2h agoThu 7 Aug 2025 at 10:11pmMarket snapshotASX 200 futures: -0.3% to 8,757 pointsAustralian dollar: flat at 65.22 US centsS&P 500: -0.1% to 6,340 pointsNasdaq: +0.3% to 21,242 pointsFTSE 100: -0.7% to 9,100 pointsEuroStoxx 600: +0.9% to 546 pointsSpot gold: flat at $US3,396/ounceBrent crude: -0.7% to $US66.41/barrelIron ore: -0.1% to $US101.65/tonneBitcoin: flat at $US117,291

Prices current around 8:10am AEST.

Live updates on the major ASX indices:

10m agoFri 8 Aug 2025 at 12:13amASX 200 drops at the open

The local share market has begun its final trading session of the week, with the ASX 200 down 0.3 per cent, as is the All Ordinaries.

Meanwhile, shares in the company behind the stock exchange, ASX Ltd, are up 1.2 per cent at the moment, recouping a little of yesterday’s heavy loss.

26m agoThu 7 Aug 2025 at 11:56pm

Reporting season ramping up in week ahead

Reporting season is a slow build, but things start picking up next week, with one of the most anticipated results coming from the Commonwealth Bank on Wednesday.

Here’s a calendar you can search to find what stocks and sector you’re interested in tracking:

NAB’s Gemma Dale described CBA results as “the most consequential number” of the season, after the big run up in the bank’s share price.

“It’s more than 10 per cent of the market and it’s run so incredibly hard — less so in the last little while — but its performance over 12 to 18 months has been so extraordinary and it’s such a chunky part of the average portfolio,” Ms Dale told The Business this week.

“You’re looking at what’s currently the most expensive bank in the world by historical standards, by peer relative standards.

“If it disappoints in a meaningful way, that’s going to have real ripple effects.”

Read more from Nadia Daly here:

43m agoThu 7 Aug 2025 at 11:40pm

🎥 Finance with David Chau

As the clock ticks down to the Friday open on the local share market, catch up on how we got here with finance presenter David Chau.

While the falls for the ASX’s major indices were limited on Thursday, the falls for ASX Ltd itself were hefty.

Loading…

53m agoThu 7 Aug 2025 at 11:30pm

Investors near ‘euphoria’ as market rollercoaster roars on

This week, we’ve seen the Australian share market smash records, from fresh intra-day all-time highs (which occur during trading sessions) to record closing highs.

Whichever way you cut it, the Australian share market is performing exceptionally well.

It’s been a remarkable turnaround from the enormous volatility we saw in early April when US President Donald Trump announced his “reciprocal” tariffs.

So what happens next?

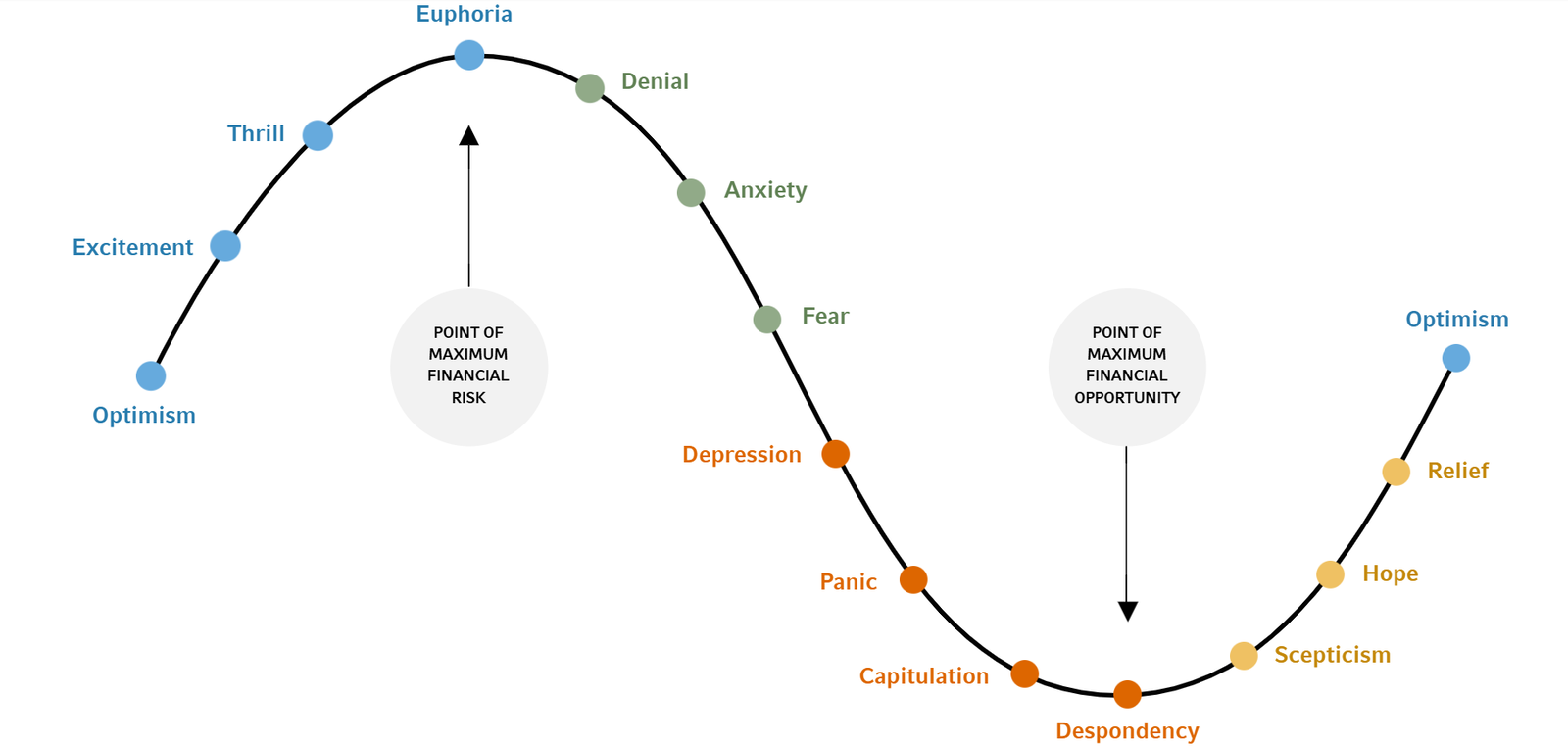

Economists point to the psychological stages of the investment journey.

While traders and investors might like to think of themselves as logical actors, like all of us, they’re human.

“It’s well-known investment markets move more than can be justified by moves in investment fundamentals, because investor emotion plays a huge part,” AMP’s head of investment strategy, Shane Oliver, noted.

As this chart demonstrates, a rollercoaster of emotions drives investor behaviour over the course of an investment cycle.

(Russell Investments)

(Russell Investments)

While you can’t predict the timing, psychologists say these stages are real and, when they occur, they put a mirror up to society.

Read more analysis here:

1h agoThu 7 Aug 2025 at 11:20pm

Oh, China, won’t you buy a Mercedes Benz?

A fascinating note from Capital Economics overnight on the prospects for Germany’s once world-beating auto sector.

It concludes that German car production could slump as much as 20% over the coming decade, mostly due to the increased competition from China’s booming EV sector.

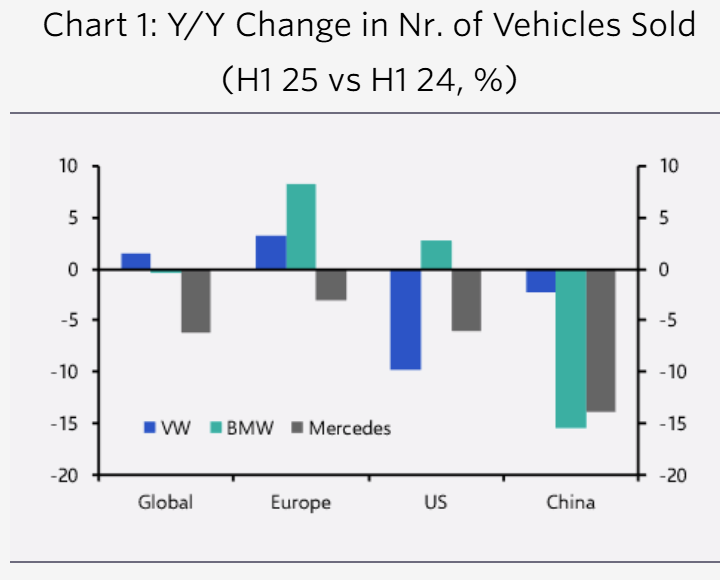

German vehicle exports to China have plunged over the past couple of years. (Capital Economics)

German vehicle exports to China have plunged over the past couple of years. (Capital Economics)

While German automakers have blamed US tariffs for a recent slide in sales and earnings, Capital Economics’ senior European economist Franziska Palmas says those increased import taxes have been just one factor.

“The reduction in the US tariff rate on car imports from the EU from 27.5% to 15%, which is expected to come into effect in the coming days, as well as some increase in German carmakers’ production in the US, will probably help to cushion the blow,” she notes.

“Perhaps more importantly, the US is a less important market for the German auto sector than one might expect. Indeed, sales in the US account for between 5% and 15% of German carmakers’ total sales, and the US is the destination of just 10% of the aggregate auto production in Germany.”

German automaker sales have fallen more in China than the US (Capital Economics)

German automaker sales have fallen more in China than the US (Capital Economics)

So, why the negative long-term outlook for Volkswagen, BMW and Mercedes?

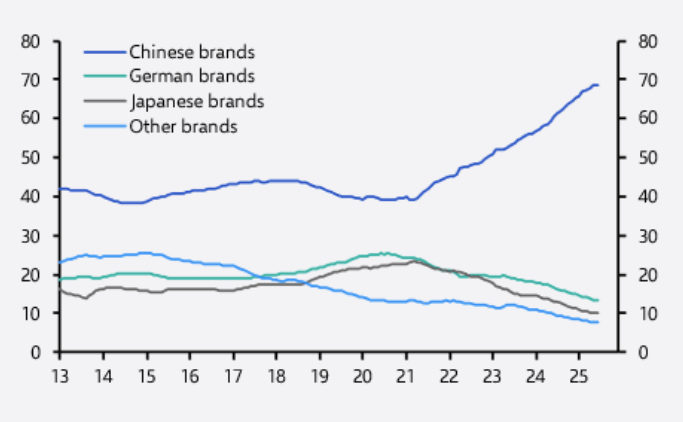

“German firms have been unable to keep up with the quality and prices of EVs produced by Chinese brands since the pandemic, and the gap is now so big that it seems very difficult that German carmakers will catch up,” Palmas notes.

“Moreover, the current frosty relationship between the EU and China will not help their standing in the Chinese market. The latest data confirm that the negative post-pandemic trend is continuing, with all German carmakers reporting falls in their sales in China in the first half of 2025, and the market share of German brands continuing its steep falls.”

Chinese car sales by origin of brand. (Capital Economics)

Chinese car sales by origin of brand. (Capital Economics)

Not only is the Chinese export market drying up as consumers increasingly turn to local brands, but Germany’s local market is shrinking as Europeans continue to have fewer children.

“Car sales in Europe have been very weak for years now. And with the European population set to shrink, that will remain the case,” the economist observes.

“Meanwhile, we still think Chinese producers will eventually gain more market share in Europe, given how competitive their EVs are, and that the EU’s tariff policy is not draconian enough to completely exclude imports from China.”

Oh, Lord, won’t somebody buy a Mercedes-Benz?

Loading1h agoThu 7 Aug 2025 at 11:05pmBHP and Vale settle Samarco UK class action: FT

Global miners BHP Group and Vale have offered about $US1.4 billion ($2.15 billion) to settle a class action lawsuit in the United Kingdom tied to one of Brazil’s worst-ever environmental disasters, the Financial Times reported overnight.

The lawsuit stems from the collapse in 2015 of the Mariana dam in southeastern Brazil, owned and operated by the Samarco joint venture of BHP and Vale. The disaster prompted legal action from hundreds of thousands of people.

BHP is currently facing a London lawsuit that claimants’ lawyers have valued at up to 36 billion pounds ($74.2 billion).

The proposed settlement includes about $US800 million in compensation for victims and $US600 million to cover legal costs associated with the High Court proceedings, the report said, citing people familiar with the matter.

BHP and Vale did not immediately respond to Reuters’ requests for comment.

In October last year, BHP described allegations that a focus on profit over safety contributed to the disaster as “far-fetched and unjustified”.

Reuters

1h agoThu 7 Aug 2025 at 10:48pmASX Ltd faces financial hit from ASIC inquiry

Shares in ASX Ltd, the operator of the stock exchange, fell sharply yesterday, losing more than 8.5 per cent.

There were a slew of factors behind the negative sentiment hitting the ASX, as chief business correspondent Ian Verrender reports.

The corporate regulator ASIC revealed it’s “in the final stages” of deciding whether to allow another stock exchange to enter the Australian market and do away with the ASX’s virtual monopoly over securities trading.

It’s the latest blow for the ASX, which has been in the regulator’s sights for years after a decade of woes, culminating in an outage last December.

A few months ago, ASIC expanded an inquiry into the outage to a full-blown probe into the ASX, which the company now warns will cost it $25-35 million in the current financial year.

UBS analysts think the outcome could be even worse, noting that, while ASX has flagged a one-off hit, “we expect Inquiry outcomes to also lead to a more recurring increase in operating costs”.

It retains a sell rating on the stock.

That’s not to mention an embarrassing mistake earlier this week, that sent TPG Telecom shares into a tailspin when an unrelated announcement was wrongly attributed to the telco and shares were allowed to trade before a proper correction was issued.

Read the full sage here:

1h agoThu 7 Aug 2025 at 10:26pmQBE half-year profit rises 27 per cent

Reporting season continues, with insurer QBE revealing a 27 per cent rise in its half-year profit, to $US1.02 billion.

It reported 6 per cent growth in gross written premiums.

QBE chief executive Andrew Horton described it as a “solid” result and said the insurer was on track to achieve its full-year guidance.

Shareholders will receive an interim dividend of 31 cents per share.

2h agoThu 7 Aug 2025 at 10:08pmStephen Miran’s Fed appointment a ‘welcome surprise’

Some early reaction to President Donald Trump’s decision to appoint the chair of his Council of Economic Advisers, Stephen Miran, to a temporary vacancy on the Federal Reserve board of governors.

Paul Ashworth, the chief North America economist at Capital Economics, has described it as a “welcome surprise”.

“Miran has been linked with the push for a so-called Mar-a-Lago currency accord, based on a paper he wrote laying out various strategies for rebalancing US trade while working in the private sector,” Ashworth notes.

“We don’t always agree with him on economic policy, but the Harvard-educated PhD economist is a good pick, who should easily be confirmed by the Senate. With the Senate currently on its summer break, however, he might not be confirmed in time to vote at the mid-September FOMC meeting.

“He is initially only being tapped to complete Kugler’s existing term as Governor, which ends in late-January next year. But, assuming he enthusiastically votes for the interest rate cuts that Trump desperately wants, he should be renominated for a new term to follow that.”

But, as Reuters reports, many economists, market analysts and politicians may be wary of his appointment because of his recent views about reducing the independence of the Fed.

“In a report last year co-authored by Miran for the Manhattan Institute, the economist proposed a sort of homeopathic cure for a series of ills he felt had infected the central bank, from ‘groupthink’ on monetary policy, to regulatory overreach, to a loss of accountability and a loss of focus on its core mission of fighting inflation,” the news agency observes.

“To regain the benefits of Fed independence from political control, Miran wrote, that independence would have to end.

“Rather than 14-year terms and protection from removal once appointed, Miran proposed, Fed governors would serve eight year stints and be subject to removal at will by the president.

“‘We recommend shortening board member terms and clarifying that members serve at the will of the US president, as well as imposing bans on the revolving door between the executive branch and the Fed,’ Miran wrote.”

It could be another interesting confirmation hearing in the US Senate.

2h agoThu 7 Aug 2025 at 10:04pmWall St mixed, Trump makes temporary Fed board appointment

Good morning — and happy Friday to everyone who gets a weekend tomorrow.

It looks like the local share market will start its final session of the week in the red, with futures pointing to a modest fall, after a mixed session on Wall Street.

The Dow lost half a per cent by the close in New York, reversing earlier gains. The S&P dipped while the Nasdaq managed to end a third of a per cent higher.

US President Donald Trump has made a temporary appointment to the Federal Reserve board, naming White House economic advisor Stephen Miran as his pick.

It follows a surprise resignation of a governor last week, and, of course, the ongoing tirades from Mr Trump against Fed chair Jerome Powell, whose term ends in May.

Locally, we’ll get you across results coming out from ASX-listed companies, including a 27 per cent rise in QBE’s half-year profit, as reporting season rolls on.

Stick with us!

Loading

ASX 200 futures: -0.3% to 8,757 pointsAustralian dollar: flat at 65.22 US centsS&P 500: -0.1% to 6,340 pointsNasdaq: +0.3% to 21,242 pointsFTSE 100: -0.7% to 9,100 pointsEuroStoxx 600: +0.9% to 546 pointsSpot gold: flat at $US3,396/ounceBrent crude: -0.7% to $US66.41/barrelIron ore: -0.1% to $US101.65/tonneBitcoin: flat at $US117,291

ASX 200 futures: -0.3% to 8,757 pointsAustralian dollar: flat at 65.22 US centsS&P 500: -0.1% to 6,340 pointsNasdaq: +0.3% to 21,242 pointsFTSE 100: -0.7% to 9,100 pointsEuroStoxx 600: +0.9% to 546 pointsSpot gold: flat at $US3,396/ounceBrent crude: -0.7% to $US66.41/barrelIron ore: -0.1% to $US101.65/tonneBitcoin: flat at $US117,291