1h agoWed 20 Aug 2025 at 12:24amMarket snapshotASX 200: -0.2% to 8,877 points

Australian dollar: -0.1% at 64.5 US centsWall Street: Dow Jones (flat), S&P 500 (-0.6%), Nasdaq (-1.5%)Europe: FTSE (+0.3%), DAX (+0.5%), Stoxx 600 (+0.7%)Spot gold: flat at $US3,314/ounce Oil (Brent crude): +0.4% to $US66.05/barrel Iron ore: -0.8% to $US100.70/tonne Bitcoin: -2.6% to $US113,490

Prices current around 10:25am AEST

Live updates on the major ASX indices:

10m agoWed 20 Aug 2025 at 2:02am

CSL continues two-day roughly 20pc share price dive

CSL shares are off around 20% over the past two days, after investors reacted badly to a slightly disappointing profit result and the announcement of a major restructure and cost-cutting plan.

Around 11:30am, CSL was off a further 3% on yesterday’s close, having lost about 17% on Tuesday following its results announcement and analyst briefing.

A range of analysts have lowered their price target on the stock, among them Barrenjoey’s Saul Hadassin and Justin Raja, who now value the company at $258 a share, down from $310 previously.

“Adding to a complex FY25 result, the announcement of a major cost-out program albeit with reinvestment of up to 50% of savings, and a proposed de-merger of Seqirus, in our view clouds the earnings outlook over the next 2-3 years,” they wrote.

“All of this detracted from a robust operating flow cash performance.”

The analysts are also not fans of the proposed de-merger of CSL’s vaccine division, Seqirus, which is mainly focused on influenza vaccines.

“We struggle to see the strategic merit surrounding the demerger at this particular point in time, given: 1) uncertainty in the actual operating earnings of the Seqirus division (based on CSL’s change to reporting of segment profit); 2) noting no Australian or internationally listed pure-play influenza vaccine peers on which to base relative valuation.”

We are always told how much investors hate uncertainty, and CSL’s share price over the past two days seems to be proof of that.

It was trading around $219 about 90 minutes into today’s session, so still a fair bit below Barrenjoey’s revised target price.

26m agoWed 20 Aug 2025 at 1:46am

Calls to slash the diesel fuel subsidy

A report by think tank Climate Energy Finance has urged the federal government to reform the diesel fuel tax credits scheme.

Australia’s biggest miners, like BHP, Rio Tinto and Fortescue have collected $60 billion in diesel rebates since 2007.

Andrew Forrest’s Fortescue Metals has campaigned for the overhaul.

“Many miners want to make the shift, but the reality is the current system subsidises burning diesel,” said Fortescue chief executive Dino Otranto.

“The Fuel Tax Credit, in its current form, encourages fossil fuel use – so it’s no surprise companies keep burning it.”

Clean Energy Finance has released the report to coincide with the federal government’s productivity roundtable.

The think tank argues the rebate should be capped at $50 million and require any tax credits above that to be reinvested into clean diesel alternatives.

Clean Energy Finance founder Tim Buckley says the scheme is a regressive policy.

“Reforming the FTC into a decarbonisation incentive would not only cut emissions, it would drive the greening of the Australian mining industry – including underpinning capacity building of our workforce and even domestic battery manufacturing capacities – boosting productivity, bolstering energy security and aligning taxpayer spending with Australia’s climate, budget and economic resilience objectives.”

43m agoWed 20 Aug 2025 at 1:29amRetail Food Group looks to sell Brumby’s brand

Retail Food Group, which owns the Gloria Jeans, Donut King, Crust Gourmet Pizza Bars and Brumby’s Bakery brands has posted disappointing full year results.

The group posted a net loss of almost $15 million, down from a profit of $5.8 million the previous year.

This was due to a $12 million non-cash impairment of Brumby’s Bakery and provisions and impairments to restructure its corporate store division (costing $15.7 million).

CEO Matt Marshall says retails conditions have improved in the past quarter.

“…with the ongoing simplification of our brand portfolio and prioritisation of growth opportunities positioning the business for sustainable long-term performance,” he said.

The company says it is looking to offload the Brumby’s brand in the 2026 financial year.

Instead, it is focusing on launching a new brand called Firehouse Subs, with 165 outlets to open in the next 10 years.

44m agoWed 20 Aug 2025 at 1:28am

Hello

Hi there.

It’s Emily Stewart here and I’m taking over from David to bring you all the finance news for the rest of the day.

There’s quite a few profit results to dig into, central bank news from across the ditch and whatever else pops up!

Stay with me (and this cat).

Loading1h agoWed 20 Aug 2025 at 1:09amStockland shares jump to 17-year high

Australian real estate developer Stockland’s shares have surged after posting solid profits.

It posted a full year net profit of $826 million, up from $305 million last year.

Revenue was up almost 5 per cent to $3.1 billion in the year to June, largely driven by a boost in residential settlements and the increased value of the company’s investment properties.

The company declared a final dividend of 17.2 cents, bringing the total dividend to 25.2 cents per share.

Shares were up more than 8 per cent to $6.19, its highest level since 2008.

1h agoWed 20 Aug 2025 at 12:56amJames Hardie and CSL among worst-performing stocks

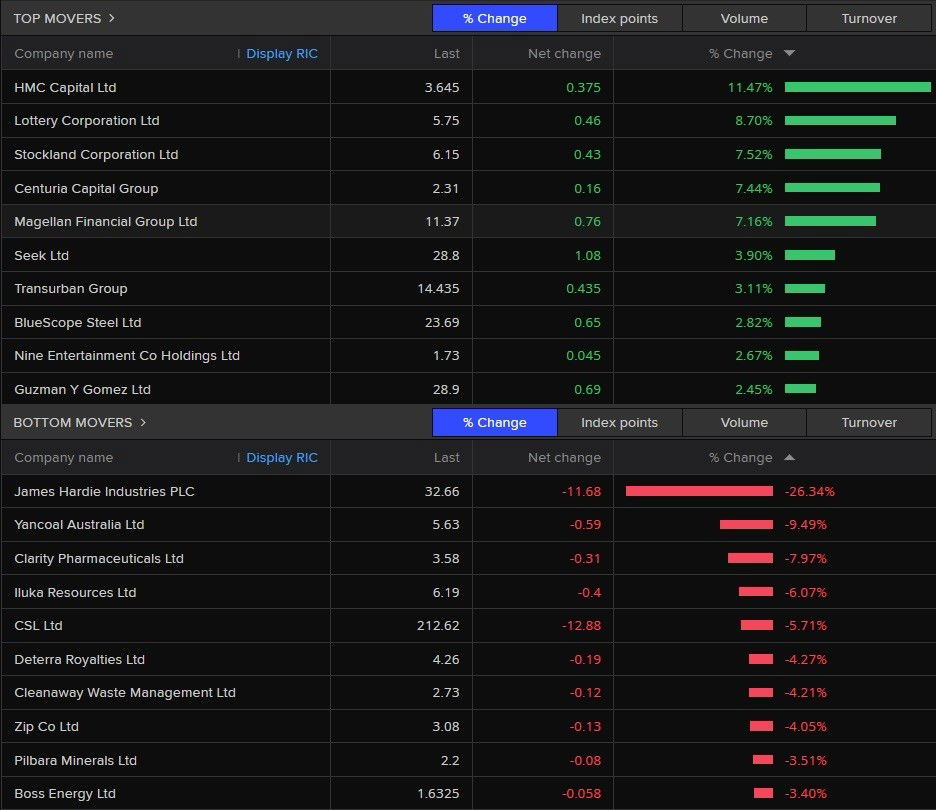

Now here are today’s best- and worst-performing stocks.

The ones that have made the biggest gains so far include HMC Capital (+11.5%), Stockland (+7.5%), Seek (+3.9%) and Transurban (+3.1%).

On the flip side, James Hardie shares plunged 26.3% after the company reported a major drop in full-year profit.

CSL is down another 5.7% (on top of yesterday’s 17% plunge) as profit result was considered “underwhelming”, along with its decision to sack 3,000 staff and spin-off its vaccine division into a separate company.

James Hardie is today’s worst performer by far. (Refinitiv)1h agoWed 20 Aug 2025 at 12:46amHealthcare and materials sectors drag ASX lower

James Hardie is today’s worst performer by far. (Refinitiv)1h agoWed 20 Aug 2025 at 12:46amHealthcare and materials sectors drag ASX lower

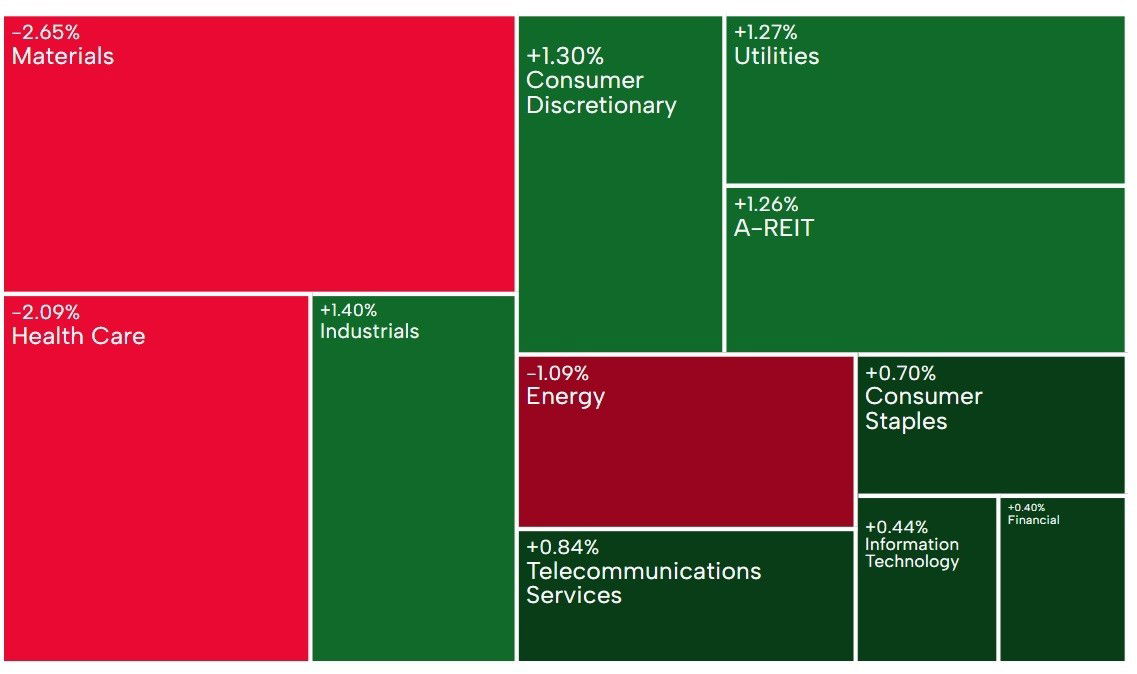

Most sectors are trading higher today despite the ASX 200 falling 0.2% in the first hour of trade.

However, some of the biggest companies on the Australian market are in the materials and healthcare sectors (and they’re both down).

So when they fall, there’s an outsized impact for the broader market:

Materials and healthcare sectors are down sharply. (ASX)1h agoWed 20 Aug 2025 at 12:32amASX falls 0.2 per cent in morning trade

Materials and healthcare sectors are down sharply. (ASX)1h agoWed 20 Aug 2025 at 12:32amASX falls 0.2 per cent in morning trade

Well, what do you know! The local share market has actually started its day lower.

The ASX 200 was down 0.2% to 8,878 points by around 10:30am AEST.

(That’s despite ASX futures — which help predict the direction of the market — pointing to a slight gain today. As you can see, it’s not always correct).

It looks like the ASX is following a weak lead from Wall Street, which was dragged down by a tech sell-off, which resulted in large falls in the share price of Nvidia, Microsoft, Amazon and others.

1h agoWed 20 Aug 2025 at 12:22amMonash IVF shares rise as investigation to remain concealed

Shares in fertility firm Monash IVF have risen 3.1 per cent in early trade.

The company has received an independent review into unrelated cases of embryo mix-ups in Brisbane and Melbourne but the contents will remain secret.

In an announcement to the ASX today, the fertility giant said the review, undertaken by barrister Fiona McLeod, would not be released publicly to protect the privacy of affected patients.

“Both cases involved non-standard IVF treatments and circumstances that would not arise in the vast majority of IVF procedures,” the statement read.

Read more on the details of the review from reporter Janelle Miles:

1h agoWed 20 Aug 2025 at 12:18amCoffee machine sales boost Breville’s profit

Breville Group has reported its full-year statutory profit rose 14.6% to nearly $136 million, driven by sales of coffee machines.

This boosted the company’s revenue by 11% to $1.7 billion.

It could possibly have something to do with the fact that people aren’t as willing to fork out $5 for a cup of coffee at the cafe each morning (and even more money if they drink several a day)!

“Coffee once again led performance across the portfolio,” Breville’s chief executive Jim Clayton said.

“After multiple years of macro uncertainty and post-COVID normalisation, BRG Group [Breville] returned to double-digit revenue growth in Global Products” across its American, emerging markets and Asia Pacific segments, he said.

As for what to expect in the current financial year, Mr Clayton expects Breville to weather the policy uncertainty caused by the Trump administration.

“For the Americas, FY26 is expected to be a year of countervailing forces: input cost inflation and an evolving US tariff policy against resilient top-line momentum buttressed by new products,” he said.

“Our strong balance sheet and unleveraged position gives us flexibility to react to challenges, so we are better placed than many, but FY26 is expected to be a dynamic year for the Americas.”

2h agoTue 19 Aug 2025 at 11:54pm

Alan Kohler’s finance report

In case you need a recap of what happened yesterday on markets, I can certainly recommend Alan Kohler’s finance report.

Alan goes into what caused the ASX to have its worst trading day in three weeks (and hint: a lot of it has to do with CSL’s rather “ordinary” profit result).

Loading…

2h agoTue 19 Aug 2025 at 11:43pm

Woodside CEO says east coast should follow WA’s lead in gas reservation policy

Energy prices are a key discussion point at the government’s economic reform roundtable this week.

Woodside Energy’s chief executive, Meg O’Neill, says: “The key to Australia’s prosperity historically has been affordable, reliable energy.”

Ms O’Neill says there’s a need for an east coast gas reservation and cites WA’s policy as one to replicate.

“I think there’s a great understanding that what works in WA could well work in the east coast if we have all the regulatory settings correct.”

She also says Woodwide remains locked in stalled negotiations with the federal government over a final agreement on the North West Shelf Project.

Woodside has seen its half-year profit fall 32% to $US1.3 billion despite a ramp-up in production. Falling commodity prices and rising costs had a significant impact on its earnings.

You can listen to the Woodside CEO’s interview with The Business host Alicia Barry here:

Loading…2h agoTue 19 Aug 2025 at 11:35pmCSL’s profit results were ‘underwhelming’, Morningstar analyst says

You may recall that CSL suffered its worst trading day on record when its shares plunged by almost 17% yesterday.

That’s despite the blood products and vaccine giant reporting a 14% rise in profit to a touch over $US3 billion.

The company also announced plans to split off its vaccine business, Seqirus, lay off about 3,000 workers, and close 26 plasma collection centres in the US.

Morningstar Australia’s equity market strategist, Lochlan Halloway, says CSL’s full-year results for the core blood plasma business were a little bit underwhelming — with the outlook for revenue and earnings growth weaker than expected.

Investors also have questions about how exactly its Seqirus demerger and massive cost-cutting plans will be implemented.

He spoke with The Business host Alicia Barry, and you can listen to his insights here:

Loading…

2h agoTue 19 Aug 2025 at 11:29pm

One quick way to boost Australian productivity? Abolish the states — analysis

That’s not quite what CEDA — the Committee for Economic Development of Australia — suggests, but it’s heading a small way down that road.

Its chief economist Cassandra Winzar is attending some of the federal government’s Economic Reform Roundtable, and CEDA has just put out a note titled “Towards a more seamless Australian economy”.

Its suggestions?

National occupation licensing to increase worker mobility and encourage the most productive businesses to expand;Harmonised and efficient environmental assessments to enable timely, environmentally responsible renewable energy development;Payroll tax harmonisation;Data sharing across jurisdictions by default to improve policy-making;More streamlined and consistent land-use regulation to tackle Australia’s housing shortage;Consistent regulations to enable a more circular economy; andNational care-worker screening to close gaps in safety checks and ease skills shortages.

In other words, lets get rid of a lot of state and local regulations that are often inconsistent across jurisdictions and replace them with national rules.

CEDA’s head of research Andrew Barker says the areas where this has already been done have delivered billions of dollars in benefits, such as an estimated $880 million a year from the national Australian Consumer Law.

To me at least, that does raise the question of why bother with state governments and boundaries at all?

They are arbitrary colonial lines and have resulted in duplication of administration and multiplication of laws.

It would do a lot of Australia’s politicians out of work, so it’s never likely to happen — it would be like turkeys voting for Thanksgiving — but surely we need to at least consider big reforms, even if they end up in much more modest compromise changes.

2h agoTue 19 Aug 2025 at 11:14pmProductivity summit turns to building homes, with warnings housing targets will not be met

Housing will dominate discussion at the Economic Reform Roundtable this morning, with ministers, business leaders and conservationists all under pressure to solve the wicked problem of building more homes without trashing the environment.

Productivity commissioner Danielle Wood, who will open the session, titled: Better Regulation and Approvals, is expected to explain to attendees that environmental approvals are one of the biggest handbrakes on housing.

In her speech to the National Press Club on Monday, Ms Wood warned “regulatory hair balls” had found their way into “almost every corner of our economy”. The result has included massive blowouts in approval times for housing and major infrastructure projects, and she argues it has hurt productivity.

The focus has again turned to aging environmental laws that both the former Morrison government and the Albanese government last term failed to reform.

You can read more about it here, in this article by Olivia Caisley:

3h agoTue 19 Aug 2025 at 10:51pmJames Hardie’s annual profit slumps 29 per cent

Fibre cement maker James Hardie has provided the market with an earnings forecast (for the current financial year) that’s below analyst expectations.

It says elevated borrowing costs in the US and President Trump’s tariffs are dampening housing market activity and demand for its products.

Here’s a closer look at its results from Reuters:

James Hardie forecast adjusted operating earnings between $US1.05 billion and $US1.15 billion for the fiscal year 2026, below the Visible Alpha consensus of $US1.23 billion.

It earned $US1.1 billion in fiscal 2025.

“Over the course of the summer, single-family new construction activity has been weaker than anticipated and we have adjusted our expectations to account for softer demand,” CEO Aaron Erter said in a statement.

“Homeowners are deferring large-ticket remodelling projects like re-siding, and affordability remains the key impediment to improvement in single-family new construction.”

The company’s sales in North America, accounting for nearly 75% of its topline, declined 12% to $US641.8 million in the quarter ended June 30.

As a result, the Dublin-headquartered firm’s adjusted net profit fell to $US126.9 million in the first quarter from $US177.6 million last year, missing the Visible Alpha estimate of $US158.5 million.

3h agoTue 19 Aug 2025 at 10:35pmSantos $36 billion takeover bid hits hurdles

Santos has announced a delay in the takeover bid that’s been led by Abu Dhabi’s national oil company.

The Australian oil and gas giant says the $36 billion deal will require at least four more weeks to finalise the terms, meaning it will miss this week’s deadline.

Our chief business correspondent Ian Verrender says the deal will need to be approved by the Treasurer, and it won’t be an easy decision to make given the transaction involves a foreign power taking control of Australia’s vital energy infrastructure.

Loading…3h agoTue 19 Aug 2025 at 10:16pmTrump slams court for blocking Resolution Copper land transfer, delaying Rio Tinto and BHP mine

US President Donald Trump blasted an appeal court’s decision to temporarily block federal officials from completing a land transfer needed for Rio Tinto and BHP to develop Arizona’s Resolution Copper project.

The San Francisco-based 9th US Circuit Court of Appeals ruled on Monday that the transfer – which had been slated for Tuesday – should be halted while the court weighs a request from the San Carlos Apache tribe to block the project for religious, cultural and environmental reasons.

The mine’s construction would cause a crater that would swallow a site where the Apache worship. That has fueled strong opposition from all but one of the state’s 22 Native American tribes, as well as the National Congress of American Indians.

It was the first time any court has ruled in favour of the Apache or their allies in more than five years of myriad legal manoeuvres against Resolution, slated to become one of the world’s largest supplies of a metal used to build nearly every electronic device.

Trump, in a post on his Truth Social platform, called the court a “radical left court” and said that those who oppose the mine “are Anti-American, and representing other copper competitive Countries.”

“It is so sad that Radical Left Activists can do this, and affect the lives of so many people,” Trump said in the post. “We can’t continue to allow this to happen to the U.S.A.!”

Trump did not outline any actions he plans to take to sway the court, but said that “our Country, quite simply, needs Copper — AND NOW!”

The court made clear it takes “no position on the merits” of the Apache’s arguments and would expedite its review. The court asked for filings to be submitted by October 14, but has not yet scheduled a hearing date. Ten of the appeal court’s 29 members were appointed by Trump.

Rio, which owns 55% of the project to BHP’s 45%, declined to comment on Trump’s post, but said it was “confident the court will ultimately affirm” the land transfer.

Trump’s post comes less than a month after he imposed a copper tariff on wiring and pipe, but not the copper concentrate produced by mines themselves, a levy falling far short of what the mining industry had expected. That will allow other countries to import copper into the U.S. without fear of tariff implications.

4h agoTue 19 Aug 2025 at 10:07pm

ACCC to investigate energy plans that promise savings but deliver poor value

The Australian Competition and Consumer Commission (ACCC) has announced it will investigate whether energy retailers are misleading consumers by advertising energy plans that promise savings yet actually provide poor value.

This investigation follows a formal complaint filed by the Australian Consumers’ Association (CHOICE), which raised concerns that many plans marketed as “savings” deals were far from the cheapest options available.

CHOICE’s complaint points to a major issue with how energy retailers advertise “savings” plans.

“In some instances, they were even more expensive than the retailer’s standing offer,” says Rosie Thomas, CHOICE director of campaigns and communications.

“Many consumers rely on these representations as indicators of value to inform their decision-making, but we found that many of these names and descriptions may not reflect genuine value.”

For more, here’s the story by Sohani Goonetillake:

ASX 200: -0.2% to 8,877 points

ASX 200: -0.2% to 8,877 points