SUMMARY

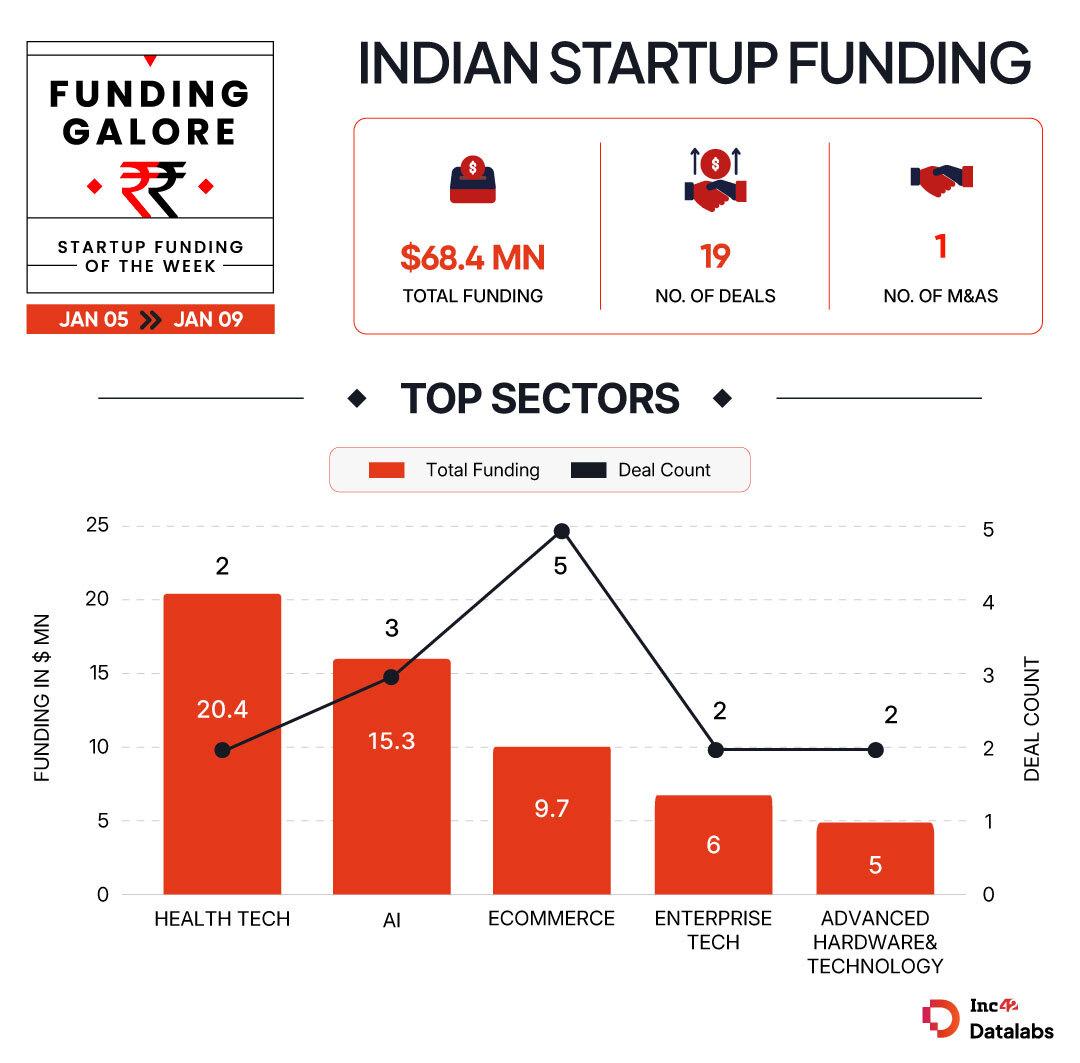

Between Jan 5 and 9, 19 startups managed to secure a fresh capital of $68.4 Mn, representing a near 34% declined from the $104.2 Mn bagged by two startups in the preceding week

With Even Healthcare bagging the largest cheque of $20 Mn, healthtech sector topped the weekly funding charts. Two startups from the space secured $20.4 Mn during the week

Ecommerce sector continued to dominate funding deal trends this week, with five D2C startups raising $9.7 Mn

After attaining relative stability in the year 2025, Indian startup funding trends were rather muted in the first week of 2026. Between Jan 5 and 9, 19 startups managed to secure a fresh capital of $68.4 Mn, representing a near 34% declined from the $104.2 Mn bagged by Arya.ag and Knight Fintech in the preceding week.

Funding Galore: Indian Startup Funding Of The Week [ Jan 5 – 9 ]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

6 Jan 2026

Even Healthcare

Health Tech

Telemedicine

B2C

$20 Mn

–

Lachy Groom, Alpha Wave, Sharrp Ventures

–

6 Jan 2026

Speed

Web3

Digital Currencies & Assets

B2C

$8 Mn

–

Tether Ventures, Ego Death Capital

Tether Ventures

8 Jan 2026

Spector.AI

AI

Application Layer

B2B

$6.7 Mn

–

IvyCap Ventures

IvyCap Ventures

8 Jan 2026

TakeMe2Space

Advanced Hardware & Technology

Spacetech

B2C

$5 Mn

Seed

Chiratae Ventures, Artha Venture Fund, SeaFund, Unicorn India Ventures

Chiratae Ventures

7 Jan 2026

Nitro Commerce

Enterprise tech

Horizontal SaaS

B2B

$5 Mn

Series A

Cornerstone Ventures, Ankurit Capital, Grand Anicut Angel Fund, Equentis Wealth Advisory Services, India Accelerator, Razorpay Ventures, Rukum Capital

Cornerstone Ventures

8 Jan 2026

Aivar

AI

Application Layer

B2B

$4.6 Mn

Seed

Sorin Investments, Bessemer Venture Partners

Sorin Investments

7 Jan 2026

Antinorm

Ecommerce

D2C

B2C

$3.1 Mn

Seed

Fireside Ventures, V3 Ventures, Rukam Capital

Fireside Ventures

8 Jan 2026

&Done

Ecommerce

D2C

B2C

$3 Mn

Series A

RTP Global, Suashish, All In Capital, Kitty Agarwal, Kunal Bahl, Rohit Bansal,Puneet Kumar

RTP Global

7 Jan 2026

Arrowhead

AI

Application Layer

B2B

$3 Mn

Seed

Stellaris Venture Partners, Kunal Shah, Madhusudanan R

Stellaris Venture Partners

6 Jan 2026

SkinInspired

Ecommerce

D2C

B2C

$2.7 Mn

Series A

Spring Marketing Capital, Beauty Innovation Fund, Arihant Patni, Unilever Ventures.

Spring Marketing Capital

7 Jan 2026

Flent

Real Estate Tech

Real Estate Services

B2C

$2.3 Mn

Pre-Series A

Incubate Fund Asia, Twin & Bull Family Office, Stride Ventures, 91Ventures, Untitled VC, WEH Ventures

Incubate Fund Asia

7 Jan 2026

RoadGrid

Cleantech

Electric Vehicles

B2C

$1.5 Mn

Pre-Series A

Venture Catalysts, Kamal Puri , IPV, FAAD Network, LetsVenture, Vrinda Goyal, Haresh Patel, Maneesh Shrivastav

Venture Catalysts

6 Jan 2026

Kayess Square

Enterprise Services

Consulting

B2B

$1.2 Mn

–

–

–

5 Jan 2026

Mylapay

Enterprise Tech

Horizontal SaaS

B2B

$1 Mn

Series A

CDM Capital and Credit Saison,GrowthCap Ventures, Pratekk Agarwaal

–

7 Jan 2026

Be Clinical

Ecommerce

D2C

B2C

$720K

Seed

V3 Ventures, Titan Capital, Kunal Bahl and Rohit Bansal

V3 Ventures

6 Jan 2026

OSSO

Healthtech

Healthcare SaaS

B2C

$443K

Seed

Haldiram Family Office, Sahil Jindal, Aakashdeep Goyal, Parijat Sharma, and Viraj Patel

Haldiram family Office

5 Jan 2026

GOAT LIFE

Ecommerce

D2C

B2C

$200K

–

D2C Insider Super Angels ,Dhruv Kohli , Akash Gupta Vikram Ahuja, Consumer Collective, Rashi Agarwal, Aditya Agrawal, Akhil Kansal, Aayushi Khandelwal, Harsh Patel Venus Dhuria, Karan Kishorepuria

–

6 Jan 2026

Lohia Aerospace Systems

Advanced Hardware & Technology

Aeriel Vehicles

B2B

–

–

Singularity AMC

Singularity AMC

8 Jan 2026

Project Studio AI

Real Estate Tech

Real Estate Services

B2C

–

–

Modulor Capital, We Founder Circle, EvolveX, Thapar Innovate

Modular Capital

Source: Inc42

Note: Only disclosed funding rounds have been included been included

Key Startup Funding Highlights Of The Week

With Even Healthcare bagging the largest cheque of $20 Mn, healthtech sector topped the weekly funding charts. Two startups from the space secured $20.4 Mn during the week.

Ecommerce sector continued to dominate funding deal trends this week, with five D2C startups raising $9.7 Mn.

A large chunk of the capital deployed during the week was concentrated around B2C startups, with these startups lapping up 70% of the overall weekly funds.

Seed staged startups secured $16.8 Mn in fresh capital across six funding deals this week.

Other Developments Of The Week

After filing its RHP on Thursday, Amagi is now set to become the first new-age tech company to go public in 2026. The media SaaS giant has trimmed the fresh issue size by 25% to INR 816 Cr along with trimming the OFS component by 22% to 2.69 Cr shares.

One of the biggest edtech mergers between upGrad and Unacademy has failed to materialise as both parties pulled the plug on discussions after failing to reach a consensus on the valuation.

In what could potentially lead to one of the largest Indian fintech startup IPOs, Razorpay is said to have roped in merchant bankers including Kotak Mahindra and Axis Capital to helm the IPO filing process. The IPO is likely to comprise a fresh issue of shares worth INR 4,500 Cr.

Tamil Nadu CM MK Stalin launched a dedicated startup policy with an outlay of INR 100 Cr to foster deeptech startups in the state.

]]>