Market Size & Trends

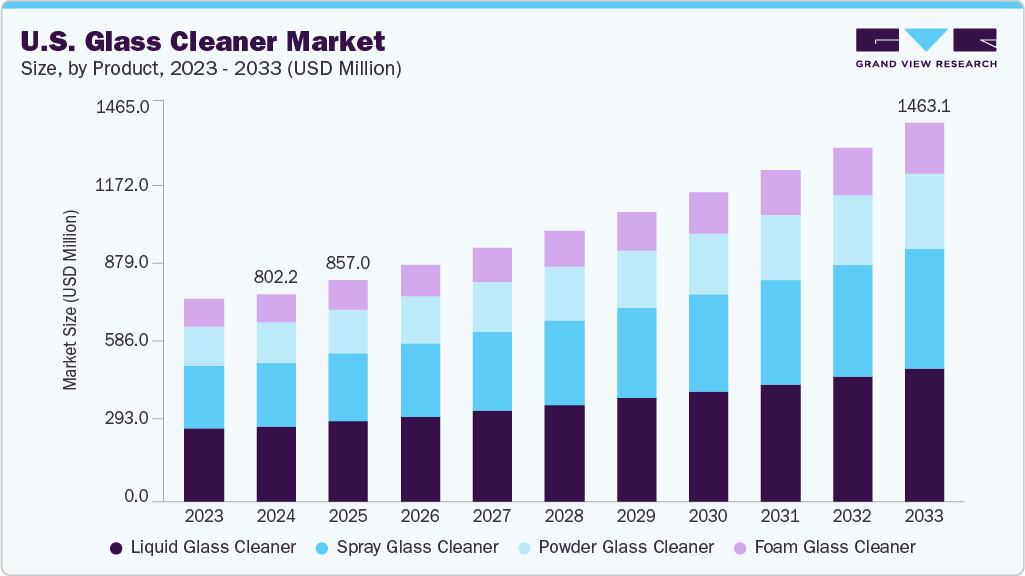

The U.S. glass cleaner market size was valued at USD 802.2 million in 2024 and is expected to reach USD 1,463.08 million by 2033, growing at a CAGR of 6.9% from 2025 to 2033. A primary driver is heightened consumer awareness of hygiene and cleanliness across both residential and commercial sectors. The COVID-19 pandemic especially reinforced these priorities, prompting more frequent and thorough cleaning routines in homes, offices, retail spaces, and hospitality venues. Glass surfaces, which are prone to visible smudges and fingerprints, require regular cleaning to maintain both hygiene standards and aesthetic appeal, further pushing demand for effective glass cleaning products.

Urbanization in the U.S. has led to a surge in construction and the widespread adoption of modern architectural designs featuring large glass elements-such as windows, facades, and partitions. The expansion of office complexes, shopping malls, and high-rise buildings amplifies the need for specialized glass cleaning products, supporting market growth in both residential and commercial settings.

Manufacturers are investing significantly in research and development to enhance cleaning performance and convenience. This includes introducing products with streak-free, quick-drying, anti-fog, and ammonia-free features, as well as developing eco-friendly, non-toxic formulations. Some innovations even include technologically advanced solutions, like robotic or AI-powered glass cleaning devices, appealing to health-conscious and tech-savvy consumers.

The U.S. benefits from a high standard of living and substantial disposable income, enabling consumers to prioritize cleaning and aesthetic upkeep in their homes and businesses. This economic ability drives demand not just for basic glass cleaning solutions but for premium products that deliver superior, streak-free results and align with lifestyle aspirations.

There’s a notable market shift toward environmentally friendly and sustainable cleaning products. Regulatory pressures and consumer preferences are steering brands toward biodegradable, non-toxic formulas and recyclable packaging. Eco-conscious consumers are increasingly seeking green cleaning solutions as part of broader environmental responsibility efforts, pushing manufacturers to diversify and innovate.

The proliferation of physical and online retail channels has made glass cleaner products more accessible. E-commerce platforms allow consumers to research, compare, and purchase niche or eco-friendly products conveniently. Digital marketing and direct-to-consumer channels boost product visibility and increase consumer awareness about the importance of maintaining clean glass surfaces, further driving market growth.

The industry faces several significant challenges despite its ongoing growth and innovation. One of the leading challenges is intense competition from alternative cleaning solutions, especially multipurpose cleaners, homemade mixtures, and natural products. Many consumers are drawn to products that offer broader utility or perceived environmental and health benefits, leading to a decline in demand for specialized glass-only cleaners. The convenience and cost-effectiveness of these alternatives, coupled with the rise of DIY cleaning recipes shared online, create a considerable barrier for traditional glass cleaning brands.

Environmental regulations and health concerns present another major obstacle. Conventional glass cleaners often contain chemicals such as ammonia, isopropyl alcohol, and volatile organic compounds (VOCs) that raise consumer health and environmental concerns. Increasing public awareness about the potential risks of chemical exposure adds pressure on manufacturers to reformulate products. However, developing eco-friendly alternatives that meet both regulatory standards and consumer expectations can be costly and technically challenging, sometimes slowing down new product development and innovation.

Product Insights

Liquid glass cleaners held the largest revenue share of over 36% in 2024. Their dominance is rooted in remarkable versatility and proven effectiveness for a wide array of glass surfaces, from household windows and mirrors to complex commercial facades. Consumers’ long-standing familiarity with liquid formulations-often ammonia or alcohol-based-reinforces brand trust and secures their place in both residential and professional cleaning settings. Their ability to deliver consistent, streak-free results makes them a staple for regular maintenance, which is particularly critical in the U.S., where glass surfaces are integral to modern architecture. Additionally, the robust presence of trusted brands like 3M, The Clorox Company, and S. C. Johnson & Son ensures strong market penetration for liquid cleaners across distribution channels.

Growth in the liquid glass cleaner segment is propelled by increasing urbanization, rising public emphasis on cleanliness, and higher disposable incomes that foster demand for both basic and premium cleaning solutions. As modern buildings incorporate larger glass installations, especially in urban areas, cleaning needs have become more complex and frequent, ensuring steady consumption of liquid solutions. Technological innovation-such as anti-fog, quick-drying, and environmentally friendly formulations-is expanding the appeal of liquid cleaners to new customer segments. However, the segment faces increased pressure to transition to safer, more sustainable formulations as consumers grow more health and eco-conscious. Among the major companies, 3M, The Clorox Company, and Reckitt Benckiser stand out as the largest players in the liquid segment.

Spray glass cleaners are expected to witness the fastest growth at a CAGR of 7.3% from 2025 to 2033. Their rapid adoption is propelled by consumer desire for convenience, precise application, and time-saving solutions for modern lifestyles. Trigger and aerosol spray formats enable users to quickly and evenly coat glass surfaces, minimizing product waste and effort while achieving streak-free results. This segment is desirable for busy households and commercial environments where ease, portability, and hygiene (especially post-pandemic) are top priorities. Spray products are well-suited for diverse applications-vehicle interiors, electronic screens, and decorative glass-supporting broad appeal.

The robust growth of sprays is further fueled by ongoing product innovation: anti-fog, ammonia-free, biodegradable, and multi-surface formulations are now commonly available, addressing both traditional and green consumer needs. The rise of online and retail distribution channels has made spray cleaners highly accessible and visible to large audiences, encouraging the adoption of new and niche products alike.

Application Insights

The residential segment held the largest revenue share of over 65% in 2024. This dominance is primarily driven by ongoing urbanization, which leads to more homes incorporating larger glass surfaces such as windows, doors, and decorative elements. The continued rise in population and housing starts further accelerates this trend, prompting increased consumption of cleaning products aimed at maintaining clear, streak-free windows, mirrors, and glass furniture. Heightened awareness of cleanliness and hygiene-especially after the COVID-19 pandemic-has made regular cleaning practices routine in households. Consumers increasingly seek glass cleaners that offer convenience, advanced formulas (such as ammonia-free and eco-friendly options), and user-friendly packaging. The rapid growth of e-commerce has boosted accessibility, giving consumers a wider range of choices and driving product adoption in residential settings.

While smaller in market share than the residential segment, the commercial application for glass cleaners is the fastest-growing segment. Growth in this area is fueled by the proliferation of modern commercial architecture, including office parks, retail centers, malls, hotels, hospitals, and public buildings that often feature extensive glass facades and partitions. Maintaining spotless glass in these high-traffic environments is not just a matter of aesthetics but is tied to hygiene, customer perception, and regulatory compliance-especially in sectors like hospitality and healthcare. Demand for high-performance, industrial-strength cleaning products is rising, with many commercial buyers looking for advanced features like anti-fog, streak-free finishes, and quick-drying formulas. The commercial sector is also adopting innovative technologies such as robotic or IoT-enabled glass cleaners to boost efficiency and safety, particularly in large-scale or difficult-to-clean structures. The overall expansion of the commercial real estate sector, combined with stricter cleanliness protocols and sustainability requirements, is set to further accelerate the demand for glass cleaning solutions in this application segment.

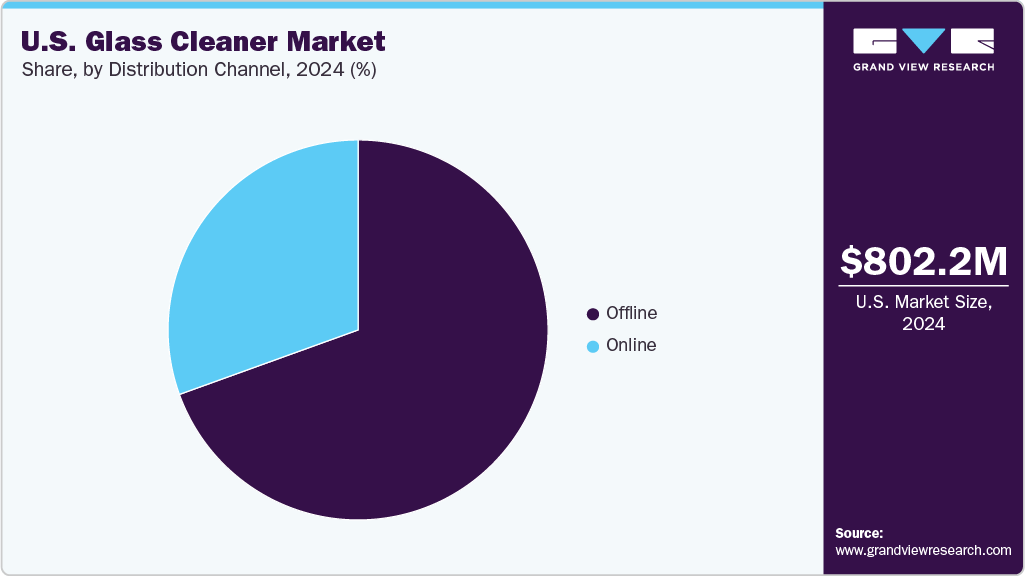

Distribution Channel Insights

Offline retail, including supermarkets, hypermarkets, convenience stores, specialty retailers, and hardware stores, remains the dominant sales channel for glass cleaners, capturing the largest market share in 2024. Several factors sustain its leadership: consumers value the immediate availability of products, the ability to physically inspect items before purchase, and the reassurance of established shopping habits at local stores. For urgent needs or regular household restocking, offline outlets serve as convenient and accessible destinations. Commercial buyers also prefer these channels when purchasing large volumes of cleaning supplies to meet operational demands. The in-person experience can encourage impulse purchases, while frequent promotions and shelf visibility help drive repeat sales. In regions where digital infrastructure lags or consumers are less comfortable with e-commerce, traditional retail continues to be the default purchasing method.

Online sales are expected to grow at a CAGR of 7.5% from 2025 to 2033. This accelerated growth is driven by the surging popularity of e-commerce platforms, particularly among younger, urban, and tech-savvy consumers who seek convenience and expanded product selections. Online shopping allows for easy product comparison, customer reviews, and targeted digital promotions, providing buyers with greater confidence in their choices. The COVID-19 pandemic significantly sped up the transition to online purchasing due to preferences for contactless shopping. Customers increasingly appreciate hassle-free ordering and home delivery-benefits that are especially appealing for busy individuals or those in remote locations with less access to physical stores. Brands are leveraging digital marketing, influencer campaigns, and special online discounts to capture and retain this growing audience. As digital penetration continues to expand and consumer comfort with technology rises, the online channel is expected to maintain its position as the fastest-growing distribution method for glass cleaners in the U.S.

Key U.S. Glass Cleaner Companies Insights

Key players operating in the U.S. glass cleaner market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Glass Cleaner Companies:

3M

The Clorox Company

Reckitt Benckiser Group PLC

S.C. Johnson & Son Inc.

Zep Inc.

PPG Industries Inc.

ITW Global Brands Inc.

Armor All Company

Stoner Inc.

CRC Industries

Chemical Guys Company

Seventh Generation Inc.

Diversey Inc.

Weiman Products LLC

Sprayway Inc.

U.S. Glass Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 857.03 million

Revenue forecast in 2033

USD 1,463.08 million

Growth rate

CAGR of 6.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and distribution channel

Country scope

U.S.

Key companies profiled

3M; The Clorox Company; Reckitt Benckiser Group PLC; S.C. Johnson & Son Inc.; Zep Inc.; PPG Industries Inc.; ITW Global Brands Inc.; Armor All Company; Stoner Inc.; CRC Industries; Chemical Guys Company; Seventh Generation Inc.; Diversey Inc.; Weiman Products LLC; Sprayway Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Glass Cleaner Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. glass cleaner market report based on product, application, and distribution channel:

Product Outlook (Revenue, USD Million, 2021 – 2033)

Liquid Glass Cleaner

Spray Glass Cleaner

Foam Glass Cleaner

Powder Glass Cleaner

Application Outlook (Revenue, USD Million, 2021 – 2033)

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)