3h agoThu 31 Jul 2025 at 12:54amMarket snapshotASX 200: -0.5% to 8,717 points (live values below)Australian dollar: +0.1% to 64.41 US centsS&P 500: -0.1% to 6,362 pointsNasdaq: +0.1% to 21,129 pointsFTSE: flat at 9,136 pointsEuroStoxx 600: flat at 550 pointsSpot gold: +0.3% to $US3,286/ounceBrent crude: +0.4% to $US73.51/barrelIron ore: +0.1% to $US99.25/tonneBitcoin: +1% to $US118,337

Prices current around 10:50am AEST

Live updates on the major ASX indices:

44m agoThu 31 Jul 2025 at 3:21am

Iron ore prices fall as China demand fears continue

The market price of one of Australia’s biggest exports is falling, as fears of falling demand in China continue.

This in from Reuters:

Iron ore futures prices declined for a second straight session on Thursday, as weaker-than-expected July factory activity data in top consumer China raised demand concerns.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange (DCE) DCIOcv1 traded 1.44% lower at 786.5 yuan a metric ton, as of 0230 GMT.

The benchmark September iron ore SZZFU5 on the Singapore Exchange was 0.75% lower at $100.95 a ton, as of 0220 GMT.

China’s manufacturing activity shrank for a fourth straight month in July, an official survey showed Thursday, suggesting a surge in exports ahead of higher U.S. tariffs has started to fade while domestic demand remained sluggish.

Prices of the key steelmaking ingredient softened on Wednesday after hopes faded that Beijing would unveil more stimulus measures at its July Politburo meeting that set the economic course for the remainder of the year.

48m agoThu 31 Jul 2025 at 3:17am

Student debts to be slashed as HECS bill passes Senate

Australians with student debts will have their HECS cut by 20 per cent after the government’s bill passed the Senate.

Education Minister Jason Clare said the bill, which passed with support from the Greens and some crossbenchers, is now guaranteed and will be backdated to June 1.

It will provide relief to those with outstanding HECS debts, who make compulsory repayments out of their income above a threshold.

Open the ABC News politics blog in a new tab to follow the latest:

1h agoThu 31 Jul 2025 at 2:50am

ASX slightly down in lunchtime trade

The ASX 200 is down almost 0.2% at lunchtime. The bottom stocks include oil and gas producers, like Beach Energy.

Any stock movements you’d like investigated today?

1h agoThu 31 Jul 2025 at 2:49am

Victims of fraud and DV being chased by ATO

This powerful story from our reporter Nassim Khadem today calls into question the powers and procedures of the tax office when chasing up business debts.

Do you have a tip-off for Nassim about this? You can email her on khadem.nassim@abc.net.au

1h agoThu 31 Jul 2025 at 2:27am

Australians seeking out bargains as cost pressures continue

So, a lot of bleating about how tough people are doing it and how interest rates MUST be lowered and yet a huge increase in retail spending. It would seem the RBA’s approach is (heaven forbid) based on data and not emotion, just as it should be.

– Bemused

Thanks for your comments!

It is worth noting these latest retail figures aren’t exactly booming, and the ABS notes they were pushed up by sales and end-of-financial-year incentives.

Australians do love an EOFY sale!

KPMG’s chief economist, Brendan Rynne, noted this effect, including purchases of winter clothing, as well as the release of new products, including a Nintendo Switch 2.

“As cost-of-living pressures continue, households are very much vying for bargains wherever they can, with sale items now consuming a far larger portion of our spending compared to just a few years ago,” Dr Rynne said in a note.

More from Steph’s reporting on this:

The 1.2 per cent rise in retail turnover in June follows a half per cent rise in May, and no change in April, according to the ABS.

Spending at the end of the financial year saw shoppers opening their wallets.

“The strong June month rise in retail turnover was driven by discounts linked to sales and new product releases,” ABS head of business statistics Robert Ewing said.

“After steady growth throughout the year, mid-year sales events increased spending on discretionary items like furniture, electrical goods and clothing items.”

So will this stop the RBA cutting in August? This note from Capital Economics doesn’t think so.

The solid pickup in retail sales in June doesn’t detract from the fact that goods spending across Q2 was rather lacklustre. That being the case, the data won’t stand in the way of the RBA cutting rates by 25bp at its meeting in two weeks’ time.

1h agoThu 31 Jul 2025 at 2:15amEggs to coffee: Why food inflation is still a problem

Yesterday I went down to a fresh produce market in Melbourne to chat to people about the latest quarterly inflation figures, which show price spikes are easing further.

Unsurprisingly, nobody seemed to be cheering at the checkout. Seems we all notice prices when they explode, but it’s a lot harder to notice easing inflation.

Lots of punters also noted ongoing spikes on some items. “Butter has been wild,” one keen cake baker noted to me.

It is worth noting that food inflation is still elevated, at 3% compared to 2.1% overall. And as Rabobank analyst notes, overall food inflation is still above the 10-year average.

Some of the items where spikes are continuing include eggs (+19.1%), coffee (+9.4%) and fresh lamb (+12.1%). These spikes are linked to environmental factors, including global drought and bird flu.

Cooking oils, cereal products and seafood are the only three categories posting price declines, Rabobank analysed.

As for butter? Rabobank notes that global butter prices are hovering near record levels, and that Australia is exposed because we are a net importer.

This doesn’t just have ramifications for household budgets and home bakers. It also flows through to the hospitality industry, which has been battling especially tough times.

As one cafe and restaurant owner told me, they’ve been reluctant to pass on higher costs like those coffee prices, because they’re worried about spooking price sensitive diners.

“The feeling right throughout hospitality is this tension between needing to keep the lights on, but also not wanting to alienate customers who are price sensitive right now,” Tresna Lee from Gemini told me.

two people in a bar (ABC News)

two people in a bar (ABC News)

The silver lining? Even the most hawkish of economists think that the overall lower inflation should prompt the RBA to cut rates in August again.

“The great hope is that lower interest rates will start to see consumer spending pick up,” economist David Bassanese says.

“Consumer spending has been constrained now for a few years, it’s certainly hurting many sectors — hospitality and retail sectors in particular.”

2h agoThu 31 Jul 2025 at 2:03am

New apartments keeping the housing industry afloat

The latest housing approvals show there’s been another dip in the demand for building for new houses, with approvals down 2% in June. Victoria was the only state where they went up.

But overall, total dwelling approvals are up, at their highest level since August 2022. And it’s because of apartments.

“It was a bumper month for private attached dwellings, up 33% to 7,594,” Timothy Hibbert from Oxford Economics Australia, just wrote in a note.

That follows a 10.3% rise in May.

“A surge in Sydney apartment approvals backed this result,” Mr Hibbert continues.

“Our project tracking suggests density bonuses for developments providing affordable stock in the state are impacting as intended in drawing out apartment developments. Queensland posted a less spectacular, but still very solid uplift.”

Some analysts have been noting in recent months that apartments are simply cheaper to build, especially during higher rates and with the property market so much more expensive to crack than several years ago.

ABS analyst Daniel Rossi also notes this today about the latest approval data:

“The average approval value for new private sector houses has continued to rise year-on-year, but has slowed during the 2024-25 financial year.

“The slowing average approval values for new houses is consistent with moderating building costs, as reflected in Producer Price Indexes.”

So what could happen next?

“With both employment and inflation indicators softening, we expect to see a rate cut in August, followed by another in Q4,” Mr Hibbert continues.

“Lower mortgage rates are already showing through in forward leads for new dwelling demand. Combined with other policy supports including increased funding in the social & affordable housing space, growth is geared to continue in financial year 2026.”

2h agoThu 31 Jul 2025 at 1:52am

Last retail trade data to be published by ABS

For all the loyalists of the retail trade dataset out there, it is with a heavy heart that I remind you that today is its final publication.

Here’s more from the ABS release:

Australian statistician David Gruen AO said: “Today’s final publication comes 74 years after Sir Roland Wilson, Chief Statistician at the time, released the results of the first Retail Trade survey in 1951.

“Sir Roland noted that total Australian retail sales in the September quarter of 1950 amounted to £383.2 million — around $20.5 billion in today’s dollars.”

Boans department store in Perth, 1950 (Supplied: State Library of WA)

Boans department store in Perth, 1950 (Supplied: State Library of WA) Sir Roland Wilson in 1965 (ANU Sir Roland Wilson Foundation)

Sir Roland Wilson in 1965 (ANU Sir Roland Wilson Foundation)

“The ABS would like to thank the many businesses that have contributed over the 74 years of the Retail Business Survey,” Dr Gruen continued.

“After today’s publication, monthly statistics on household spending will be available in the ABS’ Monthly Household Spending Indicator (MHSI), providing a more comprehensive view of consumption, across both goods and services.”

2h agoThu 31 Jul 2025 at 1:43amMid-year discounts see shoppers return: ABS

The 1.2 per cent rise in retail turnover in June follows a half per cent rise in May, and no change in April, according to the ABS.

Spending at the end of the financial year saw shoppers opening their wallets.

“The strong June month rise in retail turnover was driven by discounts linked to sales and new product releases,” ABS head of business statistics Robert Ewing said.

“After steady growth throughout the year, mid-year sales events increased spending on discretionary items like furniture, electrical goods and clothing items.”

He said consumers are targeting sales events with a focus on value for big-ticket items like household furniture, bedding, electronic devices and TVs.

“Turnover for electrical and gaming retailers was lifted further by the much-anticipated launch of the Nintendo Switch 2, which delivered record sales.”

2h agoThu 31 Jul 2025 at 1:33amRetail sales rise more than expected

The Bureau of Statistics has released retail sales data, and it’s come in stronger than expected.

Australian retail turnover rose 1.2 per cent in June, according to seasonally adjusted figures, compared to expectations for an 0.4 per cent increase, according to economists polled by Reuters.

2h agoThu 31 Jul 2025 at 1:30am

Key takeaways from RBA deputy governor Andrew Hauser’s ‘fireside chat’ — analysis

So, I’ve got back to the office now after attending the RBA deputy governor’s “fireside chat”.

Having had a couple of hours to digest what Andrew Hauser had to say, here are my thoughts on the key takeaways:

Inflation is tracking in line with RBA forecasts. RBA forecasts from May suggested inflation would be around the middle of the target, with the cash rate at 3.2% by early next year. That suggests to me that the RBA can cut the cash rate at least twice, and perhaps three times more.Unemployment isn’t high at 4.3%. The RBA is relaxed with where the jobs market is, so unless we see unemployment heading above 4.5%, I don’t think it’s going to see the bank accelerate rate cuts.We will (at least officially) remain in the dark about how individual RBA Monetary Policy Board members voted on rates, even though they will be giving their own speeches at least once a year. However, we may get hints about who is more “dovish” and “hawkish”. The RBA deputy, who came from the Bank of England, which does publish how members voted, thinks that system creates more problems than benefits.There is still scope for major surprises in the global economy, depending on where US tariffs end up and the response from other nations.

In summary, as I wrote in the headline of this article from May, interest rates could drop below 3%, but you probably don’t want them to.

I’m pretty sure Hauser, the RBA staff, and probably most board members would still broadly agree with that analysis.

3h agoThu 31 Jul 2025 at 12:49am

Flight Centre downgrade disappoints

Analysts and investors have taken a negative view on Flight Centre’s latest update, which saw it lower its profit guidance.

“While current softness in the travel market is well known to investors, we believe another FY25 downgrade, one month after balance date, will negatively surprise the market,” RBC Capital Markets analyst Wei-Weng Chen noted.

And they were proven correct, with the stock off 7.9 per cent at the moment.

Mr Chen said the downgrade puts the middle of Flight Centre’s most recent guidance 25 per cent below its original guidance provided last November. And certainly a lot has changed in that time for global relations and the fallout for travel.

3h agoThu 31 Jul 2025 at 12:43am

Beach Energy falls on $674 million impairment hit

Beach Energy is the worst-performing stock on the benchmark index so far, down 9.9 per cent.

The company released its quarterly production report, with full-year production up 9 per cent and sales revenue up 13 per cent.

Underlying earnings and profit were also higher.

However, Beach flagged a non-cash impairment charge of $674 million that will be recorded in its results for the last financial year, “related predominantly to lower commodity price outlook”.

Its results will be released this coming Monday, August 4.

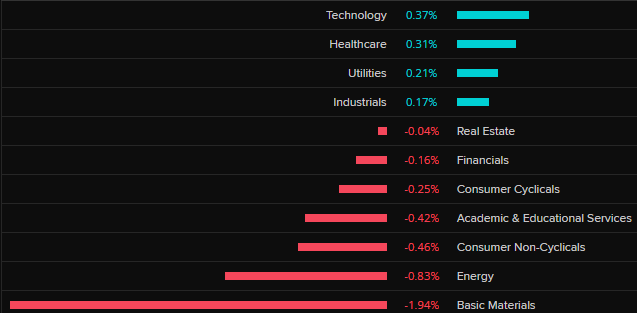

3h agoThu 31 Jul 2025 at 12:24amAustralian shares open lower as tariff deadline looms

Most sectors on the local market remain in the red 20 minutes into the session, while the ASX 200 is currently down half a per cent overall.

ASX 200 sectors (LSEG Refinitiv)

ASX 200 sectors (LSEG Refinitiv)

Flight Centre shares are down 7.2 per cent after it lowered its profit guidance.

Miners are also a major drag, led by a 7.8 per cent fall for Mineral Resources. Beach Energy shares are off 10.9 per cent, weighing on the energy sector.

3h agoThu 31 Jul 2025 at 12:06amASX opening in the red

It’s very early days as stocks are just coming online, but we currently have the ASX 200 down 0.6 per cent.

4h agoThu 31 Jul 2025 at 12:03am

The balancing act of individual RBA board members speaking

Andrew Hauser’s answer to my question about RBA board members giving speeches — something that was a recommendation of the RBA review — is quite revealing of the tensions involved.

There’s no point in the board members speaking individually if they, as Andrew Hauser put it, simply “parrot” the views of the board as a whole, as already expressed by RBA staff like himself and the governor, Michele Bullock.

Equally, he said board members won’t be able to say how they or other board members voted on contested monetary policy decisions.

A tricky balance.

4h agoWed 30 Jul 2025 at 11:59pm

RBA still working out how board member engagement will look

Our business editor, Michael Janda, is up with a question and asks whether RBA board members will be able to speak freely on their views or whether their comments will be vetted by the central bank, when an upcoming review recommendation to hear from board members is more broadly implemented.

“We’re still working that out, I’ll be totally honest with you,” Andrew Hauser says.

He says the public engagement strategy won’t just be about speeches, mentioning other mediums like podcasts.

“It’s also about listening,” he notes, saying board members will go to events and hear from the businesses and other community members.

4h agoWed 30 Jul 2025 at 11:56pm

What would RBA like to see from productivity roundtable?

Wavestone Capital portfolio manager Catherine Allfrey asks what the RBA would like to see from the upcoming productivity roundtable.

Andrew Hauser says it’s not for the RBA to weigh in on.

“We take the economy as it is and deliver our mandate,” Mr Hauser says.

“They are political choices … any central bank that plays in that space risks their credibility.”

4h agoWed 30 Jul 2025 at 11:50pm

How does the RBA define full employment?

Even though unemployment recently jumped from 4.1 to 4.3%, RBA deputy governor Andrew Hauser says the Australian economy remains near “full employment”.

Orthodox economists define “full employment” as the level of unemployment compatible with inflation remaining within the central bank’s target range, in Australia, 2-3%.

Many economists have suggested that, for whatever reason, the unemployment rate compatible with “full employment” — the NAIRU, or non-accelerating inflation rate of unemployment — has fallen, perhaps to 4 per cent or less.

It seems Hauser is sticking with the RBA’s previous estimates that full employment is somewhere around 4.25-4.5%.

ASX 200: -0.5% to 8,717 points (live values below)Australian dollar: +0.1% to 64.41 US centsS&P 500: -0.1% to 6,362 pointsNasdaq: +0.1% to 21,129 pointsFTSE: flat at 9,136 pointsEuroStoxx 600: flat at 550 pointsSpot gold: +0.3% to $US3,286/ounceBrent crude: +0.4% to $US73.51/barrelIron ore: +0.1% to $US99.25/tonneBitcoin: +1% to $US118,337

ASX 200: -0.5% to 8,717 points (live values below)Australian dollar: +0.1% to 64.41 US centsS&P 500: -0.1% to 6,362 pointsNasdaq: +0.1% to 21,129 pointsFTSE: flat at 9,136 pointsEuroStoxx 600: flat at 550 pointsSpot gold: +0.3% to $US3,286/ounceBrent crude: +0.4% to $US73.51/barrelIron ore: +0.1% to $US99.25/tonneBitcoin: +1% to $US118,337