United States Natural Food Colors Market Overview

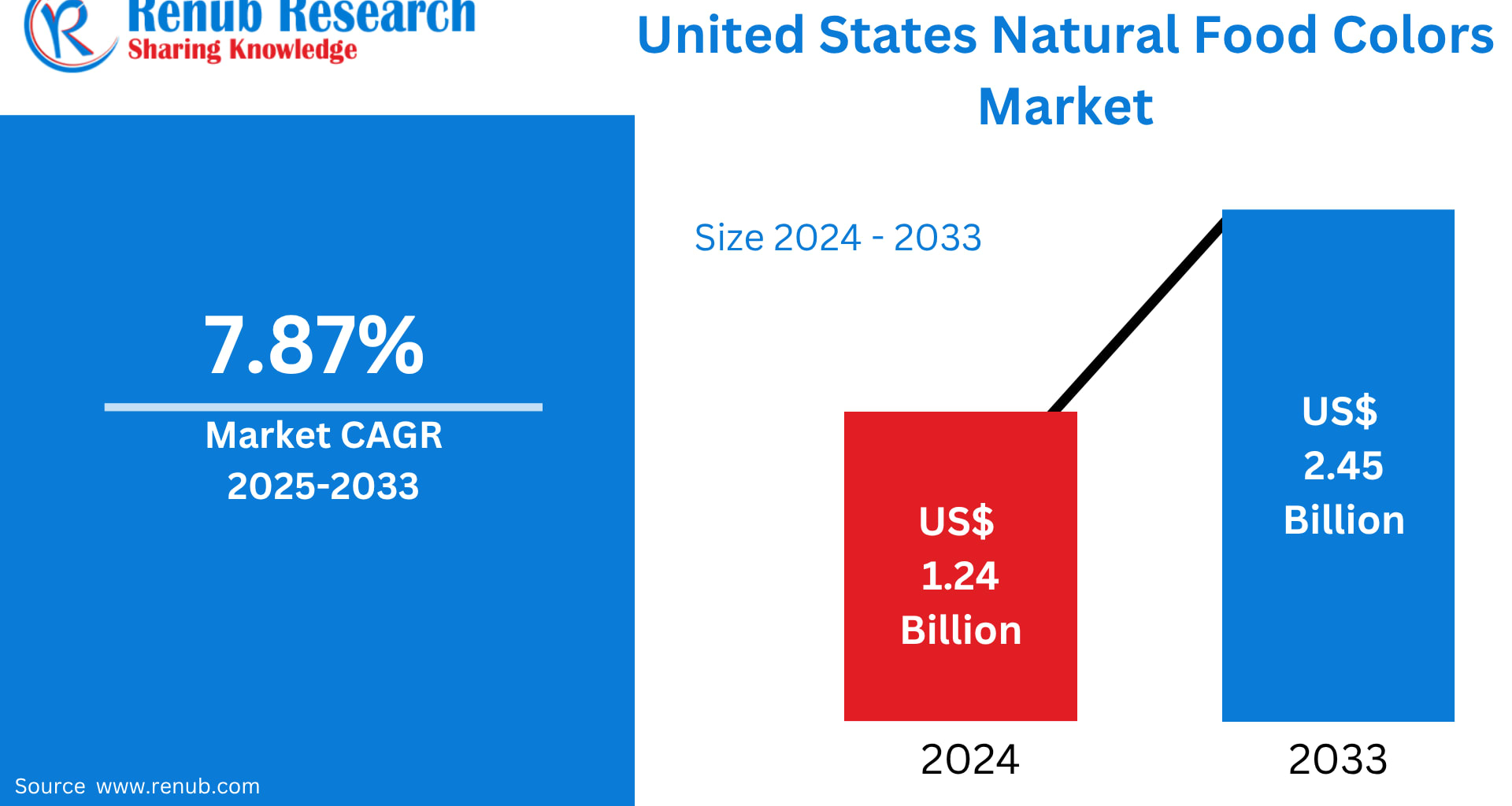

The United States Natural Food Colors Market is undergoing a decisive transformation as food and beverage manufacturers shift away from synthetic additives toward plant-based, label-friendly alternatives. According to Renub Research, the market is expected to grow from US$ 1.24 billion in 2024 to US$ 2.45 billion by 2033, expanding at a robust CAGR of 7.87% during 2025–2033.

Beyond consumer demand, regulatory pressure and evolving food safety standards are accelerating the adoption of natural alternatives. As a result, natural food colors are becoming mainstream across beverages, bakery and confectionery, dairy products, plant-based meat alternatives, and even pet food. While challenges related to cost, stability, and scalability persist, innovation in extraction, fermentation, and encapsulation technologies continues to unlock new opportunities across the U.S. food ecosystem.

United States Natural Food Colors Industry Outlook

Natural food colors are pigments sourced from ingredients such as beetroot, turmeric, paprika, spirulina, annatto, and berries. Unlike artificial dyes, these colors align with clean-label standards and resonate strongly with consumers seeking minimally processed foods. In the United States, the demand for such ingredients is particularly strong in products targeted at children, health-conscious adults, and premium food segments.

Food manufacturers are increasingly reformulating legacy products to replace synthetic dyes with natural alternatives. This transition is supported by advancements in food science, including microencapsulation, precision fermentation, and AI-assisted formulation, which help improve color stability, shelf life, and application versatility.

Despite higher production costs and supply chain complexities, the long-term outlook remains highly favorable. As sustainability, transparency, and nutrition become central pillars of food branding, natural food colors are expected to evolve from a “nice-to-have” ingredient to an industry standard.

Key Factors Driving the United States Natural Food Colors Market

Growing Consumer Demand for Clean-Label Foods

Clean-label consumption has become a defining trend in the U.S. food and beverage industry. Consumers are actively avoiding artificial additives and favoring ingredients that are recognizable, natural, and easy to understand. Natural food colors fit perfectly into this narrative, offering visual appeal without compromising ingredient transparency.

Parents, in particular, are driving this shift, as concerns over synthetic dyes and children’s health continue to rise. Brands that emphasize “no artificial colors” on packaging are gaining consumer trust, brand loyalty, and competitive advantage.

Rising Health and Wellness Awareness

Health-conscious consumers are increasingly linking diet quality with long-term wellbeing. Artificial food dyes have been associated—rightly or wrongly—with allergies, hyperactivity, and other health concerns, pushing consumers toward natural alternatives.

This trend is further reinforced by the popularity of organic foods, plant-based diets, and non-GMO products. Natural food colors complement these lifestyles, making them especially attractive to manufacturers targeting wellness-focused demographics.

Regulatory Pressure and Policy Shifts

Regulatory scrutiny is playing a crucial role in accelerating market growth. While the U.S. Food and Drug Administration (FDA) continues to evaluate the safety of artificial colorants, several states have introduced stricter labeling and usage guidelines. California, for example, has implemented policies limiting synthetic dyes in school meals.

Consumer advocacy groups and media coverage have further intensified pressure on manufacturers to adopt natural solutions. In response, many companies are proactively reformulating products to mitigate regulatory, legal, and reputational risks.

Challenges Facing the United States Natural Food Colors Market

High Production and Raw Material Costs

One of the biggest barriers to adoption is cost. Natural food colors require complex extraction processes and depend on agricultural raw materials that are often seasonal and geographically limited. Compared to synthetic dyes, natural alternatives typically have lower pigment concentration, requiring higher usage levels to achieve the same visual impact.

These factors can squeeze profit margins and lead to higher retail prices, making cost optimization a critical challenge for manufacturers.

Stability and Performance Limitations

Natural pigments are more sensitive to heat, light, oxygen, and pH variations. For example, anthocyanins can change color based on acidity, while curcumin may degrade under high heat. Ensuring consistent color performance across different food matrices and storage conditions requires significant R&D investment.

Although technological advancements are improving stability, performance limitations remain a key hurdle—particularly in processed and shelf-stable foods.

United States Natural Food Colors Market by States

California Natural Food Colors Market

California leads the U.S. market due to its progressive regulations, strong clean-label culture, and health-focused consumer base. Cities such as Los Angeles, San Francisco, and San Diego are hubs for organic, plant-based, and sustainable food innovation. State policies limiting synthetic dyes—especially in schools—have accelerated the adoption of natural alternatives.

Collaboration between startups, universities, and major food brands further strengthens California’s leadership position.

Texas Natural Food Colors Market

Texas is emerging as a high-growth market, supported by a strong food manufacturing base and diverse culinary influences. Demand is particularly high for naturally colored beverages, sauces, and plant-based proteins. Retailers such as H-E-B and Central Market are expanding clean-label offerings, encouraging manufacturers to adopt natural color solutions.

New York Natural Food Colors Market

New York’s market growth is fueled by regulatory transparency requirements and a diverse, trend-driven consumer base. Urban centers like New York City show strong preference for naturally colored beverages, bakery items, and specialty foods. State-level disclosure laws further incentivize manufacturers to transition away from artificial additives.

Recent Developments in the Market

November 2024: Archer Daniels Midland introduced a new plant-based color functionality platform combining natural pigments with adaptogens for functional beverage applications.

August 2024: Sentient Technologies launched heat-stable fermented vegetable-based red colors designed for plant-based meat and dairy alternatives in North America.

Market Segmentation Overview

By Ingredient

Beta-carotene

Lycopene

Curcumin

Anthocyanin

Carmine

Copper Chlorophyllin

Paprika

Betanin

Riboflavin

Blue Spirulina

Caramel

Annatto

Others

By Application

Bakery & Confectionery

Beverages

Dairy & Frozen Products

Meat Products

Oils & Fats

Fruits & Vegetables

Meat Alternatives / Plant-based Meat

Pet Food

By States

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, Washington, New Jersey, Rest of the United States

Competitive Landscape and Company Analysis

The U.S. natural food colors market is moderately consolidated, with global ingredient leaders investing heavily in innovation, sustainability, and clean-label solutions. Key players include:

Symrise AG

Chr Hansen Holding A/S

McCormick & Company

Givaudan

International Flavors & Fragrances Inc.

Ingredion Inc.

BASF SE

FMC Corporation

Each company profile typically includes business overview, key executives, recent developments, SWOT analysis, and revenue performance.

Final Thoughts

The United States Natural Food Colors Market is on a clear upward trajectory, supported by clean-label demand, health-driven consumption, and regulatory momentum. While challenges such as cost and stability remain, continuous innovation in food science and ingredient sourcing is steadily closing the gap between natural and synthetic color performance.

As consumer trust, transparency, and sustainability become non-negotiable in the food industry, natural food colors are poised to become a foundational component of future product development. For manufacturers, early investment in natural coloring solutions represents not just regulatory compliance—but a strategic advantage in a rapidly evolving market landscape.