components of U.S. medical supplies. For manufacturers, distributors, and healthcare institutions, the coming decade offers unprecedented opportunity to innovate and serve a rapidly evolving clinical landscape.