Welcome to The Artsy Gallery Report 2025. Now in its second edition, the report highlights the galleries and dealers that have driven the most impact through online sales on Artsy this past year.

This year’s report features 40 Artsy partner galleries across four categories: large, mid-size, small, and secondary market, which were determined by factors including artists represented, physical locations, and art fair participation. We placed additional emphasis on smaller galleries this year, given their critical importance to the art ecosystem and the increasing collector demand for more accessibly priced works by emerging artists.

Amid persistent volatility in financial markets, the art world has faced headwinds in the past year. Nonetheless, online sales continue to be a bright spot for galleries. Artsy has seen growth in first-time purchasers on the platform throughout the year, especially for listings where works are available for instant purchase. The galleries featured in this report and beyond have succeeded by continuing to experiment and evolve their own practices and programs using Artsy’s tools.

Notably, many of these galleries listed more of their works with visible prices, or price ranges, than their peers. Doing so saves time, ensuring that galleries receive interest only from the most qualified potential buyers. Many have also expanded the variety of works that they offer on Artsy. Even the most prominent galleries often present works priced at three or low four figures in dollars to attract new clients who may grow into higher price brackets in the future.

Consistent and welcoming engagement remains the unifying factor driving success on Artsy for all of these galleries. They offer new works weekly. They respond to inquiries and orders in hours, if not minutes. They go out of their way to make potential clients they meet online feel just as valued as those who walk into their gallery or booth at a fair, asking questions and finding out what else the collectors might be interested in from their program. And they’re persistent: “You’d be amazed how many people ignore two emails, and then the third one, they go ‘oh, yeah, sorry, I’ve been meaning to reply to you,’” Baldwin founder Adam Baldwin noted in his gallery’s profile in the report.

Below, we share an abridged version of the report. Read the full analysis by downloading The Artsy Gallery Report 2025.

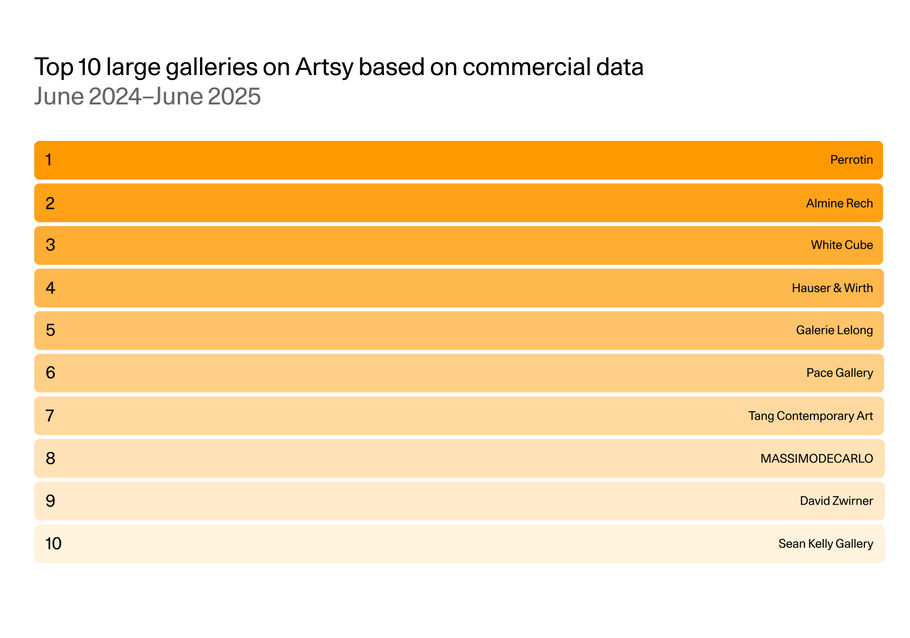

Large galleries

Here, we spotlight the top-performing large galleries on Artsy, based on our data on commercial interactions from June 2024 to June 2025.

The galleries in this section are among the most recognizable names in the art world. They have multiple physical locations, are regular participants at leading art fairs worldwide, and work with some of the world’s most renowned artists. That’s likely why the works they list for sale on Artsy are among the most coveted by collectors on the platform.

The galleries that make up our top 10 are some of the most prolific when it comes to uploading artworks to Artsy: Over the period analyzed, these galleries uploaded an average of 512 artworks.

These top-ranked galleries are also very responsive to potential buyers who contact them through Artsy. When it comes to inquiries—messages from potential buyers about works they’re interested in purchasing—these galleries have an above-average response rate and response speed compared to other large galleries. In fact, top-performing galleries of all sizes on Artsy respond at least 20% faster than their less successful peers.

Leading the rankings this year is Perrotin, which takes over the first-place slot from last year’s leader, Almine Rech. Founded in 1990 by Emmanuel Perrotin in Paris, the gallery has played a key role in supporting the careers of many influential contemporary artists, including Takashi Murakami, Maurizio Cattelan, and JR.

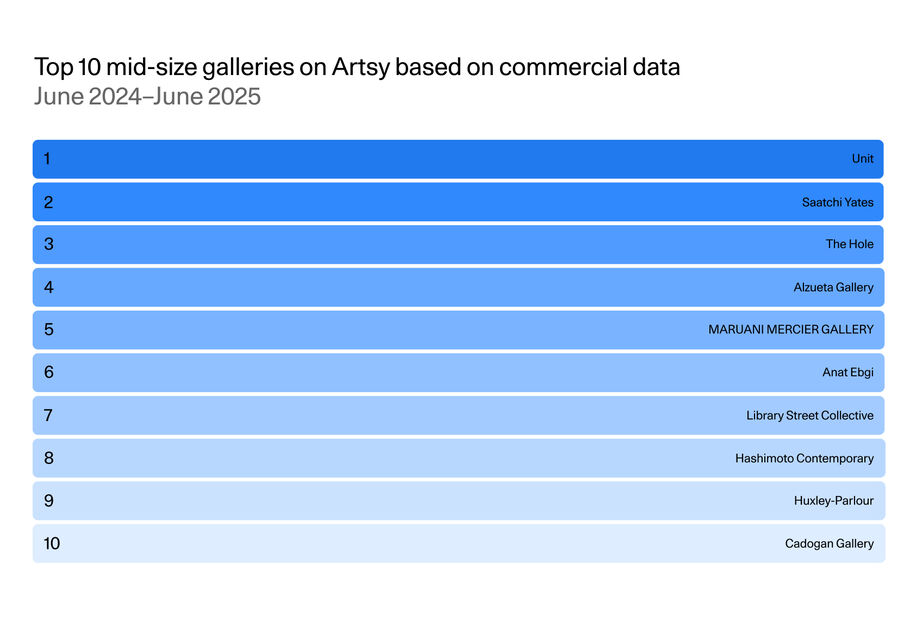

Mid-size galleries

Here, we focus on the top-performing mid-size galleries on Artsy, based on our data on commercial interactions from June 2024 to June 2025.

On Artsy, mid-size galleries are established players in the art world, positioned between the international blue-chip and smaller, independent segments of the market. They represent a sizable number of artists, are frequent attendees at international art fairs, and may have more than one physical location.

When it comes to their activity on Artsy, these galleries treat the platform as an extension of their physical spaces and share information about their current programs, such as artwork descriptions and artist bios, with ample context and detail. The galleries ranked here exemplify several of the best practices recommended for success on Artsy. For instance, they respond to inquiries often and quickly: The fastest gallery in this ranking replied with an average speed of two hours, while another top-responding gallery replied to 96% of its inquiries. (Artsy recommends responding to inquiries within 24 hours.)

Unit leads our rankings of mid-size galleries for the second consecutive year (last year, mid-size and small galleries were combined in a single category). Founded in 2013 by Joe Kennedy and his childhood friend Jonny Burt in a modest 300-square-foot pop‑up in West London, the gallery today is located in the heart of Mayfair, where it runs an active and dynamic program of emerging and mid-career artists.

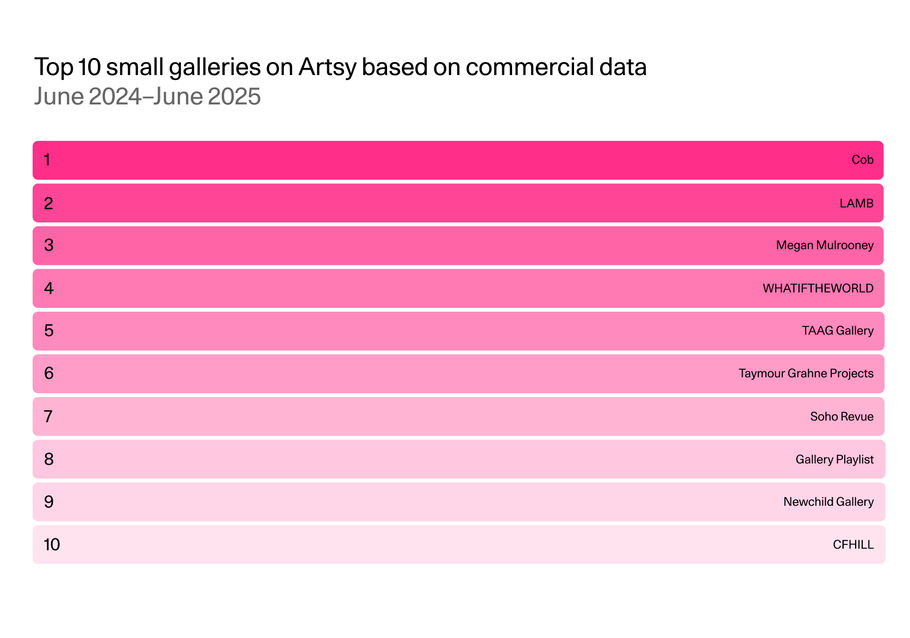

Small galleries

Here, we focus on the top-performing small galleries on Artsy, based on our data on commercial interactions from June 2024 to June 2025.

Small galleries are the bedrock of the contemporary art world. They play a crucial role in providing access to—and shaping the careers of—emerging artists, and help to provide everyone from potential collectors to institutions with new ways of engaging with art at its most cutting-edge. As such, these galleries are using Artsy to introduce their programs and artists to a wider audience, many of whom will be encountering them for the first time via the platform.

This gallery segment is highly focused on context and transparency. The galleries at the top of the rankings here provide ample information to help potential buyers. Biographies of their artists (including career data) help drive the likelihood of sales. Artist bios convey credibility, which is particularly important for emerging voices who lack the name recognition of their more established peers.

Topping the rankings this year is Cob. The London gallery consistently punches above its weight when it comes to tastemaking prowess and growing the careers of the artists that it shows. Founded in 2011 as an artist-led project space with adjacent studios, the gallery has remained steadfast in its commitment to emboldening and nurturing multidisciplinary emerging talent.

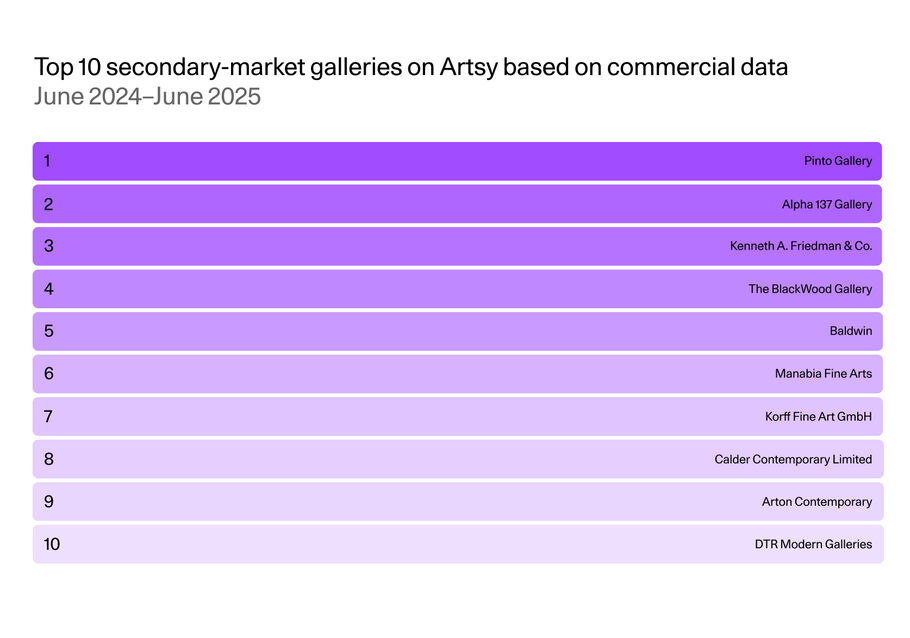

Secondary-market galleries

This section ranks the top-performing secondary-market galleries on Artsy, according to commercial activity from June 2024 to June 2025.

While these galleries may represent some artists on the primary market (works being sold for the first time), their businesses are heavily weighted towards the secondary market (the resale of works). Of all the categories, these galleries offer the broadest range of art, from artworks by the most recognizable artists of the past century to prints and editions. Many of these galleries have developed specific niches and specialties.

The secondary-market galleries that ranked at the top this year are utilizing Artsy to showcase their inventory in as much detail and depth as possible. Rather than being selective about listing works of a particular price point or area, these galleries list works across different categories and segments. They make use of shows and viewing rooms to highlight their inventory in different ways, creating online-only showcases of particular series or artists that are coveted by collectors.

Topping the list this year is new entrant Pinto Gallery. The digital-first gallery specializes in limited-edition prints and originals from leading Japanese artists as well as other in-demand names. Partly, it has succeeded by being flexible in meeting the demand for these names as it spikes and shifts, creating multiple entry points for collectors to access their artworks.

Methodology

This report seeks to provide an understanding of the art market dynamics online for different segments of the Artsy gallery ecosystem. To create this report, we analyzed commercial actions on artworks listed by Artsy gallery partners from June 2024 through June 2025. Commercial actions, including inquiries and e-commerce purchases, serve as indications of market interest and sales. We also looked at the galleries’ total gross merchandise value (GMV) on Artsy in our analysis of secondary-market galleries.

We divided galleries into four categories—large, mid-size, small, and secondary-market—through quantitative and qualitative factors, including but not limited to: number of artists the gallery represents, type of inventory, art fair presentations, physical gallery locations, and artwork value segments.

Arun Kakar

Arun Kakar is Artsy’s Art Market Editor.

Thumbnail: Heenang heesoo Kim, Untitled (Couple in Blue), 2025. Courtesy of the artist and Unit.