1h agoThu 7 Aug 2025 at 12:28amMarket snapshotASX 200: -0.1% to 8,833 points (live values below)Australian dollar: flat at 64.99 US centsS&P 500: +0.7% to 6,345 pointsNasdaq: +1.2% to 21,169 pointsFTSE 100: +0.2% to 9,164 pointsEuroStoxx 600: -0.1% to 541 pointsSpot gold: flat at $US3,369/ounceBrent crude: +0.1% to $US66.99/barrelIron ore: +0.2% to $US101.45/tonneBitcoin: -0.1% to $US114,958

Prices current around 10:25am AEST

Live updates on the major ASX indices:

8m agoThu 7 Aug 2025 at 2:15am

Bank updates ahead of next week’s RBA meeting

NAB is the latest lender to cut fixed rates by up to 0.25 percentage points, a decision made ahead of next week’s RBA meeting.

This takes the bank’s lowest advertised fixed rate to 5.19% for its 2-year term for owner-occupiers paying principal and interest.

NAB now has the lowest fixed 1- to 5-year fixed rates among the big banks.

Canstar.com.au’s data insights director, Sally Tindall says, “NAB has come out swinging ahead of the RBA meeting, cutting fixed rates by up to 0.25 percentage points and undercutting its big bank rivals on a range of terms. Its two‑year rate at 5.19 per cent now sets the pace among the big four.”

“While fixed rates aren’t the flavour of the month for most borrowers, cuts like these are a sign the banks are bracing for the RBA to move again – most likely on Tuesday.”

ANZ, however, has gone the other way.

The bank has increased the rate on its Plus variable home loan by 0.16 percentage points, which takes this rate to 5.75%.

This is only for new customers and does not impact existing ANZ Plus home loan borrowers.

Sally Tindall says, “ANZ’s hike to its lowest variable rate is a reminder some banks are still looking to protect margins. It’s an unusual move just days out from a Board meeting that could deliver a cut, but it shows how some banks don’t follow the tide. Let’s just hope it’s not contagious.”

23m agoThu 7 Aug 2025 at 2:00am

AUD and NZD updates

The second half of 2025 is not looking good for the Australian and New Zealand dollar, according to Capital Economics.

Markets Economist Shivaan Tandon says the currencies had been the worst victims of global trade tensions, although still had performed better than expected since early April, compared to their G10 peers.

However, those days could be gone for the Aussie and Kiwi dollars. Currently, each are sitting at 65.13 and 59.40 US cents respectively.

38m agoThu 7 Aug 2025 at 1:45am

Tobacco sales to impact supermarkets

According to Morgan Stanley, the rapidly declining sale of tobacco is set to continue through this next financial year, adding pressure on top-line growth for Australian supermarkets.

Tobacco now accounts for about 3-4% of total sales at the grocery store.

One reason for this is the drastic increase in the consumption of illicit tobacco.

You can read my full report on black market cigarettes from last month, below:

53m agoThu 7 Aug 2025 at 1:30am

More changes to CSIRO

There are fears hundreds more Commonwealth Scientific and Industrial Research Organisation (CSIRO) jobs could be axed this year, the union has warned.

It comes as 440 positions were slashed last year.

You can read the full report from my colleague Niki Burnside below:

1h agoThu 7 Aug 2025 at 1:22am

📆 Reporting season calendar: AMP results

Reporting season is underway, with AMP on today’s agenda.

You can use this handy calendar to search for particular stocks or sectors you’re interested in:

And, of course, stay across the live blog every trading day for all our coverage, as well as on The Business on ABC News Channel and iView.

1h agoThu 7 Aug 2025 at 1:17amASX shares slump as stock exchange competition from Cboe looms large

As you might have noticed in Sam’s earlier post, the ASX is the biggest loser on the stock market’s top 200 index.

ASX shares were down 8.7% at $64.20 around 11:00am AEST.

Aside from the ongoing embarrassment about yesterday’s TPG confusion, the bigger factor is news out last night that the Australian Securities and Investments Commission (ASIC) is close to approving a rival exchange.

That was revealed publicly in communications from Treasurer Jim Chalmers following an investor round table he hosted yesterday, where ASIC chair Joe Longo gave an update.

“Making our markets more competitive will make our economy more prosperous and productive,” said the Treasurer in a statement.

“If it goes ahead, this will mean more investment in Australian businesses and that means more jobs and opportunities for Australian workers.”

And the company seeking to open that exchange is a big name — Cboe, the Chicago Board Options Exchange.

The global markets giant already has a significant presence in Australia.

CommSec says about 20% of equity trading volume goes through Cboe Australia.

However, all those companies are currently listed on the ASX, Cboe Australia simply provides an alternative trading platform.

What ASIC is close to green-lighting is the ability of Cboe Australia to have companies list on its own exchange, so they won’t have to be on the ASX.

Think of it a bit like the NASDAQ in New York, which competes against the NYSE for listings.

Some companies may choose a dual listing, but for others, a rival exchange may offer the prospect of reduced listing costs.

For the ASX that could mean reduced margins from listing fees and also reduced trading volumes if some firms choose to move away or float only on Cboe Australia.

On top of all that, the ASX released an update today revealing a $25-35 million estimated cost for its response to ASIC’s compliance assessment and inquiry, which the corporate and financial regulator is running after a series of major problems with stock market operations, including outages, many related to the exchange’s aging CHESS technology for processing trades.

1h agoThu 7 Aug 2025 at 1:03amFallout of ASX’s TPG bungle continues

Shares in stock exchange operator ASX have plunged 8.7 per cent in early trade, a day after it incorrectly paused trading in TPG Telecom shares over an unrelated deal with private equity operator TPG.

ASX is also facing potential competition from a rival operator — we’ll bring you more details shortly.

TPG shares are currently 1.5 per cent higher, recouping some of yesterday’s losses which came after it returned to trade, after the inadvertent pause. The stock closed 5.1 per cent lower on Wednesday.

1h agoThu 7 Aug 2025 at 1:00amNeuren surges on upbeat drug sales

Pharmaceutical company Neuren is the standout on the benchmark index today.

Shares rose nearly 6% to $18.02 by 10:55am AEST, after its partner Acadia Pharmaceuticals, which sells a Neuren drug to treat Rett syndrome, saying quarterly sales increased moderately.

Acadia announced net sales of DAYBUE of $US96.1 million for the second quarter, up 14% each, compared with the same time last year and the first quarter of the year.

It said it was primarily due to the growth in unit sales shipped to more unique patients.

Acadia reiterated its full-year 2025 guidance for DAYBUE US net sales of US$380 – 405 million.

1h agoThu 7 Aug 2025 at 12:46am

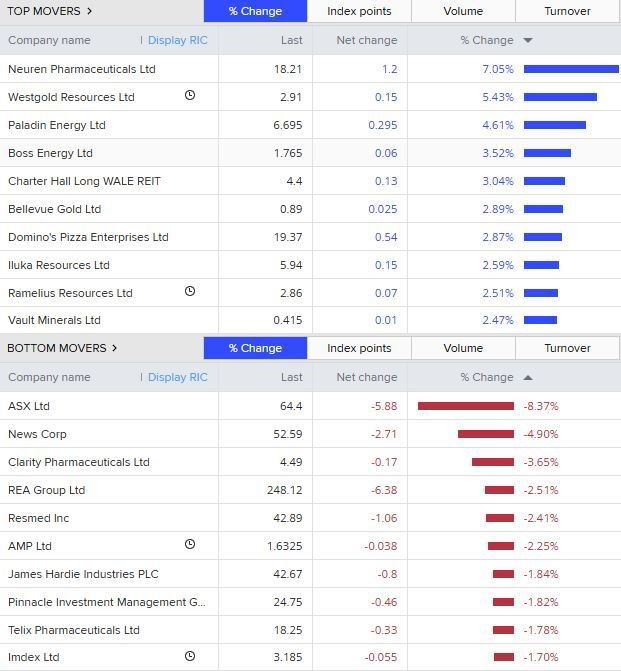

Top and bottom movers at open (LSEG)2h agoThu 7 Aug 2025 at 12:18amASX edges lower

(LSEG)2h agoThu 7 Aug 2025 at 12:18amASX edges lower

The Australian share market has opened lower today, down 11 points or 0.1% to 8,832 in the first 15 minutes of trade.

2h agoWed 6 Aug 2025 at 11:46pmAMP posts lower statutory profit of $98m

Wealth manager AMP has reported a lower statutory profit for the first half of the financial year, citing litigation and remediation related costs including class action costs.

The firm posted a 4.9% drop in statutory net profit to $98 million for the six months ended June, down from $103 million a year earlier.

Revenue from ordinary activities was down 3.5% to 1.376 million.

However, AMP’s largest profit-making division, Platforms, which provides pension and investment solutions, posted a 7.4% growth in net profit after tax, citing ongoing net cashflow momentum.

Meanwhile, AMP Bank’s profits for the period improved 2.9% to $36 million.

It declared an interim dividend of 2 cents per share.

3h agoWed 6 Aug 2025 at 11:10pmHas Glencore been ‘very, very good to Australia’? Analysis by Michael Janda

The controversy over Glencore shutting its loss-making Mount Isa copper smelter and Townsville refinery rages on.

The federal government is putting pressure on the multinational mining giant to reverse its decision.

But the company’s CEO Gary Nagle wants the Queensland and/or federal governments to stump up some cash to invest in the operations if it is to keep them open, hitting back at claims that the company has profited from Mount Isa and owes something to the town.

“Mount Isa had been good to Glencore, but I can tell you that Glencore has been very, very good to Australia for many, many years,” Mr Nagle said, as reported in The Australian newspaper.

“I was just looking at some of the numbers. Over the past six years alone, Glencore has contributed over $100bn to the Australian local, regional and national economies. If you want to break that down a little bit that’s nearly $13bn of wages paid to good Australians every single week and every single month.

“We’ve spent more than $60bn over the last six years with nearly 7000 Australian-based businesses.

“We paid royalties and taxes to the state and federal government of nearly $28bn over the past six years. And going forward, we’ve got plans to spend a lot of money as well.”

But where is Glencore generating the profits to fund this investment, the jobs and taxes?

Yes, it’s from resources owned by the people of Queensland and Australia, which they have, through their governments, allowed the Swiss-based company to mine and sell.

The royalties Glencore claims kudos for paying are technically not a tax, but are meant to be a payment for the non-renewable raw resources it is extracting. There’s a question over whether the sale price that state governments are getting is high enough.

Their argument is that the profits are so large that we could significantly increase taxes and companies would still mine Australia’s resources because it would remain very profitable.

Then there’s also an argument about whether Glencore has historically paid all the taxes it should have — the company featured prominently in the Paradise Papers, which I worked on with Four Corners.

3h agoWed 6 Aug 2025 at 10:34pmGovernment asked to back away from heavy-handed AI regulationLoading…

How to regulate artificial intelligence is fast becoming a new battleground.

An interim report from Australia’s Productivity Commission warning the federal government against taking a heavy-handed approach has surprised some.

Former Human Rights Commissioner and the co-director of the UTS Human Technology Institute, Ed Santow, says the idea that privacy and copyright protections need to be relaxed to realise AI’s maximum gains is incorrect.

Professor Santow’s interview with The Business comes as Australia’s eSafety Commissioner released a report showing big tech companies aren’t doing enough when it comes to combating child exploitation material on their platforms.

As for whether tech companies can be trusted to do the right thing when it comes to artificial intelligence, Professor Santow says “we shouldn’t trick ourselves into thinking that they will go the extra mile necessarily in protecting the community if there isn’t a clear return on investment for that. That’s the role of regulation. It makes sure that we don’t end up with the kind of lowest common denominator effect but rather we hold everyone to a standard that treats people fairly, and protects people’s basic rights.”

3h agoWed 6 Aug 2025 at 10:24pmTrump imposes an additional 25% tariff on Indian goods

US President Donald Trump has issued an executive order on Wednesday imposing an additional 25% tariff on goods from India, saying the country has imported Russian oil.

Oil prices seesawed and finished down, as Trump’s remarks about progress in talks with Moscow created uncertainty on whether the US would impose new sanctions on Russia.

The White House order did not mention China, which is another big purchaser of Russian oil.

Last week, US Treasury Secretary Scott Bessent warned China that it could also face new tariffs if it continued buying Russian oil.

With Reuters

4h agoWed 6 Aug 2025 at 10:21pmQuest for agelessness drives longevity boom

Cryotherapy, infant stem cells, extreme cold, IV infusions, red light therapy, blue light therapy … more Australians are paying big bucks to buy into a “longevity” industry worth an estimated $2.5 trillion globally — and that has some traditional doctors worried.

Read more from business reporter Nadia Daly.

4h agoWed 6 Aug 2025 at 10:15pmWarnings RBA’s move to end card surcharges could hike banking costsLoading…

The Reserve Bank has proposed an end to card surcharges, but similar moves overseas have led to higher banking costs.

Experts say a cap on interchange fees will cost banks $900 million, which they are likely to recoup via higher card costs or devalued rewards points.

Banks and other stakeholders have until the end of the RBA’s consultation period on August 26 to make submissions.

Read more from business reporter Emily Stewart:

4h agoWed 6 Aug 2025 at 10:07pm

ICYMI: Alan Kohler’s Finance Report4h agoWed 6 Aug 2025 at 9:52pmTrump says US will charge tariff of about 100% on semiconductor imports

The United States will impose a tariff of about 100% on semiconductor chips imported into the country, President Donald Trump said on Wednesday.

Trump told reporters in the Oval Office that the new tariff rate would apply to “all chips and semiconductors coming into the United States,” but would not apply to companies that had made a commitment to manufacture in the United States.

“So 100% tariff on all chips and semiconductors coming into the United States. But if you’ve made a commitment to build (in the US), or if you’re in the process of building (in the US), as many are, there is no tariff,” Mr Trump said.

Reporting by Reuters

4h agoWed 6 Aug 2025 at 9:50pmApple’s $154-billion pledge boosts Wall Street US President Trump and Apple CEO Cook announce Apple’s $154 billion investment in US manufacturing (Reuters: Jonathan Ernst)

US President Trump and Apple CEO Cook announce Apple’s $154 billion investment in US manufacturing (Reuters: Jonathan Ernst)

US stocks ended higher on Wednesday, led by a more than 1% gain in the Nasdaq, as Apple shares climbed after the announcement of a domestic manufacturing pledge, and as some companies delivered upbeat earnings reports.

Shares of Apple jumped 5.1% and provided the biggest boost to all three of the major indexes after company announced a $154-billion domestic manufacturing pledge.

It comes as President Trump pursues an aggressive tariff and trade agenda aimed at moving some manufacturing back into the United States.

Apple said in February it would spend $769 billion in US investments in the next four years that will include a giant factory in Texas for artificial intelligence servers while adding about 20,000 research and development jobs across the country.

Trump’s tariffs cost Apple $1.2 billion in the June quarter and spurred some customers to buy iPhones in late spring this year.

Apple has been shifting production of products bound for the US, sourcing iPhones from India and other products such as Macs and Apple Watches from Vietnam.

In addition, shares of McDonald’s rose 3% after the fast-food restaurant’s affordable menu drove global sales past expectations, while Arista Networks shares jumped 17.5% after the cloud networking company projected current-quarter revenue above estimates.

“Earnings continue to come in better than expected,” said Sam Stovall, chief investment strategist at CFRA Research.

He said while there is uncertainty surrounding tariffs, investors appear to be upbeat about the near term.

Results are now in from about 400 of the S&P 500 companies for the second-quarter earnings season.

About 80% of reports are beating analyst earnings expectations – above the 76% average of the last four quarters – and earnings growth for the quarter is estimated at 12.1%, up from 5.8% at the start of July, according to LSEG data.

with Reuters

ASX 200: -0.1% to 8,833 points (live values below)Australian dollar: flat at 64.99 US centsS&P 500: +0.7% to 6,345 pointsNasdaq: +1.2% to 21,169 pointsFTSE 100: +0.2% to 9,164 pointsEuroStoxx 600: -0.1% to 541 pointsSpot gold: flat at $US3,369/ounceBrent crude: +0.1% to $US66.99/barrelIron ore: +0.2% to $US101.45/tonneBitcoin: -0.1% to $US114,958

ASX 200: -0.1% to 8,833 points (live values below)Australian dollar: flat at 64.99 US centsS&P 500: +0.7% to 6,345 pointsNasdaq: +1.2% to 21,169 pointsFTSE 100: +0.2% to 9,164 pointsEuroStoxx 600: -0.1% to 541 pointsSpot gold: flat at $US3,369/ounceBrent crude: +0.1% to $US66.99/barrelIron ore: +0.2% to $US101.45/tonneBitcoin: -0.1% to $US114,958