Electronic Accessories Market Summary

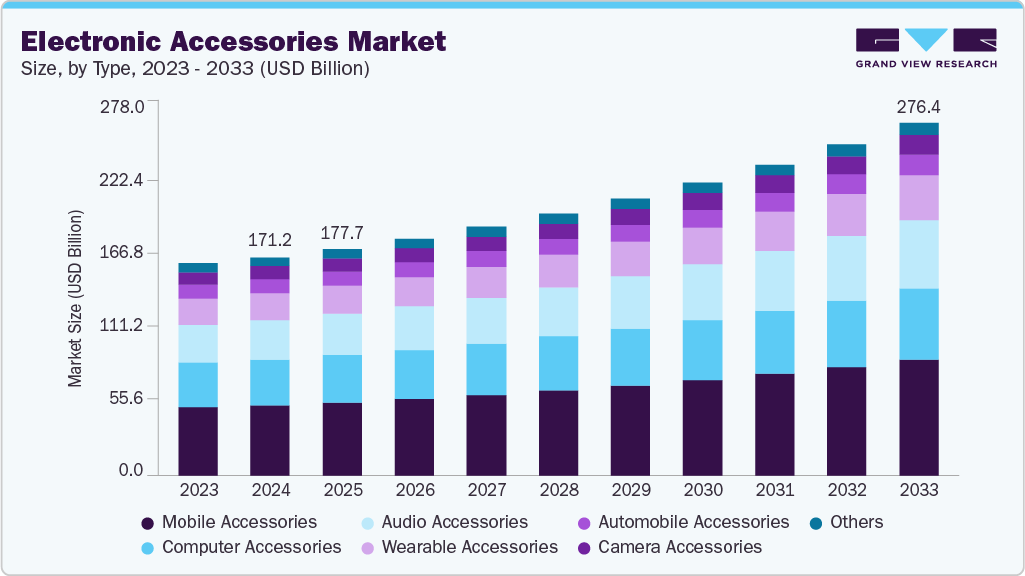

The global electronic accessories market size was estimated at USD 171.20 billion in 2024 and is projected to reach USD 276.40 billion by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The growing use of smartphones, tablets, laptops, wearables, and smart TVs is driving demand for electronic accessories.

Key Market Trends & Insights

Asia Pacific electronic accessories market held the largest global revenue share of over 41.55% in 2024.

The electronic accessories industry in the U.S. led North America with the largest revenue share in 2024.

By type, the mobile accessories segment held the largest revenue share in 2024.

By price range, the premium segment is expected to grow at the fastest CAGR of over 7.0% from 2025 to 2033.

Market Size & Forecast

2024 Market Size: USD 171.20 Billion

2033 Projected Market Size: USD 276.40 Billion

CAGR (2025-2033): 5.7%

Asia Pacific: Largest market in 2024

As smartphone penetration exceeds 80% in many regions, consumers increasingly purchase complementary products like chargers, cases, earbuds, and power banks. This rising ownership of smart devices fuels consistent accessory demand, especially in both emerging and developed markets, making it a key factor in the sustained growth of the electronic accessories industry.

The electronic accessories industry is experiencing a major transformation with a shift from traditional wired products to wireless and smart technologies. Consumers are increasingly favoring Bluetooth-enabled audio devices such as wireless earphones, speakers, and headsets for their convenience, portability, and sleek designs. Wireless chargers and Wi-Fi-enabled smart accessories have also gained popularity, especially among tech-savvy and minimalist users. Devices like Apple AirPods, Samsung Galaxy Buds, and smart rings from Oura and Ultrahuman exemplify this shift, offering seamless integration with smartphones and wearables. These innovations not only provide greater mobility and clutter-free usage but also align with the growing demand for multifunctional and intelligent gadgets. As the ecosystem of connected devices expands and battery technologies improve, wireless accessories are set to become the default choice across segments, further accelerating their global adoption and reinforcing their position as the key market growth drivers.

The global transition to work-from-home (WFH) and hybrid work models, accelerated by the COVID-19 pandemic, has permanently reshaped the demand landscape for electronic accessories. With professionals working remotely, there has been a substantial rise in the purchase of productivity-enhancing accessories such as webcams, noise-canceling headsets, external keyboards, ergonomic laptop stands, and high-speed routers. These tools have become essential for maintaining efficiency, collaboration, and communication in virtual work environments. Moreover, companies are now allocating budgets for employee technology upgrades, further boosting the business-to-business (B2B) demand for such accessories. This trend is not limited to corporate sectors; freelancers, content creators, and educators are also contributing to rising sales. As hybrid work continues to define the modern workplace, the demand for high-quality, durable, and comfortable computing accessories is expected to remain robust. The long-term adoption of flexible work arrangements will continue to be a major driver of growth within the electronic accessories ecosystem.

The electronic accessories market, particularly in segments like mobile and audio accessories, is becoming increasingly saturated due to the presence of numerous players offering similar or near-identical products. This overcrowding has led to intense price competition, as companies strive to undercut each other to gain market share. As a result, profit margins are compressed, and consumers often prioritize price over brand, leading to low brand loyalty. Even established brands face challenges maintaining differentiation, as functionality across products becomes standardized. This commoditization pressures manufacturers to either innovate rapidly or compete on volume and cost, making it difficult for smaller or premium-focused companies to sustain long-term profitability.

Product Type Insights

The mobile accessories segment accounted for a market share of over 32.0% in 2024. The rapid growth in smartphone ownership, particularly in emerging markets such as India, Indonesia, and parts of Africa, is a key driver of the mobile accessories market. As smartphones become more affordable and internet access expands, more users are entering the digital ecosystem. This surge in smartphone adoption leads to increased demand for essential accessories like chargers, earphones, protective cases, and power banks to enhance device functionality and longevity. In 2025, smartphone penetration has surpassed 80% in many regions globally, highlighting a maturing but still expanding market. This growing user base ensures consistent and recurring demand for mobile accessories, especially in value-conscious, high-growth markets.

The audio accessories segment is anticipated to grow at a significant CAGR of 6.9% during the forecast period. The audio accessories segment is witnessing a major shift from wired to wireless technologies, with True Wireless Stereo (TWS) devices adoption driving market growth. Products like Apple AirPods, Samsung Galaxy Buds, and affordable alternatives from Boat, Realme, and Soundcore are gaining popularity due to their convenience, compact design, and ease of use. The removal of headphone jacks in many modern smartphones has further accelerated this transition, pushing consumers toward Bluetooth-enabled solutions. TWS earbuds are now widely used for music, calls, gaming, and workouts, making them an essential accessory across age groups and income segments. This wireless trend is reshaping consumer expectations and product innovation.

Connectivity Type Insights

The wireless segment accounted for the largest share of the electronic accessories market in 2024. The elimination of traditional ports, particularly the 3.5mm headphone jack and USB-A, in modern smartphones, especially premium models, has significantly influenced consumer behavior. As brands move toward sleeker, portless designs, users are increasingly adopting wireless alternatives. Bluetooth earphones, such as AirPods and Galaxy Buds, have become standard audio solutions, while wireless chargers and docks offer convenience without cable clutter. This shift has also boosted demand for smart hubs and accessories that connect seamlessly via Bluetooth, Wi-Fi, or near field communication (NFC). The trend not only supports a minimalist aesthetic but also aligns with the growing ecosystem of interconnected, wireless devices-driving strong and sustained growth in the wireless electronics accessories segment.

The wired segment is expected to register a significant CAGR during the forecast period. In professional and enterprise settings such as offices, call centers, gaming environments, and content creation studios, wired accessories remain essential due to their reliability and performance. Wired keyboards, mice, microphones, and headsets offer lower latency, consistent connectivity, and no battery dependency, critical for uninterrupted workflows and real-time communication. These accessories are also less prone to interference or pairing issues compared to wireless options, making them ideal for high-volume or precision-dependent tasks. In creative fields, wired audio gear ensures higher fidelity and minimal lag. At the same time, in corporate environments, the simplicity and plug-and-play nature of wired devices contribute to reduced IT support needs and greater operational efficiency.

Distribution Channel Insights

The online segment accounted for the largest share of the electronic accessories industry in 2024. E-commerce platforms play a key role in driving the electronic accessories market by offering highly competitive pricing and frequent promotional discounts. Flash sales, festive offers, and bundled deals make products more affordable, particularly appealing to cost-sensitive consumers. Additionally, online-exclusive private labels such as AmazonBasics and Flipkart SmartBuy offer reliable accessories at significantly lower prices than traditional brands, helping shoppers save without compromising functionality. These platforms also eliminate intermediaries, reducing overall costs and allowing sellers to pass on the savings to buyers. The constant availability of price comparisons and user reviews further reinforces value-driven purchasing, making online channels the preferred choice for budget-conscious and informed customers alike.

The offline segment is expected to grow at a significant CAGR during the forecast period. Offline retail channels offer personalized, face-to-face assistance, which is especially valuable for less tech-savvy customers or those unsure about product compatibility and features. In-store staff can provide real-time demonstrations, recommend suitable accessories, and clarify doubts, enhancing the buying confidence of shoppers. This human interaction is often missing in online purchases. Additionally, established retail chains and brand-exclusive outlets are perceived as more trustworthy, particularly for high-value or critical accessories. They often offer more reliable after-sales service, easier return policies, and on-the-spot replacements, which increases customer satisfaction and brand loyalty. This sense of security makes offline retail a preferred channel for many consumers.

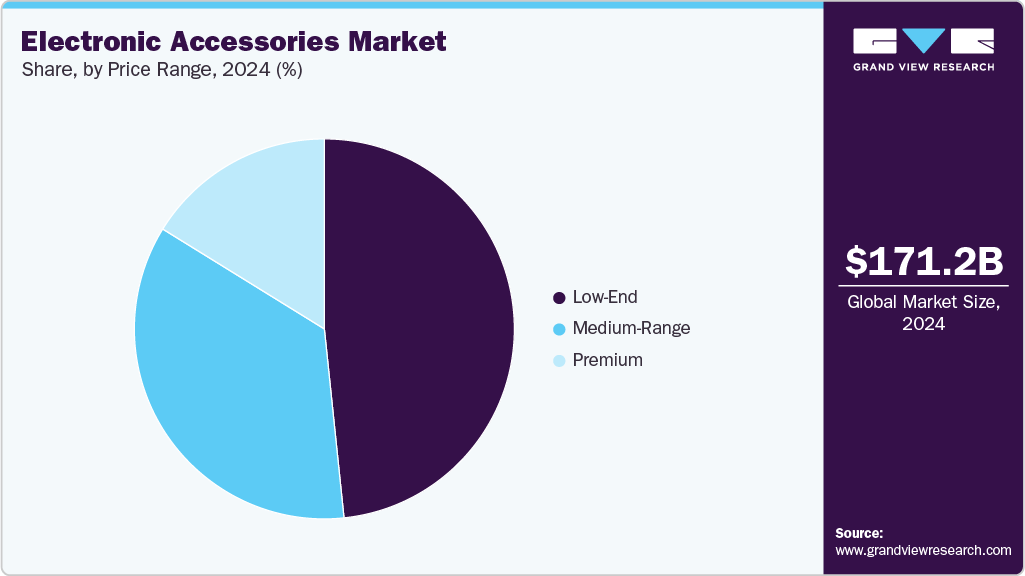

Price Range Insights

The low-end segment accounted for the largest market share in 2024. Low-end electronic accessories are easily accessible across a wide range of retail channels, including general stores, kiosks, mobile shops, e-commerce platforms, and even roadside vendors. Their widespread availability ensures convenience and quick access for consumers, especially in regions where formal retail infrastructure may be limited. Online marketplaces also use these products as bundled add-ons or upsell items. Simultaneously, the rapid growth in smartphone adoption across emerging markets like India, Indonesia, and Africa is fueling demand for essential, affordable accessories such as wired earphones, USB cables, screen protectors, and chargers. These items are typically the first purchases made by new smartphone users, driving steady volume sales.

The premium segment is expected to grow at a significant CAGR during the forecast period. Rising disposable incomes, especially in urban and developed markets, are encouraging consumers to invest in premium electronic accessories that enhance their lifestyle. Products with superior design, durability, and functionality, such as high-end earbuds, ergonomic keyboards, high-end car audio systems, or smartwatches, are increasingly preferred over low-cost alternatives. This trend is particularly strong among millennials and Gen Z professionals, who value both aesthetics and performance in their tech gear. As digital devices become integral to daily routines, consumers are more willing to pay for accessories that complement their personal style and offer long-term value. This growing appetite for premiumization is driving innovation and higher spending in the market.

Regional Insights

Asia Pacific electronic accessories market held the largest revenue share of 41.55% in 2024. Innovation and local manufacturing are the key growth drivers. Tech hubs like Shenzhen, Seoul, Tokyo, and Bangalore foster rapid product development, enabling quick adaptation to market trends. Meanwhile, robust manufacturing ecosystems in China, Taiwan, and India ensure large-scale, cost-efficient production and fast global distribution. This combination of innovation and output agility allows regional players to lead in launching affordable, cutting-edge accessories for global and local markets alike.

China Electronic Accessories Market Trends

The China electronic accessories market held a substantial share in 2024. Shenzhen, China, leads the global market, with over 70% of products designed or manufactured in the region. It serves as the headquarters for major brands like Anker, Baseus, and UGREEN, supported by a dense network of suppliers and highly responsive OEMs. Shenzhen’s ability to refresh product lines every 2-3 months enables faster innovation and adaptability, giving it a competitive edge over Western markets in both speed and scale of production.

The electronic accessories market in Japan held a substantial market share in 2024. The synergy between gaming and anime subcultures is driving demand for themed electronic accessories. The esports boom, fueled by games like Valorant and Japan’s League of Legends scene, has led to rising sales of custom controllers (e.g., Hori) and anime-themed peripherals like mouse pads. Simultaneously, VTuber fandoms boost accessory sales through branded headsets, microphones, and stands, tapping into strong otaku loyalty and expanding merchandising opportunities in the electronics space.

The India electronic accessories market’s growth is fueled by over 700 million smartphone users and rising disposable incomes, driving strong demand for essentials like fast chargers, earbuds, phone cases, and power banks. Local brands such as Boat and Ambrane dominate the affordable segment, particularly in the sub- USD 20 TWS earbuds category, outperforming global players. This reflects a preference for value-driven, locally tailored products that align with the needs of India’s vast and price-conscious consumer base.

North America Electronic Accessories Market Trends

North America electronic accessories industry held a significant global share in 2024. The rise of remote and hybrid work models in North America has significantly increased demand for productivity-enhancing electronic accessories. Consumers and enterprises alike are investing in webcams, wireless headsets, keyboards, and docking stations to improve virtual collaboration and work-from-home efficiency. This trend is driving steady growth across both B2C and B2B segments, as technology has become essential for maintaining seamless communication, comfort, and performance in flexible work environments.

The electronic accessories industry in the U.S. is expected to grow significantly from 2025 to 2033. The rapid adoption of smart home devices in the U.S., such as security cameras, smart plugs, voice assistants, and smart thermostats, is fueling demand for compatible electronic accessories. Consumers increasingly purchase wireless chargers, mounting kits, smart hubs, and adapters to support seamless integration and functionality across devices. As households expand their IoT ecosystems, accessories grow in parallel, making smart home integration a significant market growth driver.

Europe Electronic Accessories Market Trends

The electronic accessories industry in Europe is expected to grow at a CAGR of 5.7% from 2025 to 2033. The rise of electric vehicles (EVs) from brands like Tesla, Volkswagen, etc. is driving demand for automotive accessories such as in-car wireless chargers, dash cams, and smart mounts. As vehicles become more connected, accessories that support Android Auto and Apple CarPlay, like wireless adapters and integration kits, are gaining popularity. These innovations enhance driver convenience, safety, and infotainment, making connected car accessories a fast-growing segment in the electronics accessories market.

The UK electronic accessories market is expected to grow rapidly in the coming years. Growing environmental awareness, along with strict e-waste regulations and Right to Repair laws, is pushing brands to adopt more sustainable accessory designs. Additionally, the USB-C mandate is accelerating demand for standardized, compliant chargers and cables, promoting eco-friendly and interoperable electronic accessory ecosystems.

The electronic accessories market in Germany held a substantial market share in 2024. Germany’s strong EV adoption with over 1.3 million electric vehicles on its roads fuels demand for in-car Qi wireless charging pads, dash cams (e.g., Nextbase), and smart mounts. Premium automakers like BMW and Mercedes are integrating 5G hotspots and advanced infotainment systems, boosting demand for mobile routers and connectivity accessories. Additionally, the rise of high-end in-car audio systems encourages complementary accessory purchases for enhanced driving and entertainment experiences.

Key Electronic Accessories Company Insights

The key market players are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some examples of such initiatives:

In June 2025, Boat launched the boAt SmartRing Active Plus, in India at ₹2,999 (~$35), It offers health tracking features including heart rate, HRV, SpO₂, stress, sleep, and skin temperaturealong with a remote camera control feature, 5 ATM water resistance, and up to 5 days of battery life.

In May 2024, Sony India launched the ULT POWER SOUND series in May 2024, featuring wireless speakers (ULT TOWER 10, FIELD 7, FIELD 1) and ULT WEAR noise‑cancelling headphones. These products, built for immersive “massive bass” using an “ULT” button, deliver deep sound, party lighting, karaoke/mic modes, and portability, appealing to music lovers seeking rich, front‑row audio experiences.

In June 2023, Sony Electronics introduced six new additions to its automotive audio lineup: four car speakers and two subwoofers in the premium GS series, including models XS-162GS, XS-160GS, XS-690GS, XS-680GS, XS-W124GS, and XS-W104GS. Designed for enhanced in-car audio, the series offers rich bass, clear treble, and easy installation, catering to drivers seeking superior sound quality and immersive music experiences on the road.

Key Electronic Accessories Companies:

The following are the leading companies in the electronic accessories market. These companies collectively hold the largest market share and dictate industry trends.

Apple Inc.

Samsung Electronics

Sony Corporation

Logitech International

Xiaomi Corporation

Anker Innovations

Belkin International

Bose Corporation

HP Inc.

Dell Technologies

Sennheiser

Harman International

AmazonBasics

Portronics Digital Private Limited

Boat

Garmin Ltd.

Electronic Accessories Market Report Scope

Report Attribute

Details

Market size in 2025

USD 177.71 billion

Revenue forecast in 2033

USD 276.40 billion

Growth rate

CAGR of 5.7% from 2025 to 2033

Actual data

2021 – 2023

Base year

2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product type, connectivity type, distribution channel, price range, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Apple Inc.; Samsung Electronics; Sony Corporation; Logitech International; Xiaomi Corporation; Anker Innovations; Belkin International; Bose Corporation; HP Inc.; Dell Technologies; Sennheiser; Harman International; AmazonBasics; Portronics Digital Private Limited; Boat; Garmin Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electronic Accessories Market Report Segmentation

This report forecasts the revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the electronic accessories market report based on product type, connectivity type, distribution channel, price range, and region:

Product Type Outlook (Revenue, USD Billion, 2021 – 2033)

Mobile Accessories

Computer Accessories

Audio Accessories

Wearable Accessories

Automobile Accessories

Camera Accessories

Others

Connectivity Type Outlook (Revenue, USD Billion, 2021 – 2033)

Distribution Channel Outlook (Revenue, USD Billion, 2021 – 2033)

Price Range Outlook (Revenue, USD Billion, 2021 – 2033)

Low-End

Medium-Range

Premium

Regional Outlook (Revenue, USD Billion, 2021 – 2033)

North America

Europe

Asia Pacific

China

India

Japan

South Korea

Australia

Latin America

Middle East & Africa

UAE

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b. The global electronic accessories market size was estimated at USD 171.20 in 2024 and is expected to reach USD 177.71 billion in 2025.

b. The global electronic accessories market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 276.40 billion by 2033.

b. The online segment accounted for a market share of 56.05% in 2024. E-commerce platforms play a key role in driving the electronic accessories market by offering highly competitive pricing and frequent promotional discounts. Flash sales, festive offers, and bundled deals make products more affordable, particularly appealing to cost-sensitive consumers. Additionally, online-exclusive private labels such as AmazonBasics and Flipkart SmartBuy offer reliable accessories at significantly lower prices than traditional brands, helping shoppers save without compromising functionality.

b. The key market players in the global Electronic Accessories market include Apple Inc., Samsung Electronics, Sony Corporation, Logitech International, Xiaomi Corporation, Anker Innovations, Belkin International, Bose Corporation, HP Inc., Dell Technologies, Sennheiser, Harman International, AmazonBasics, Portronics Digital Private Limited, and Boat

b. The growing use of smartphones, tablets, laptops, wearables, and smart TVs is driving demand for electronic accessories. As smartphone penetration exceeds 80% in many regions, consumers increasingly purchase complementary products like chargers, cases, earbuds, and power banks. This rising ownership of smart devices fuels consistent accessory demand, especially in both emerging and developed markets, making it a key factor in the sustained growth of the electronic accessories market.