CNBC’s Jim Cramer suggested dealmaking will help drive the market next year, reviewing mergers and acquisitions that could occur.

“The setup’s a great one,” he said. “The chief pillar? Takeovers and acquisitions. They’re going to be an extraordinary force for the bulls in 2026.”

Cramer explained that mergers are important for stocks because the market is fundamentally about supply and demand. When the number of shares increases, the averages can have trouble advancing, he said. However, takeovers can “temper the market’s endless stock issuance,” he continued.

2026 is likely to see a “robust issuance,” Cramer said, saying two huge private operators could come public — OpenAI and SpaceX. It could be “hard to overcome that much new supply,” he pointed out.

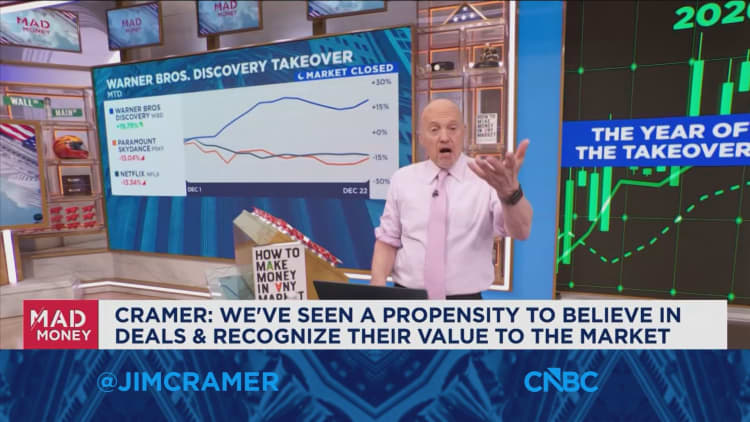

He suggested that “the most salient takeover battle right now” is the contest for Warner Bros Discovery. Paramount Skydance and Netflix are both vying for the company, he explained, adding that on Monday, the former guaranteed the backing of billionaire Larry Ellison to finance the deal. However, he also noted that Netflix has the blessing of WBD’s board. Cramer said he primarily cares that there are “two bidders with big pools of capital,” indicating WBD’s value has gone up since the bidding began.

Uniform maker Cintas has been trying buy rival UniFirst since 2022, Cramer continued. Cintas announced a new bid on Monday, nearly a year since its last bid was rejected. Cramer noted that the company is so confident the regulators will approve the deal that it’s offering a $350 million reverse termination fee on the $5.2 billion transaction. He suggested the acquisition stands a better chance than in years past because the Trump administration is more merger friendly than the Biden administration.

“They’re strategic, they’re valuable, and they’re going to make you a lot of money,” Cramer said of potential deals going into 2026.

Jim Cramer’s Guide to Investing

Jim Cramer’s Guide to Investing