TOKYO, Aug 7 — Chip-related shares were down in early Asian trade today, after US President Donald Trump said he planned to impose a 100 per cent tariff on imported semiconductors.

Tokyo Electron, a major Japanese producer of chipmaking equipment, plunged 3.4 per cent as markets opened in Tokyo, and chipmaker Renesas was down 2.5 per cent.

In Seoul, chip giant SK hynix plunged 2.9 per cent, while traders awaited the market’s opening bell in Taipei, where TSMC — the world’s largest contract maker of chips — is listed.

Trump said yesterday at the White House that “we’re going to be putting a very large tariff on chips and semiconductors”.

The level would be “100 per cent”, he told reporters, although he did not offer a timetable for the new levy being enacted.

“But the good news for companies like Apple is, if you’re building in the United States, or have committed to build… in the United States, there will be no charge,” Trump said.

Apple announced yesterday that it will invest an additional US$100 billion (RM422.6 billion) in the United States, taking its total pledge to US$600 billion over the next four years.

Governments around the world are bracing as new waves of US tariffs are due to take effect this week.

They hit many products from Brazil yesterday and are set to hit dozens of other economies — including the European Union and Taiwan — beginning today.

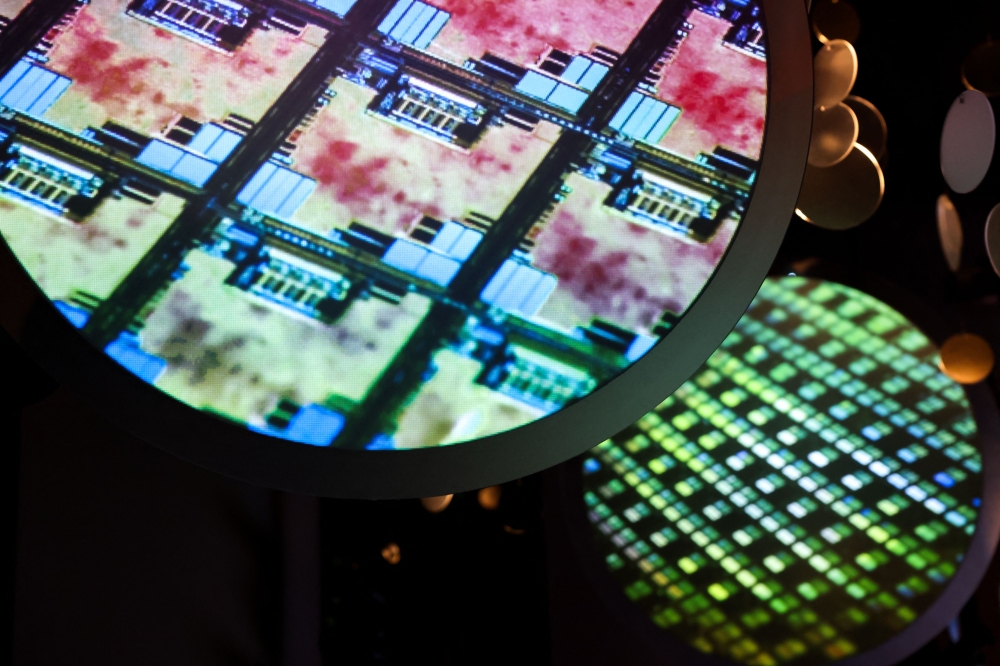

Among other chip-related stocks in Tokyo today, precision tools maker Disco Corporation gave up 1.3 per cent while Sumco, which makes silicon wafers, lost 1.7 per cent. — AFP