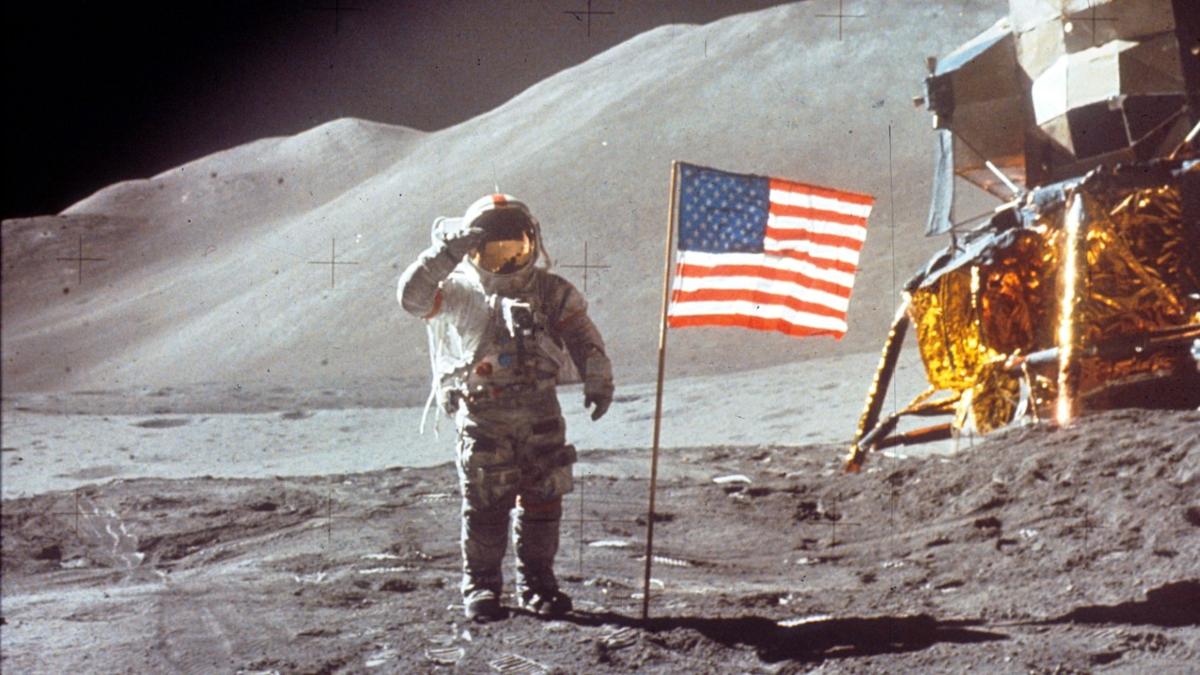

NASA / Hulton Archive via Getty Images

Rocket Lab (RKLB) jumped after President Trump signed an executive order targeting a 2028 moon landing and permanent lunar outpost by 2030.

Rocket Lab completed its 20th Electron launch of 2025 ahead of schedule for the U.S. Space Force.

The policy emphasizes private sector efficiency and domestic supply chains. Rocket Lab supplies satellite components including solar arrays and sensors.

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

President Trump just signed an executive order today reaffirming the U.S.’s commitment to landing astronauts on the moon by 2028 as part of NASA’s Artemis program. Titled “Ensuring American Space Superiority,” the order also sets a goal for establishing initial elements of a permanent lunar outpost by 2030, including nuclear power sources on the lunar surface.

Trump will reorganize space policy coordination under the White House Office of Science and Technology Policy, with the president as chairman. The policy urges efficiency among private contractors and calls for a space security strategy to address threats.

Newly appointed NASA administrator Jared Isaacman — who was previously a SpaceX customer — has emphasized prioritizing a lunar return to compete with China. This move signals continued support for commercial involvement in U.S. space efforts.

Shares of Rocket Lab (NASDAQ:RKLB) jumped in morning trading today following the news, building on positive momentum from the company’s successful 20th Electron rocket launch of 2025, which yesterday deployed a U.S. Space Force mission ahead of schedule.

However, the broader space sector also gained traction, with Intuitive Machines (NASDAQ:LUNR) rocketing sharply higher in morning trading, supported by the executive order and a KeyBanc analyst initiating coverage of the stock with an Overweight rating and a $20 per share price target.

Rocket Lab operates as an end-to-end space company, providing not only launch services with its Electron rocket but also spacecraft design, manufacturing, and components. The company supplies satellite subsystems, including star trackers, reaction wheels, solar cells and arrays, satellite radios, and separation systems. It has invested in expanding U.S. production of space-grade solar cells and electro-optical sensors to meet demand for domestic supply chains in national security missions.

Trump’s executive order emphasizes private sector efficiency and commercial partnerships for ambitious goals like the 2028 moon landing and lunar infrastructure. While it relies heavily on larger contractors for key elements, such as human landers, the focus on broader lunar presence and space security could increase opportunities for small satellite deployments, responsive launches, and component supplies.

Story Continues

Rocket Lab’s responsive launch capabilities, which it has demonstrated by accelerating missions for the U.S. Space Force, position it well for government contracts. Its component manufacturing segment, which includes high-demand items like advanced sensors and solar arrays, stands to benefit from heightened U.S. investment in space systems and a push for domestic production.

The policy’s call for private contractor efficiency aligns with Rocket Lab’s track record of rapid, reliable operations, including its record launch cadence. As NASA and the War Dept. pursue lunar and security objectives, demand for integrated space solutions — from payloads to on-orbit management — may rise, boosting sales across Rocket Lab’s diversified segments.

The executive order extends benefits across the space industry. By prioritizing cost-effective solutions and domestic capabilities, it supports increased funding and contracts for responsive space access, satellite deployments, and infrastructure development.

Rocket Lab has secured multiple U.S. government missions in 2025, and it is a key partner for NASA’s Artemis Moon program, demonstrating its role in meeting these priorities. The policy’s focus on space security and lunar goals could drive demand for small launch providers and component suppliers, as agencies seek agile, reliable options beyond larger incumbents.

With Rocket Lab’s record 20 Electron launches in 2025, including the successful STP-S30 mission yesterday, deploying experimental DiskSats — a new type of spacecraft just 40 inches wide and 1 inch thick (think of it as an orbiting manhole cover) — the company is well-positioned to capture additional opportunities in a policy environment favoring accelerated timelines and private innovation.

Rocket Lab’s ownership of the full space value chain — from manufacturing components and spacecraft to providing launch services and mission operations — places it in an enviable position for sustained growth. This vertical integration allows for higher margins in the space systems segment compared to launch alone, recurring revenue from components and software, and agility in meeting government and commercial needs.

With U.S. space policy prioritizing ambitious timelines and private sector involvement, Rocket Lab’s proven execution and broad capabilities make it a compelling long-term holding in the evolving space economy.

You may think retirement is about picking the best stocks or ETFs, but you’d be wrong. Even great investments can be a liability in retirement. It’s a simple difference between accumulating vs distributing, and it makes all the difference.

The good news? After answering three quick questions many Americans are reworking their portfolios and finding they can retire earlier than expected. If you’re thinking about retiring or know someone who is, take 5 minutes to learn more here.