Foreign trade in the pre-tariff Trump era

Before analysing what happened in 2025, it is worth reviewing some structural features of US foreign trade. Compared to other advanced economies, the US is a relatively closed economy. On average, during the period 2018-2024, imports of goods accounted for 11.6% of GDP, while exports reached just 7.4%. This pattern has translated into a persistent trade deficit in the balance of goods, which in terms of GDP stood at around 4.2% in 2024 (equivalent to some 1.2 trillion dollars). All of this coexisted with a historically low average applied tariff, of around 2%.

An atypical year for US foreign trade

In real terms, US exports have grown in 2025 at a year-on-year rate of 5% during the first three quarters, a figure comparable to that observed in previous years. This relatively dynamic behaviour can be explained, in part, by the absence – at least for now – of tariff reprisals from the country’s main trading partners. Moreover, the resilience of the global economy and the competitiveness of some export sectors have cushioned the negative impact of trade uncertainty.

The behaviour of imports, on the other hand, has been notably more volatile. The first feature to highlight is the sharp rebound observed in Q1 2025. In year-on-year terms, real imports increased by around 25% from January to March, an exceptional growth rate that was driven by an anticipation effect: consumers, businesses and distributors brought forward purchases in order to stockpile before the new tariffs came into effect.

This increase was followed by a partial correction in Q2. Imports fell by 14% quarter-on-quarter, although they remained at levels similar to those of the previous year, with an annual growth of 0.6%. This pattern suggests that the subsequent adjustment did not fully correct the initial hoarding. In Q3, imports remained stable compared to the previous quarter, but with a 4% year-on-year decline, which could already reflect a more direct impact of tariffs on purchasing decisions. However, due to the significant offsetting effect between quarters, the aggregate balance continues to show an increase in imports. In the cumulative period from January to September, imports grew by 6% compared to the same period in 2024.

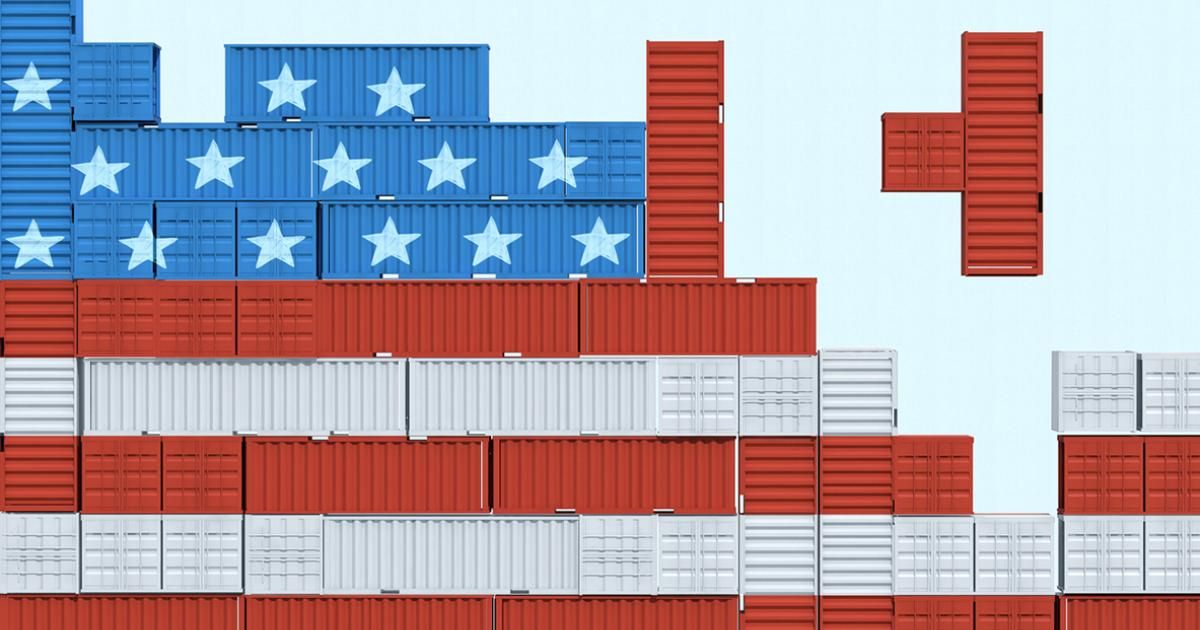

Beyond the aggregate trends, one of the most key developments in 2025 was the change in the geographical pattern of US imports.

US imports are highly concentrated by place of origin. Between 2018 and 2024, the main trading partners – the EU, China, Canada, Mexico, Japan and the United Kingdom – accounted for nearly 70% of total imports on average. China has historically been the US’ main trading partner in terms of imports, although its share has been steadily declining: from 21% of the total in 2018 to 13% in 2024. In 2025, this trend accelerated significantly, with a share that is slightly below 10%.