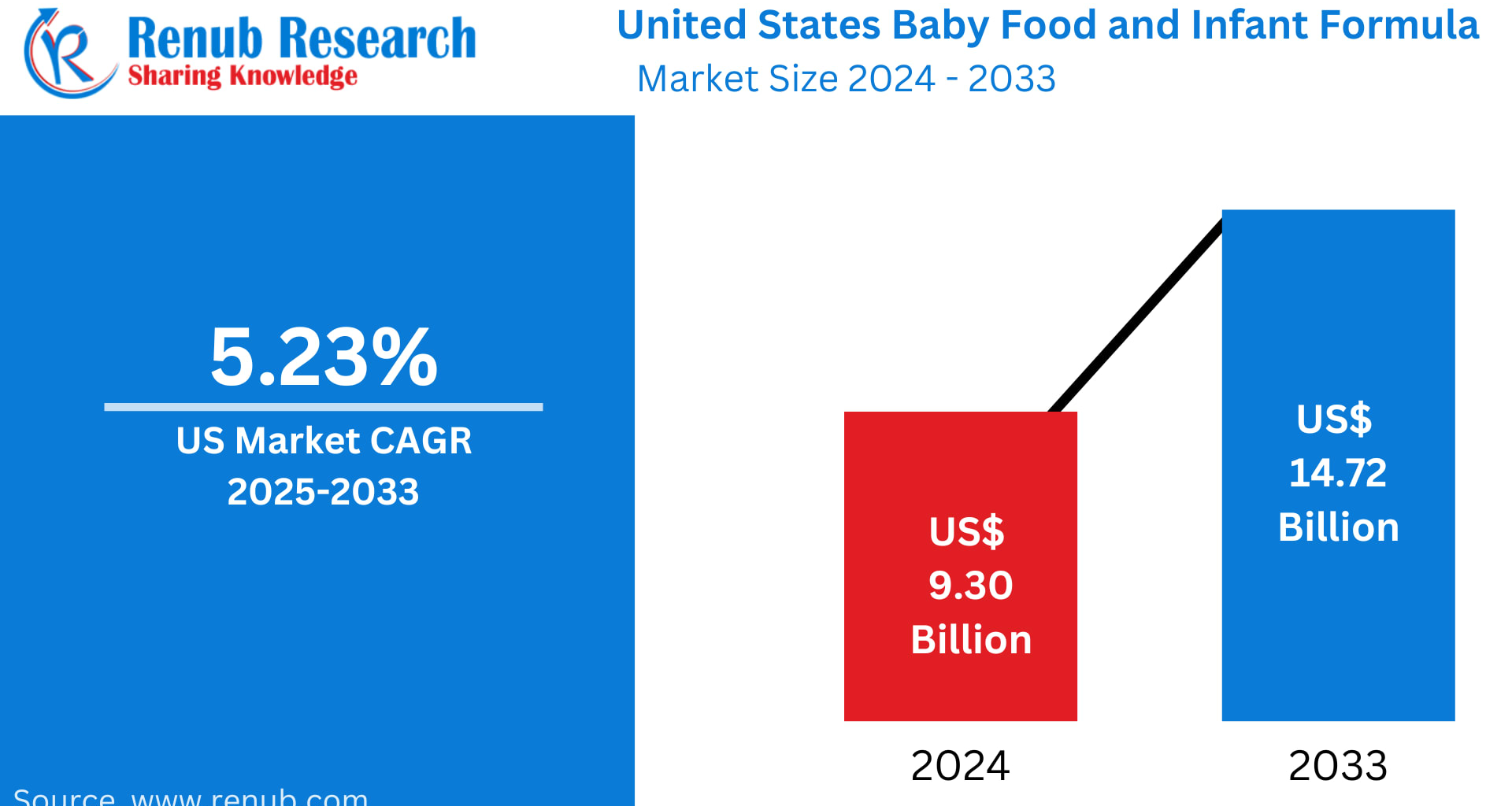

The United States baby food and infant formula market is entering a period of unprecedented transformation, shaped by changing lifestyles, shifting parental expectations, and rapid advancements in nutritional science. According to Renub Research, the industry is projected to grow from US$ 9.30 billion in 2024 to US$ 14.72 billion by 2033, registering a CAGR of 5.23% between 2025 and 2033. This positive outlook is anchored by rising consumer awareness of infant nutrition, demand for organic and premium baby foods, and ongoing innovation in formula manufacturing technologies.

At the same time, tightening regulatory oversight, pricing competition, and heightened consumer scrutiny on product safety pose challenges for brands navigating this rapidly evolving landscape. From milk formulas and dried baby food to the surge in online distribution, the U.S. infant nutrition market reflects a blend of innovation, responsibility, and shifting consumer priorities.

Understanding the United States Baby Food & Infant Formula Ecosystem

Baby food includes soft, nutritional foods designed specifically for infants and toddlers—ranging from purees and cereals to snacks and ready-to-eat meals. These products provide essential vitamins, minerals, and macronutrients that support physical and cognitive development during early life. Infant formula, meanwhile, is a scientifically formulated breast-milk substitute for babies who cannot be exclusively breastfed. It contains proteins, fats, carbohydrates, vitamins, minerals, and probiotics tailored to support healthy growth.

In the United States, both categories have become essential due to busy lifestyles and changing family structures. With more parents working full time and households spending less time on meal preparation, convenient, safe, and nutritionally optimized infant foods are increasingly in demand. Growing awareness around clean-label products, organic farming, traceable ingredients, and allergen-free formulations is further transforming the industry.

Government oversight also plays a significant role. The FDA continues to tighten restrictions and improve compliance requirements. For instance, in January 2025, the agency released draft guidance to improve manufacturing standards for low-moisture ready-to-eat foods, including powdered infant formula. This move reflects growing public concern about food safety and contamination incidents, prompting manufacturers to adopt more advanced and transparent production systems.

Key Driving Forces in the U.S. Baby Food & Infant Formula Market

1. Rising Parental Awareness of Infant Nutrition

Parents today are better informed and more research-driven than ever. With widespread access to scientific studies and nutritional guidelines, caregivers increasingly seek products that provide comprehensive nutritional support, including:

Probiotics for gut health

DHA for brain development

Clean-label, non-GMO ingredients

Organic and minimally processed foods

The shift toward preventive health—especially in early childhood—has significantly boosted demand for premium infant formulas and enhanced baby foods. Parents are no longer satisfied with basic nutrition; they want functional benefits that contribute to long-term physical and cognitive development.

The emergence of FDA-backed guidelines and stronger regulatory frameworks further reinforces trust in high-quality formula manufacturers, making parents more confident in relying on packaged infant nutrition solutions.

2. Demand for Ready-to-Use and Convenient Products

Fast-paced lifestyles, dual-income households, and rising maternal employment have led to surging demand for convenient feeding options. Ready-to-eat pouches, dissolvable snacks, portable containers, and easy-to-mix infant formulas offer flexibility without compromising nutrition.

Manufacturers continue to innovate to meet these expectations. For instance, in August 2024, Abbott expanded its Pure Bliss™ by Similac® product line, introducing new organic and European-formulated options tailored to diverse parental preferences. Such developments indicate a clear shift toward premiumization and personalization in infant nutrition.

3. Expansion of Retail and E-Commerce Distribution

The availability and accessibility of baby food products have drastically improved through:

Major supermarket chains

Pharmacies

Discount stores

Online marketplaces

Subscription-based delivery services

E-commerce, in particular, has become a lifeline for new parents seeking convenience, product variety, and competitive pricing. Subscription models offering scheduled formula deliveries and curated baby food bundles eliminate last-minute shopping stress and ensure consistent access to essential products.

Market Challenges

1. Regulatory Scrutiny and Product Safety Concerns

The FDA enforces strict regulation on infant formula and baby food production to ensure nutritional adequacy and eliminate contamination risks. While beneficial to consumers, this creates significant compliance costs for manufacturers.

High-profile recalls involving heavy metals, bacterial contamination, or mislabeling have made U.S. consumers more cautious. As a result, brands must invest heavily in:

Traceable sourcing

Clean manufacturing processes

Rigorous quality testing

Transparent labeling

Failure to meet these benchmarks can rapidly erode consumer trust.

2. Pricing Pressures and Intense Competition

The U.S. infant formula market includes both long-established players and emerging organic baby food startups. Competition intensifies as:

Private-label store brands offer cost-effective alternatives

Organic and premium formulas remain expensive

Consumers increasingly compare products online

For many low-income households, premium formulas remain unaffordable, pushing them toward budget-friendly products. To retain loyalty, major brands must continuously innovate while keeping prices competitive—a balancing act that remains challenging.

United States Baby Food Market by Type

Milk Formula

The milk formula category forms the backbone of the U.S. infant nutrition industry. It includes:

Standard formulas

Organic formulas

Hypoallergenic and sensitive formulas

Specialized formulas for medical conditions

Demand continues to grow due to increased reliance on formula feeding, innovation in nutritional enrichment (DHA, ARA, prebiotics), and the rise of imported and European-style formulas that promise cleaner ingredient profiles.

Dried Baby Food

Dried baby foods—especially infant cereals and powdered meals—remain essential due to their affordability, long shelf life, and nutritional density. Recent developments in the category include:

Fortified iron-rich varieties

Probiotic-enriched formulations

Organic, allergen-free, and clean-label offerings

These products are favored by parents seeking convenience without sacrificing health benefits.

Prepared Baby Food

Ready-made purees, pouches, and snacks dominate the prepared baby food category. They appeal strongly to on-the-go parents looking for high-quality, ready-to-eat meals with transparent ingredient lists.

The rise of plant-based and allergen-sensitive formulations is particularly noteworthy, aligning with broader U.S. food trends.

United States Baby Food & Infant Formula Market by Distribution Channel

Supermarkets and Hypermarkets

These remain the dominant retail channels due to product variety, promotions, and easy accessibility.

Pharmacies

Pharmacies play a crucial role in distributing specialized formulas—particularly medical-grade, hypoallergenic, and prescription-based varieties. Professional guidance from pharmacists also enhances consumer trust.

Convenience Stores

Though limited in variety, convenience stores serve as vital emergency supply points, especially for urban families.

Online Channels

Fast-growing, highly influential, and preferred by modern parents for price comparisons, reviews, and subscription benefits.

Regional Insights

Northeast United States

A hub for premium and organic baby food demand, fueled by affluent households and strong preferences for sustainable, ethically sourced products.

Midwest United States

Consumers prioritize affordability and accessibility. Growing e-commerce penetration is helping rural families access broader product options.

Southern United States

High birth rates support stable growth. The region shows balanced demand for both premium formulas and affordable brands.

Western United States

California and Washington lead the adoption of:

Plant-based infant formulas

Clean-label foods

Non-GMO and preservative-free products

The West remains the most innovation-driven region in the U.S. baby food sector.

Key Players in the U.S. Baby Food & Infant Formula Market

The market includes several major global and domestic leaders, each competing through product innovation, marketing, and distribution expansion. Based on market relevance, here are the key companies:

Abbott Laboratories

Kraft Heinz Company

Hero Group

Hain Celestial Group, Inc.

Nestlé

Lactalis (Stonyfield Farm, Inc.)

Reckitt Benckiser Group plc

Danone

Each player focuses on revenue growth, product diversification, and scientific advancements to cater to health-conscious American parents.

Final Thoughts

The United States baby food and infant formula market is poised for steady growth throughout the next decade, supported by rising nutritional awareness, technological improvements, and evolving distribution networks. Parents now expect more than just basic nutrition—they seek transparency, functional health benefits, sustainability, and convenience. As a result, brands are under increasing pressure to invest in clean-label formulations, rigorous safety standards, and consumer education.

Looking ahead, success in this market will depend on a company’s ability to balance innovation with affordability, navigate regulatory challenges, and meet the diverse nutritional needs of America’s next generation.