TL;DR: AI is the New Cloud — But Bigger and Faster

Artificial Intelligence is not just catching up to cloud computing — it’s about to blow past it at unprecedented speed. While cloud computing took over a decade to reach $750B in market size, AI is projected to hit $1.8T by 2030, representing growth rates that make even the cloud boom look conservative. This isn’t just another tech trend; it’s the defining infrastructure shift of the next decade.

The Numbers Tell an Incredible Story

AI Market Trajectory: Explosive and Accelerating

The AI market has reached an inflection point that dwarfs early cloud adoption curves:

Current State (2024-2025):

Market size: $233-638 billion (varies by methodology)

2025 projection: $294-757 billion

Growth rate: 19-35% CAGR through 2030

Future Projections:

2030: $826B – $1.8T depending on research firm

2034: $3.6T – $4.8T projected market size

Compound growth averaging 25-30% annually

The variance in AI market sizing reflects the challenge of defining “AI” — some studies include only pure AI software, while others encompass AI-enabled hardware, services, and adjacent technologies. But regardless of methodology, the growth trajectory is unmistakably explosive.

Cloud Computing: The Mature Powerhouse

Cloud computing, now in its mature growth phase, presents a different but equally compelling story:

Current State (2024-2025):

Market size: $676-912 billion (depending on public/private cloud scope)

2025 projection: $781B – $913B

Growth rate: 16-21% CAGR through 2030

Future Projections:

2030: $2.3T – $2.6T projected market size

2034: $5.1T projected market size

Compound growth stabilizing around 16-21% annually

Cloud has achieved the scale and predictability that enterprise infrastructure investors love — steady, massive, and essential.

The Growth Rate Differential: AI is 1.5-2x Faster

When you normalize for market maturity, the growth differential becomes striking:

AI Growth Characteristics:

Early Stage Acceleration: AI is where cloud was in 2015-2017

Funding Velocity: AI startups raised $25.2B in generative AI alone in 2023

Enterprise Adoption: 35% of businesses have integrated AI (vs 94% cloud adoption)

Valuation Premium: AI startups valued 60% higher than non-AI startups in B-series funding

Cloud Growth Characteristics:

Mature Market Dynamics: Predictable 16-21% growth with massive scale

Market Penetration: 94% of enterprises use cloud in some capacity

Infrastructure Lock-in: Multi-year contracts and switching costs create stability

Geographic Expansion: Growth driven by emerging market adoption

Market Size Context: Cloud’s Head Start vs AI’s Acceleration

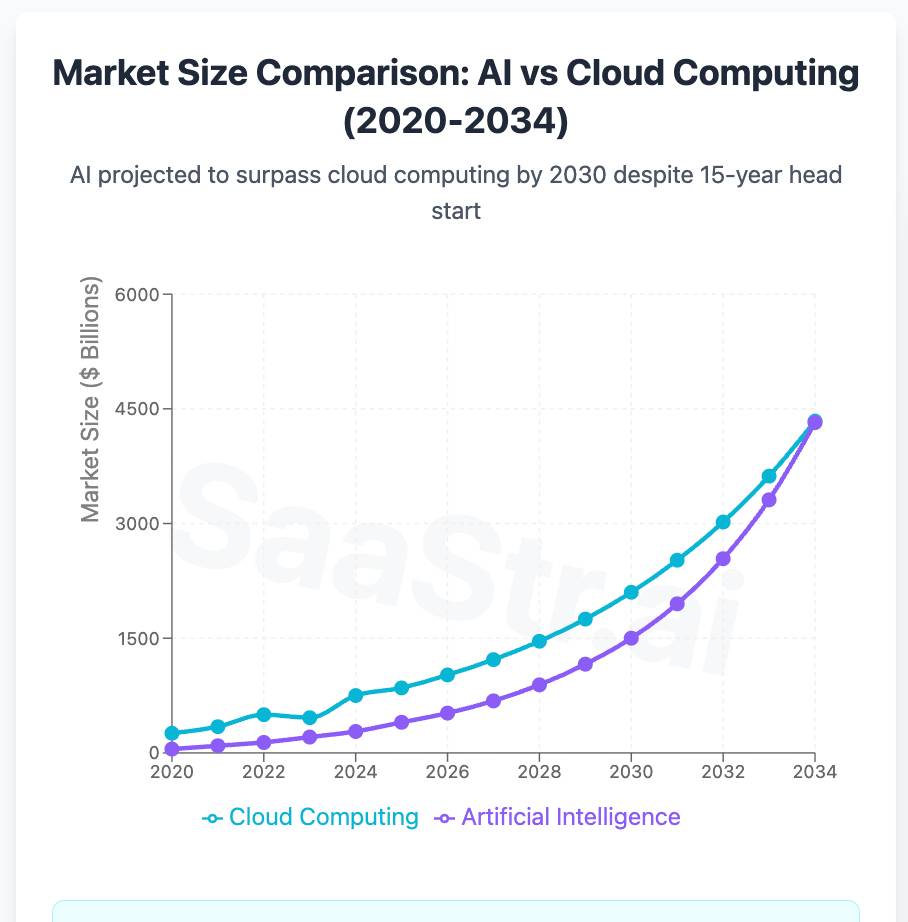

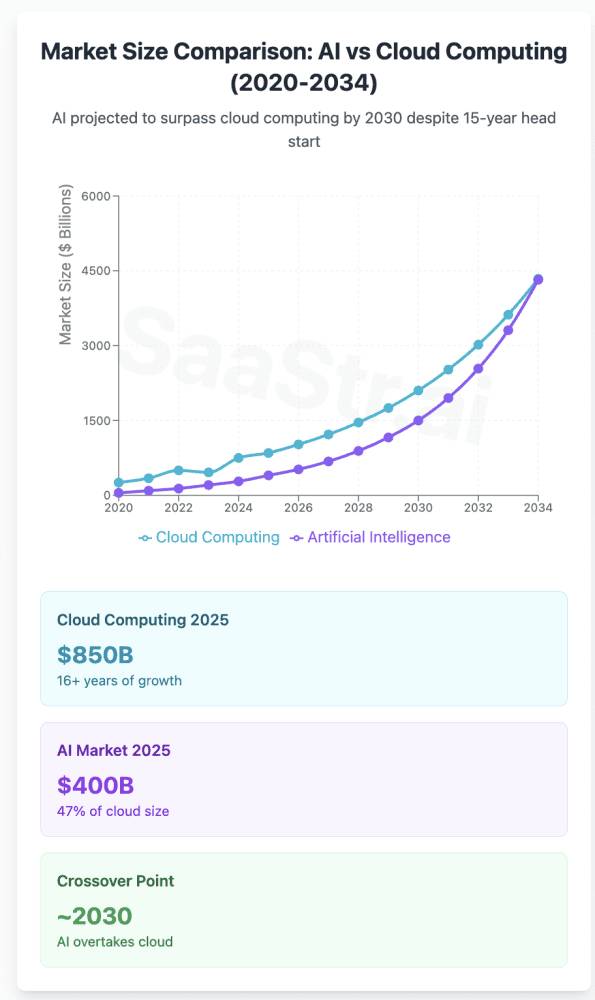

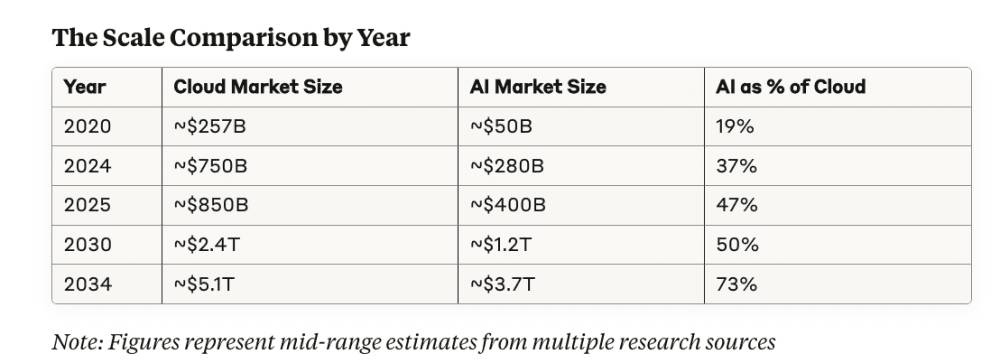

The Scale Comparison by Year

Note: Figures represent mid-range estimates from multiple research sources

This progression shows AI achieving market size parity with cloud by 2030 and potentially exceeding it by 2034 — a remarkable feat considering cloud’s 15-year head start.

Industry Adoption Patterns: Different But Complementary

AI Adoption Leaders

Financial Services: 20% of enterprise AI market by 2030

Retail & E-commerce: 33% of enterprise generative AI market

Healthcare: 21.3% CAGR — highest among all industries

Manufacturing: Predictive maintenance and quality control driving adoption

Cloud Adoption Maturity

IT & Telecommunications: Leading industry segment

BFSI: 17.1% of total cloud market share

Healthcare: 17.6% CAGR in cloud computing

SMEs: 21.7% CAGR — fastest growing segment

Geographic Battle Lines: US vs China Defines Both Markets

Both AI and cloud markets show similar geographic concentration patterns:

AI Geographic Dominance:

US & China: 60% of global AI patents

Top 100 AI R&D companies: 40% concentrated in US/China

North America: 29.5% market share, but Asia-Pacific growing fastest

Cloud Geographic Patterns:

North America: 39-52% market share (varies by segment)

Asia-Pacific: 22.1% CAGR through 2030 — fastest growing region

Europe: €201.86B market in 2025, growing to €428B by 2030

The Investment Flow Tells the Real Story

AI Investment Momentum

2023 Generative AI funding: $25.2B (8x increase from 2022)

Q1 2024 AI startup funding: $12.2B across 1,166 deals

Government commitments: Pentagon allocated $17.2B for AI/defense tech in 2025

Corporate investment: Microsoft $2.2B Malaysia cloud/AI investment

Cloud Investment Patterns

Infrastructure spend: $723B expected in 2025 public cloud spending

Enterprise spending: 21.5% increase YoY in cloud services

CapEx commitments: Amazon $30B in data center expansion

Market maturity: Predictable, massive, annuity-style revenue

Strategic Implications for SaaS Leaders

For Cloud-Native Companies

The AI acceleration doesn’t diminish cloud importance — it amplifies it. AI workloads are inherently cloud-native, requiring:

Massive compute scaling for training and inference

Data lake architectures for model training

Edge deployment for real-time AI applications

Multi-cloud strategies for AI model redundancy

For AI-First Startups

The growth rates are real, but so is the competition:

Talent premium: AI engineers command 2-3x typical software engineer salaries

Infrastructure costs: Model training costs can exceed $100M for frontier models

Regulatory uncertainty: AI safety regulations emerging globally

Market timing: Window for AI-first companies narrowing as incumbents adapt

For Enterprise Buyers

Both markets demand strategic thinking:

Cloud optimization: 30-47% cloud waste suggests need for FinOps discipline

AI ROI measurement: Early adopters seeing 12-15% operational cost reductions

Integration challenges: AI/cloud integration complexity requires new skillsets

Vendor strategy: Multi-cloud + multi-AI-provider strategies emerging

The Bottom Line: Symbiotic Growth, Not Competition

AI and cloud computing aren’t competing — they’re creating a virtuous cycle:

Cloud enables AI scale: Without cloud infrastructure, AI couldn’t achieve current growth rates. Every major AI breakthrough relies on cloud compute elasticity.

AI drives cloud demand: AI workloads are the primary driver of infrastructure demand growth, pushing cloud providers toward specialized AI chips, containers, and services.

Together they enable the next platform shift: The combination of ubiquitous cloud access and embedded AI capabilities is creating entirely new software categories and business models.

What This Means for Your 2025 Strategy

The data suggests three clear implications:

If you’re building on cloud: Double down on AI integration. The companies winning in 2030 will be those that built AI-native products on cloud infrastructure today.

If you’re building AI-first: Don’t underestimate infrastructure strategy. The cost and complexity of AI at scale demands sophisticated cloud architecture from day one.

If you’re buying both: Develop integrated procurement strategies. The vendors winning long-term contracts will be those offering seamless AI/cloud integration, not point solutions.

The race isn’t between AI and cloud — it’s toward the integrated AI/cloud platform that defines the next decade of enterprise software. The numbers suggest that platform will be massive, global, and fundamental to every business that wants to compete in the 2030s.

Analysis based on data from Fortune Business Insights, Precedence Research, Statista, Grand View Research, and other leading market research firms. Market size estimates vary by methodology and scope definition.