United States Antimony recently promoted Melissa Pagen to President and Chief Operating Officer of its Bear River Zeolite division, following her role in securing a US$245,000,000 Defense Logistics Agency contract and a US$106,700,000 supply agreement. The company is emphasizing Bear River Zeolite as a long-lived asset, highlighting over 400 years of zeolite reserves that management believes can support a larger revenue base under Pagen’s leadership. We’ll now examine how Pagen’s promotion and zeolite growth focus might reshape United States Antimony’s broader investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

United States Antimony Investment Narrative Recap

To own United States Antimony, you need to believe the company can turn its fully integrated antimony and zeolite platform into durable, profitable revenue, while managing regulatory and execution risks. Pagen’s promotion looks most relevant to the near term catalyst of scaling Bear River Zeolite under large, long dated contracts, but it does not remove key risks around permitting, capital intensity, or supply reliability across the broader portfolio.

The US$245,000,000 Defense Logistics Agency contract and the US$106,700,000 supply agreement that Pagen helped secure stand out as the clearest near term growth drivers for Bear River Zeolite. They support management’s focus on zeolite as a long lived asset and may help offset some project timing and funding uncertainties elsewhere in the business, although investors still need to watch how efficiently the company converts these contracts into consistent cash generation.

However, investors should also be aware that if permitting setbacks or regulatory pushback persist across key mining projects, then…

Read the full narrative on United States Antimony (it’s free!)

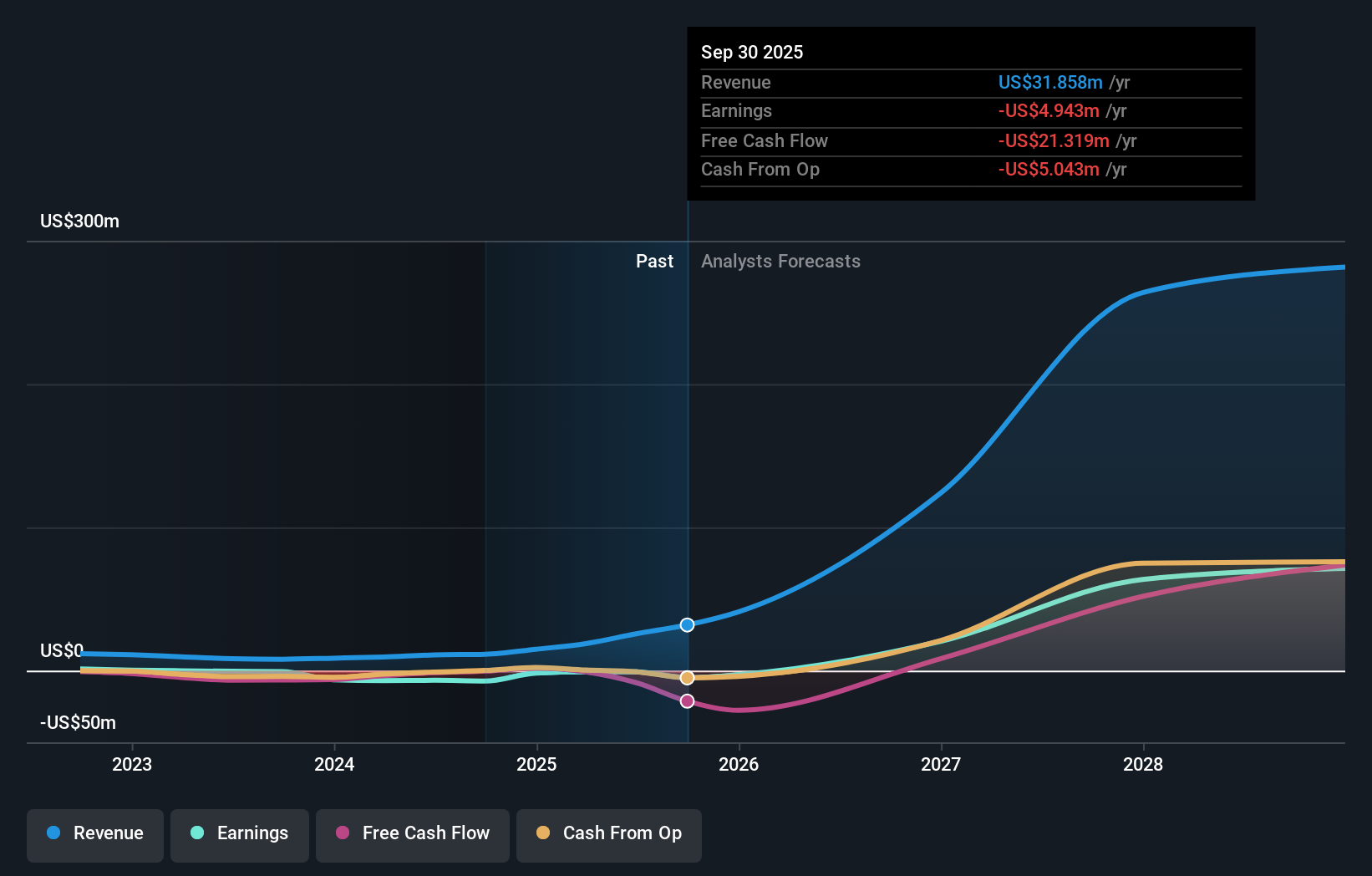

United States Antimony’s narrative projects $208.1 million revenue and $82.5 million earnings by 2028.

Uncover how United States Antimony’s forecasts yield a $9.67 fair value, a 23% upside to its current price.

Exploring Other Perspectives UAMY Earnings & Revenue Growth as at Jan 2026

UAMY Earnings & Revenue Growth as at Jan 2026

Nineteen members of the Simply Wall St Community currently see fair value for United States Antimony anywhere between US$1.31 and US$41, reflecting very different revenue and earnings assumptions. When you compare those views with the company’s reliance on timely permits for Alaska and Ontario projects, it is a reminder that project execution outcomes could sharply influence how those valuation opinions evolve over time.

Explore 19 other fair value estimates on United States Antimony – why the stock might be worth over 5x more than the current price!

Build Your Own United States Antimony Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Seeking Other Investments?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com