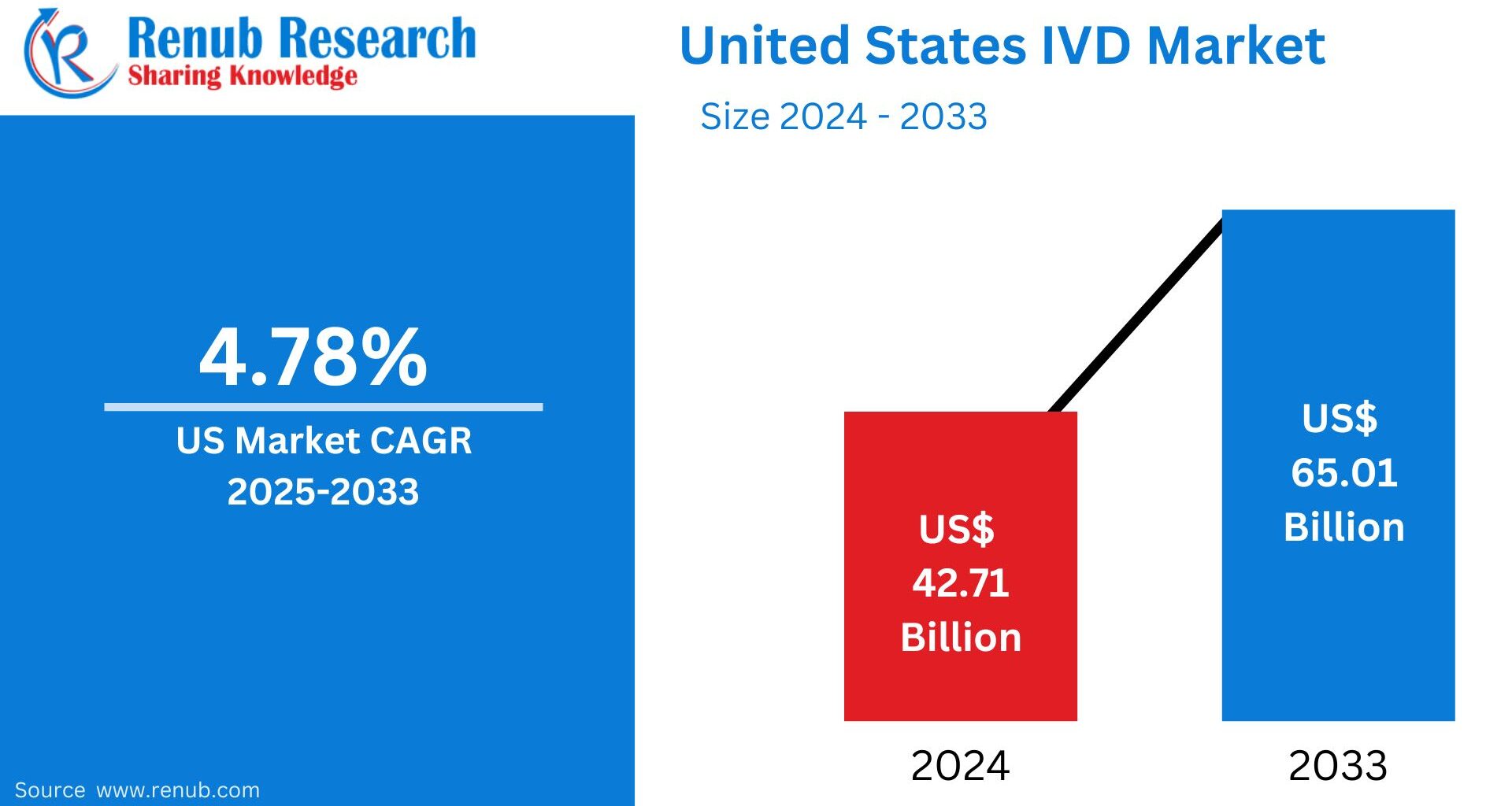

The United States In-Vitro Diagnostics (IVD) market is entering a transformative period driven by advanced molecular technologies, rising chronic disease prevalence, and continued health reforms supporting early and accurate diagnosis. According to Renub Research, the U.S. IVD market size is estimated at US$ 42.71 billion in 2024 and projected to reach US$ 65.01 billion by 2033, reflecting steady growth supported by innovation and increased adoption across healthcare settings. From 2024 to 2030, the market is expected to grow at a 4.78% CAGR, underscoring the indispensable role of diagnostics in modern medicine.

IVD technologies—ranging from PCR assays and immunoassays to hematology analyzers and home-based test kits—have become foundational for disease detection, therapeutic decisions, and public health monitoring. As the U.S. healthcare system shifts toward preventive care and precision medicine, the importance of high-quality, rapid, and accessible diagnostics has never been greater.

United States In-Vitro Diagnostics Market Overview

In-vitro diagnostics refer to tests performed outside the body using biological samples such as blood, tissues, saliva, or urine. These tests help detect infections, cancers, genetic disorders, metabolic conditions, and more. Whether used in hospitals, standalone labs, research institutions, or even at home, IVD technologies provide clinicians with accurate and actionable insights that guide treatment pathways.

In the United States, the market benefits from a robust healthcare infrastructure, strong R&D ecosystem, and early adoption of cutting-edge technologies. IVD tools are essential not only for routine screenings and chronic disease management but also for breakthroughs in personalized medicine, where testing can determine the most effective treatment for an individual based on their genetic or molecular profile.

The acceleration in point-of-care testing, continued investment in molecular diagnostics, and the increasing shift toward automation in clinical labs collectively signal a new era for the U.S. diagnostics landscape.

Growth Drivers of the U.S. In-Vitro Diagnostics Market

1. Technological Advancements in Diagnostics

Innovation is the heartbeat of the IVD market. Recent advancements in molecular diagnostics, next-generation sequencing (NGS), digital PCR, AI-driven platforms, and automated analyzers have significantly improved test speed, accuracy, and accessibility.

For example, in July 2023, Siemens Healthineers launched a next-gen analyzer for immunoassay and clinical chemistry testing, designed to deliver higher precision and throughput across labs of all sizes. Such innovations reduce clinical workflow burdens, support rapid decision-making, and expand the potential for early disease detection.

Moreover, the rapid rise of home-based testing kits, accelerated post-pandemic, continues to take diagnostics beyond traditional hospital walls—improving convenience, compliance, and public health surveillance.

2. Rising Incidence of Chronic Diseases

Chronic diseases pose one of the largest healthcare burdens in the United States, and IVD plays a pivotal role in early detection and disease monitoring.

The country has over 54 million adults aged 65+, representing 16.5% of the population—projected to reach 85.7 million by 2050.

According to the American Cancer Society, 2023 saw an estimated 1.96 million new cancer cases and over 609,000 deaths.

As conditions such as cancer, diabetes, heart disease, and autoimmune disorders rise, so does the demand for accurate, rapid diagnostics. IVD tools enable clinicians to identify disease progression early, tailor treatment plans, and monitor therapeutic effectiveness over time.

3. Government Initiatives and Healthcare Reforms

Federal and state-level healthcare reforms continue to support the expansion of diagnostic testing in the U.S. The Affordable Care Act (ACA) significantly increased access to preventive health services, leading to higher testing volumes across laboratories and clinics.

Additionally:

Investments in precision medicine initiatives

Funding for biomedical research

Programs promoting early disease detection

have collectively strengthened the development and adoption of IVD technologies. Improved reimbursement structures for certain test categories have also encouraged both providers and patients to use more advanced diagnostics.

Challenges Facing the United States IVD Market

1. Complex Regulatory Landscape

The U.S. Food and Drug Administration (FDA) enforces strict regulatory standards to ensure safety and reliability. While these standards protect patient health, they also pose challenges:

Lengthy approval timelines

Cost-intensive compliance requirements

Extensive pre- and post-market documentation

Need for continuous quality audits

Small and emerging companies often face obstacles in bringing new technologies to market swiftly, slowing innovation cycles and raising development costs.

2. High Cost of Advanced IVD Products

Cutting-edge diagnostics require sophisticated equipment, specialized reagents, and trained professionals—all of which drive up costs.

This creates disparities in access, especially in:

Rural regions

Underfunded clinics

Community health centers

While demand for high-quality diagnostics continues to grow, affordability remains a concern. Price-sensitive markets are more likely to delay adoption of advanced technologies, potentially impacting early detection and patient outcomes.

Technology Spotlight: United States PCR Market

PCR (Polymerase Chain Reaction) technology remains one of the most widely utilized diagnostic tools due to its speed, sensitivity, and versatility.

Why PCR Continues to Grow:

Essential for detecting infectious diseases (viral, bacterial, fungal)

Widely used in cancer genomics and genetic disorder screening

Real-time PCR and digital PCR provide precise quantitative data

Rapid turnaround times support emergency and critical care

Continuous improvements in digital PCR, multiplex testing, and portable PCR devices are strengthening adoption across hospital laboratories and point-of-care environments.

Product Outlook: United States IVD Instruments Market

Instruments represent the most significant revenue-generating segment in the U.S. IVD market. Hospitals and labs increasingly rely on advanced, automated systems that offer:

High throughput

Workflow optimization

Minimal manual intervention

Continuous data integration

State-of-the-art analyzers improve diagnostic accuracy while reducing human error. As the U.S. focuses more on boosting laboratory efficiency, the demand for next-gen instruments will remain robust.

Application Spotlight: Hematology as a Fast-Growing Segment

Hematology—focused on blood-related conditions—is expected to be among the fastest-growing IVD applications during the forecast period.

Drivers include:

Increasing prevalence of anemia, leukemia, and clotting disorders

Higher adoption of automation in hematology analyzers

Integration of AI for morphological analysis and disease detection

Rising demand for routine blood testing in clinical practice

Given the central role of blood tests in routine health assessments, hematology will remain a cornerstone of diagnostic care in the United States.

Key Players in the U.S. In-Vitro Diagnostics Market

The market is dominated by established multinational companies known for their innovation pipelines, extensive product portfolios, and strong distribution networks.

Major Companies Include:

Roche Diagnostics

Danaher Corporation

Thermo Fisher Scientific Inc.

Bio-Rad Laboratories, Inc.

BioMérieux

Abbott Laboratories

Sysmex Corporation

Notable Recent Developments

March 2023: Atila Biosystems partnered with Stilla Technologies to commercialize co-labeled digital PCR instruments using Atila’s assay kits and Stilla’s Naica platform.

January 2023: QIAGEN introduced the EZ2 Connect MDx platform, enhancing automated sample processing compatible with PCR, qPCR, and related applications.

These collaborations and launches underscore the sector’s push toward automation, precision, and faster clinical workflows.

United States IVD Market Segmentation

By Test Type (11 Segments)

ELISA & CLIA

PCR

Rapid Tests

Fluorescence Immunoassays (FIA)

In Situ Hybridization

Transcription Mediated Amplification

Sequencing

Colorimetric Immunoassay

Radioimmunoassay (RIA)

Isothermal Nucleic Acid Amplification Technology

Others

By Product (3 Segments)

Reagents

Instruments

Services

By Application (7 Segments)

Immunochemistry

Clinical Chemistry

Hematology

Coagulation

Molecular Diagnostics

Microbiology

Others

Each segment plays a critical role in shaping U.S. diagnostic capabilities across hospitals, private labs, and research institutions.

Company Analysis (3 Viewpoints Each)

Each major player can be evaluated through:

Overview

Recent Developments

Revenue Analysis

This multi-dimensional approach helps understand the competitive dynamics within the U.S. IVD landscape.

Final Thoughts

The United States In-Vitro Diagnostics market is on a solid growth path, poised to reach US$ 65.01 billion by 2033. As technological advancements accelerate and demand for early detection rises, IVD will continue to be the backbone of modern healthcare. Whether through digital PCR, AI-powered analyzers, or at-home diagnostic kits, the U.S. is moving toward a future where diagnostics are faster, more precise, more accessible, and deeply integrated into everyday health management.

Despite challenges around regulatory hurdles and high costs, the market’s trajectory remains overwhelmingly positive. Continuous innovation, strengthened healthcare policies, and rising consumer awareness will drive the next decade of expansion—making IVD one of the most influential sectors in American healthcare.