United States Carpet Market Overview

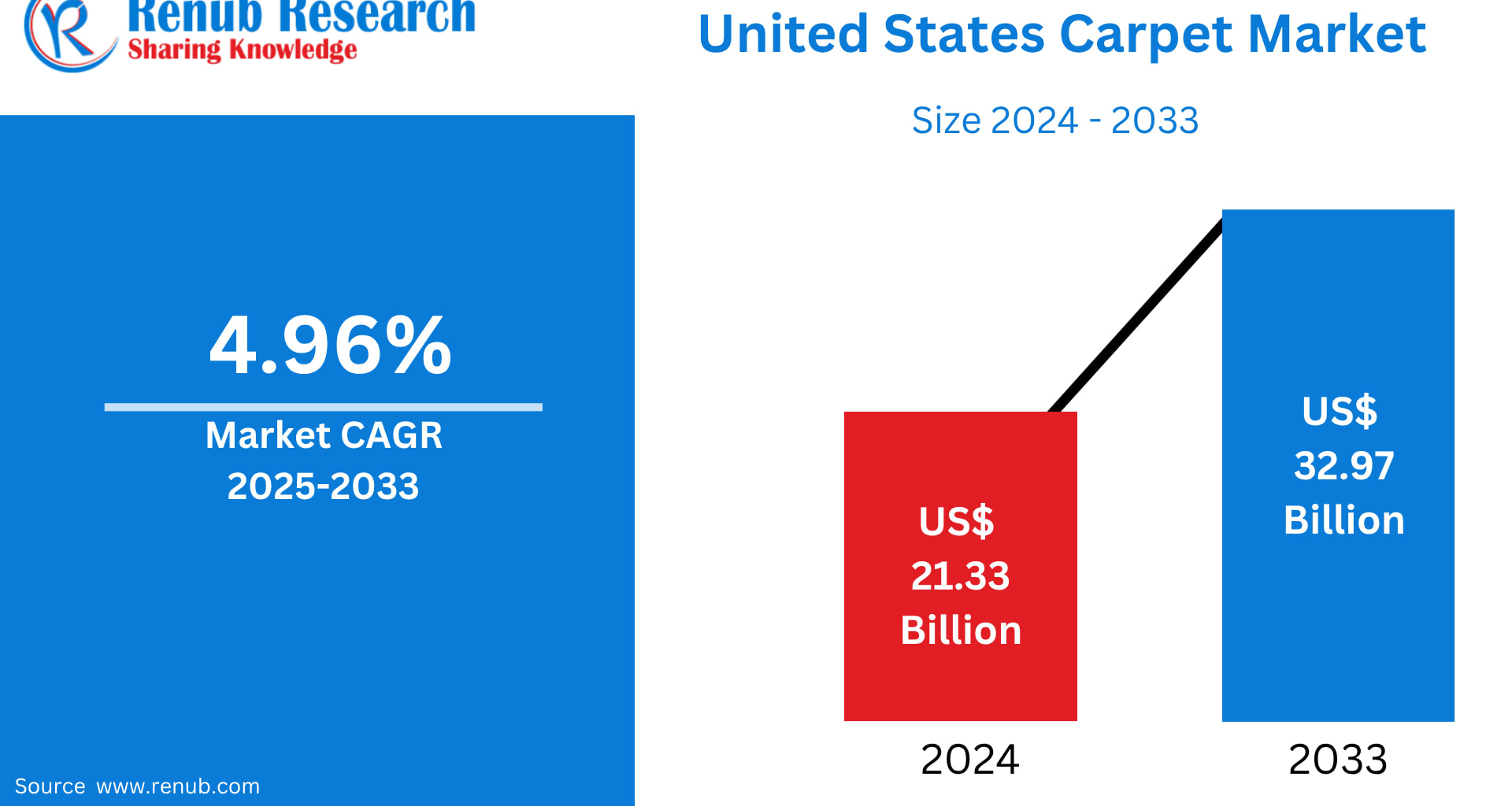

The United States Carpet Market is anticipated to grow from US$ 21.33 billion in 2024 to US$ 32.97 billion by 2033, expanding at a CAGR of 4.96% during 2025–2033, according to Renub Research. This growth reflects a strengthening demand for durable, cost-effective, and aesthetically appealing flooring solutions across residential, commercial, and institutional environments.

Carpet—constructed using wool, nylon, polyester, or polypropylene fibers—remains a staple flooring choice for millions of American homes and businesses. Its multifunctional appeal is broad: carpets add visual warmth, offer underfoot comfort, reduce noise, and provide enhanced insulation in colder climates.

Across U.S. households, carpets dominate bedrooms, living areas, basements, and staircases due to their comfort-centric profile. In commercial real estate—especially hotels, offices, and educational buildings—they are integral for acoustics, durability, and design flexibility. The market increasingly favors advancements such as stain-resistant carpets, antimicrobial treatments, and eco-friendly versions that fit the sustainability-driven preferences of today’s consumers.

In short, while consumer lifestyles, home improvement activity, and design trends evolve, carpeting continues to maintain its relevance in the nation’s flooring mix—supported by leading domestic manufacturers and global brands that continue to deliver innovative solutions.

Growth Drivers of the United States Carpet Market

1. Rising Home Renovation and Remodeling Activities

One of the strongest contributors to U.S. carpet demand is the continued rise in home renovations. Americans are increasingly investing in interiors that emphasize comfort, warmth, and aesthetic cohesion—all of which make carpet a natural choice.

Post-pandemic lifestyle shifts, along with a surge in remote work, have encouraged homeowners to revamp living rooms, bedrooms, and home offices. Carpet tiles and modular carpeting—popular for their DIY-friendly installation—are gaining traction among younger homeowners and suburban families.

Notably, the Harvard University Joint Center for Housing Studies reported that home improvement and repair spending reached a staggering US$ 472 billion in 2022. Aging housing stock, deferred maintenance, and growing middle-class spending all support a robust remodeling trend that will sustain carpet demand through the forecast period.

2. Expansion of Commercial Real Estate & Hospitality Sectors

The U.S. commercial carpet segment benefits heavily from ongoing construction and renovation activity across office buildings, hotels, retail spaces, hospitals, and educational campuses.

Carpets remain the preferred choice for their:

Noise reduction capabilities in corporate and institutional environments

Aesthetic versatility, aligning with modern office interiors

Comfort, especially in hospitality and premium hotel segments

Safety features, including slip resistance

CBRE’s 2025 U.S. Hotel Investor Intentions Survey shows a striking positive sentiment: 94% of respondents plan to maintain or increase their hospitality investments, up from 85% in 2024. Premium hospitality properties—including luxury and upper-upscale hotels—are adopting high-quality woven carpets and designer commercial tiles to elevate guest experience.

Additionally, LEED-certified buildings increasingly adopt low-VOC, recyclable, and eco-friendly carpets to align with sustainability mandates.

3. Technological Advancements & Eco-Friendly Innovation

The U.S. carpet market is evolving rapidly, led by major advancements such as:

Stain-resistant & spill-proof coatings

Antimicrobial and allergy-friendly fibers

Recycled material-based carpets (PET plastics, reclaimed fibers)

Biodegradable carpet options

Modular carpets with customizable layouts

Environmentally conscious consumers and builders prioritize carpets with Green Label Plus certification or those compatible with LEED (Leadership in Energy and Environmental Design) standards.

A notable innovation is OBJECT CARPET’s NEOO mono-material polyester carpet (2022)—a fully recyclable solution that marked a shift toward circular production. The company continues to expand its sustainable portfolio through DUO technology, aiming to convert its entire product line to recyclable materials by 2026.

Digital design tools and 3D customization platforms are also transforming retail engagement, enabling personalized designs and seamless installation planning.

Challenges in the U.S. Carpet Market

1. Growing Popularity of Hard Surface Flooring

The increasing appeal of hard surface flooring—such as hardwood, engineered wood, luxury vinyl tile (LVT), and laminate—is a significant competitive challenge. These options are widely perceived as:

Easier to clean

More durable in moisture-prone rooms

More compatible with minimalist interior design trends

With younger demographics gravitating toward contemporary aesthetics, carpets must compete through innovation in hybrid products, sustainable materials, and enhanced durability.

2. Maintenance Concerns & Shorter Lifespan

Carpet naturally requires more frequent cleaning due to its fiber structure, which can trap dust, allergens, and stains. This is a critical consideration for households with pets or children.

Other challenges include:

Odor retention

Wear and tear in high-traffic zones

Higher maintenance costs over time

Compared with hard surface flooring, which may last decades, carpet’s shorter lifecycle can reduce repeat purchases, particularly in rental properties where landlords prioritize durability and low maintenance.

United States Market by Carpet Type

Woven Carpet Market

Woven carpets cater to the luxury segment, known for their intricate patterns, density, and long-lasting structure. Produced through traditional weaving techniques, they are favored in:

Luxury homes

High-end hospitality spaces

Heritage buildings

Designer commercial interiors

Though more expensive than tufted carpets, woven carpets offer superior elegance and lifespan, ensuring stable demand in niche markets.

Nylon Carpet Market

Nylon remains one of the most popular synthetic carpet materials due to its:

Superior resilience

Excellent stain resistance

Wide color availability

Ability to handle heavy foot traffic

This makes nylon carpets ideal for both residential households and commercial environments. Modern nylon fibers incorporate enhanced stain protection and are increasingly available in eco-friendly or recycled variants.

Residential Carpet Market

The residential segment holds the largest share of the U.S. carpet market. Key reasons include:

Comfort and warmth

Cost-effectiveness versus hardwood

Strong insulation properties in colder states

Wide variety of textures, colors, and price ranges

DIY-friendly carpet tiles and hypoallergenic solutions appeal strongly to younger homebuyers and families focused on indoor air quality.

Commercial Carpet Market

The commercial segment is driven by demand from:

Office buildings

Healthcare facilities

Educational institutions

Hospitality venues

Commercial carpets prioritize durability, acoustic performance, and easy maintenance. Modular carpet tiles dominate due to their versatility and cost-efficient replacement cycle.

Government spending on public infrastructure—including hospitals and schools—is further boosting demand for high-performance commercial carpeting.

State-Level Market Highlights

California Carpet Market

California is one of the largest and most progressive carpet markets, bolstered by:

Strong real estate activity

Green building regulations

Preference for low-emission, recyclable carpeting

Growing office and tech-sector developments

Major urban centers—Los Angeles, San Diego, and San Francisco—contribute heavily to both residential and commercial carpet consumption.

New Jersey Carpet Market

New Jersey’s carpet market benefits from:

Proximity to New York City

High population density

Strong suburban housing activity

Institutional renovation across schools and healthcare centers

There is a growing shift toward Green Label-certified carpets due to rising sustainability awareness.

New York Carpet Market

New York’s carpet market is diverse, serving:

Luxury Manhattan residences

Office towers

Retail complexes

Hospitality properties

Infrastructure upgrades across public schools and government buildings also amplify demand. In urban areas, noise reduction and indoor air quality standards strengthen the need for high-performance carpeting.

United States Carpet Market Segmentation

By Product Type

Woven

Knotted

Needle Felt

Tufted

By Material

Nylon

Polypropylene

Polyester

Acrylic

Wool & Wool Blends

Others

By End Use

Residential

Commercial

Industrial

Top 10 Carpet Markets by State

California

Texas

New York

Florida

Illinois

Pennsylvania

Ohio

Georgia

Washington

New Jersey

(Plus Rest of the United States)

Key Companies Covered (5 Viewpoints Each)

Overview

Key Person

Recent Developments

SWOT Analysis

Revenue Analysis

Major Players

Honeywell International Inc.

Munters Group

Phoenix Manufacturing Inc.

Bonaire Heating & Cooling

Celsius Design Limited

Colt Group Limited

Condair Group AG

Final Thoughts

The United States Carpet Market is entering a dynamic period driven by home renovation trends, commercial real estate expansion, and rapid sustainability-focused innovation. While hard surface flooring remains a major competitor, the carpet industry is responding with better materials, recyclable solutions, advanced stain resistance, and design versatility that resonates with both residential and commercial buyers.

With a projected market value of US$ 32.97 billion by 2033, carpets will continue to play a fundamental role in American interior spaces—combining comfort, style, and evolving technology to meet the demands of modern living.