Movements in Equity & Bond Indices

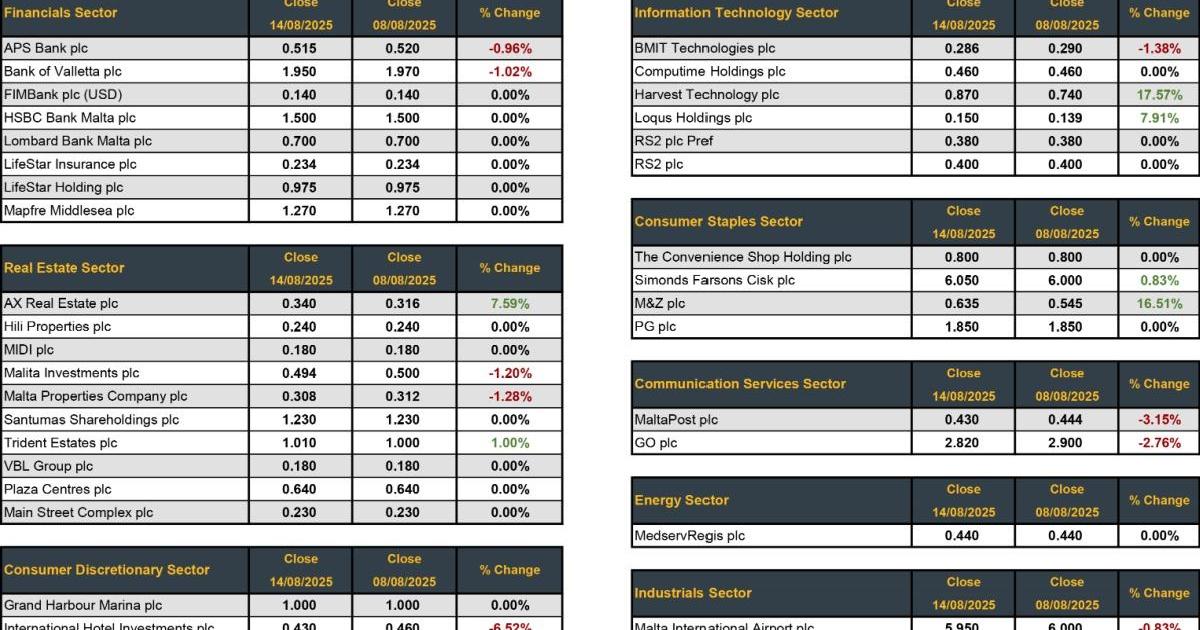

The MSE Equity Total Return Index (MSE) closed the week marginally higher by 0.12%, surpassing the 9,000 points level. A total of 20 equities were active, as six advanced and nine declined. In this shortened trading week, turnover fell to €0.6 million, down from €1.1m last week. Activity was dominated by the two largest banks, led by Bank of Valletta plc (BOV).

The MSE Corporate Bonds Total Return Index lost 0.3% to end the week at 1,166.61 points. A total of 65 issues were active, as turnover reached €1.8m across 185 transactions. The 3.8% Hili Finance Company plc Unsecured 2029 was the most traded bond issue, as turnover in the bond reached €0.2m. The bond closed the week at €96.25.

In the sovereign debt market, the MSE MGS Total Return Index eased slightly, closing at 964.13 points. Turnover totalled €3.5m across 69 transactions, with 26 issues active. Most of the activity was concentrated in a handful of short-dated issues.

Top market movements

In the banking sector, BOV shares declined by 1% to end the week at €1.95, after trading at a weekly low of €1.92 and a high of €1.97. Turnover reached nearly €0.4m, as 44 deals were executed.

Meanwhile, HSBC Bank Malta plc closed flat at €1.50, as 11 transactions worth €95,507 were recorded.

Likewise, Lombard Bank plc shares traded flat at €0.70, as one deal of 4,200 shares was executed.

APS Bank plc lost 1% to close at €0.515. During the week the equity traded between a weekly high of €0.53 and a low of €0.50. A total of 18 transactions worth €38,121 were recorded.

In the property sector, AX Real Estate plc shares jumped by 7.6%, as one deal of 5,000 shares was executed at €0.34.

On the other hand, Malta Properties Company plc shares declined by 1.3% to end the week at €0.308.

In the IT sector, Harvest Technology plc surged by 17.6%, or €0.13, as four transactions of 3,305 shares were executed. The equity closed the week at €0.87.

In the IT sector, Harvest Technology plc surged by 17.6%, or €0.13, as four transactions of 3,305 shares were executed

BMIT Technology plc shares declined by 1.4% to €0.286, on thin trading, while Loqus Holdings plc shares jumped by 8% to close at €0.15, on the back of positive preliminary unaudited half-yearly results.

Malta International Airport plc closed lower by 0.8% to finish at €5.95 after trading at a weekly high of €6. Seven transactions worth €38,622 were executed.

Company announcements

During the first six month of the year, Computime Holdings plc generated revenue of €11.6m at group level, an increase of 17% over the €9.9m reported in the same period last year. Operating profit rose 20% to €2.1m, while profit after tax for the group increased by 21% to €1.9m.

Recurring revenue increased to €8.8m, representing 76% of total revenue compared to 73% in the same period in 2024. The board will meet on October 8 to consider an interim dividend for the 2025 financial year.

In preliminary unaudited results published for the year ended June 30, 2025, Loqus Holdings plc reported a 9% increase in revenue. Growth was driven primarily by the continued expansion of the openFleet product line and the successful onboarding of a key strategic client, which contributed to a substantial uplift in recurring revenue. The latter accounts for 91% of total revenue. These developments resulted in a notable turnaround, with the group reporting a preliminary profit of €234,000 compared to a loss of €648,000 in the previous year.

The board of M&Z plc is scheduled to hold a meeting on August 26 to consider and approve the company’s unaudited financial statements for the six months ended June 30, 2025.

MIDI plc and International Hotel Investments plc announced that their respective boards are scheduled to meet on August 28, to consider and approve the interim unaudited financial statements for the six-month period ended June 30, 2025.

Meanwhile, the board of Trident Estates plc is scheduled to meet on September 10, to consider and approve the company’s condensed consolidated interim financial statements for the six months ended July 31, 2025.

This article, compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The company is licensed to conduct investment services by the MFSA and is a member of the Malta Stock Exchange and the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, tel: 2122 4410, or e-mail info@jesmondmizzi.com.