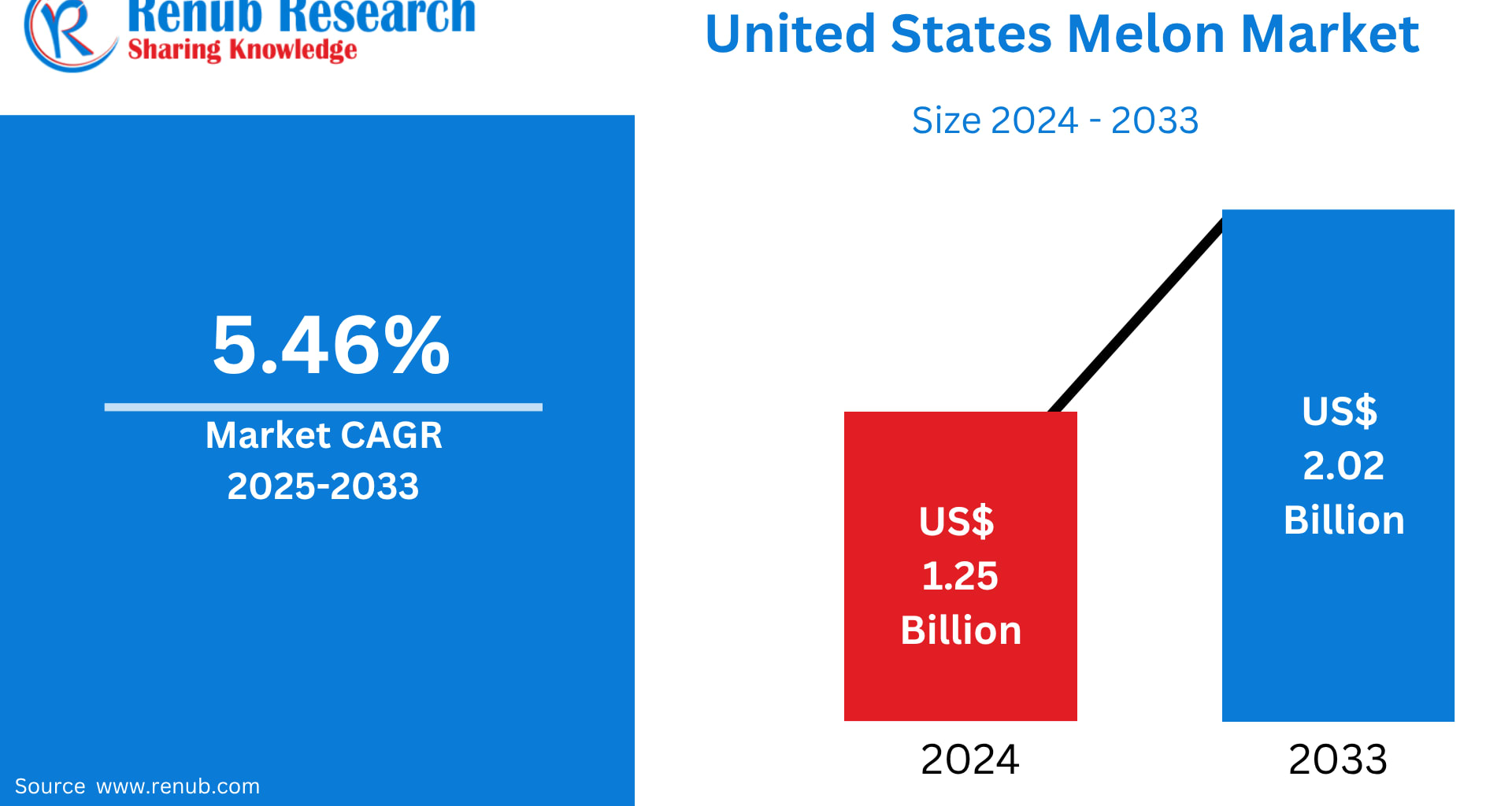

The United States melon market is positioned for steady expansion over the next decade as consumers increasingly gravitate toward healthy, refreshing, and convenient food choices. According to Renub Research, the U.S. melon market is projected to reach US$ 2.02 billion by 2033, rising from US$ 1.25 billion in 2024 at a CAGR of 5.46% from 2025 to 2033. The shift toward nutritious snacking, growing demand for pre-packaged fruit formats, and seasonal consumption patterns—particularly during hot American summers—are driving this growth.

Melons, which include varieties such as watermelon, cantaloupe, and honeydew, are deeply integrated into American food culture. Their naturally sweet flavor, high water content, and versatility make them a staple in households nationwide. Whether served freshly sliced, mixed into fruit salads, blended into smoothies, or incorporated into desserts, melons continue to enjoy widespread appeal among health-conscious consumers of all ages.

A Snapshot of the U.S. Melon Market

Melons belong to the Cucurbitaceae family and are prized for their juicy pulp and hydrating properties. Watermelon remains the most popular variety in the U.S., especially during summer when it dominates outdoor gatherings, barbecues, and holiday celebrations. Cantaloupe and honeydew maintain a strong year-round grocery store presence due to their longer shelf life and consistent consumer demand.

Their appeal is driven not just by flavor but also nutritional value—melons are low in calories, rich in vitamins A and C, and naturally hydrating. This combination positions them as an ideal snack for those seeking nutritious, refreshing alternatives to processed foods.

As the health and wellness movement continues to influence buying behaviors, melon consumption is expanding across demographic groups. The growth of value-added formats—like pre-cut melon bowls, ready-to-eat fruit mixes, and cold-pressed melon beverages—further enhances accessibility for busy consumers seeking convenience without compromising nutrition.

Key Growth Drivers in the U.S. Melon Market

1. Rising Health Consciousness Among Consumers

A shift toward healthier lifestyles has become one of the strongest drivers of the melon market. As consumers increasingly prioritize vitamin-rich foods, melons—known for their hydrating qualities and antioxidant content—are being incorporated more frequently into daily diets.

Watermelon and cantaloupe, in particular, are celebrated for being low-calorie, vitamin-packed, and naturally energizing. These qualities have made melons especially popular among fitness enthusiasts, families, and individuals pursuing balanced diets.

Innovation in greenhouse-grown melons has also supported this trend.

For example, in May 2022, Pure Flavor® introduced Solara™, the first greenhouse-grown melons in the fresh produce industry, offering improved consistency and quality. Greenhouse technology ensures year-round production, reducing reliance on seasonal availability and expanding consumer access.

As public awareness of fruit consumption benefits grows, the melon market continues to gain traction nationwide.

2. Convenience and Ready-to-Eat Melon Products

The U.S. food landscape has seen significant growth in convenience-driven purchases, and melons are no exception. Today’s consumers seek products that are fast, fresh, and portable—benefits that pre-cut and pre-packaged melon products readily deliver.

Retailers and food-service providers have introduced:

Pre-sliced watermelon cubes

Grab-and-go fruit bowls

Melon salad packs

Ready-to-serve mixed fruit platters

This convenience trend aligns with rising demand for meal solutions requiring minimal preparation.

Brands across the food industry are also expanding ready-to-eat offerings. For instance, Blue Apron launched its Prepared & Ready line in December 2023, highlighting a broader industry shift toward high-quality, ready-to-eat meals. Though not melon-specific, this trend has spillover effects on fresh-cut produce categories, including melons.

The market for pre-packaged melons is expected to grow further as time-pressed consumers and working families increasingly prioritize convenience over traditional whole-fruit purchases.

3. Seasonal Popularity and Summer Consumption Patterns

Melons are deeply connected to summer in the American diet. With their high water content and hydrating properties, melons are among the most preferred fruits during hot weather.

Watermelon consumption, in particular, experiences a dramatic seasonal spike. Outdoor activities, holiday gatherings like the Fourth of July, and warmer climate conditions drive this surge.

According to the National Watermelon Promotion Board (NWPB), per capita watermelon consumption reached 16.9 pounds in 2023, up from 15.5 pounds in 2022—highlighting the fruit’s increasing popularity.

Climate shifts and advanced storage technologies have begun supporting off-season demand, enabling grocers to offer fresh melons more consistently even outside traditional growing months. As availability expands, seasonal demand spikes are reinforced rather than diminished.

Key Challenges in the U.S. Melon Market

1. Seasonality and Supply Fluctuations

While consumer demand remains strong, melon production faces limitations rooted in seasonality. Watermelon and cantaloupe thrive only during certain months and are primarily cultivated in specific regions. Consequently, U.S. markets experience tight supply during off-season periods, leading to increased reliance on imports from countries such as Mexico and Central America.

These fluctuations create price inconsistencies and impact year-round access. Seasonal dependence makes it challenging for retailers to maintain stable inventories and for consumers to enjoy consistent pricing.

2. Weather and Climate Risks

Melon cultivation is highly sensitive to climatic conditions. Extreme heat waves, droughts, unexpected frosts, or floods can significantly reduce crop yields and compromise fruit quality.

As climate change accelerates, growers face increased unpredictability. Reduced yield potential affects supply chains, raises production costs, and contributes to market volatility.

These environmental risks highlight the importance of:

Advanced irrigation technologies

Controlled-environment agriculture

Sustainable farming practices

Without innovations in production, the melon market may face future constraints in meeting rising consumer demand.

United States Melon Production Market Overview

Melon production is a vital component of U.S. agriculture, with California, Texas, Florida, and Arizona serving as the primary producing states. These regions offer the warm, dry climates ideal for cultivating watermelon, cantaloupe, and honeydew.

Watermelon remains the dominant crop, followed by cantaloupe. Domestic demand is increasingly driven by consumer preference for fresh, seasonal produce and nutrient-dense fruit options.

According to USDA-NASS 2022, eight states collectively cultivate more than 100,000 acres of watermelon annually, with Florida ranking as the top producer. Despite this strong output, production volumes remain highly sensitive to weather conditions.

In 2022, U.S. melon availability per capita totaled 21.1 pounds, broken down as:

Watermelon — 14.1 pounds

Cantaloupe — 5.3 pounds

Honeydew — 1.6 pounds

Watermelon alone accounted for more than half of total melon availability, significantly outperforming other varieties.

Market Segmentation

By Type

The U.S. melon market is segmented across three categories:

Watermelon

Cantaloupe

Honeydew

Each segment experiences unique production, import, and consumption patterns.

Watermelon – Market & Volume Segmentation

Market

Production

Imports

Exports

Watermelon holds the largest market share, driven by strong domestic production and high summer demand. Imports help stabilize supply during off-season months.

Cantaloupe – Market & Volume Segmentation

Market

Production

Imports

Exports

Cantaloupe production remains robust but more reliant than watermelon on imports during winter and spring.

Honeydew – Market & Volume Segmentation

Market

Production

Honeydew consumption is smaller compared to watermelon and cantaloupe but maintains steady year-round demand in fresh-cut products and fruit blends.

Company Analysis

Major companies profiled across three viewpoints—Overview, Recent Developments, and Sales Analysis—include:

Nestlé SA

Ingredion

Tate & Lyle

Cargill

PepsiCo

While these companies are not melon producers, they influence adjacent markets, including fruit-based beverages, sweeteners, flavorings, and packaged foods. Their innovations and distribution networks indirectly support melon demand through partnerships, product lines, and ingredient usage in beverages and snacks.

Final Thoughts

The United States melon market is entering a transformative phase fueled by health-driven consumption, seasonal preferences, and growing demand for convenient, ready-to-eat fruit products. With the market expected to reach US$ 2.02 billion by 2033, melons will continue to solidify their role as essential components of the American diet.

However, stakeholders must address challenges related to climate variability, seasonal production limits, and supply chain vulnerabilities. Innovations in greenhouse farming, improved irrigation, and sustainable agricultural practices will play key roles in meeting rising consumer expectations.

Ultimately, as consumers increasingly seek fresh, nutritious, and hydrating food options, melons—whether watermelon, cantaloupe, or honeydew—are well positioned to remain a top choice across U.S. households for years to come.