Tesla appears to be slowing down while Micron and Taiwan Semiconductor are ramping up.

Tesla (TSLA +1.73%) has been a massively successful stock for many shareholders, with returns of 3,500% over the past 10 years. But Tesla is in the middle of a major transition right now as it shifts away from being a strictly electric vehicle (EV) company toward robotics and autonomous vehicles (AVs).

But riding out Tesla’s shift could be risky for shareholders. Meanwhile, artificial intelligence (AI) stocks, including Micron Technology (MU 2.62%) and Taiwan Semiconductor (TSM +1.91%), are benefiting from a surge in demand for AI infrastructure. Here’s why I think it’s better to pass on Tesla stock right now and opt for Micron and Taiwan Semiconductor.

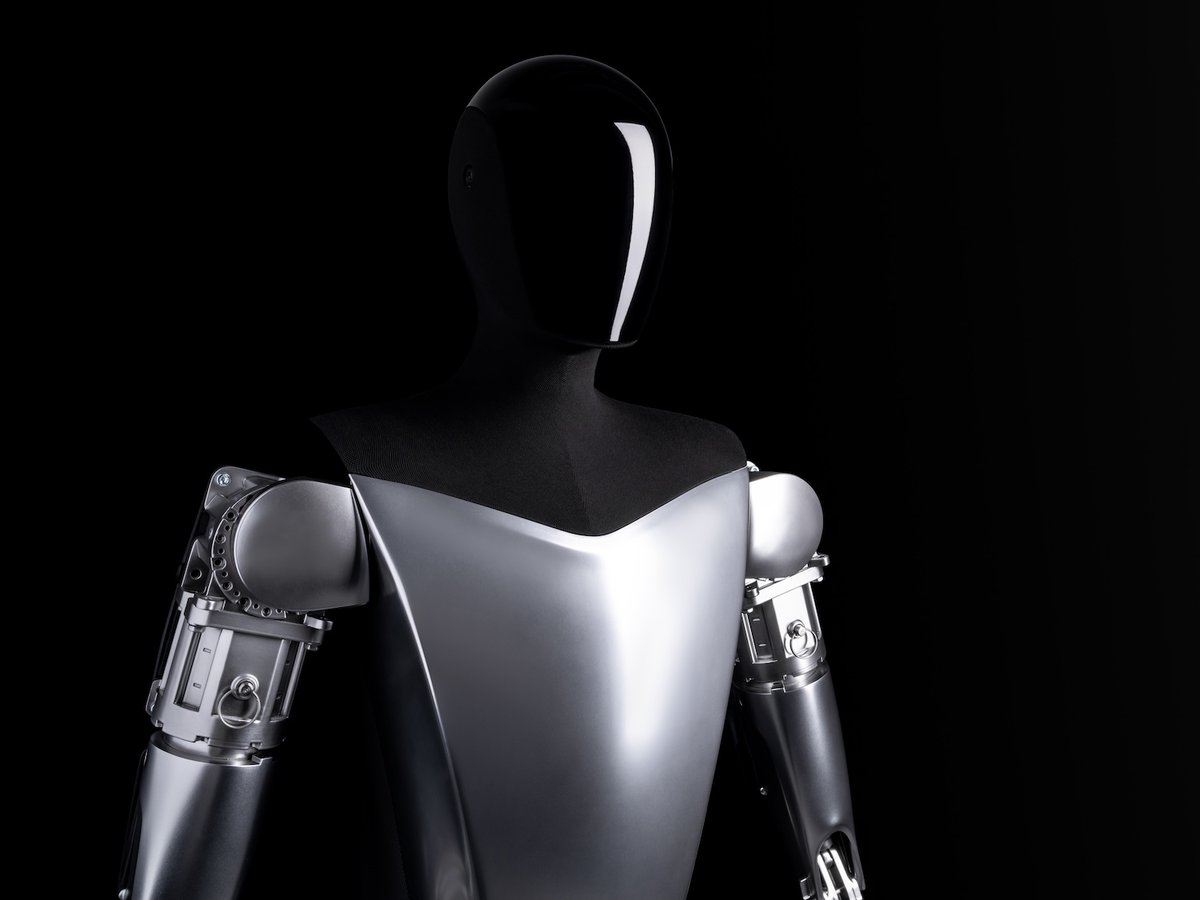

Image source: Tesla.

Why you should consider leaving Tesla stock alone right now

The argument for buying Tesla is that AVs could be worth $1.4 trillion by 2040, and humanoid robotics will be worth an estimated $5 trillion by 2050. Tesla is already working toward its goals in these markets, with limited self-driving robotaxis in a handful of cities and the company saying that production of its Optimus robots will start this year, aiming to eventually produce 1 million annually at its Fremont facility.

But the problem for Tesla right now is that its core EV business is slowing significantly while its costs are rising to fund its new endeavors. Sales declined in the fourth quarter, and annual revenue fell for the first time, coming in at $94.8 billion. Operating expenses also rose 39% in the quarter to $3.6 billion, and the company’s net income fell 60% to $0.24 per share.

Tesla will need to continue spending significant money — it expects capital expenditures to be at least $20 billion this year — to make the leap from EVs to robots and AVs. And on top of all of these hurdles, Tesla’s shares have a trailing price-to-earnings (P/E) ratio of 390, compared to the tech sector average P/E ratio of 42, making the company’s stock very expensive during this time of transition.

Why Micron and Taiwan Semiconductor are better buys

It’s a bit cliché to talk up AI stocks right now, but two with lots of long-term potential are Micron and Taiwan Semiconductor Manufacturing Co. (TSMC), both leaders in their respective markets. TSMC holds an estimated 70% of all processor manufacturing and makes the most advanced AI chips, while Micron sells in-demand memory chips used in AI data centers. Executive Vice President of Operations Manish Bhatia recently said, that “the shortage we are seeing is really unprecedented.”

Today’s Change

(-2.62%) $-10.35

Current Price

$384.34

Key Data Points

Market Cap

$444B

Day’s Range

$370.72 – $389.70

52wk Range

$61.54 – $455.50

Volume

676K

Avg Vol

32M

Gross Margin

45.53%

Dividend Yield

0.12%

Both companies are also experiencing strong sales and earnings growth. Micron’s revenue rose 56% in its fiscal first quarter (which ended Nov. 27) to $13.6 billion, and adjusted earnings per share rose 167% to $4.78. TSMC reported first-quarter (ended Dec. 31) sales up nearly 26% to $33.7 billion, and diluted earnings increased 35% to $3.14 per American depositary receipt (ADR).

More growth could be on the way for both of these AI stocks, too, as spending for AI data centers continues. Nvidia’s management estimates that AI infrastructure spending will reach between $3 trillion and $4 trillion by 2030.

And finally, Micron and TSMC are much cheaper than Tesla. Micron’s P/E ratio is just 39, and TSMC’s is about 33, making them relative bargains compared to both Tesla and the broader tech sector.

Chris Neiger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Micron Technology, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has a disclosure policy.