United States Durable Medical Equipment Market Overview

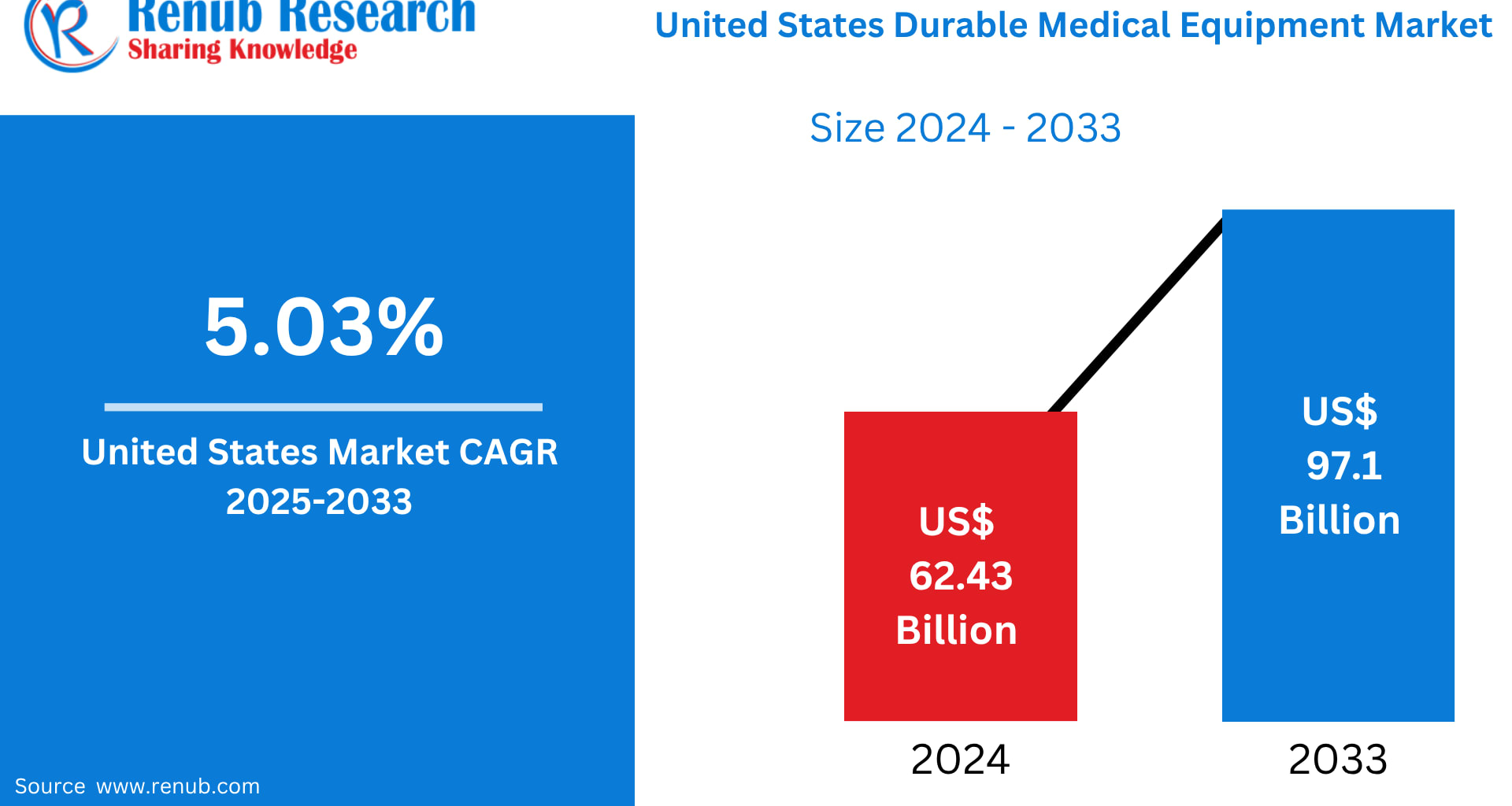

The United States Durable Medical Equipment (DME) Market is entering a phase of sustained and resilient growth, supported by demographic shifts, chronic disease prevalence, and the rapid transition of care from hospitals to homes. According to Renub Research, the market was valued at US$ 62.43 billion in 2024 and is projected to reach US$ 97.10 billion by 2033, expanding at a CAGR of 5.03% from 2025 to 2033.

DME plays a pivotal role in the U.S. healthcare ecosystem by reducing hospital stays, lowering overall healthcare costs, and enhancing patient quality of life. With Medicare, Medicaid, and private insurers covering a significant portion of DME under medical necessity guidelines, the sector remains closely tied to reimbursement policies and regulatory oversight.

Growth Drivers in the United States Durable Medical Equipment Market

Aging Population and Rising Chronic Disease Burden

One of the strongest growth engines of the U.S. DME market is the aging population. As nearly 77 million baby boomers transition into senior age groups, demand for mobility aids, respiratory devices, and monitoring equipment continues to accelerate. Older adults are more susceptible to arthritis, osteoporosis, cardiovascular disorders, diabetes, and mobility impairments—conditions that often require long-term equipment support.

In parallel, chronic diseases affect more than half of U.S. adults, creating sustained demand for glucose monitors, oxygen concentrators, CPAP devices, and infusion pumps. As healthcare increasingly emphasizes disease management rather than episodic treatment, DME becomes central to helping patients maintain independence and dignity while managing long-term conditions.

Expansion of Home Healthcare Services

Home healthcare is transforming how medical services are delivered across the United States. Rising hospital costs, shorter inpatient stays, and patient preference for home-based recovery are driving rapid adoption of home healthcare models, directly benefiting the DME market.

Durable equipment such as hospital beds, oxygen therapy devices, nebulizers, suction pumps, and mobility aids is essential for safe and effective in-home treatment. Medicare and Medicaid reimbursement support for home healthcare has improved affordability and accessibility, while private insurers increasingly recognize home care as a cost-effective alternative to institutional treatment.

Advancements in remote monitoring, portable devices, and telehealth integration further strengthen this trend. As care shifts from hospitals to homes, demand for compact, user-friendly, and technologically enabled DME solutions is expected to rise steadily through 2033.

Technological Advancements in Medical Devices

Innovation is reshaping the U.S. durable medical equipment landscape. Modern DME products are becoming lighter, smarter, more efficient, and more patient-centric. Examples include smart wheelchairs with navigation assistance, Bluetooth-enabled glucose meters, battery-powered suction pumps, and portable oxygen concentrators with extended battery life.

Integration with smartphones, cloud platforms, and telehealth systems allows real-time data sharing between patients, caregivers, and clinicians. These features improve treatment adherence, enable early intervention, and enhance clinical outcomes. Material innovations have also improved comfort, durability, and infection control.

As patients and providers increasingly favor technology-driven, easy-to-use solutions, manufacturers are intensifying R&D investments, fueling the evolution of next-generation DME across the United States.

United States Durable Medical Equipment Market Challenges

High Costs and Reimbursement Limitations

Despite strong demand, the DME market faces challenges related to high upfront costs and complex reimbursement processes. While many devices qualify for Medicare and Medicaid coverage, approval timelines, documentation requirements, and reimbursement caps can delay patient access.

Out-of-pocket expenses for advanced or non-covered models often discourage adoption, particularly among low-income and elderly populations. Frequent changes in reimbursement policies and coding guidelines also create revenue uncertainty for suppliers and providers, affecting long-term planning and market entry for smaller players.

Regulatory Compliance and Quality Standards

The U.S. DME industry operates under strict oversight from regulatory bodies such as the FDA and CMS. Manufacturers must comply with detailed standards related to product safety, labeling, quality control, and post-market surveillance.

Regulatory delays, recalls, or compliance failures can significantly disrupt operations and damage brand credibility. Smaller manufacturers, in particular, face difficulties balancing regulatory costs with innovation and price competitiveness, making compliance a persistent challenge across the sector.

Product-Specific Market Insights

United States Medical Wheelchairs Market

The U.S. medical wheelchair segment is experiencing steady growth driven by aging demographics, rehabilitation needs, and disability prevalence. Both manual and powered wheelchairs are widely used in home care, hospitals, and long-term care facilities. Technological enhancements such as lightweight frames, power tilt, recline functions, and advanced joystick controls have significantly improved user comfort and mobility.

Insurance coverage through Medicare and Medicaid supports accessibility, while customization options are increasingly important for patient satisfaction. Rising orthopedic procedures and veteran healthcare needs continue to strengthen this segment.

United States Commodes and Toilets Market

Adaptive commodes and toilet aids play a crucial role in maintaining independence and dignity among elderly and mobility-impaired individuals. Growth in this segment is closely linked to the aging-in-place trend and expansion of home healthcare services.

Products such as bedside commodes, rolling commodes, and drop-arm designs are widely adopted across homes, hospitals, and nursing facilities. Innovations in hygiene, adjustability, and ease of cleaning enhance usability, supporting consistent market expansion.

United States Blood Sugar Monitoring Equipment Market

The U.S. blood sugar monitoring equipment market is growing rapidly due to the high prevalence of diabetes. Devices such as glucometers and continuous glucose monitors (CGMs) are essential for daily disease management.

Modern systems offer real-time alerts, smartphone integration, and data analytics, improving compliance and clinical outcomes. Insurance coverage, digital healthcare adoption, and patient-centered care models continue to boost demand for durable and wearable glucose monitoring solutions.

United States Nebulizers Equipment Market

Nebulizers are vital in managing respiratory conditions such as asthma, COPD, and cystic fibrosis. Rising air pollution, smoking-related illnesses, and post-pandemic respiratory awareness are fueling growth in this segment.

Home-based nebulizer use is increasing due to telehealth expansion and earlier hospital discharges. Portable, battery-powered models are particularly popular, enhancing convenience and treatment adherence.

United States Suction Pumps Equipment Market

Suction pumps are essential in surgical, emergency, and home care settings for airway clearance and fluid removal. Growth is driven by rising surgical volumes, emergency response needs, and chronic respiratory conditions.

Technological improvements in noise reduction, suction precision, and portability have expanded their use beyond hospitals into ambulatory and home care environments, supporting long-term market growth.

End-User Analysis

Hospitals Durable Medical Equipment Market

Hospitals remain major consumers of durable medical equipment, relying on a broad range of devices for inpatient, outpatient, and critical care. Investment in smart beds, mobility aids, ventilators, and infection-control-friendly equipment is increasing as hospitals modernize infrastructure and improve patient safety.

Bulk purchasing agreements and long-term supplier partnerships shape procurement strategies in this segment.

Home Healthcare Durable Medical Equipment Market

Home healthcare represents the fastest-growing end-user segment in the U.S. DME market. Products such as oxygen concentrators, hospital beds, glucose monitors, and mobility aids are increasingly prescribed for home use.

Value-based care models, reimbursement support, and patient preference for home recovery are accelerating adoption. Lightweight, compact, and easy-to-use devices dominate purchasing decisions, reinforcing strong growth momentum.

State-Level Market Insights

California Durable Medical Equipment Market

California leads the U.S. DME market due to its large elderly population, advanced healthcare infrastructure, and strong home healthcare adoption. Urban centers such as Los Angeles and San Francisco drive demand for technologically advanced equipment, while rural regions emphasize mobile and home-based solutions.

New York Durable Medical Equipment Market

New York’s DME market benefits from dense population, high chronic disease prevalence, and extensive hospital and home care networks. Strong Medicaid coverage and a focus on post-acute care and health equity support sustained market demand across urban and suburban regions.

Competitive Landscape and Key Players

The U.S. Durable Medical Equipment market is moderately consolidated, with established players focusing on innovation, distribution expansion, and regulatory compliance. Key companies include Invacare Corporation, NOVA Medical Products, Inogen, Inc., Thermo Fisher Scientific Inc., Abbott, Medtronic, Baxter, B. Braun SE, Boston Scientific Corporation, and BD.

These companies are evaluated across five key dimensions: company overview, leadership, recent developments, SWOT analysis, and revenue performance, highlighting their strategic positioning in the evolving U.S. healthcare landscape.

Final Thoughts

The United States Durable Medical Equipment Market stands at the intersection of aging demographics, chronic disease management, home healthcare expansion, and medical technology innovation. With the market projected to reach US$ 97.10 billion by 2033, DME will remain a cornerstone of patient-centered, cost-effective healthcare delivery.

As healthcare continues to move beyond hospital walls, durable medical equipment will play an increasingly vital role in enhancing independence, improving outcomes, and supporting value-based care models across the United States. For manufacturers, providers, and policymakers alike, the coming decade offers significant opportunities to shape the future of long-term medical care through durable, intelligent, and accessible equipment solutions.