Important Dates for TSP Investors from FRTIB

In the monthly meeting of the Federal Retirement Thrift Investment Board (FRTIB), several significant dates for your Thrift Savings Plan (TSP) were announced.

The year-end processing schedule is available on tsp.gov. Withdrawals requested through noon (Eastern Time) on December 29 will be reported to the Internal Revenue Service (IRS) as income for 2025. Withdrawals processed after that time will be reported to the IRS as income for 2026. The TSP is processing the remaining required minimum distributions for 2025, so that participants aged 73 and older can avoid unnecessary penalties from the IRS.

Also, detailed information regarding the upcoming Roth in-plan conversion feature is available on the TSP website. This conversion plan feature will be available beginning January 28, 2026.

Interfund Transfers and Participant Asset Allocation as of November 2025

TSP investors decided to transfer at least some of their investment funds out of the stock market and seek the safety or higher returns in other funds.

About $1.5 billion was transferred from the S Fund in November and $403 million from the C Fund. Where did the money go? $921 million was transferred into the G Fund, $260 million into the F Fund, and $526 million into the I Fund.

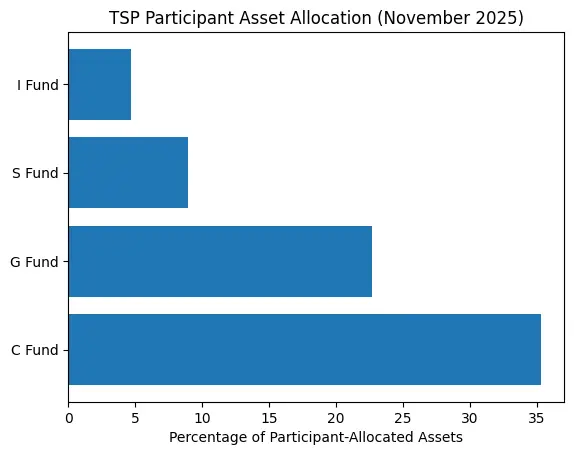

The transfer activity in November had little impact on TSP investors’ overall asset allocation, as the amounts were relatively small. The C Fund accounted for 35.3% of participant-allocated funds, followed by the G Fund at 22.7%. Despite the noteworthy returns of the I Fund in 2025 (see chart below), only 4.7% of TSP investor assets are in the I Fund. The S Fund has 8.9%.

Fund% of Participant AllocationC Fund35.3G Fund22.7S Fund8.9I Fund4.7F Fund2.2%

📉 December 2025 TSP Returns (Month-to-Date)

G Fund: Slight positive — up about +0.19% month-to-date (MTD) so far

I Fund: Only other fund showing a net positive monthly return, up about +0.33% so far in December

Other Funds:

F Fund: Slight negative (~-0.40% MTD)

C Fund: Down more (~-1.78% MTD)

S Fund: Also down (~-0.76% MTD)

L Funds: All showing modest month-to-date declines, roughly in line with their equity exposure

Bottom line so far in December: The safe, bond-like G Fund and the internationally oriented I Fund are holding up best. U.S. stock-linked funds (C, S) and mixed lifecycle funds are mostly down so far this month, reflecting broader stock market softness.

📊 Year-to-Date (YTD) 2025 TSP Returns

I Fund: Leading the pack with ~+29% YTD — far outpacing others thanks to strong international equity performance.

C Fund: Solid U.S. stock gains with roughly +15.7% YTD.

S Fund: Good performance in small/mid-caps — around +11.1% YTD.

F Fund: Positive returns in bonds — about +7.05% YTD.

G Fund: Modest but steady return as expected — roughly +4.3% YTD.

Lifecycle (L) Funds: All showing strong YTD gains, roughly +8.6% to +19.6% depending on equity exposure.

Summary of What This Means for TSP Returns

2025 has been a strong year overall for most TSP funds, especially international (I Fund) and U.S. stock (C and S) exposures.

December so far has been weak for equities, with U.S. stock funds showing declines — likely reflecting market volatility late in the year — while the G Fund (safety) and I Fund still show small gains.

If you’re risk-averse or near retirement, the G Fund’s consistency stands out. If an investor is largely investing for strong growth this year, the I Fund is the clear stand-out.

📊 TSP Returns So Far December and 2025 Year-to-Date

FundMonth-to-DateYear-to-DateG Fund0.19%4.28%F Fund-0.40%7.05%C Fund-1.78%15.68%S Fund-0.76%11.12%I Fund0.33%28.96%L Income-0.14%8.65%L 2030-0.48%13.79%L 2035-0.57%14.74%L 2040-0.64%15.64%L 2045-0.69%16.41%L 2050-0.75%17.17%L 2055-0.90%19.56%L 2060-0.90%19.57%L 2065-0.90%19.57%L 2070-0.90%19.58%L 2075-0.90%N/AReturns as of December 17, 2025 | Source: TSPDataCenter.com

© 2025 Ralph R. Smith. All rights reserved. This article

may not be reproduced without express written consent from Ralph R. Smith.