United States Washing Machine Market Outlook

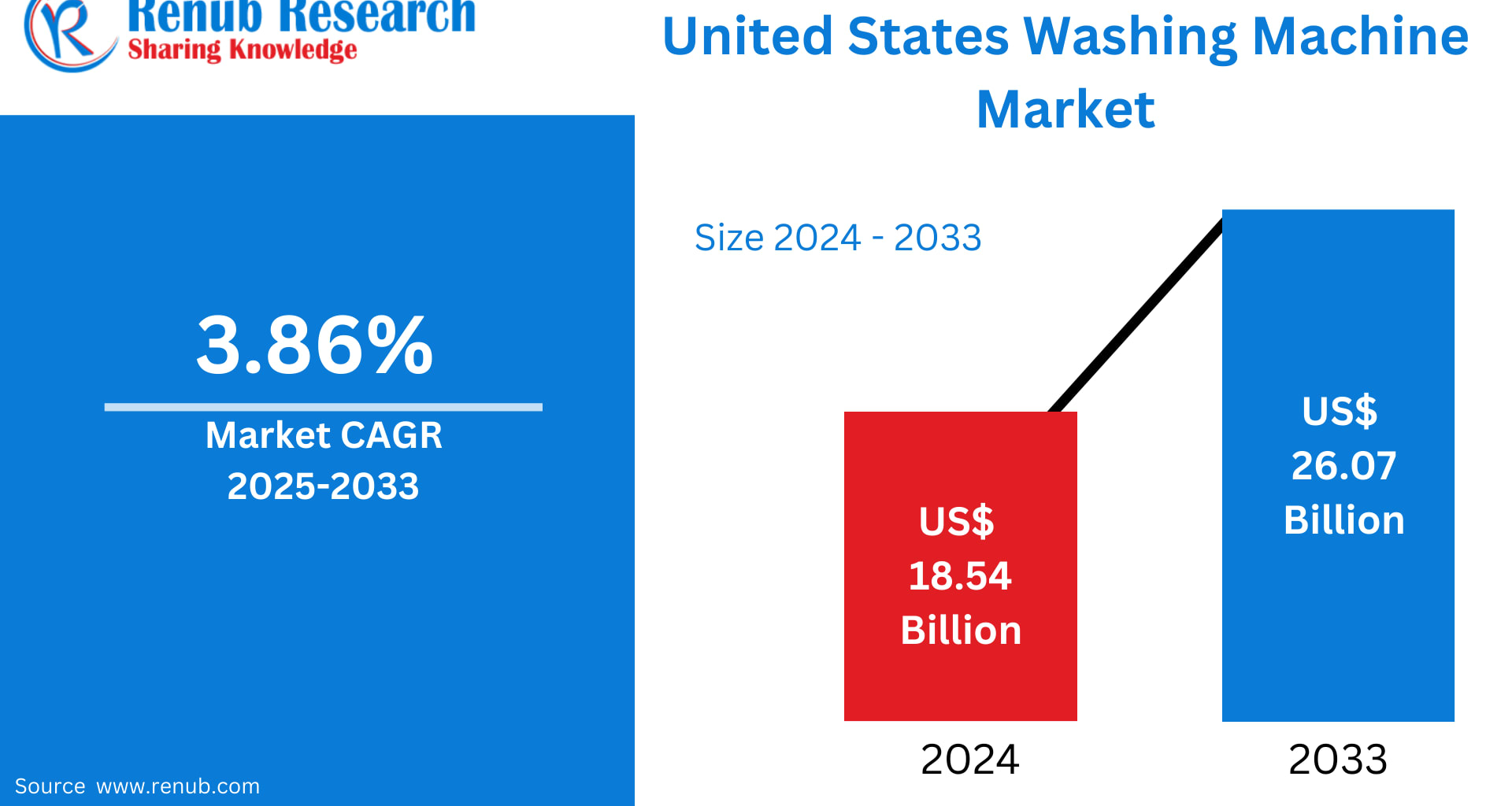

The United States Washing Machine Market is projected to reach US$ 26.07 billion by 2033, rising from US$ 18.54 billion in 2024, expanding at a CAGR of 3.86% during 2025–2033, according to Renub Research. Market expansion is being driven by rising consumer demand for energy-efficient appliances, growing adoption of smart and connected home technologies, and the increasing preference for time-saving household solutions among busy American households.

United States Washing Machine Market Overview

A washing machine is an essential household appliance designed to clean clothes, linens, and fabrics by automating soaking, washing, rinsing, and spinning processes. Modern washing machines in the U.S. market are available in top-load, front-load, and high-efficiency (HE) formats, offering multiple wash programs, temperature controls, fabric-specific cycles, and increasingly Wi-Fi-enabled smart features.

In the United States, washing machines are considered a standard home necessity. High disposable income, widespread urbanization, and fast-paced lifestyles have reinforced reliance on automated laundry solutions. Over the years, the market has matured, with replacement purchases and feature-driven upgrades now accounting for a significant share of sales.

Rising environmental consciousness has also reshaped consumer behavior. Water scarcity concerns, electricity costs, and sustainability commitments are pushing households toward Energy Star-certified, low-water-consumption, and inverter-motor-based washers. At the same time, manufacturers are differentiating products through AI-powered wash optimization, app-based controls, noise reduction technology, and cold-water performance, making washing machines smarter and more efficient than ever before.

Growth Drivers in the United States Washing Machine Market

Growing Demand for Energy-Efficient Appliances

Energy efficiency remains the most influential growth driver in the U.S. washing machine market. Federal initiatives such as Energy Star labeling, combined with rising electricity and water costs, are encouraging consumers to choose high-efficiency washers that reduce long-term utility expenses.

Manufacturers are responding with innovations such as inverter motors, intelligent load sensing, automatic water level adjustment, and cold-water wash optimization. Front-load washing machines, in particular, are gaining traction due to their lower water usage and superior energy performance.

In November 2024, AB Electrolux announced the launch of a new energy-efficient laundry pair engineered for effective stain removal even in cold water. Since nearly 85% of a washing machine’s climate footprint comes from its usage, cold-water washing technologies are becoming a key sustainability differentiator.

Increasing Urbanization and Lifestyle Changes

Urban living continues to reshape appliance demand in the United States. Smaller living spaces, rising apartment living, and the dominance of dual-income households are driving demand for compact, fully automatic, and low-maintenance washing machines.

Consumers increasingly value features such as quick wash cycles, self-cleaning drums, low-noise operation, and space-saving designs. With nearly 90% of the U.S. population expected to live in urban areas by 2050, demand for efficient and adaptable laundry appliances is expected to remain strong.

Lifestyle-driven replacement cycles—where consumers upgrade for convenience rather than necessity—are significantly contributing to sustained market growth.

Technological Innovation and Smart Capabilities

Smart technology integration is transforming washing machines from basic appliances into connected lifestyle products. AI, IoT, and cloud connectivity now enable washing machines to deliver personalized wash cycles, remote monitoring, automatic detergent dosing, and predictive maintenance alerts.

In April 2025, Samsung Electronics introduced its Bespoke AI Top Load Washer series in global markets, featuring AI Wash, AI Energy Mode, and AI Vibration Reduction Technology Plus (VRT+™). These advancements highlight how artificial intelligence is enhancing efficiency, fabric care, and user convenience.

As smart home adoption accelerates across the U.S., smart washing machines are expected to gain mainstream acceptance rather than remain niche offerings.

Challenges in the United States Washing Machine Market

High Initial Cost of Advanced Models

Despite long-term savings, the high upfront cost of smart and high-efficiency washing machines remains a key barrier. Advanced models often carry premium pricing due to embedded sensors, AI chips, and connectivity features.

Price sensitivity is especially prominent among renters, students, and lower-income households, many of whom prioritize affordability over advanced functionality. This limits rapid penetration of premium models in certain demographic segments.

Supply Chain Disruptions and Inflationary Pressures

The U.S. washing machine industry continues to feel the impact of global supply chain disruptions, including higher logistics costs, semiconductor shortages, and fluctuating raw material prices. Inflation has further complicated pricing strategies for manufacturers and retailers.

While supply conditions are gradually stabilizing, manufacturers remain cautious, focusing on localized sourcing and inventory optimization to reduce future volatility.

Segment Analysis

United States Fully Automatic Washing Machine Market

Fully automatic washing machines dominate the U.S. market due to their ease of use, efficiency, and time-saving benefits. Both top-load and front-load variants enjoy strong demand among urban and suburban households.

Features such as digital controls, automatic load sensing, energy-efficient cycles, and minimal manual intervention make these machines especially attractive to working professionals and families. Continued product innovation ensures this segment remains the backbone of market revenues.

United States Smart Connected Washing Machine Market

Smart connected washing machines represent one of the fastest-growing segments. Wi-Fi-enabled appliances that integrate with smartphones and voice assistants such as Alexa and Google Assistant are gaining popularity.

Benefits such as remote operation, usage analytics, maintenance alerts, and energy tracking are reshaping user expectations. As smart home ecosystems expand across the U.S., connected washers are becoming an integral part of modern households.

United States Residential Washing Machine Market

The residential segment accounts for the majority of washing machine demand in the U.S. Nearly every household owns a washer, making replacement and upgrades the primary growth drivers.

Urban consumers increasingly prefer compact, stackable, and multifunctional machines, while suburban households opt for large-capacity washers capable of handling bulk loads. Consumer preferences vary by space availability, income, and household size, creating opportunities across multiple price points.

United States Healthcare Washing Machine Market

Healthcare facilities require commercial-grade washing machines capable of high-temperature sanitization for linens, uniforms, and reusable medical textiles. Post-pandemic hygiene standards have accelerated investment in heavy-duty, infection-control-compliant washers.

Hospitals, nursing homes, and clinics prioritize durability, capacity, and compliance with sanitation regulations, making this a specialized yet steadily growing segment.

United States E-Commerce Washing Machine Market

E-commerce is rapidly transforming appliance retail in the United States. Online platforms offer price transparency, product comparisons, customer reviews, financing options, and doorstep delivery, making them increasingly attractive.

Major retailers such as Amazon, Best Buy, and Home Depot are leveraging digital channels to expand reach. E-commerce enables manufacturers to directly engage consumers, promote new launches, and gather real-time market insights.

Regional Market Insights

California Washing Machine Market

California leads demand due to its strict energy and water efficiency regulations, environmentally conscious consumers, and high smart home adoption. Energy Star-rated and smart washing machines are especially popular, supported by state sustainability initiatives.

New York Washing Machine Market

New York’s dense urban environment drives demand for compact, portable, and stackable washing machines. Renters favor space-saving models, while e-commerce dominates distribution due to logistical convenience in metropolitan areas.

New Jersey Washing Machine Market

New Jersey exhibits balanced demand across suburban and urban segments. High-capacity washers with premium features are popular in suburban homes, while compact automatic models dominate city apartments. Proximity to major metro markets fuels competitive pricing and brand variety.

Market Segmentation Overview

By Product

Fully Automatic

Semi-Automatic

By Technology

Smart Connected

Conventional

By End Use

Residential

Commercial

By Application

Healthcare

Hospitality

Others

By Sales Channel

E-Commerce

Retail Chains

Direct Sales

Top States Covered

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, Washington, New Jersey, Rest of United States

Key Players Analysis

The U.S. washing machine market is highly competitive, with innovation, brand trust, and distribution strength determining market leadership. Each company is analyzed across Overview, Key Personnel, Recent Developments, SWOT Analysis, and Revenue Performance.

Major Players Include:

Whirlpool

Samsung Electronics

LG Electronics

IFB Appliances

Panasonic Holdings Corporation

Haier Inc.

Godrej

GENERAL ELECTRIC COMPANY

AB Electrolux

Final Thoughts

The United States Washing Machine Market is transitioning from a mature appliance category into a technology-driven, sustainability-focused industry. While challenges such as high upfront costs and supply chain volatility persist, long-term fundamentals remain strong.

Energy efficiency regulations, smart home integration, urban lifestyle shifts, and replacement-driven demand will continue to shape market dynamics through 2033. Manufacturers that balance affordability, innovation, and sustainability will be best positioned to capture future growth.