JPMorgan recently shifted its rating on IREN from “Overweight” to “Neutral,” citing uncertainty about the timing of a potential high-performance computing deal as a key reason. Despite some caution, analysts pointed to long-term growth prospects tied to IREN’s ability to participate in emerging digital infrastructure trends. Now, we’ll consider how analyst attention on potential high-performance computing growth could shape IREN’s forward-looking investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

IREN Investment Narrative Recap

For anyone considering IREN as a long-term holding, the key belief centers on its transition from cryptocurrency mining to a broader role in digital infrastructure and AI-driven data center services. JPMorgan’s recent downgrade, tied to uncertainty around a major high-performance computing contract, does not appear to materially shift the short-term catalyst: successfully converting infrastructure and capital allocation into revenue from AI and cloud opportunities. The biggest risk remains IREN’s ongoing reliance on volatile mining revenues until this pivot fully materializes.

Most recently, the company’s move to appoint J.P. Morgan Securities and Citigroup as co-lead underwriters for a US$500 million fixed-income offering stands out. This aligns with the near-term need to secure funding for large-scale infrastructure projects like Sweetwater and Childress, which are core to realizing AI and high-performance computing ambitions highlighted in current analyst attention. This financing news is directly relevant to both the company’s biggest risk and catalyst, underlining that execution and funding go hand in hand for IREN’s future.

However, even with fresh analyst attention on new business lines, investors should be mindful that the company’s heavy dependence on volatile mining revenues could still…

Read the full narrative on IREN (it’s free!)

IREN’s outlook anticipates $1.4 billion in revenue and $547.2 million in earnings by 2028. This scenario requires annual revenue growth of 55.2% and an earnings increase of $582.9 million from the current level of -$35.7 million.

Uncover how IREN’s forecasts yield a $22.00 fair value, a 33% upside to its current price.

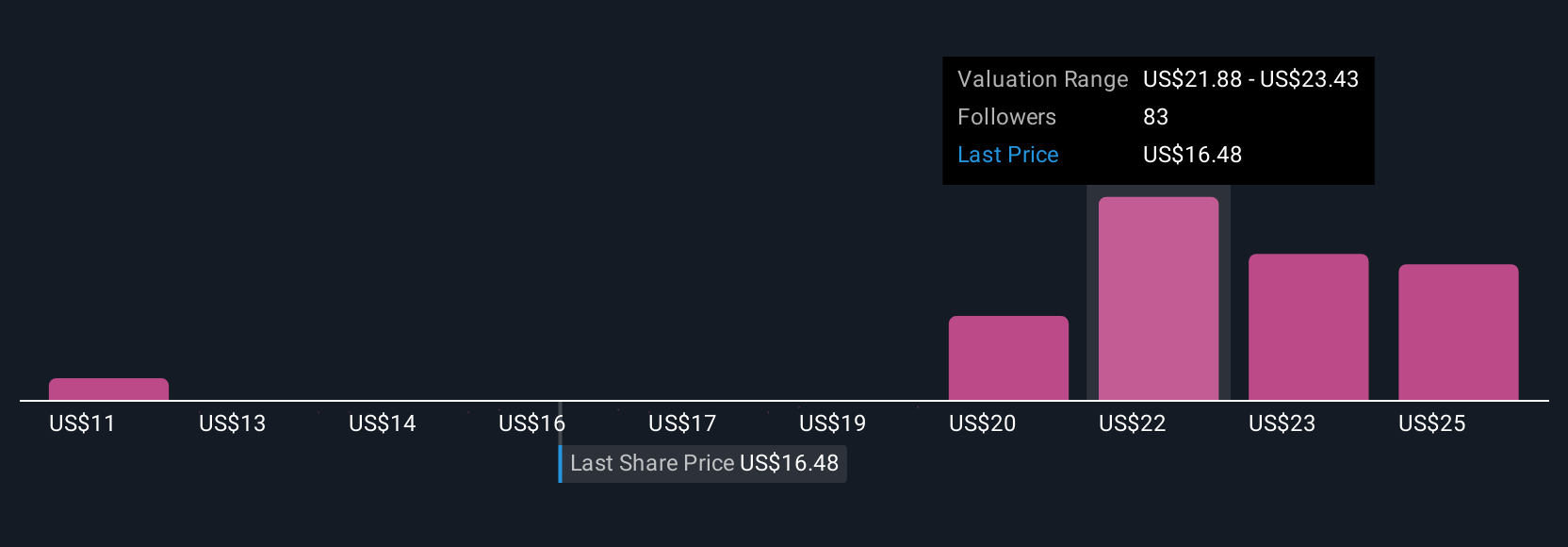

Exploring Other Perspectives IREN Community Fair Values as at Aug 2025

IREN Community Fair Values as at Aug 2025

Simply Wall St Community members posted 12 fair value estimates for IREN, spanning from US$11.00 to US$26.54 per share. Your view may differ widely, especially with upcoming funding decisions shaping the company’s progress in AI infrastructure, consider how these opposing perspectives might affect your outlook.

Explore 12 other fair value estimates on IREN – why the stock might be worth 33% less than the current price!

Build Your Own IREN Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com