U.S. DNA Synthesis Market Summary

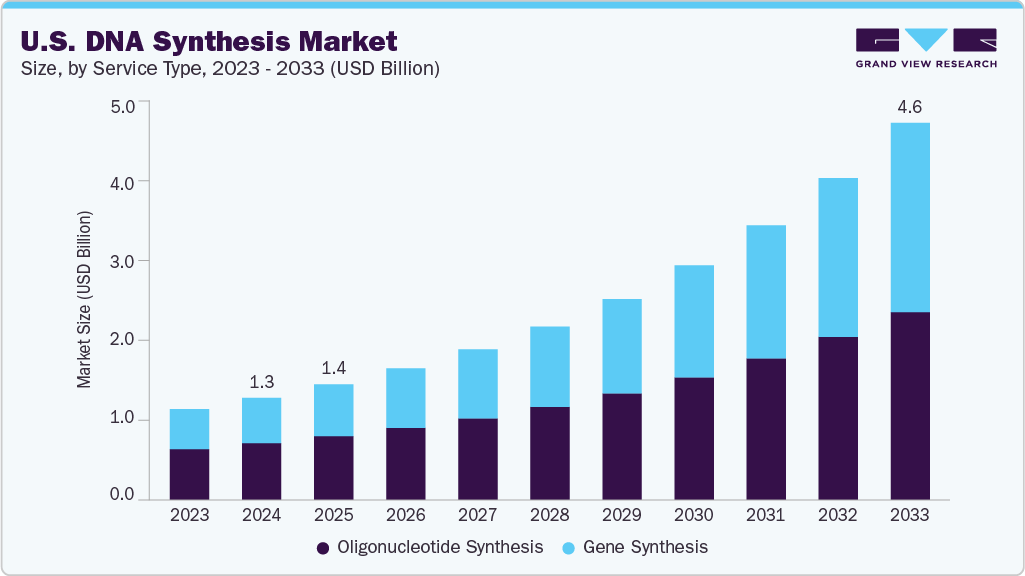

The U.S. DNA synthesis market size was estimated at USD 1.25 billion in 2024 and is projected to reach USD 4.62 billion by 2033, expanding at a CAGR of 15.93% from 2025 to 2033. This high growth is driven by increasing demand in synthetic biology, personalized medicine, and biotechnology research. Advancements in gene editing technologies and declining costs of U.S. DNA synthesis are further accelerating market expansion. The U.S. remains a key player in global genomic innovation, supported by strong investment in R&D and a well-established biotech infrastructure.

Advances in Gene Editing Technologies

Rapid advancement and widespread adoption of gene editing technologies, particularly CRISPR-Cas9. These tools rely heavily on synthetic DNA sequences such as guide RNAs and donor templates to target and modify genetic material precisely. U.S. DNA synthesis enables researchers to design and manufacture these sequences quickly and accurately, which is critical for the success of gene editing experiments. As the demand for high-throughput genome editing increases in academic and commercial research, the need for custom DNA sequences grows in parallel, directly fueling the U.S. DNA synthesis industry.

The applications of CRISPR and other gene editing technologies are rapidly expanding across different fields. The demand for precisely synthesized DNA sequences increases as these technologies gain wider adoption in research and commercial sectors. This need is driven by the requirement for high-quality, custom DNA to ensure accuracy and efficiency in gene editing experiments. As a result, the growing use of gene editing tools directly boosts the U.S. DNA synthesis market.

Rising Demand for Personalized Medicine and Gene Therapies

The growing emphasis on personalized medicine and gene therapies propels the U.S. DNA synthesis market. Customized treatments are tailored to individual genetic profiles, requiring the quick and accurate synthesis of DNA sequences for diagnostics and therapies. This method is vital in developing gene treatments for rare genetic disorders and cancers. Being able to synthesize specific DNA sequences allows for creating personalized therapies that are more effective and cause fewer side effects than traditional options.

Recent advancements highlight this trend. For example, in May 2025, doctors at the Children’s Hospital of Philadelphia and the University of Pennsylvania successfully treated an infant with a severe genetic disorder using customized gene-editing therapy. This groundbreaking procedure involved base editing to fix a genetic mutation, marking an important milestone in gene therapy. Such developments emphasize the vital role of U.S. DNA synthesis in enabling personalized treatments tailored to the unique genetic makeup of each patient.

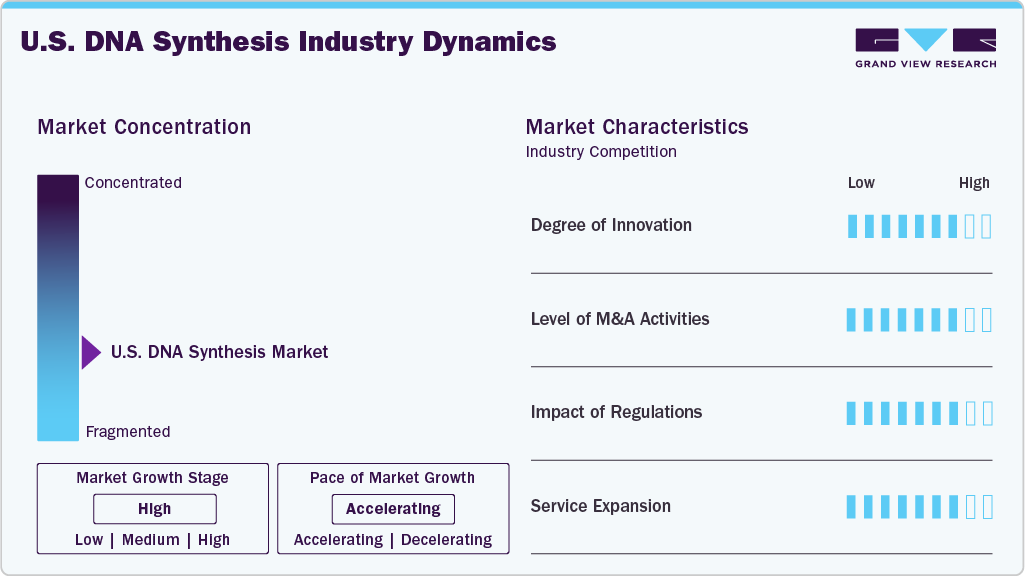

Market Concentration & Characteristics

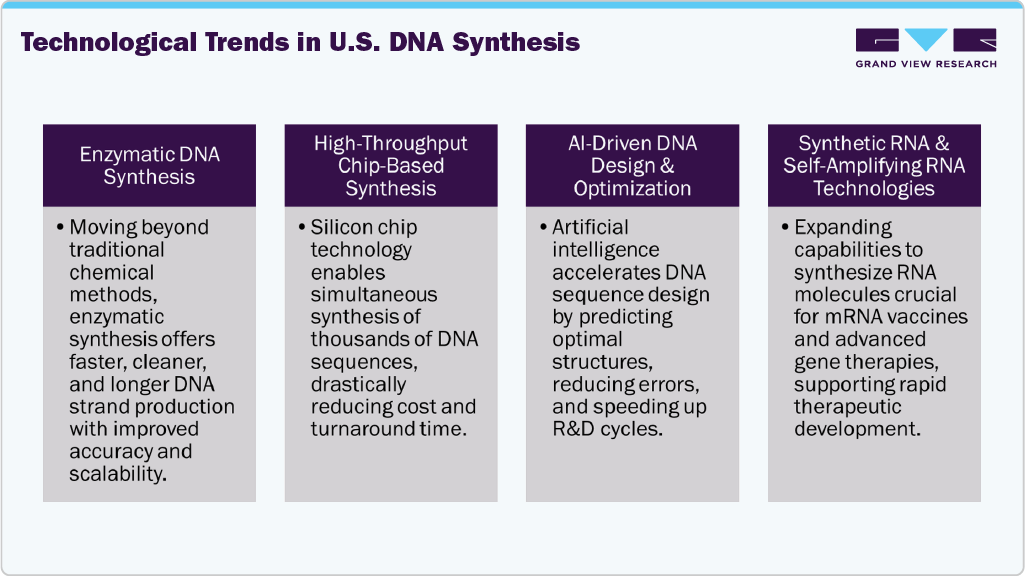

The degree of innovation in the U.S. DNA synthesis market is exceptionally high, driven by continuous technological advancements that improve the speed, accuracy, and cost-effectiveness of synthesizing DNA sequences. Cutting-edge methods such as enzymatic synthesis and automated high-throughput platforms have revolutionized the ability to produce longer, more complex DNA strands with fewer errors. For instance, in May 2025, Ansa Biotechnologies, based in the US, broke synthetic DNA length barriers, revolutionizing life science research and enabling unprecedented advancements in biotechnology and synthetic biology. These technological breakthroughs expand the range of applications and lower barriers to entry, accelerating market growth and adoption across biotechnology, medicine, and synthetic biology sectors.

The U.S. DNA synthesis industry has seen a significant increase in mergers and acquisitions (M&A) activity as companies strive to strengthen their gene editing, synthetic biology, and personalized medicine capabilities. For instance, in February 2025, Maravai LifeSciences, headquartered in San Diego, completed the acquisition of Officinae Bio’s DNA and RNA business. This strategic move integrated Officinae Bio’s AI-driven mRNA design platform with Maravai’s and TriLink BioTechnologies’ manufacturing capabilities, enhancing the development of nucleic acid-based therapies. This wave of consolidation reflects growing investor confidence and a competitive drive to secure cutting-edge U.S. DNA synthesis solutions, which are essential for developing next-generation gene therapies and biotechnological applications.

Regulations play a critical role in shaping the U.S. DNA synthesis market by ensuring the’ ethical use, safety, and security of synthetic DNA technologies. Strict oversight from agencies like the FDA and the Department of Health and Human Services mandates compliance with guidelines related to genetic engineering, biosafety, and dual-use research concerns. While regulatory frameworks may slow the pace of product approvals and add to development costs, they also help build public trust and prevent misuse of synthetic DNA in areas such as biosecurity and gene editing. As regulations evolve to keep pace with rapid technological advances, companies in the U.S. DNA synthesis market must navigate complex compliance requirements, which can influence innovative timelines and market entry strategies.

Service expansion is a key growth driver in the U.S. DNA synthesis industry, with companies continuously broadening their offerings to meet the increasing demand for faster, more customizable, and cost-effective solutions. For instance, in May 2025, Ansa Biotechnologies launched new commercial products in the US, advancing complex U.S. DNA synthesis capabilities and strengthening its position in the synthetic biology and life sciences markets. By enhancing speed, precision, and scalability capabilities, U.S. DNA synthesis providers can better support diverse applications such as gene therapy, synthetic biology, and genomic research. This strategic expansion of services helps address evolving customer needs and fuels overall market growth.

Services Type Insights

The oligonucleotide synthesis segment led the U.S. DNA synthesis industry in 2024, driven by its vital role in research, diagnostics, and therapeutic applications. Oligonucleotides, short DNA or RNA molecules, serve as fundamental building blocks used widely in PCR assays, gene editing, and antisense therapies. For example, in May 2025, Oligo Factory, based in Holliston, Massachusetts, expanded its offerings by launching a low-scale oligo synthesis capability. This new service allows the production of custom DNA and RNA oligonucleotides in quantities as small as 50 nanomoles, meeting early-stage therapeutic, diagnostic, and life science research needs. Additionally, Oligo Factory introduced its rebranded product lines: FactorTx for therapeutics, FactorDx for diagnostics, and FactorLS for life sciences, to better match market demands. Advances in synthesis technologies have improved the speed, accuracy, and affordability of oligonucleotide production, further strengthening its leadership position within the U.S. DNA synthesis market.

The gene synthesis segment is expected to grow at the fastest CAGR of 17.62% during the forecast period. This rapid expansion is driven by increasing demand for full-length gene constructs in areas such as synthetic biology, gene therapy, and recombinant protein production. Advances in gene synthesis technologies, including greater accuracy and scalability, allow researchers and biotech firms to create more complex genetic sequences efficiently. For example, in August 2023, UC San Diego launched the Gene Therapy Initiative in California, supported by a $5 million donation from the Nancy and Geoffrey Stack Foundation. The initiative aims to develop innovative gene-based therapies for rare genetic diseases affecting both children and adults. It emphasizes advancing stem cell and gene therapy research, promoting interdisciplinary collaboration, and turning scientific discoveries into clinical treatments, further strengthening the segment’s robust market growth.

Application Insights

The research and development (R&D) sector led the U.S. DNA synthesis industry in 2024, capturing a significant revenue share of 63.82%. This leadership is fueled by the widespread use of U.S. DNA synthesis technologies across academic institutions, pharmaceutical companies, and biotech firms for basic research, drug discovery, and genetic engineering. Ongoing investments in R&D activities to create new therapies, enhance synthetic biology applications, and advance genomic research keep the high demand for U.S. DNA synthesis products and services strong in this sector. For example, in May 2025, RootPath, based in the U.S., introduced the Megabase Spark program to support underfunded research by providing up to 3 million base pairs of rBlocks synthetic DNA at no cost.

The therapeutics segment is expected to have the fastest compound annual growth rate (CAGR) of 17.13% during the forecast period. This rapid expansion is driven by the increasing use of synthetic DNA in developing gene therapies, mRNA-based treatments, and personalized medicines targeting genetic disorders and cancers. For example, in May 2025, The Scientist noted that U.S.-based companies used cell-free U.S. DNA synthesis to significantly accelerate next-generation mRNA therapeutics, enabling full-length, NGS-verified gene constructs in days and transforming vaccine and gene therapy pipelines. As clinical pipelines more frequently include gene-editing and nucleic acid-based therapies, the demand for high-precision, custom U.S. DNA synthesis continues to grow, making the therapeutics segment a key driver of future market growth.

End Use Insights

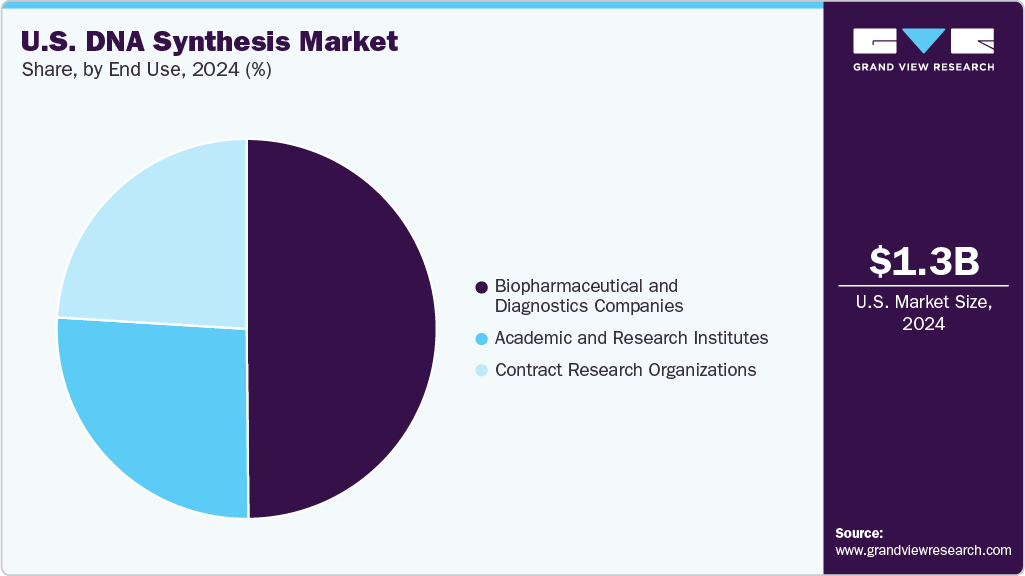

The biopharmaceutical and diagnostics companies segment led the U.S. DNA synthesis industry in 2024, capturing a dominant revenue share of 49.87%. This leadership is driven by the widespread use of synthetic DNA in drug development, molecular diagnostics, vaccine production, and biomarker discovery. These companies depend heavily on high-quality, customized DNA sequences to support research, clinical trials, and commercial product development, especially in gene therapy, oncology, and infectious diseases, solidifying their strong market position.

The contract research organizations (CROs) segment is expected to grow at the fastest CAGR during the forecast period. This growth is fueled by the rising trend of outsourcing research and development activities by biopharmaceutical and biotech companies aiming for cost savings, specialized expertise, and quicker turnaround times. CROs are increasingly utilizing advanced U.S. DNA synthesis technologies to support various services, including gene synthesis, molecular cloning, and preclinical development. They play a crucial role in the expanding fields of synthetic biology and precision medicine.

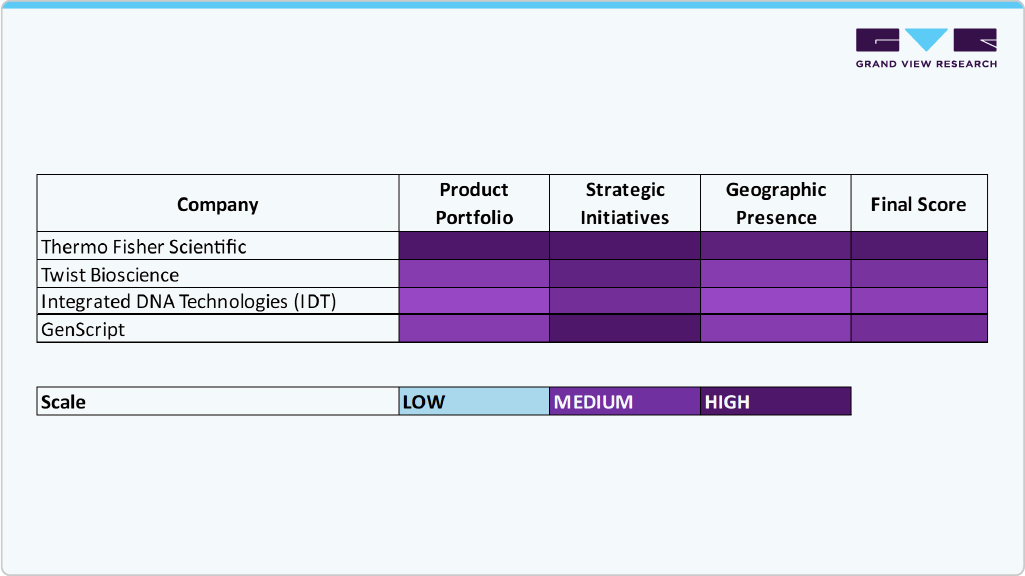

Key U.S. DNA Synthesis Company Insights

The U.S. DNA synthesis industry is led by several established companies that have secured strong market positions through comprehensive service portfolios, advanced synthesis technologies, and ongoing investments in research and development. Key players such as Thermo Fisher Scientific, Twist Bioscience, Integrated DNA Technologies (IDT), GenScript, BIONEER Corporation, Eton Bioscience, LGC Biosearch Technologies, IBA Lifesciences GmbH, Eurofins Scientific, and Quintara Biosciences continue to drive market growth by providing high-quality synthetic DNA products and customized solutions that cater to a wide range of applications in synthetic biology, gene editing, diagnostics, and therapeutics.

These organizations maintain competitive advantages by leveraging cutting-edge synthesis platforms, including chip-based and enzymatic U.S. DNA synthesis technologies, which allow for rapid, scalable, and precise production of DNA sequences. Strategic collaborations and partnerships with pharmaceutical companies, biotechnology startups, and academic institutions strengthen their market presence and facilitate innovation. For instance, companies like Thermo Fisher Scientific and Twist Bioscience are at the forefront of developing high-throughput U.S. DNA synthesis solutions, meeting the growing demand for gene therapy development and synthetic biology research.

GenScript, Quintara Biosciences, and Integrated DNA Technologies are also expanding their capabilities through investments in next-generation synthesis platforms and contract research services, enabling end-to-end solutions from gene design to manufacturing. Emerging players like BIONEER Corporation and Eton Bioscience focus on niche markets and specialized custom DNA products, contributing to the market’s diversity and technological advancement.

The U.S. DNA synthesis market is marked by a dynamic convergence of well-established expertise and innovative newcomers, intensified by active mergers and acquisitions, strategic alliances, and breakthrough product launches. As precision medicine, gene editing, and synthetic biology applications expand, companies that combine technological excellence with scalable, ethical, and cost-effective solutions are poised to lead the market’s evolution. Emphasis on quality, speed, data security, and regulatory compliance will remain critical in sustaining long-term growth and maintaining customer trust in this rapidly advancing industry.

Key U.S. DNA Synthesis Companies:

Thermo Fisher Scientific, Inc

Twist Bioscience

BIONEER CORPORATION

Eton Bioscience, Inc.

LGC Biosearch Technologies

IBA Lifesciences GmbH

Eurofins Scientific

Integrated DNA Technologies, Inc.

Quintara Biosciences

GenScript

Recent Developments

In May 2025, Twist Bioscience and Ginkgo Bioworks (U.S.) revised their collaboration, a three-year, USD 15 million agreement granted Twist long. DNA synthesis IP while Ginkgo retained product supply with flexible ordering.

In May 2025, U.S.-based Twist Bioscience spun out its DNA data storage division into an independent company, positioning the new entity to focus exclusively on scalable information storage solutions in DNA.

In May 2024, US-based GenScript Biotech launched a self‑amplifying RNA synthesis service in North America, delivering scalable, high‑quality saRNA tailored for advanced therapeutic development and research applications.

In April 2022, U.S.-based GenScript debuted the industry’s highest-throughput semiconductor U.S. DNA synthesis platform, enabling massively parallel oligonucleotide production over 5.7 billion per run for commercial DNA data storage.

In November 2021, GenScript launched a state-of-the-art, 50,000 ft² automated gene synthesis center in Piscataway, New Jersey, USA, boosting capacity tenfold to support U.S.-based biopharma and synthetic biology customers.

U.S. DNA Synthesis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.41 billion

Revenue forecast in 2033

USD 4.62 billion

Growth rate

CAGR of 15.93% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, application, end use

Key companies profiled

Thermo Fisher Scientific, Inc; Twist Bioscience; BIONEER CORPORATION; Eton Bioscience, Inc.; LGC Biosearch Technologies; IBA Lifesciences GmbH; Eurofins Scientific; Integrated DNA Technologies, Inc.; Quintara Biosciences; GenScript

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. DNA Synthesis Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the U.S. DNA synthesis market on the basis of service type, application, and end use.

Service Type Outlook (Revenue, USD Million, 2021 – 2033)

Application Outlook (Revenue, USD Million, 2021 – 2033)

Research and Development

Diagnostics

Therapeutics

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Biopharmaceutical and Diagnostics Companies

Academic and Research Institutes

Contract Research Organizations

Frequently Asked Questions About This Report

b. The U.S. DNA synthesis market size was estimated at USD 1.25 billion in 2024 and is expected to reach USD 1.41 billion in 2025.

b. The U.S. DNA synthesis market is expected to grow at a compound annual growth rate of 15.93% from 2025 to 2033 to reach USD 4.62 billion by 2033.

b. Research and development segment dominated the U.S. DNA synthesis market with a share of 63.82% in 2024. This is attributable to rising healthcare awareness coupled with increasing research and development initiatives.

b. Some key players operating in the U.S. DNA synthesis market include Thermo Fisher Scientific, Inc; Twist Bioscience;BIONEER CORPORATION; Eton Bioscience, Inc.; LGC Biosearch Technologies; IBA Lifesciences GmbH; Eurofins Scientific; Integrated DNA Technologies, Inc.; Quintara Biosciences; GenScript

b. Key factors that are driving the market growth include increasing demand in the U.S., which is soaring due to biotech R&D, gene therapy, synthetic biology, automated platforms, regulatory support, and expanding CDMO partnerships