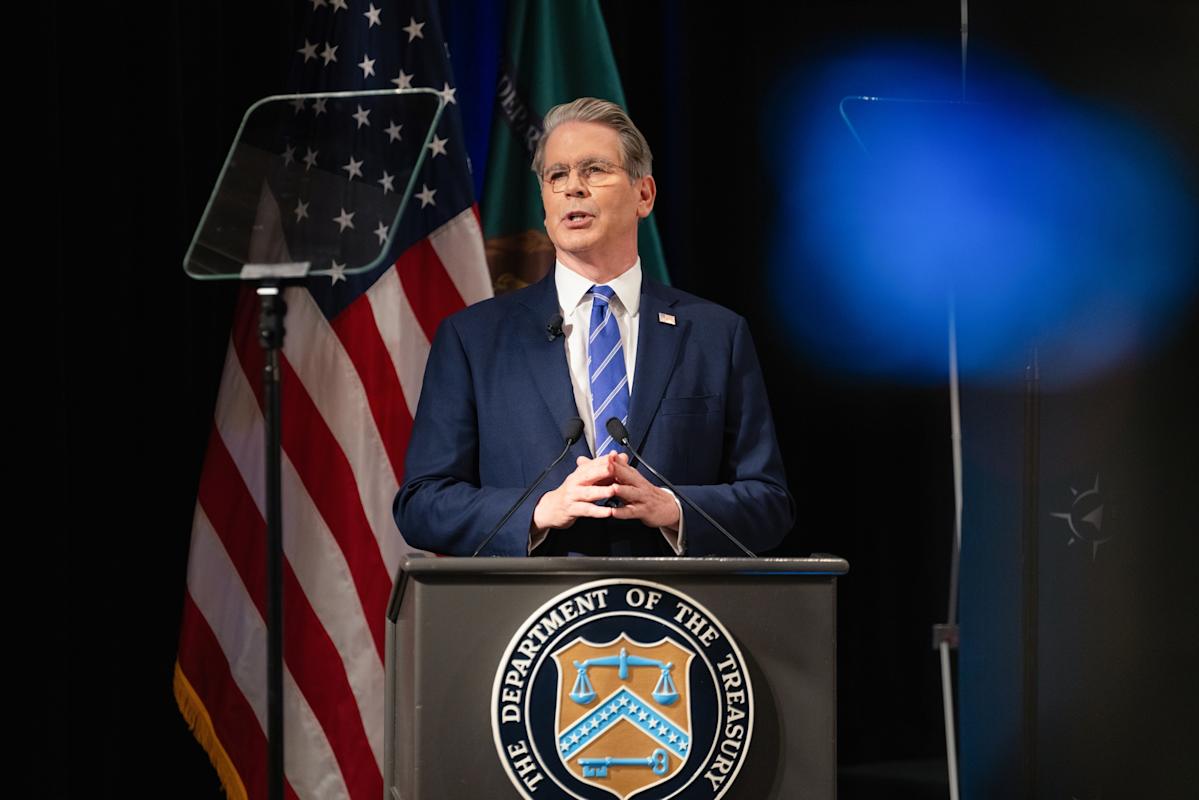

Photographer: Ben Brewer/Bloomberg

(Bloomberg) — Treasury Secretary Scott Bessent said he had spoken with his Japanese counterpart amid a selloff in Japan’s government bonds that he said had fed through to affect the Treasuries market.

“I’ve been in touch with my economic counterpart in Japan, and I am sure that they will begin saying the things that will calm the market down,” Bessent said in a Fox News interview from Davos, Switzerland, where he was attending the annual World Economic Forum.

Most Read from Bloomberg

Tuesday’s trading session in Tokyo saw what dealers said was the most chaotic session in recent memory. Yields on Japan’s 30- and 40-year bonds both jumped by more than 25 basis points, the biggest move since US President Donald Trump’s Liberation Day tariffs rattled global markets last year.

WATCH: For 30 years, Japan’s prices were largely at a standstill. Now a weak yen has changed everything. Here’s how consumers and businesses are coping with rising costs, and what it means for the future.Source: Bloomberg

Ten-year Treasury yields were up about 6 basis points as of 2:24 p.m. in New York, at 4.28%. Earlier in the session, they hit their highest level since August.

Japanese Finance Minister Satsuki Katayama, also attending the meetings in Davos, separately called on market participants to calm down after the intense selloff. Bessent, who had a decades-long career as a hedge fund manager, said the Japanese market saw a “six standard deviation” move over the past two days. The equivalent in the US would see 10-year yields surge 50 basis points, he said.

‘False Narrative’

“It’s very difficult to disaggregate the market reaction from what’s going on endogenously in Japan,” Bessent said. “Japanese rates are up a tremendous amount.”

The Japanese bond slide was underway before news about Greenland, Bessent said — playing down any impact from concerns about Trump’s moves to threaten European nations with tariff hikes over their opposition to his attempt to control the semi-autonomous Danish territory.

Asked earlier about reports on the idea of Europe possibly selling US Treasuries as a potential countermeasure to Trump’s Greenland initiative, Bessent dismissed that speculation as a “false narrative.” He said that “there is no talk in European governments” of such a measure and that media had “latched on” to a Deutsche Bank report.

“It defies any logic and I could not disagree more strongly on that,” Bessent said at a press conference.

European Voices

Deutsche Bank strategist George Saravelos wrote in a weekend note that Europe amounts to being “America’s largest lender,” and that the US reliance on foreign nations for capital is its “key weakness.” Given the high inter-dependence of European and US financial markets, “it is a weaponization of capital rather than trade flows that would by far be the most disruptive to markets,” Saravelos wrote.

For its part, the Danish pension fund AkademikerPension said Tuesday it’s planning to exit US Treasuries by the end of the month. Michael Krautzberger, a senior executive at Germany’s Allianz Global Investors, said fueling market volatility could help put pressure on Trump. But UBS Group AG Chief Executive Officer Sergio Ermotti said it would be a “dangerous bet” for Europeans to attempt to weaponize their holdings of Treasuries.

Bessent likened the uproar over Greenland to the “hysteria” that followed the Liberation Day tariff announcement. In his press conference, he said, “I am confident that the leaders will not escalate, and that this will work out in a manner that ends up in a very good place.”

He then said on Fox Business that his message now is the same as last April: “Sit back, take a deep breath. Do not retaliate. Do not retaliate.”

–With assistance from Vivianne Rodrigues.

Most Read from Bloomberg Businessweek

©2026 Bloomberg L.P.