Aug 28, 2025

IndexBox has just published a new report: U.S. – Metal Complete And Assembled Domestic Furniture – Market Analysis, Forecast, Size, Trends and Insights.

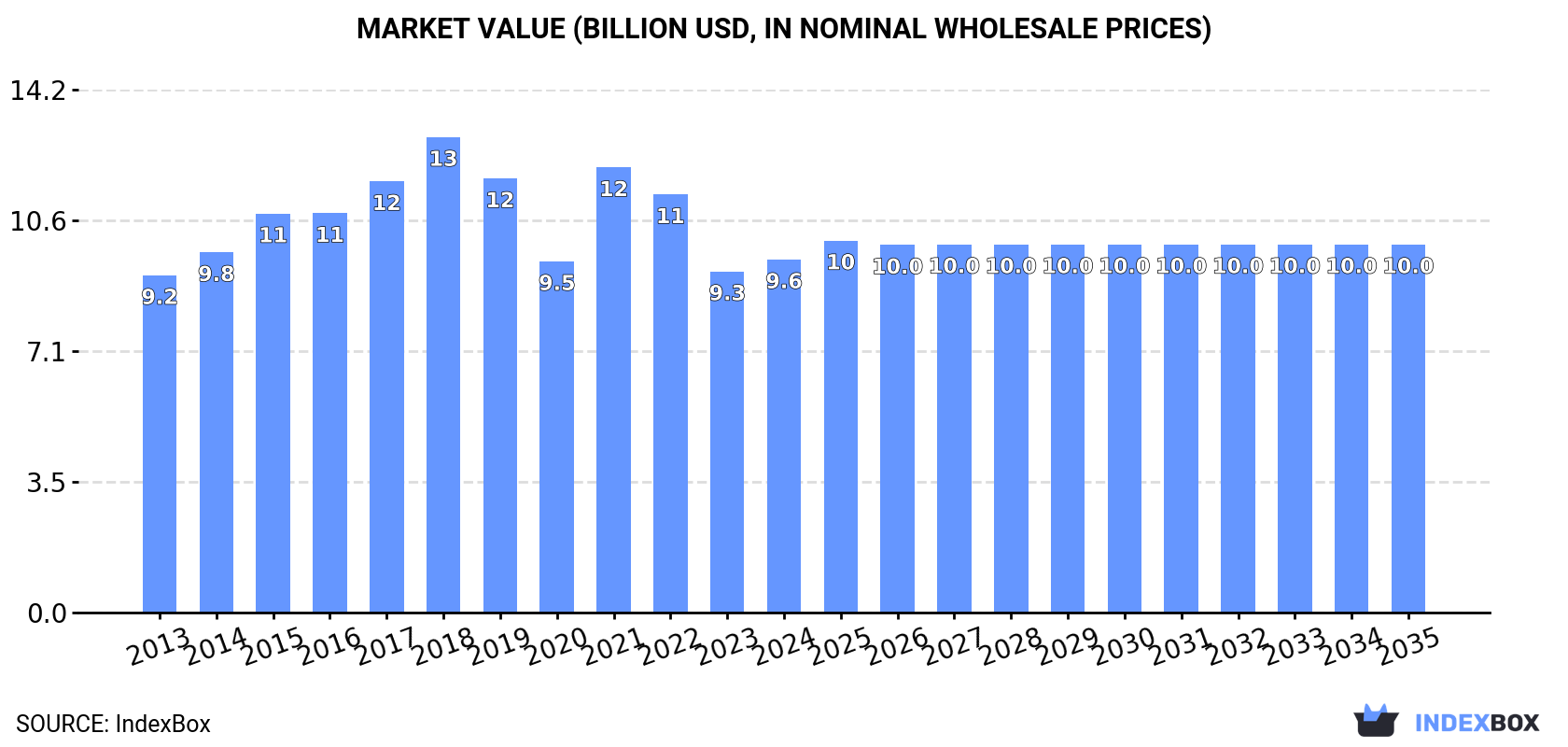

The metal furniture market in the United States is expected to see a steady increase in demand, with a forecasted CAGR of +0.2% in volume and +0.4% in value from 2024 to 2035. By the end of 2035, the market volume is projected to reach 3.1M tons and the market value is expected to reach $10B in nominal prices.

Market Forecast

Driven by increasing demand for metal furniture in the United States, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +0.2% for the period from 2024 to 2035, which is projected to bring the market volume to 3.1M tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +0.4% for the period from 2024 to 2035, which is projected to bring the market value to $10B (in nominal wholesale prices) by the end of 2035.

ConsumptionUnited States’s Consumption of Metal Domestic Furniture

ConsumptionUnited States’s Consumption of Metal Domestic Furniture

After two years of decline, consumption of metal furniture increased by 9.9% to 3M tons in 2024. Over the period under review, consumption posted a strong increase. Metal domestic furniture consumption peaked at 3.8M tons in 2021; however, from 2022 to 2024, consumption stood at a somewhat lower figure.

The size of the metal domestic furniture market in the United States expanded modestly to $9.6B in 2024, increasing by 3.5% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). In general, consumption saw a relatively flat trend pattern. Metal domestic furniture consumption peaked at $12.9B in 2018; however, from 2019 to 2024, consumption stood at a somewhat lower figure.

ProductionUnited States’s Production of Metal Domestic Furniture

In 2024, production of metal furniture in the United States expanded slightly to 111K tons, growing by 3.6% on the previous year. In general, production, however, continues to indicate a abrupt decrease. The most prominent rate of growth was recorded in 2022 when the production volume increased by 15%. Over the period under review, production hit record highs at 316K tons in 2014; however, from 2015 to 2024, production remained at a lower figure.

In value terms, metal domestic furniture production fell to $520M in 2024. Over the period under review, production, however, continues to indicate a drastic downturn. The pace of growth appeared the most rapid in 2022 when the production volume increased by 20% against the previous year. Over the period under review, production reached the peak level at $2.3B in 2018; however, from 2019 to 2024, production failed to regain momentum.

ImportsUnited States’s Imports of Metal Domestic Furniture

After two years of decline, supplies from abroad of metal furniture increased by 9.4% to 2.9M tons in 2024. Over the period under review, imports enjoyed a resilient expansion. The pace of growth was the most pronounced in 2020 with an increase of 45%. Over the period under review, imports attained the peak figure at 3.7M tons in 2021; however, from 2022 to 2024, imports failed to regain momentum.

In value terms, metal domestic furniture imports rose to $10.2B in 2024. The total import value increased at an average annual rate of +1.7% from 2013 to 2024; however, the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. The pace of growth was the most pronounced in 2021 with an increase of 26% against the previous year. As a result, imports attained the peak of $12.8B. From 2022 to 2024, the growth of imports remained at a lower figure.

Imports By Country

In 2024, China (2M tons) constituted the largest supplier of metal domestic furniture to the United States, accounting for a 68% share of total imports. Moreover, metal domestic furniture imports from China exceeded the figures recorded by the second-largest supplier, Vietnam (252K tons), eightfold. The third position in this ranking was taken by Mexico (188K tons), with a 6.4% share.

From 2013 to 2024, the average annual growth rate of volume from China totaled +5.5%. The remaining supplying countries recorded the following average annual rates of imports growth: Vietnam (+28.8% per year) and Mexico (+7.5% per year).

In value terms, China ($5B) constituted the largest supplier of metal furniture to the United States, comprising 49% of total imports. The second position in the ranking was held by Vietnam ($1.3B), with a 13% share of total imports. It was followed by Mexico, with a 9.2% share.

From 2013 to 2024, the average annual rate of growth in terms of value from China amounted to -1.9%. The remaining supplying countries recorded the following average annual rates of imports growth: Vietnam (+28.2% per year) and Mexico (+6.0% per year).

Import Prices By Country

In 2024, the average metal domestic furniture import price amounted to $3,453 per ton, dropping by -5.6% against the previous year. Over the period under review, the import price showed a perceptible downturn. The growth pace was the most rapid in 2022 when the average import price increased by 9.9% against the previous year. Over the period under review, average import prices hit record highs at $5,873 per ton in 2015; however, from 2016 to 2024, import prices failed to regain momentum.

There were significant differences in the average prices amongst the major supplying countries. In 2024, amid the top importers, the country with the highest price was Canada ($7,793 per ton), while the price for China ($2,475 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Canada (+2.8%), while the prices for the other major suppliers experienced a decline.

ExportsUnited States’s Exports of Metal Domestic Furniture

In 2024, the amount of metal furniture exported from the United States fell dramatically to 35K tons, waning by -30.8% against the year before. In general, exports showed a abrupt slump. The growth pace was the most rapid in 2023 when exports increased by 15% against the previous year. The exports peaked at 201K tons in 2014; however, from 2015 to 2024, the exports stood at a somewhat lower figure.

In value terms, metal domestic furniture exports dropped modestly to $1.1B in 2024. Over the period under review, exports continue to indicate a slight descent. The pace of growth was the most pronounced in 2021 with an increase of 13% against the previous year. The exports peaked at $1.3B in 2014; however, from 2015 to 2024, the exports failed to regain momentum.

Exports By Country

Mexico (11K tons), Canada (6.6K tons) and Costa Rica (1.5K tons) were the main destinations of metal domestic furniture exports from the United States, with a combined 54% share of total exports. The UK, China, Guatemala, the Dominican Republic, Germany, Jamaica, Panama, Japan, Australia and Saudi Arabia lagged somewhat behind, together accounting for a further 24%.

From 2013 to 2024, the biggest increases were recorded for Guatemala (with a CAGR of +3.8%), while shipments for the other leaders experienced more modest paces of growth.

In value terms, Canada ($562M) remains the key foreign market for metal furniture exports from the United States, comprising 51% of total exports. The second position in the ranking was taken by Mexico ($160M), with a 15% share of total exports. It was followed by the UK, with a 3.6% share.

From 2013 to 2024, the average annual rate of growth in terms of value to Canada was relatively modest. Exports to the other major destinations recorded the following average annual rates of exports growth: Mexico (+0.7% per year) and the UK (-3.2% per year).

Export Prices By Country

The average metal domestic furniture export price stood at $30,957 per ton in 2024, rising by 42% against the previous year. Over the period under review, the export price showed a resilient expansion. The most prominent rate of growth was recorded in 2020 an increase of 216% against the previous year. The export price peaked in 2024 and is likely to see gradual growth in the near future.

Prices varied noticeably by country of destination: amid the top suppliers, the country with the highest price was Canada ($85,148 per ton), while the average price for exports to Guatemala ($5,369 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was recorded for supplies to Canada (+26.0%), while the prices for the other major destinations experienced more modest paces of growth.