4h agoFri 11 Jul 2025 at 1:08amMarket snapshotASX 200: flat at 8,584 points (live values below)Australian dollar: -0.3% to 65.66 US centsNikkei 225: +0.1% to 39,674 pointsS&P 500: +0.3% to 6,280 pointsNasdaq: +0.1% to 20,630 pointsEuroStoxx 600: +0.5% to 552 pointsFTSE 100: +1.2% to 8,975 pointsSpot gold: +0.1% to $US3,327/ounceBrent crude: +0.3% to US$68.83/barrelIron ore: +0.3% to $US97.85/tonneBitcoin: +1.8% to $US115,631

Prices current around 11am AEST

Live updates from major ASX indices:

Just nowFri 11 Jul 2025 at 5:20am

Will a forecast LNG glut eventuate and help cut energy prices?

An interesting note from CBA’s commodities analyst Vivek Dhar on forecasts of an increase in global liquefied natural gas (LNG) supply that could outstrip demand growth.

Here’s the highlights:

“The International Energy Agency (IEA) estimates that committed LNG export capacity will rise by ~294bcm (~54% of LNG exports in 2024) from 2025 to 2030. This implies that LNG export capacity will expand by ~6.2% CAGR (Compounded Annual Growth Rate) over the same time frame. These additions in LNG export capacity reflect commitments made since 2019 given projects typically take 4 to 5 years to come online,” he notes.

“The US accounts for just over half (~51%) of the additional LNG capacity from 2025 to 2030, followed by Qatar (22%) and Canada (9%). FIDs [final investment decisions] for US LNG projects surged in 2022 and 2023 in the wake of the Ukraine war due to record‑high LNG spot prices and significant buyer interest for additional LNG from a flexible producer.”

He says this surge in capacity may not be matched by an equivalent rise in demand.

“With LNG exports rising 5.0% CAGR in the last 10 years and only 2.4% CAGR in the last 5 years, market worries seem justified that LNG export capacity growth will eclipse LNG import demand.”

If this eventuates, Dhar says it could be good news for gas-reliant manufacturers and electricity consumers on Australia’s east coast, whose energy prices are largely set by the movements in gas costs.

“An oversupply of LNG in coming years and a fall in spot LNG prices would provide relief to the energy intensive sectors in Europe and east‑coast Australia. However, an oversupply in LNG markets is contested. Shell’s LNG outlook for 2025, which interprets market projections, shows a fairly balanced outlook to 2033.”

Just nowFri 11 Jul 2025 at 5:20amRisk of ‘sharp falls’ in Aussie dollar

CBA economists say the Australian dollar is at risk of sharp falls over the next few months because of tariff and economic uncertainty. ◼

The US dollar rose against most major currencies in Asia after US President Donald Trump announced blanket tariffs of 15 per cent or 20 per cent on most trading partners, and 35 per cent on some imports from Canada.

“Near record high US equities and the lack of significant negative impacts of tariffs on the US economy to date have likely emboldened President Trump to increase his aggression on tariffs,” CBA said in a research note.

“But next week’s US CPI for June could show more impact of tariffs on goods inflation, supporting US short term interest rates and the USD.

That said, CBA says there the risk of US Federal Reserve chairman Jerome Powell being dismissed complicates the outlook for US interest rates.

“It is no secret President Trump wants the FOMC (Federal Open Market Committee) to lower interest rates. President Trump has repeatedly criticised FOMC chair Powell and signalled interest in replacing him,” they note.

“However, political interference in the FOMC can undermine its credibility and independence, leading to higher inflation and long term interest rates.

” As the global benchmark, higher US interest rates can lift long term interest rates in other economies too.”

On the Aussie dollar, it suggests financial markets are not pricing a high chance of a major disruption to the world economy from high US tariffs.

“That complacency puts AUD and NZD at risk of sharp falls over the next few months.”

1h agoFri 11 Jul 2025 at 4:15am

How Trump tariff beef with Brazil opens gate for Australia

The Trump administration’s threat of a 50 per cent tariff on Brazilian imports could present an opportunity for Australia.

Brazil is a major supplier of beef, coffee and orange juice to the US, and is currently number one in beef.

The tariffs are due to take effect on August 1.

US-based Global AgriTrends meat analyst Brett Stuart said for Brazil’s beef industry, the proposed 50 per cent tariff would become an import tax of 76.4 per cent, as it already incurred a 26.4 per cent duty once it exported more than 65,000 tonnes — a quota triggered in late January.

“76 per cent, that is just untenable, that’s unworkable,” he said.

And Australia would be an obvious winner if Brazil bowed out of the US market.

“I think overnight, Australian and New Zealand beef prices will see sharp demand … the phones are going to be ringing if this happens,”

Read the full story from Landline’s Matt Brann here:

1h agoFri 11 Jul 2025 at 3:46amMichael Every asks: Did TACO trades just get burrito-ed?

A combo of confidence, arrogance, and ignorance markets has seen continued TACO trades on tariffs, according to Rabobank’s Michael Every.

But as he notes — “(US President Donald) Trump always chickens out, say those who just watched him bomb Iran’s nuclear sites with vastly fatter tail risks than a spike in CPI (the fear of which overlooking Japanese car-markers just cut prices 19.4 per cent to keep access to the US market). But did that just get burrito-ed?”

He says Mr Trump “just dropped a bomb” in stating he plans to impose rates of 15 per cent or 20 per cent on most trading partners.

Mr Trump also dropped a 35 per cent tariff on non-USMCA (United States-Mexico-Canada Agreement) compliant goods from Canada starting on August 1, with any counter tariff rate stacked on top: “no transshipped goods from Canada will be allowed”, Every notes.

“Can you see what was flagged here months ago: that the US would set the level of the USMCA external tariff, forming a Fortress North America?”

He says a similar Mr Trump letter could go out to the EU today.

“Will it say 10 per cent, 15 per cent, 20 per cent, or 35 per cent, and will everyone continue to buy EUR on the back of it because markets? Perhaps: but, what a croque, monsieur or madame. There’s no ham in that toasted sandwich if you open it up and look.”

Brazilian President Luiz Inácio Lula da Silva announced he would impose retaliatory tariffs on the US if Mr Trump followed through on a pledge to boost import taxes by 50 per cent, and said he wasn’t obliged to use the dollar for trade.

“Is he referring to the BRICScoin that doesn’t exist, or to barter, or to gold, or CNY? Every asks.

“Somebody will be eating humble taco ahead there — place your trading bets accordingly.”

1h agoFri 11 Jul 2025 at 3:21amASX loses early gains

The S&P/ASX 200 index is down 0.1 per cent at 8,585.3 after an early rise.

The Index rose above 8,600 points in the opening minutes of trading on Friday, before easing back, following US President Trump’s threats of a 35 per cent tariff on Canada and tariffs of 15 to 20 per cent on other countries that haven’t yet reached trade deals.

But the nations’ big miners are seeing strong gains, off the back of iron prices holding strong. BHP is up more than 3 per cent, Rio Tinto 2.8 per cent and Fortescue 3.6 per cent.

Bitcoin is trading about 0.5 per cent higher at USD$116,447.

2h agoFri 11 Jul 2025 at 2:58am

Update

It doesn’t really matter what tariff he applies to us, as long as it’s lower than our competitors, right?

– Greg

Thanks for the question, Greg.

As my colleague Michael Janda reported earlier this week, the Productivity Commission says Australia will actually benefit from Donald Trump’s trade tariffs because some global capital flows will be redirected towards Australia.

Modelling by the Productivity Commission found that Donald Trump’s “liberation day” tariffs — as well as sector-specific tariffs on aluminium, steel and automobiles and parts — could lead to a 0.37 per cent increase in Australia’s GDP.

Productivity Commission deputy chair Alex Robson explained it this way: “What happens is that there’s capital outflow from the United States that’s got to go somewhere. It comes to Australia as well as other countries,” he said.

“And the overall impact on us in the long run is that capital inflow increases our production and is actually good for GDP in Australia, by a very small amount.

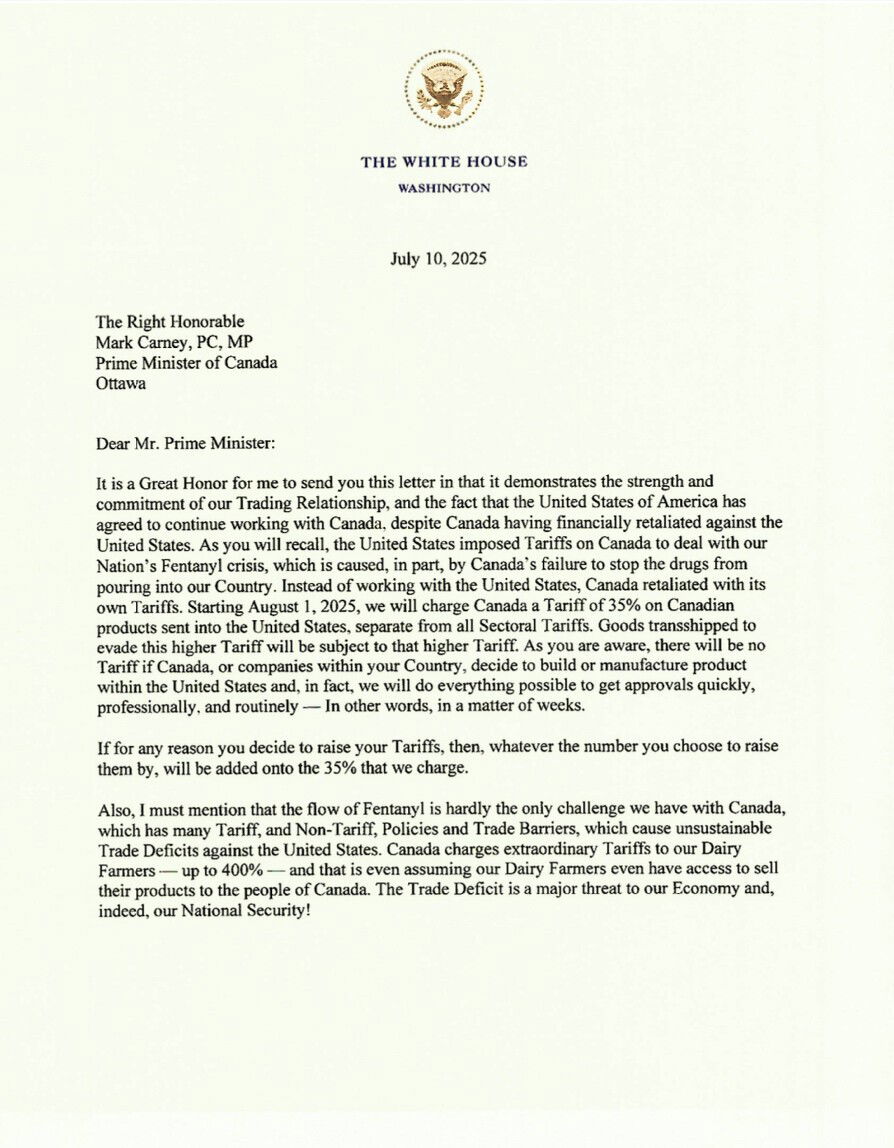

2h agoFri 11 Jul 2025 at 2:46amFentanyl isn’t Trump’s only grief with Canada

More details of US President Donald Trump’s tariff rate on Canada are coming in from Bloomberg.

The US will levy a 35 per cent tariff on some goods entering the US from Canada starting August 1.

The announced rate is an increase from the current 25 per cent tariff on Canadian imports not covered by the trade deal negotiated between the US, Canada and Mexico, which do not face additional tariffs.

That exclusion is poised to remain unchanged, according to an official, who spoke to Bloomberg on condition of anonymity.

The US is also expected to keep a lower 10 per cent tariff on energy related imports as well as Trump’s increased levies on key goods including metals, the official said.

While most Canadian exports were shielded from Trump’s tariffs thanks to the trade agreement, the US President had imposed a 25 per cent tariff on many goods, citing the threat of the highly addictive drug fentanyl, which is trafficked across the US-Canadian border.

“Fentanyl is hardly the only challenge we have with Canada,

which has many Tariff, Non-Tariff, Policies and Trade Barriers,

which cause unsustainable Trade Deficits against the United

States,” Trump said in a letter to Canadian Prime Minister Mark Carney.

2h agoFri 11 Jul 2025 at 2:21amCapital Economics revises forecast of RBA cash rate cut to later in 2026

Capital Economics says it now expects the RBA’s cash rate will hit 2.85 per cent by the second quarter of 2026 because of the Reserve Bank’s preference to “move gradually”.

It said the RBA’s shock decision to leave rates on hold at this week’s meeting was more about timing than direction.

“The RBA’s decision to leave rates unchanged at its meeting this week came as a surprise to most.

“As it turns out, a majority of the Board preferred to wait for the full Q2 CPI data (due by end-July) before cutting rates, amid concerns about resurgent price pressures in certain areas.

“Nevertheless, we still think that some of the bank’s concerns about resurgent price pressures are overdone,” according to Capital’s senior APAC economist Abhijit Surya.

He said Capital believed underlying inflation would continue to trend lower.

“Accordingly, we’re sticking with our below-consensus terminal rate forecast of 2.85 per cent,” he said.

“However, given the [Reserve] Bank’s gradualist stance, we now expect the trough to occur in Q2 next year, rather than in Q1.”

3h agoFri 11 Jul 2025 at 1:47amCanada dropped tech tax to get a better trade deal but tariff threat looms

Canada dropped its plan to tax US digital giants for revenue earned in Canada in the hope of getting a better trade deal.

But now Donald Trump has threatened Canada with 35 per cent tariffs, will the Canadians regret that decision?

The digital services tax (DST) would have meant US tech giants including Amazon, Apple, Google, Meta and Microsoft faced a 3 per cent charge on Canadian revenue above $20 million.

The DST was announced in 2020 to try and recoup revenues generated from Canadians.

But after US President Donald Trump described the tax as a “blatant attack”, and threatened higher tariffs on imports from Canada, the Canadian government announced at the end of June that it would drop the tax.

Canada’s finance minister, François-Philippe Champagne has said “Canada’s preference has always been a multilateral agreement related to digital services taxation”.

3h agoFri 11 Jul 2025 at 1:36am

Australia could face more than 10% tariff, Rabobank warned

As we get news out of the US that US President Donald Trump is now floating tariffs of above 10% on all trading partners, I thought about a brief conversation I had with Ben Picton at Rabobank yesterday.

He was saying to me that the case with Brazil, which got a boosted tariff this week, highlights how Trump is willing to get tough on trading partners.

He noted that Brazil is seen to have been irking the US president with its cosier relationship with China.

He’s got this thought about Australia.

3h agoFri 11 Jul 2025 at 1:22amTrump threatens blanket 15-20% tariff in NBC interview

The US president is out talking this morning and has told NBC News he will likely impose a blanket tariff on most trading partners of 15 or 20 per cent — that would be above the 10 per cent “base” tariff announced in April.

Donald Trump told NBC that the European Union and Canada would receive letters notifying them of their new tariff rates “today or tomorrow” — before following through on Canada, flagging a 35 per cent rate from August 1.

4h agoFri 11 Jul 2025 at 1:12am

At least it’s Friday

boring day on markets nothing going nowhere hohum

– chrisso

Chrisso, you’re right in that the ASX isn’t going anywhere overall at the moment but we’ve got some big moves for stocks.

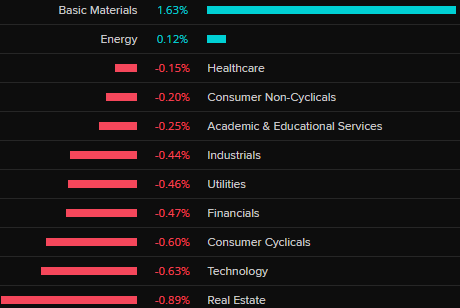

Our exposure to commodities is offsetting the negative sentiment from tariffs so far:

ASX 200 (LSEG Refinitiv)4h agoFri 11 Jul 2025 at 1:00amDonald Trump’s letter to Canada’s PM threatening 35pc tariffs

ASX 200 (LSEG Refinitiv)4h agoFri 11 Jul 2025 at 1:00amDonald Trump’s letter to Canada’s PM threatening 35pc tariffs

Here is the letter that US President Donald Trump sent to Canada’s Prime Minister Mark Carney, as posted by the US leader on his Truth Social platform.

The tariffs are threatened to take effect from August 1.

This is the latest in a series of letters the US president has sent to various world leaders this week threatening rates of tariffs similar to Liberation Day levels if trade deals are not struck before August 1.

4h agoFri 11 Jul 2025 at 12:45amPentagon’s investment in US rare earths firm sparks Australian rally

Overnight news that the US Defense Department will buy $US400 million worth of preferred stock in rare earths miner MP Materials has sparked a huge rally across the sector in Australia.

The deal also involves investment to expand the company’s rare earths processing and magnet production capacity, as well as guaranteed offtake prices for the company’s key products.

MP Materials surged about 50% in US trade overnight, and the evidence it has provided of the US government’s willingness to invest big money in the sector to secure supplies of critical minerals has sparked a rally locally.

Local players Iluka and Lynas have surged 25% and 17% respectively in early trade, while lithium miners Mineral Resources (+6%), Liontown (+5%) and Pilbara Minerals (+3.9%), as well as nickel and cobalt firm IGO (+4%), are also benefitting.

4h agoFri 11 Jul 2025 at 12:41am

USD rises on more Trump tariff news

The greenback is up 0.2% after US president Donald Trump announced 35% tariffs on Canada after closing. Trump is also floating blanket 15% or 20% tariffs on most trading partners.

You may recall this note from CBA, which I posted just a few hours ago, where its currency analysts noted the potential for more tariff news to push the USD higher.

It explains why tariff news would push the US currency higher.

There is further upside to the USD over the next week in our view. For example, next week’s US CPI could show more impact of tariffs on goods inflation that pushes out market pricing for a cut in the Funds rate in September. Market pricing has shifted a long way against a 25bp cut in September from 116% on 2 July to 72% currently.

Futures for Wall Street indexes are down but not hugely as this latest round of tariff news comes out of the White House.

4h agoFri 11 Jul 2025 at 12:40amStock futures down, US dollar up on tariff developments

Lots of market moves flashing on the screen as we see Donald Trump’s announcement of a 35 per cent tariff on Canada from August 1 influence trade:

US stock futures falling, with Nasdaq emini futures down 0.6%US dollar on the rise, while the Aussie dollar loses 0.3%Tokyo’s Nikkei reverses gains to trade flatEuropean stock futures declining, with Stoxx 50 futures off 0.3%4h agoFri 11 Jul 2025 at 12:25amBreaking: Aussie dollar reverses on Trump’s Canada tariff

In news just in via Reuters, the US President Donald Trump has announced a 35 per cent tariff on goods imported from Canada from August 1.

After hitting its highest since November, the Aussie dollar is reversing course on the news:

AUDUSD (LSEG Refinitiv)

AUDUSD (LSEG Refinitiv)

4h agoFri 11 Jul 2025 at 12:24am

ASX opens pretty flat with miners leading

Here’s the top and bottom movers right now.

Iluka +25.6%Lynas +17.2%Mineral Resources +7.8%

The bottom are quite a few constant top and bottom movers.

Lifestyle -2.2%Zip -2.2%Life360 -2.1%

The Aussie dollar has also come down a bit more, off about 0.3% now close to 65.55 US cents. That’s as the US announces extra tariffs on Canada, sending the USD higher.

5h agoThu 10 Jul 2025 at 11:56pm

Two in five Australian suburbs at record highs

That’s according to new property price analysis by Cotality (formerly CoreLogic). It has found “values across 44.8% of the 3,722 suburbs analysed are sitting at a peak at the end of June”.

And that’s “expected to rise in coming months”. It’s actually WA and Queensland that are leading the trend, the analysis firm notes, with other markets not at record highs.

“Brisbane and Regional Queensland recorded the highest share of suburbs at peak, at 78.8% and 77.7% respectively.

“Perth followed with 74.8% of suburbs recording all-time highs, while Adelaide, Regional SA and Regional WA saw 61.4%, 58.8% and 53.6% of suburbs at peak respectively.”

Although the majority of suburbs nationwide are not currently at a record high, momentum is building. At the end of June, values across 329 suburbs were within 0.5% of their previous peak, with 290 of those recording value rises over the quarter.

ASX 200: flat at 8,584 points (live values below)Australian dollar: -0.3% to 65.66 US centsNikkei 225: +0.1% to 39,674 pointsS&P 500: +0.3% to 6,280 pointsNasdaq: +0.1% to 20,630 pointsEuroStoxx 600: +0.5% to 552 pointsFTSE 100: +1.2% to 8,975 pointsSpot gold: +0.1% to $US3,327/ounceBrent crude: +0.3% to US$68.83/barrelIron ore: +0.3% to $US97.85/tonneBitcoin: +1.8% to $US115,631

ASX 200: flat at 8,584 points (live values below)Australian dollar: -0.3% to 65.66 US centsNikkei 225: +0.1% to 39,674 pointsS&P 500: +0.3% to 6,280 pointsNasdaq: +0.1% to 20,630 pointsEuroStoxx 600: +0.5% to 552 pointsFTSE 100: +1.2% to 8,975 pointsSpot gold: +0.1% to $US3,327/ounceBrent crude: +0.3% to US$68.83/barrelIron ore: +0.3% to $US97.85/tonneBitcoin: +1.8% to $US115,631