The love for chocolate in the United States is more than a casual indulgence — it is a deeply rooted cultural phenomenon that continues to drive one of the nation’s strongest food categories. From premium truffles and seasonal candy assortments to artisanal bean-to-bar creations, chocolate maintains a loyal and ever-expanding consumer base.

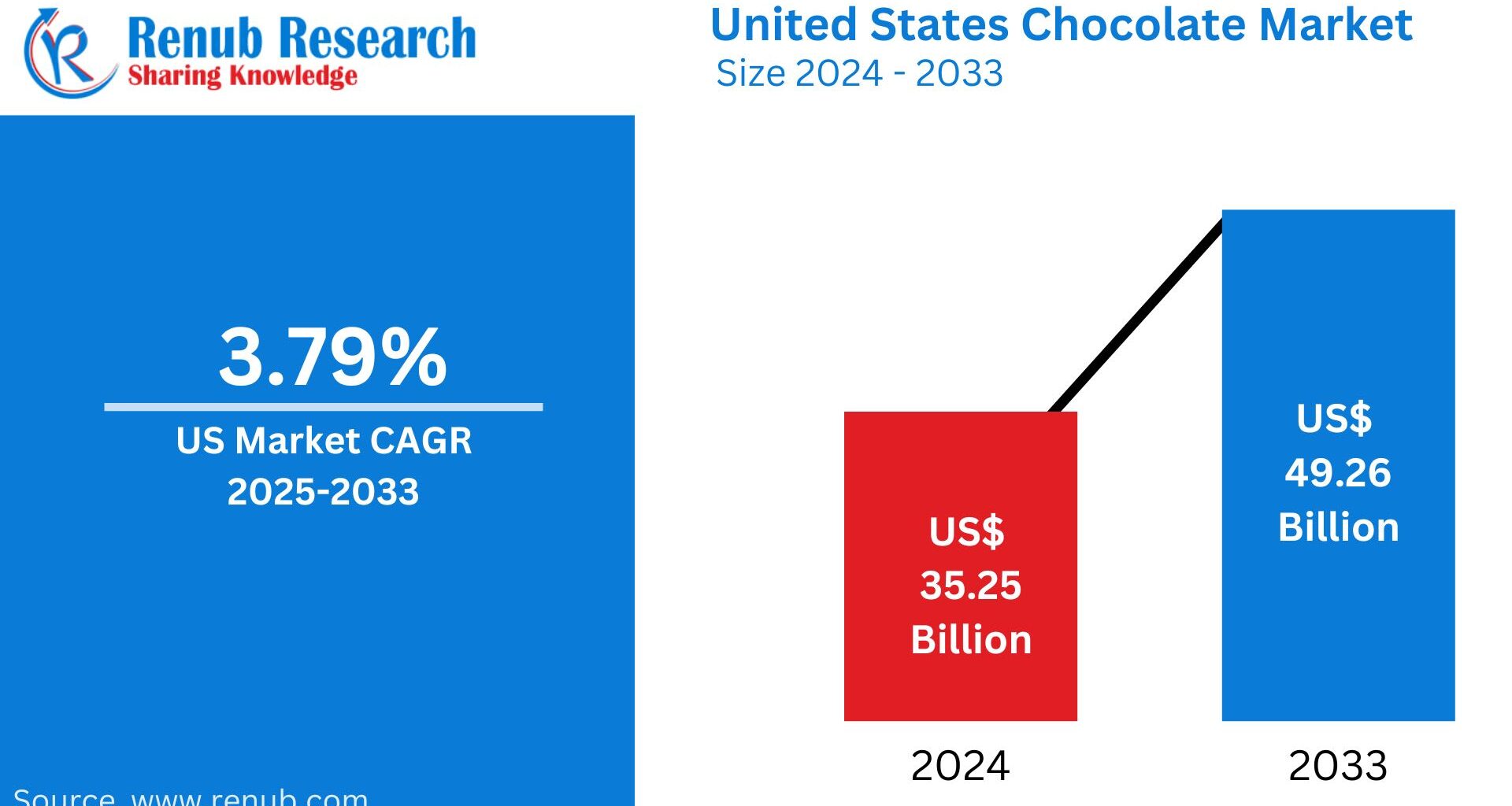

According to Renub Research, the United States chocolate market reached US$ 35.25 billion in 2024 and is projected to grow at a CAGR of 3.79% from 2025 to 2033, ultimately scaling to US$ 49.26 billion. This steady growth is largely fueled by rising demand for healthier chocolate varieties, increased gifting trends, and widespread interest in premium and ethically sourced confections.

The United States Chocolate Market & Forecast 2024–2033 study evaluates the industry by Type (Dark and Milk/White Chocolate), Distribution Channels, State Markets, and Competitive Landscape, offering a holistic picture of a market driven by changing lifestyles, wellness considerations, and strong retail penetration.

United States Chocolate Market Outlook

Chocolate — typically made from cocoa beans, sugar, and optional milk solids — remains one of the most versatile and beloved treats in the country. American consumers enjoy chocolate in numerous forms: bars, truffles, beverages, chips, coatings, snacks, and desserts. Increasingly, chocolate’s appeal is expanding beyond indulgence into wellness, especially as dark chocolate gains recognition for its antioxidant-rich profile and lower sugar content.

In the U.S., chocolate consumption surges during key holidays such as Valentine’s Day, Halloween, Easter, and Christmas, reflecting deeply ingrained gifting traditions. Simultaneously, growing interest in organic, fair-trade, and sustainably sourced chocolates shows a shift toward conscious consumerism.

The convenience factor also plays a significant role — chocolate remains one of the most accessible impulse purchases across supermarkets, convenience stores, and online platforms, keeping demand consistently strong throughout the year.

Key Trends Shaping the U.S. Chocolate Market

1. Rising Attraction Toward Luxury and Premium Chocolates

One of the most powerful market drivers is the shift toward premium, artisanal, and luxury chocolates. American shoppers increasingly view chocolate not just as a treat, but as a mini-luxury or self-reward.

Premium brands such as Lindt, Ferrero Rocher, and Ghirardelli continue to outperform mass-market products, thanks to their craftsmanship appeal, superior ingredients, and strong visual merchandising.

According to the National Confectioners Association (NCA):

67% of consumers buy premium chocolate at least occasionally.

Nearly 30% prefer it over mainstream alternatives.

Attractive in-store displays, influencer-driven promotions, and upscale packaging contribute to impulse buying, boosting market revenues.

2. Seasonal Chocolate Sales Remain a Powerhouse

Chocolate has become synonymous with American celebrations. Seasonal demand is among the strongest pillars of the industry.

NCA reports that Valentine’s Day, Halloween, Easter, and the winter holidays account for 64% of annual U.S. chocolate and candy revenues.

During these periods, chocolate serves as a gift, festive snack, tradition keeper, and emotional comfort — all of which create predictable, high-volume purchasing cycles year after year.

Manufacturers typically launch seasonal limited editions, collectible packaging, and special flavor variations — strategies that help maintain consumer excitement and higher profit margins.

3. Innovative Flavors and Ingredient Experimentation

The flavor landscape of American chocolate is evolving rapidly as adventurous consumers seek unique, exotic, and globally inspired combinations.

Manufacturers increasingly experiment with ingredients such as:

Spices (cardamom, chili, saffron)

Fruits (yuzu, raspberry, passionfruit)

Nuts and seeds (pistachio, quinoa, sesame)

Savory notes (sea salt, miso)

Superfoods (matcha, goji berries)

A standout innovation is Cacao Barry’s WholeFruit chocolate, introduced in 2021. Crafted entirely from cacao fruit, it appeals strongly to chefs and chocolatiers seeking healthier, cleaner-label products.

Japanese-inspired flavors have also gained traction — the Royce green tea chocolate, for example, is increasingly popular among U.S. consumers.

Flavor innovation not only attracts new customers but also differentiates brands in a competitive landscape, driving repeat purchases.

4. Growing Popularity of Dark Chocolate Due to Health Benefits

Dark chocolate has gained strong acceptance among health-conscious American consumers. With its high antioxidant levels, flavonoids, and relatively lower sugar content, dark chocolate is often marketed as a guilt-free indulgence.

Johns Hopkins Medicine highlights several health benefits associated with dark chocolate:

Improved heart health

Better cognitive function

Enhanced mood

Anti-inflammatory potential

Possible reduction in blood pressure

This health halo continues to boost premium dark chocolate consumption, pushing manufacturers to expand portfolios featuring 70% cocoa and higher varieties, sugar-free innovations, and keto-friendly options.

Market Challenges

1. Rising Cocoa Prices and Supply Chain Instability

Cocoa is the backbone of the chocolate industry — and its volatility remains a major challenge.

Global cocoa supplies, primarily sourced from West Africa, face disruptions due to:

Climate change

Crop disease

Political instability

Labor shortages

Inefficient logistics

Higher cocoa prices force companies either to raise retail prices — potentially reducing consumer demand — or absorb costs, which squeezes profit margins. Ensuring a long-term sustainable and ethical cocoa supply chain remains one of the industry’s most pressing priorities.

2. Increasing Health Concerns and Changing Dietary Preferences

As more Americans shift toward healthier diets, concerns about:

High sugar content

Calorie density

Obesity

Artificial additives

have pushed manufacturers toward reformulation.

This includes:

Reduced-sugar chocolates

Functional chocolates (with protein, fiber, or probiotics)

High-cocoa dark chocolates

Organic and clean-label variants

Although such innovation broadens opportunities, it also requires substantial investment in R&D and production adjustments, adding pressure to manufacturers’ cost structures.

Distribution Channel Insights

Hypermarkets & Supermarkets Lead the Market

Large-format retailers dominate chocolate sales due to:

High footfall

Extensive product assortments

Promotional pricing

Strong merchandising capabilities

Consumer trust and convenience

Their ability to showcase numerous brands side-by-side makes them the preferred shopping destination for most chocolate categories, from affordable snacks to premium boxed chocolates.

United States Chocolate Market by State

California

California’s chocolate market is poised for substantial expansion due to its:

Huge population base

Food-forward culture

Emphasis on health and wellness

Strong artisanal chocolate ecosystem

Brands like Navitas, known for raw cacao and superfood blends, are adopting regenerative agriculture practices to appeal to eco-conscious consumers. California’s robust distribution channels and culinary innovation further strengthen its role as a major chocolate hub.

New York

New York’s chocolate market is among the most dynamic due to its:

Diverse consumer base

High demand for luxury and artisanal products

Influence of tourism

Specialty retailers and gourmet stores

New Yorkers favor chocolates that are ethically sourced, organic, and high in cocoa content. Seasonal peaks are strongly pronounced in the state, driving consistent revenue spikes. The city’s upscale retail landscape also makes it a hotspot for premium global chocolate brands.

Company Landscape and Key Developments

Major players shaping the U.S. chocolate market include:

Nestlé S.A.

The Hershey Company

Mondelez International, Inc.

General Mills Inc.

Cargill Inc.

Saputo Inc.

Chocoladefabriken Lindt & Sprüngli AG

Godiva Chocolates

Recent Strategic Moves

Puratos (Dec 2023): Acquired Canada’s Foley’s Chocolates — its largest North American acquisition — strengthening its U.S. manufacturing and boosting its portfolio of plant-based, protein-enriched, and sugar-free chocolate solutions.

Mars Inc. (Nov 2023): Announced acquisition of UK’s Hotel Chocolat for £534 million to scale international expansion.

Mondelēz (Oct 2023): Relaunched Toblerone with new formats under the “Never Square” identity, backed by major investment in premiumization and global distribution.

Theo Chocolate (July 2023): Merged with American Licorice Co., alongside restructuring and facility consolidation.

Ferrero North America (May 2023): Revealed new seasonal offerings and expanded its Kinder chocolate line at the Sweets & Snacks Expo.

These strategic shifts reflect the industry’s focus on premium branding, portfolio diversification, and sustainable sourcing.

Market Segmentation

By Type

Dark Chocolate

Milk/White Chocolate

By Distribution Channel

Hypermarkets/Supermarkets

Convenience Stores

Online Retail Stores

Other Channels

By State

Includes major markets such as: California, Texas, New York, Florida, Illinois, Pennsylvania, New Jersey, Washington, Michigan, Virginia, Maryland, Colorado, Tennessee, Arizona, Minnesota, and many others across the U.S.

Each company profile includes:

Overview

Recent Developments

Revenue Analysis

Final Thoughts

The United States chocolate market is entering a new era characterized by premiumization, health-centric product development, ethical consumption, and experiential gifting. Despite challenges such as rising cocoa costs and health concerns, the industry’s ability to innovate in flavor, packaging, retail strategy, and sustainability keeps it resilient and competitive.

As consumers seek deeper sensory experiences and better-quality ingredients, companies that prioritize transparency, craft, and wellness-oriented formulations are expected to lead the next phase of growth. With a projected rise to US$ 49.26 billion by 2033, the U.S. chocolate market remains one of the most promising segments within the broader confectionery industry.