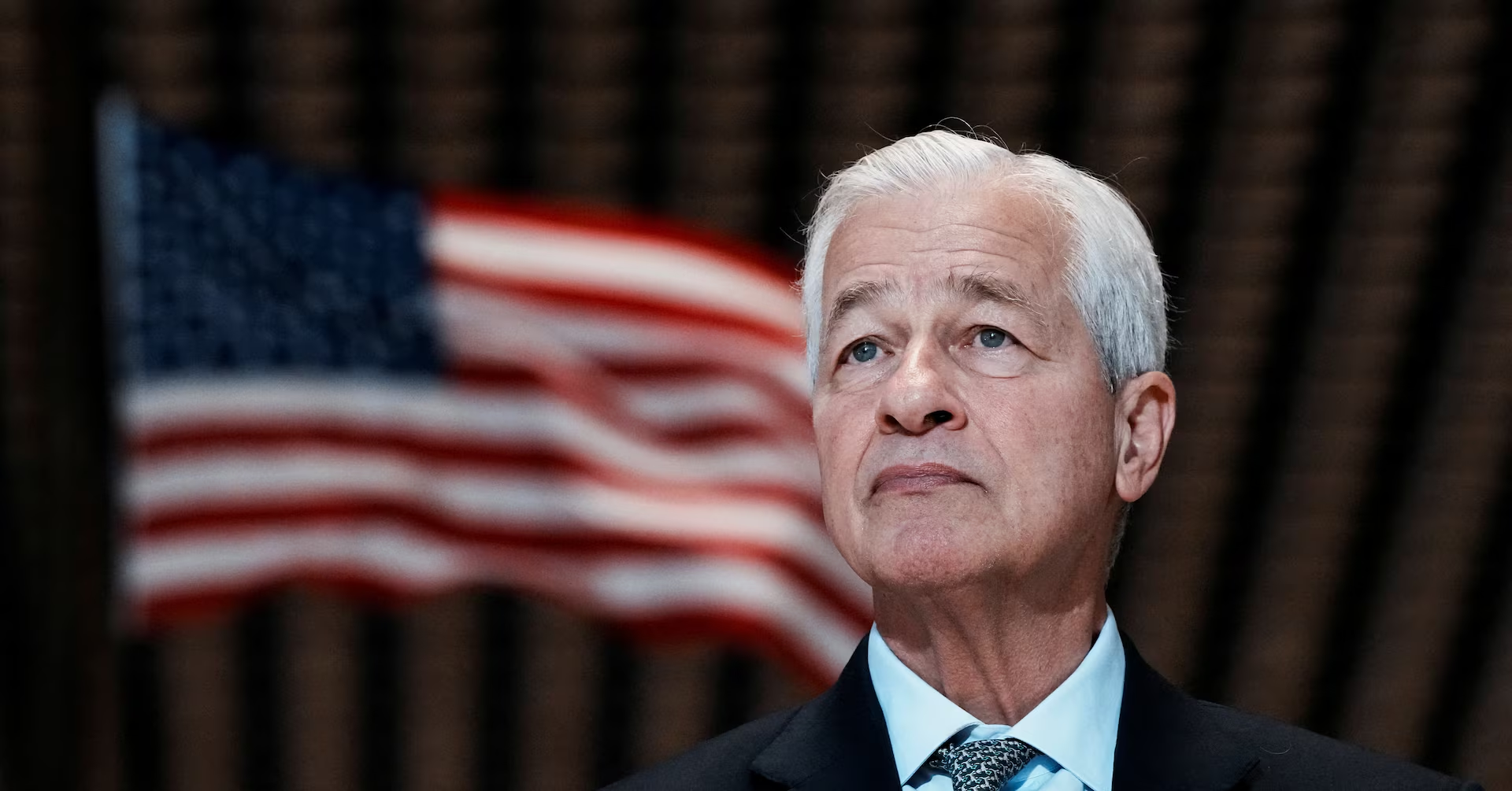

Item 1 of 2 Jamie Dimon, Chairman and Chief Executive Officer of JPMorgan Chase & Co., attends the ribbon-cutting ceremony opening the firm’s new headquarters at 270 Park Avenue, in New York City, U.S., October 21, 2025. REUTERS/Eduardo Munoz

[1/2]Jamie Dimon, Chairman and Chief Executive Officer of JPMorgan Chase & Co., attends the ribbon-cutting ceremony opening the firm’s new headquarters at 270 Park Avenue, in New York City, U.S., October 21, 2025. REUTERS/Eduardo Munoz Purchase Licensing Rights, opens new tabTrump’s lawsuit against JPMorgan highlights political conflict with Wall Street banksBanks face unpredictable policy environment, affecting reputation and advocacy effortsDespite conflicts, industry expects capital relief and regulatory changes to boost profitsNEW YORK/WASHINGTON, Jan 25 (Reuters) – U.S. President Donald Trump’s lawsuit against JPMorgan Chase (JPM.N), opens new tab and its CEO Jamie Dimon highlights a growing, and politically fraught, conflict in the administration’s policy agenda for Wall Street, with big banks scoring wins but also facing setbacks.In his most confrontational move yet against Wall Street, Trump filed a $5 billion lawsuit on Thursday accusing the nation’s largest lender and Dimon of closing several of his and his companies’ accounts on political grounds. Trump has long claimed that Wall Street banks have sought to marginalize him and other conservatives – allegations JPMorgan and other banks deny.

Sign up here.

The move underscores how large financial institutions, expected to be major winners of Trump’s sweeping deregulatory agenda, are increasingly navigating an unpredictable and sometimes hostile policy environment that could damage their reputations, potentially affect their business, and force them to rethink their lobbying strategy in Washington.

“The industry is losing as many battles as it wins on big issues and the constant pressure and random nature of developments is taking its toll,” said Todd Baker, a senior fellow at Columbia University.

The president’s lawsuit follows his threat to cap interest rates on consumer credit cards at 10% – a proposal Dimon warned would be an “economic disaster” – and comes as Trump’s regulators move to make it easier for fintech, crypto firms and some corporations to compete directly with traditional banks.

“The Trump administration is delivering by shoring up financial markets and cutting unnecessary red tape to accelerate growth,” White House spokesman Kush Desai said.

JPMorgan declined to comment. On Thursday, it said “we believe the suit has no merit. We respect the President’s right to sue us and our right to defend ourselves…JPMC does not close accounts for political or religious reasons.”

Trump has also targeted other lenders. The Trump Organization is suing credit card giant Capital One (COF.N), opens new tab, alleging the bank closed its accounts for political reasons.Trump has criticized Bank of America CEO Brian Moynihan over debanking and told CNBC in August that the bank declined to provide Trump with an account. Large banks have consistently said they do not reject customers on political or other belief-based grounds. Trump also last year attacked Goldman Sachs CEO David Solomon for the bank’s bearish stance on tariffs.

Bank of America and Goldman declined to comment. Capital One did not immediately provide comment.

“Banks probably will be more cautious moving forward after seeing this reaction, seeing that they’re no longer just under threat of regulatory retaliation, but also lawsuits,” said Nicholas Anthony, a policy analyst at Washington think tank, the Cato Institute.

ADVOCACY EFFORTS

Wall Street banks have expanded their Washington advocacy operations and hired lobbyists close to the White House. The eight biggest lenders boosted their combined lobbying spending by almost 40% to $12 million in the fourth quarter of 2025, compared with the same period in 2024, according to a Reuters analysis of disclosures. They lobbied Congress, the White House and other federal agencies on issues ranging from credit card swipe fees to crypto legislation.

The Washington-based Financial Services Forum, which represents those banks, also in December launched the American Growth Alliance, a non-profit that it said would spend tens of millions of dollars advocating for “commonsense” policies to grow the economy. The Forum and American Growth Alliance declined to comment.

“The biggest question that remains is what steps will be necessary to navigate an administration that has shown a willingness to intervene aggressively and unpredictably in the sector,” said Myra Thomas, banking analyst at eMarketer.

CAPITAL WIN STILL EXPECTEDTo be sure, Trump administration regulators are set to hand big banks massive capital relief, which by some estimates could free up as much as $200 billion of cash. Lenders have also cheered regulators’ shift to overhaul bank supervision, and their support of big mergers.

When Dimon convened financial CEOs at a conference at JPMorgan’s brand-new New York skyscraper just last month, executives were optimistic that those changes would unleash more profits, according to a person who attended the event.

“There’s just a much more rational approach on focusing on the big, important matters,” Citizens Financial CEO Bruce Van Saun said on Wednesday, referring to supervision. “That’s a refreshing change.”

The industry still expects to lock in capital relief, said another bank CEO who declined to be identified discussing regulatory issues. Those changes continue to make bank stocks attractive, said investors.

“This case is not likely to move that needle much,” said Brian Mulberry, senior client portfolio manager at Zacks Investment Management, which owns JPMorgan shares.

Indeed, bank shares have kept pace with markets under Trump’s presidency.

Bank shares keep pace with equity markets during Trump’s second termJPMorgan shares outpace broader markets under CEO Jamie DimonHowever, the president’s whipsawing financial policies, some of which are also being driven by his need to address voter cost-of-living concerns ahead of this year’s congressional elections, are souring the mood.Banks were blindsided by the credit card proposal, and have since been trying to help shape Trump’s affordability agenda. Some executives are also frustrated that banks are losing ground to fintechs and crypto firms favored by Trump’s inner circle, according to three industry executives.

“I don’t think Trump has a lot of love for the big banks,” said Brian Jacobsen, chief economic strategist at Annex Wealth Management.

Writing and additional reporting by Michelle Price; additional reporting by Pete Schroeder and Tatiana Bautzer; editing by Megan Davies and Diane Craft

Our Standards: The Thomson Reuters Trust Principles., opens new tab