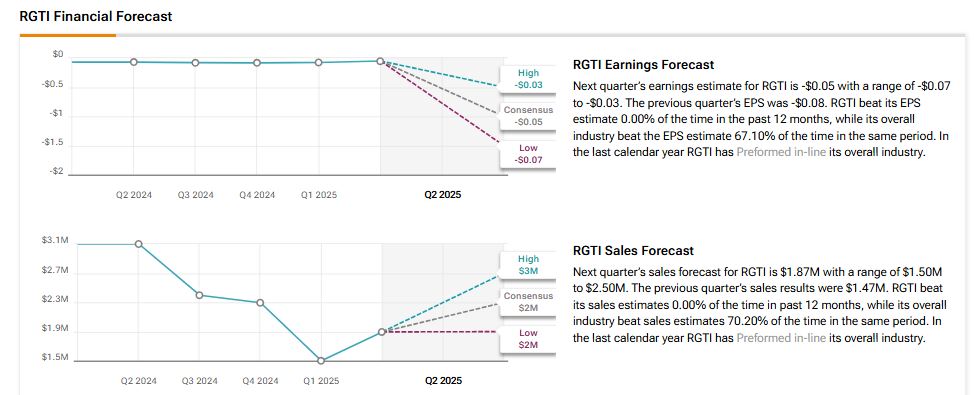

Quantum computing company Rigetti Computing (RGTI) is scheduled to report its results for the second quarter of 2025 after the market closes on Tuesday, August 12. RGTI stock has surged over 1,700% over the past year, driven by growing investor interest in next-gen computing. Wall Street analysts expect Rigetti to report a narrower loss per share of $0.05 in Q2 2025, compared to a loss of $0.07 in the prior-year quarter.

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the company’s revenue for Q2 2025 is expected to decline by about 39% year-over-year to $1.87 million. It’s worth noting that Rigetti has missed earnings estimates six times in the past nine quarters.

During the Q2 earnings call, investors will be watching Rigetti’s cash burn, progress in advancing its quantum computing technology, and any updates on commercial adoption timelines or new customer wins.

Analysts’ Views Ahead of Q2

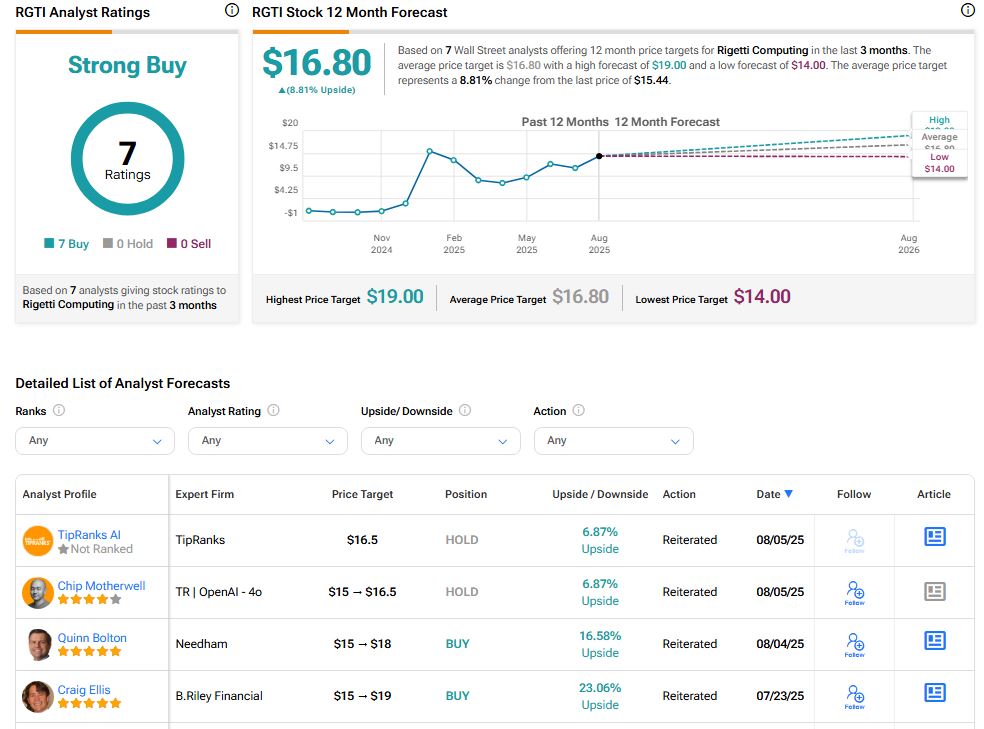

Heading into the Q2 print, Needham Top analyst N. Quinn Bolton reiterated a Buy rating on RGTI stock and raised the price target to $18 from $15, citing growing momentum in quantum tech. He believes new U.S. policy efforts, like the Quantum Leadership Act of 2025, could drive government funding higher and benefit companies like Rigetti.

Also, B. Riley analyst Craig Ellis recently raised his price target on Rigetti Computing to $19 from $15 and maintained a Buy rating. The 5-star analyst expects Q2 revenue and EPS to come in at $1.9 million and ($0.06), roughly in line with consensus.

Options Traders Anticipate a Large Move

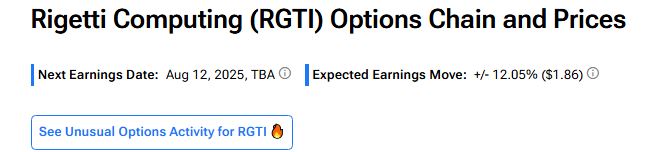

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 12.05% move in either direction.

Is RGTI Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on RGTI stock based on seven unanimous Buys assigned in the past three months, as indicated by the graphic below. The average RGTI stock price target is $16.80, implying upside potential of 8.81%.