Markets surged late last week after Federal Reserve Chairman Jerome Powell suggested at Jackson Hole that the U.S. central bank may be ready to cut interest rates in September. Traders took it as a green light, while Goldman Sachs, J.P. Morgan, Barclays and others quickly pivoted their forecasts. The CME FedWatch tool now puts the odds of a September cut at nearly 90%.

I should point out, though, that the Fed isn’t preparing to cut because the economy is booming (which would be counterintuitive). It’s cutting because cracks are starting to appear in the foundation, particularly in the labor market. At the same time, Trump’s sweeping tariffs may be feeding inflation, making Powell’s job more political than ever.

This tug-of-war, between fiscal and monetary policy, gets to the heart of today’s investing landscape.

And nowhere are the consequences clearer, perhaps, than in housing and gold.

The Decline of Affordability in the U.S. Housing Market

If you ask Americans what the American Dream means, 75% will tell you it includes owning a home.

That’s according to a January survey by Realtor.com. But the data shows the dream is fading.

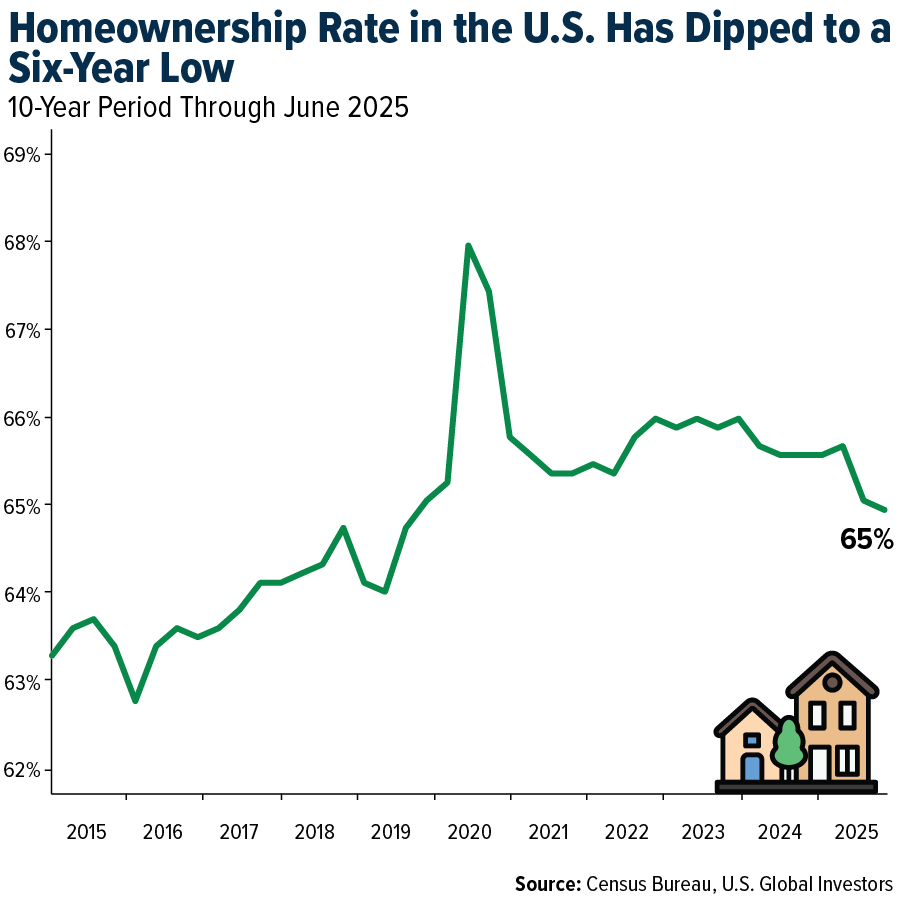

In the second quarter of this year, the homeownership rate fell to 65%, the lowest since 2019 and well below the 2004 peak of 69%. Affordability is at a multidecade low. The culprit? A perfect storm of high mortgage rates and home prices that, while off their June highs, are still out of reach for many Americans.

According to the Harvard Joint Center for Housing Studies, the annual income needed to afford payments on a median-priced home was $79,000 in 2021. By 2024, it had jumped to $127,000, representing a 60% increase in just three years. Median household income, meanwhile, barely budged.

Homebuying Costs Continue to Rise in the U.S.

2021

2023

2024

Interest Rate

2.96%

6.81%

6.72%

Median Home Price

$357,100

$394,100

$412,500

Median Household Income

$79,260

$77,540

$80,610

Required Annual Income

$79,330

$121,860

$126,670

Source: Joint Center for Housing Studies of Harvard University, Census Bureau, U.S. Global Investors

That gap may help explain why buyers are walking away. In July, nearly 60,000 home-purchase agreements were canceled—15% of all pending sales, the highest rate on record for July, according to Redfin. In U.S. Global Investors’ hometown of San Antonio, one in five buyers is walking away after signing a contract.

Renting Has Become the Cheaper Option in Most U.S. Cities

The pain doesn’t stop at mortgages. The average American is now paying nearly $2,800 per year for home insurance, up sharply as inflation, supply chain disruptions and extreme weather take their toll. In Nebraska and Oklahoma, where hail and volatile weather are common, premiums are nearly triple the national average.

The result is that for the first time in decades, renting is far cheaper than owning. In 49 out of 50 major U.S. metros, it costs more to buy than to rent, according to Bloomberg.

This flips the script of generational wealth-building. For much of U.S. history, owning a home was the surest way to grow wealth. Today, that pathway is being priced out of reach for younger families.

Powell Faces Pressure Between Jobs Weakness and Inflation Risk

All of this leaves Chair Powell in a bind. On one hand, the job market is softening, and there’s political pressure from the president to slash rates aggressively to 1%.

On the other hand, tariffs could create sticky inflation. Cut too soon, and the Fed risks stoking even higher prices. Wait too long, and layoffs spread.

Wall Street is split. Some analysts expect cuts in both September and December, whereas others warn that cutting now could be a “policy error.”

What’s clear is that the Fed is increasingly politicized, with central bank independence at risk. Powell has been publicly attacked by Trump, who has gone so far as to demand his resignation. The president also states that he is firing Federal Reserve Board Governor Lisa Cook due to alleged mortgage fraud.

On Thursday, Governor Cook filed a lawsuit against the administration.

Falling Rates Have Been Favorable for Gold Prices

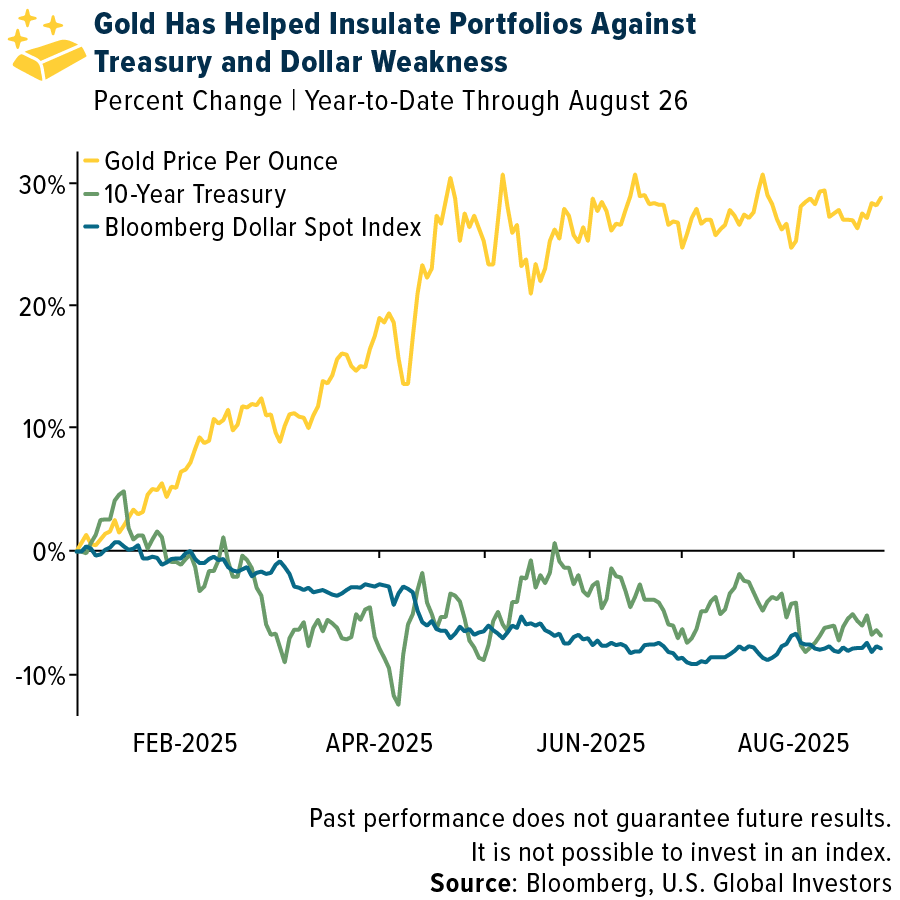

That brings us to gold, the asset investors have reached for in uncertain times.

Unlike a house, gold doesn’t generate rental income or dividends. But it does something just as valuable: It protects purchasing power, which has plummeted dramatically over the decades.

When interest rates have fallen, gold has historically shone brighter. Yields on savings accounts and bonds decline, making non-yielding assets like gold more attractive. At the same time, a weaker dollar raises the price of gold.

Gold is already up significantly this year, but the case for owning it hasn’t diminished. If anything, I believe it has strengthened.

Why Gold Remains a Core Asset in Uncertain Times

I’ll leave you with two insights.

Be cautious about assuming the Fed can “fix” the economy with rate cuts. Lower rates may offer some relief, but they can’t roll back tariffs or rebuild housing supply overnight.

And two, consider taking a serious look at gold and real assets as part of a diversified portfolio. I continue to recommend a 10% weighting in the yellow metal, with 5% in physical gold and the other 5% in high-quality gold mining stocks and ETFs. Rebalance on a regular basis.

I happen to believe that the American Dream is alive and well, but it’s being reshaped. For older generations, homeownership was the cornerstone of wealth. For younger Americans, that path appears to be narrowing. Meanwhile, the Fed is being pulled between inflation and politics, and the U.S. debt load is swelling.

As I often say, government policy is a precursor to change. Today’s policies—tariffs, deficits, politicized rate cuts—are pointing toward a future where gold is more than just a “barbarous relic.” It’s proven itself to be a core asset in uncertain times such as now.

To receive information on gold investment opportunities, send us an email to info@usfunds.com with the subject line GOLD.

Index Summary

The major market indices finished down this week. The Dow Jones Industrial Average lost 0.19%. The S&P 500 Stock Index fell 0.13%, while the Nasdaq Composite fell 0.19%. The Russell 2000 small capitalization index gained 0.17% this week.

The Hang Seng Composite lost 1.18% this week; while Taiwan was up 1.97% and the KOSPI rose 0.55%.

The 10-year Treasury bond yield fell 2 basis points to 4.227%.

Airlines and Shipping

Strengths

The best-performing airline stock of the week was Trip.com, up 13.6%. Boeing delivered 28 MAX aircraft so far this month, and with 14 currently in customer acceptance flights, August deliveries are expected to total in the high 30s to low 40s—potentially the strongest August since 2018, according to Bank of America.

Crude tanker ton-mile demand has grown 6% year-over-year in August, supported by rising OPEC output and strong Chinese inventory restocking. VLCC spot rates have surged to $50,000 per day following tighter U.S. sanctions on Iran, according to Bank of America.

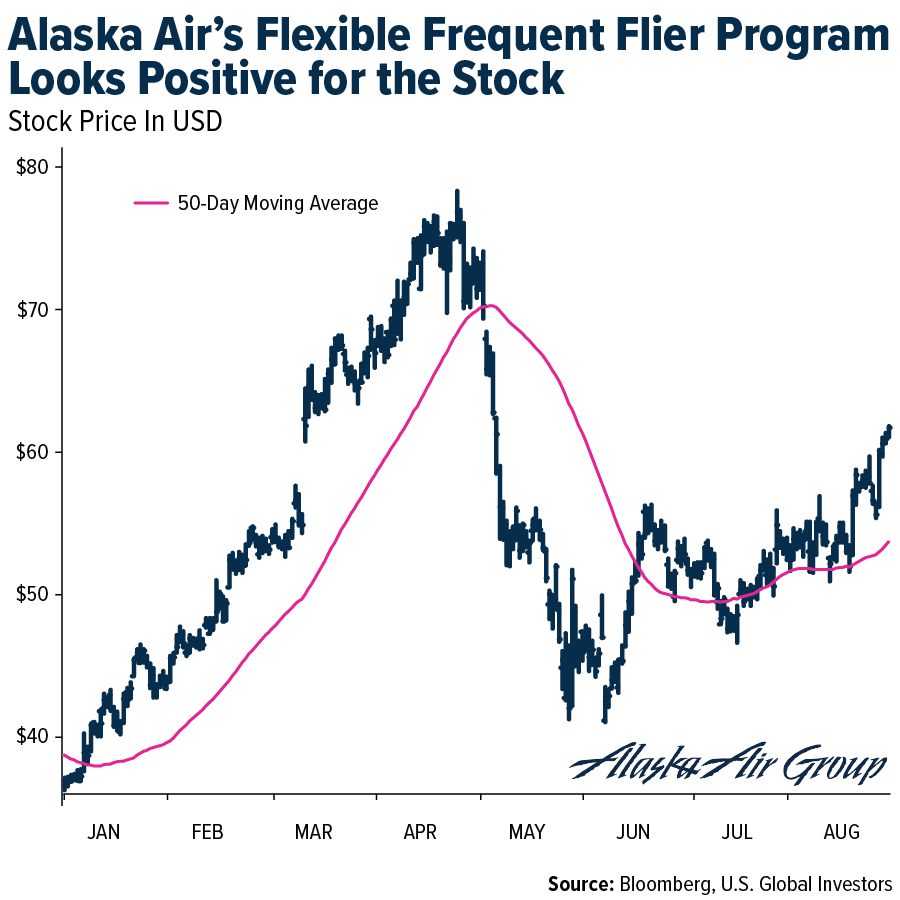

Alaska Under, the new Alaska Air loyalty program, allows members to earn points based on flight distance; five points per dollar spent on tickets, or a flat 500 points per flight segment, according to Morgan Stanley.

Weaknesses

The worst-performing airline stock of the week was Ryanair, down 4.9%. U.S. Bank can now withhold 25% of Spirit’s credit card sales to build its holdback. The payment processing contract was extended by two years. As a result, Spirit may burn enough cash to fall below covenant levels by year-end.

Ocean container rates fell 10% sequentially and remain under significant year-over-year pressure, down 76%. The decline is driven by disruptions in trade flows stemming from tariff policies, with the ongoing trade war and uncertainty prompting a “wait-and-see” approach among shippers, buyers, and cargo owners, according to Goldman Sachs.

Air New Zealand issued first-half 2026 profit-before-tax guidance of at or below $34 million, citing higher aviation charges, subdued domestic demand, limited capacity growth (2–4%, with 1–2% domestic and 3–4% international), ongoing aircraft availability issues, and flat fuel costs, according to UBS.

Opportunities

According to JP Morgan, Copa is expected to deliver a cash flow yield of 8% in the second half of 2025 and 12% in 2026. This should support a 6.5% dividend yield next year, along with a $200 million buyback program, half of which has already been executed, implying an additional 2% yield if completed.

NHK reports that Japan’s Ministry of Land, Infrastructure, Transport and Tourism will prioritize shipbuilding in next year’s budget request, due by the end of August. The plan includes support for domestic shipyard expansion and automation, aligning with Japan-U.S. economic security talks, according to Goldman.

Southwest flies to a limited number of international destinations and has not announced new routes. The airline cited dependencies such as pilot and flight attendant contract changes, according to Morgan Stanley.

Threats

Following recent amendments to the Card Processor Agreement, Raymond James estimates Spirit is on track to reach a 100% credit card holdback by year-end 2025. However, monthly cash burn is expected to rise by an additional $90 million until then. They also estimate Spirit will hit its $450 million minimum liquidity covenant by early December.

Recent Houthi attacks have reduced Red Sea transits to just 17% of normal levels, with bulkers and tankers seeing the sharpest declines. Bank of America expects the Red Sea to remain effectively closed through at least the first half of 2026.

More domestic capacity reductions are underway, according to Bank of America. American Airlines led the cuts, lowering fourth-quarter 2025 domestic growth from 6.8% to 5.5% by trimming both November and December schedules. Total scheduled domestic growth is now revised down from 2.9% to 2.6%.

Luxury Goods and International Markets

Strengths

The U.S. economy demonstrated resilience with a revised GDP growth rate of 3.3% in the second quarter, well above earlier estimates. This upward revision reflects stronger consumer spending and business investment than anticipated, signaling robust underlying economic momentum.

Pernod Ricard, the French spirits group behind Absolut vodka and Jameson whiskey, reported strong quarterly results, supported by resilient demand for its premium brands. The company’s strategy of focusing on higher-quality spirits is paying off, with growth led by categories such as whiskey, cognac, and tequila.

Chow Sang Sang Holdings, a Hong Kong jewelry retailer, was the top performer in the S&P Global Luxury Index, surging 14.51%. Shares rose this week after the company reported strong first-half profit growth, raised its dividend, and reassured investors with cost-cutting measures and margin improvements.

Weaknesses

Tesla’s sales dropped 40% across Europe in July compared to a year earlier, losing market share to competitors. The company sold 8,837 cars in the EU last month, down from 14,769 in July 2024. Meanwhile, BYD’s European sales rose to 13,503, up from 4,151 a year earlier.

U.S. luxury stocks have outperformed their European counterparts so far this year, highlighting a clear regional divide in market sentiment and growth. While European brands like Burberry and Watches of Switzerland have faced weak consumer spending and macroeconomic headwinds, American names such as Ralph Lauren and Tapestry have shown strong momentum.

SJM Holdings, a casino operator in Hong Kong, was the worst-performing stock in the S&P Global Luxury Index, falling 11.1%. Shares dropped this week as investors reacted to its disappointing second-quarter and first-half results.

Opportunities

Tesla has officially launched the Cybertruck in South Korea, allowing existing reservation holders to confirm orders from August 29 to September 4. New orders will open on September 5, 2025. This marks the first time the Cybertruck is officially available outside North America, making South Korea the first international market to receive the electric pickup following its release in the U.S., Canada, and Mexico.

PVH Corp., the parent company of Calvin Klein and Tommy Hilfiger, raised its full-year revenue guidance after reporting stronger-than-expected sales. The company cited resilient consumer demand in both North America and Europe, with premium categories showing steady growth despite global economic uncertainty.

Williams-Sonoma posted solid quarterly results, demonstrating resilience despite rising tariffs on imported goods. The home furnishings retailer reported steady sales growth and strong profitability, with management noting that disciplined sourcing, supply chain efficiencies, and a focus on premium products have helped preserve margins.

Threats

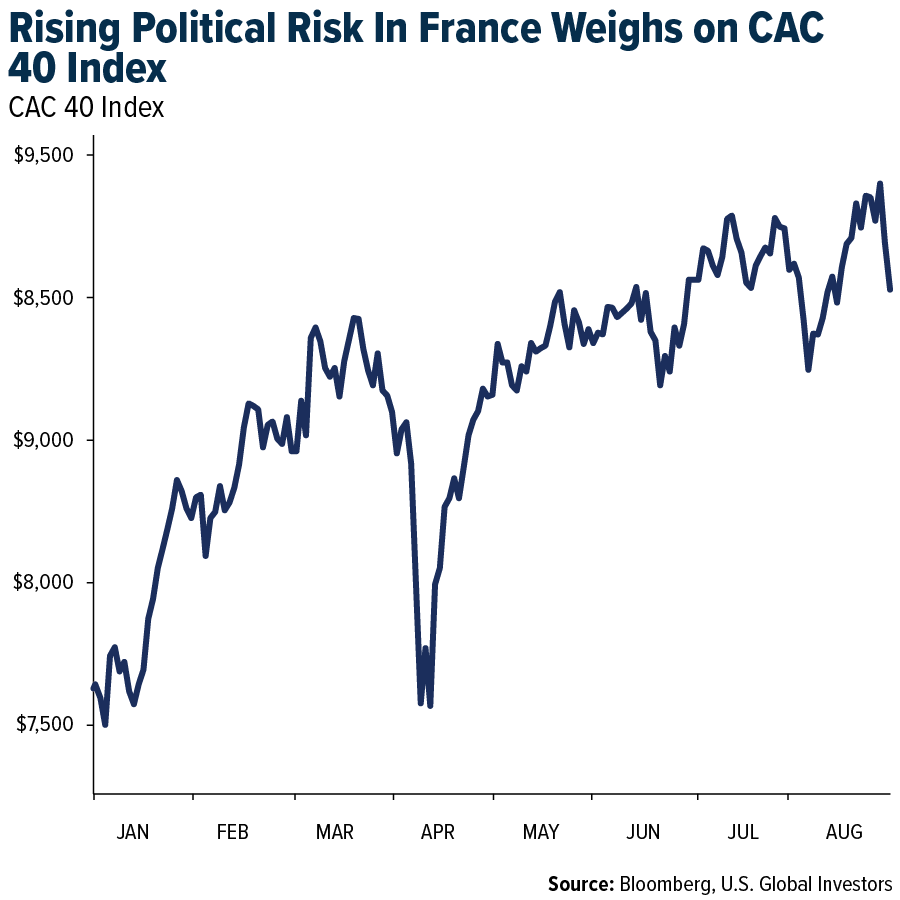

Political uncertainty in France, triggered by the announcement of a snap confidence vote scheduled for September 8, 2025, is raising concerns about pressure on the Paris stock exchange, where many luxury stocks are listed. Prime Minister François Bayrou called the vote in an effort to pass a €44 billion austerity plan not supported by opposition parties. The threat of a government collapse could weigh on investor sentiment and the performance of luxury equities.

Next week, China will stage a major military parade in Beijing on September 3 to commemorate the 80th anniversary of Japan’s surrender in World War II. The parade will be attended by Russian President Vladimir Putin and North Korean leader Kim Jong Un, signaling unity with China. It marks Kim’s first major international appearance in years and highlights growing ties among the three leaders amid rising geopolitical tensions with the West.

Tariff uncertainty under President Trump has led even wealthy consumers to delay purchases, putting pressure on luxury automakers like Lamborghini. The company currently faces steep 27.5% import duties on U.S. sales, making its high-priced vehicles more vulnerable to price sensitivity. Lamborghinis cannot be manufactured in the U.S., as the “Made in Italy” promise remains central to the brand’s identity.

Energy and Natural Resources

Strengths

The best-performing commodity for the week was natural gas, rising 6.XX%. The primary catalyst for this price increase was the latest U.S. Energy Information Administration (EIA) weekly storage report. Released on Thursday, the report showed a smaller-than-expected injection of natural gas into storage. This tighter supply eased concerns about a potential oversupply, which had contributed to price declines in previous months.

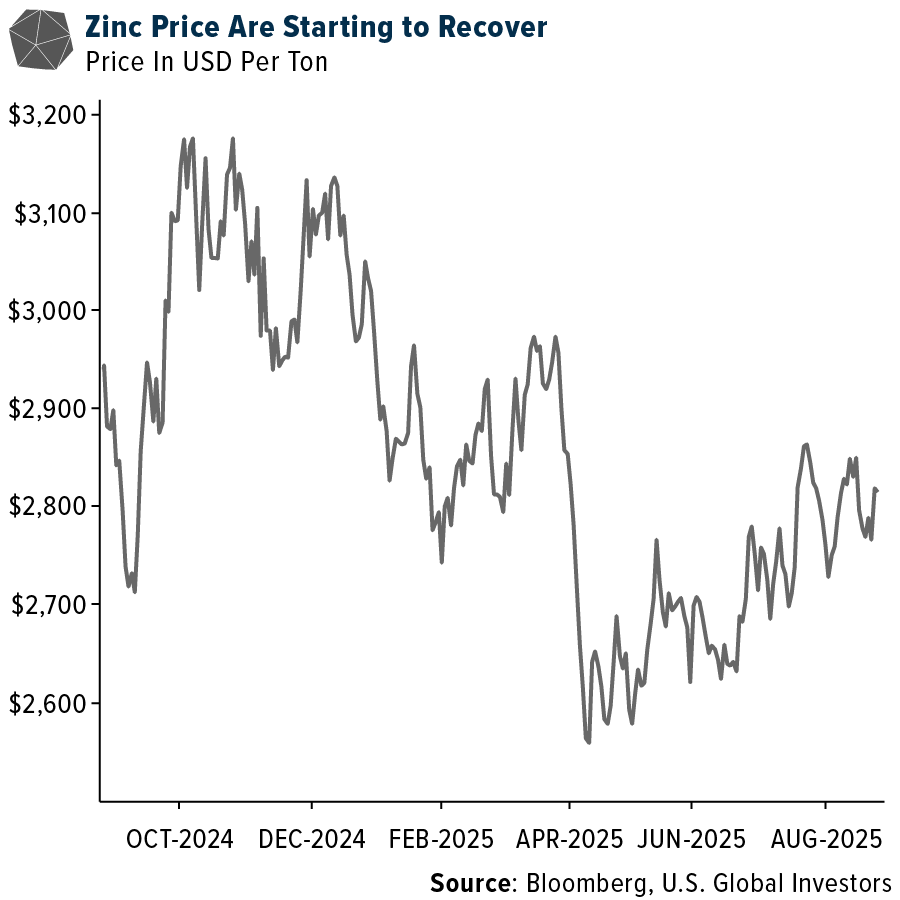

The zinc market has been very tight in recent years, as reflected by persistent inventory declines to multi-year lows. These shortfalls have been largely driven by limited mine supply growth, leading to a sharp drop in treatment charges. In addition to subdued upstream expansion, a lack of concentrates, exacerbated by record feedstock imports from Chinese smelters, has strained

First Quantum Minerals Ltd. has shelved plans to sell minority stakes in its Zambian copper mines after a $1 billion gold-streaming deal eased balance sheet pressures. Early last year, the company said it was considering selling minority interests in its Kansanshi and Sentinel operations in Zambia, following the forced shutdown of its flagship Panama mine in late 2023, according to Bloomberg.

Weaknesses

The worst-performing commodity for the week was China lithium carbonate 99.5%, which dropped 4.XX%. Emirates Global Aluminum ended all bauxite mining operations in Guinea after the Guinean government transferred its mining license to a newly created state-owned firm, following a dispute over EGA’s failure to build an alumina refinery.

China’s imports of liquefied natural gas are set to decline for a 10th consecutive month on a year-over-year basis, according to data from Kpler, due to strong piped supply and increased domestic output. August deliveries are expected to total around 5.93 million tons—approximately 9% lower than a year ago, based on official volumes.

U.S. steel prices declined through July and August and remain under pressure as new capacity ramps up, including from Steel Dynamics and U.S. Steel. Demand indicators are soft, reflected in short mill lead times. While Section 232 tariffs limit import flows, feedback suggests buyers remain cautious amid weak demand prospects, according to Bank of America.

Opportunities

Abaxx Technologies Inc. (NEOE: ABXX) just posted its biggest trading day, with over 2,379 gold lots and 453 LNG lots traded—worth about $309 million notional. The milestone highlights Abaxx’s growing liquidity in both metals and energy markets.

Copper and potash are among six new additions proposed for the U.S. Geological Survey’s 2025 draft list of 54 critical minerals, alongside lead, rhenium, silicon, and silver. The move aims to pave the way for broader policy support.

Fortescue’s metals CEO sees China’s major infrastructure projects as a bullish signal for iron ore, despite ongoing real estate woes. He cited the $167 billion Yarlung Tsangpo hydropower project and rapid high-speed rail expansion as key drivers, according to Dow Jones.

Threats

Soaring utility bills across PJM’s 13-state grid are becoming a political flashpoint, especially in battleground states where AI data center demand is straining outdated transmission infrastructure. With prices at record highs despite cost-cutting promises, energy policy is emerging as a key issue ahead of critical gubernatorial and congressional races. New U.S. policies restricting permits for solar and wind projects may limit consumer access to cheaper electricity.

Pakistan plans to ask Qatar to delay liquefied natural gas deliveries over the next five years, as the country struggles with weak demand and rising import costs. Officials are in Qatar this week seeking to postpone two LNG shipments per month in 2026, according to sources familiar with the matter.

China’s Ministry of Industry and Information Technology issued new regulations Friday, imposing output controls on rare-earth mining and smelting, and requiring companies to track and report product flows. China, which supplies about two-thirds of global rare-earth minerals and processes around 90%, continues to wield its dominance as a key leverage point in trade talks with the U.S.

Bitcoin and Digital Assets

Strengths

Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Cronos, rising 89.32%.

BitMine Immersion Technologies increased its crypto and cash holdings by $2.2 billion to $8.8 billion over the past week, adding more than 190,500 tokens—growing from 1.52 million to 1.71 million—according to Bloomberg.

The CFTC has issued guidance allowing offshore crypto exchanges to legally reenter the U.S. market by registering as foreign boards of trade, provided their home regulators meet U.S. standards. This could pave the way for firms like Binance to compete directly with Coinbase and Kraken, potentially shaking up the U.S. crypto landscape.

Weaknesses

Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was SPX6900, down 22.15%.

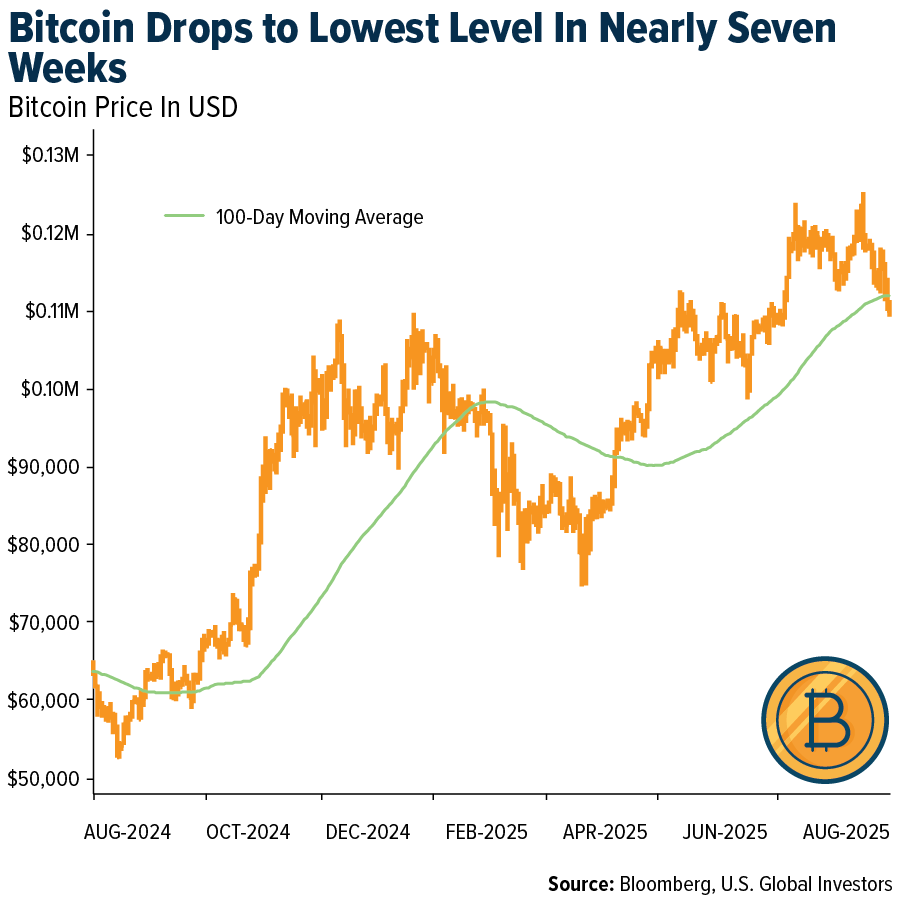

Bitcoin traded near its lowest level in nearly seven weeks after retreating from the record high set in mid-August. The decline comes as Ether is gaining momentum, with the token hitting an all time high of $4,955 on Sunday, writes Bloomberg.

Australia just ordered Binance’s local arm to bring in an outside auditor after regulators flagged “serious concerns” about money-laundering and terrorism-financing controls, pointing to high staff turnover, weak oversight and potentially poor resourcing at the exchange.

Opportunities

Galaxy Digital, Multicoin Capital, and Jump Crypto are in talks with potential backers to raise approximately $1 billion to accumulate Solana. The firms plan to form a digital asset treasury company by acquiring an undisclosed publicly traded entity, with Cantor Fitzgerald LP serving as lead banker, according to Bloomberg.

Trump Media & Technology Group Corp and Crypto.com have reached a deal with Yorkville Acquisition Corp to establish a crypto treasury company focused on acquiring and holding CRO tokens. The company will raise capital to purchase cryptocurrencies, and shares held by Trump Media, Crypto.com, and Yorkville will be subject to a mandatory one-year lock-up period, Bloomberg reports.

The Commerce Department will begin publishing its economic statistics on the blockchain, Secretary Howard Lutnick announced. “We are going to put out GDP on the blockchain so people can use the blockchain for data distribution,” Lutnick said during President Trump’s cabinet meeting, according to Bloomberg.

Threats

Bitpanda has ruled out a London listing due to low share-trading liquidity, according to the Financial Times. Co-founder Eric Demuth also cited the UK’s relative market immaturity and the company’s stronger revenue base in Europe, Bloomberg reports.

France’s finance ministry has asked Électricité de France to pause bitcoin miner MARA’s planned majority acquisition of its Exaion unit over sovereignty concerns, Agence France-Presse reports. While Exaion isn’t classified as strategic, it develops technologies that could be highly important in the future, Bloomberg notes.

A coalition of 112 crypto firms, investors, and advocacy groups, led by the DeFi Education Fund, warned Senate committees that they won’t back new market-structure legislation unless it clearly protects developers and non-custodial services from being labeled intermediaries. Signers include Coinbase, Kraken, Ripple, a16z, Uniswap Labs, and major U.S. crypto lobbies.

Defense and Cybersecurity

Strengths

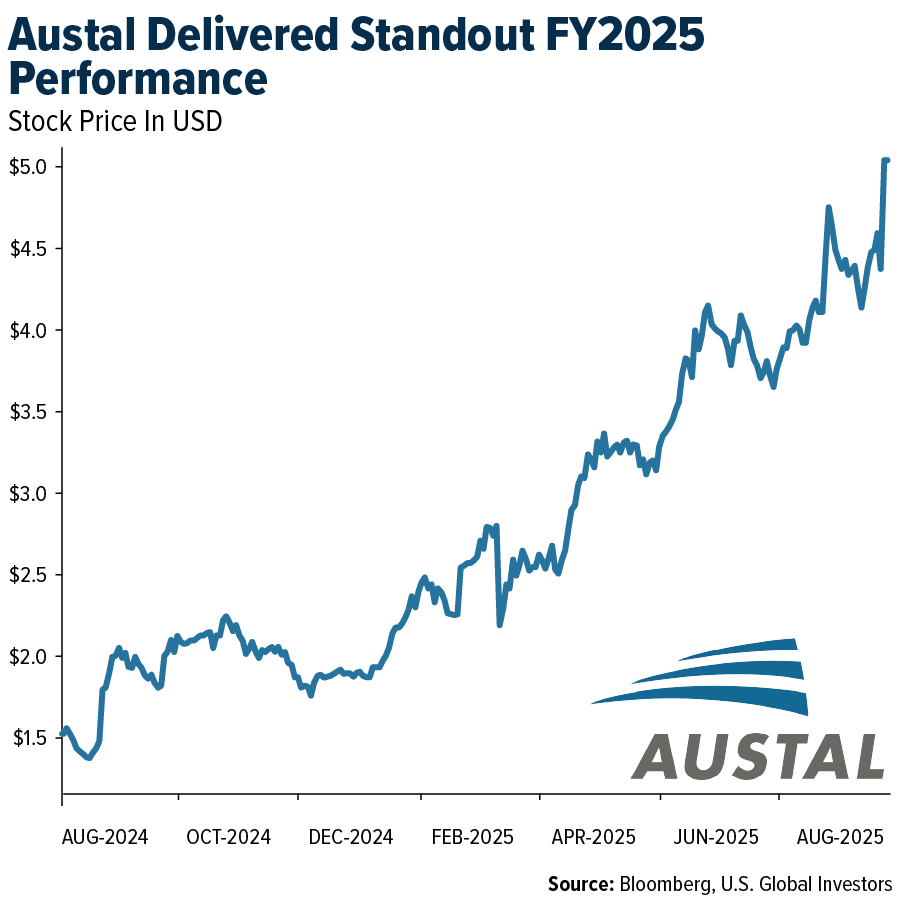

Austal delivered a strong FY2025 performance, with revenue up 24% and earnings per share surging 468% year-over-year, supported by record cash reserves and a near-record A$13.1 billion order book. The results, driven by government contracts and operational improvements, pushed the stock to record highs and signaled confidence in the company’s long-term growth outlook.

The U.S. Army is teaming up with USC’s Institute for Creative Technologies to weave AI into training and cyber defense, betting that algorithms can shape future battles as much as tanks and artillery.

The best-performing stock this week in the XAR ETF was Rocket Lab Corp, rising 9.51% after its 70th successful Electron launch, a $23.9 million CHIPS Act grant to expand U.S. semiconductor production, and a wave of bullish analyst upgrades boosted investor confidence.

Weaknesses

The two-week deadline for peace talks passed without a meeting between Putin and Zelensky. Ukraine ramped up strikes inside Russia, including attacks on the Druzhba oil pipeline, straining ties with Hungary. In response, Russia launched one of its largest attacks on Kyiv, killing 21 civilians, while the U.S. approved the sale of 3,000 ERAM missiles worth $825 million.

AMD and Intel announced price cuts of up to 50% on high-end server chips—including AMD’s EPYC 9965 and Intel’s Xeon 6980P—amid rising competition and shifting market dynamics.

The worst-performing stock this week in the XAR ETF was Archer Aviation, falling 7.45% after disappointing quarterly losses, insider share sales, and growing skepticism over the eVTOL sector’s long path to profitability.

Opportunities

Lockheed Martin announced a partnership with Rheinmetall to manufacture missiles—including ATACMS and Hellfire variants—in Germany.

NVIDIA’s new Blackwell GPUs are expected to account for over 80% of its high-end shipments in 2025. Surging AI data center demand is driving orders from Foxconn, Supermicro, Quanta, and Wiwynn, with liquid cooling becoming the standard setup.

TSMC announced it will remove Chinese manufacturing equipment from its 2-nanometer chip production lines to avoid potential U.S. sanctions under the proposed Chip EQUIP Act, which targets “foreign entities of concern” such as Chinese suppliers. The company is also reviewing its supply chain to reduce dependence on Chinese materials and chemicals.

Threats

Check Point researchers uncovered a social engineering campaign called ZipLine, in which attackers target U.S. supply chain–critical manufacturers by posing as legitimate contacts through company “Contact Us” forms. They build weeks of trust using fake NDAs and AI-themed pitches, ultimately delivering weaponized ZIP files that install the stealthy MixShell malware.

President Trump has threatened to impose 200% tariffs on China over rare-earth magnet exports, a move that could significantly disrupt trade relations and global supply chains.

Ukrainian intelligence discovered a Russian drone built mostly with Chinese components that hijacks mobile networks to stream live video, strike targets, or overwhelm air defenses—highlighting Moscow’s growing dependence on Chinese military technology.

Gold Market

This week gold futures closed at $3,516.9, up $98.4 per ounce, or 2.88%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week higher by 4.82%. The S&P/TSX Venture Index came in up 3.16%. The U.S. Trade-Weighted Dollar rose 0.05%.

Strengths

The best-performing precious metal for the week was silver, up 3.12%, and ending the month higher by 9.98%, making it the strongest performer among precious metals for the month. For the first time since 1996, foreign central banks now hold a larger share of their international reserves in gold than in U.S. Treasuries, a significant shift in the global financial landscape, as noted by Otavio (Tavi) Costa, a macro strategist at Crescat Capital, on X.

According to JP Morgan, Ramelius’ FY25 EBITDA of $819 million beat consensus by 5%, driven by lower expenses. Profit after tax came in at $476 million, 4% above expectations.

Equinox announced the start of ore processing at the Valentine mine and remains on track for first gold pour by late September, with nameplate capacity expected in Q2 2026, according to BMO.

Weaknesses

Palladium was the worst-performing precious metal of the week, down 0.89%, and also the worst for the month, falling 8.00%, a possible sign of weakening industrial demand. West African Resources Ltd. was halted after the Burkina Faso government moved to acquire a 35% stake in its newly built Kiaka gold mine. The government already holds a 15% free-carried interest, and the 2024 mining code allows such equity participation, according to Raymond James.

Orezone Gold Corp., where the Burkina Faso government holds a 10% free-carried interest, saw its share price fall nearly 15% on speculation it could be next after West African’s announcement.

Harmony Gold Mining Co. Ltd. dropped 14% in U.S. trading after full-year net income missed expectations. BMO’s Raj Jay noted lower production guidance, along with higher costs and capital spending. In a strong gold market, missing guidance is costly to shareholders.

Opportunities

Vietnam will end its state monopoly on gold imports and exports, aiming to close the gap between local and global prices. The move could also boost demand as the premium disappears.

Newmont Corp., the world’s largest gold miner, is considering major cost-cutting measures—including job cuts—after its $15 billion acquisition of Newcrest. Costs have surged, with all-in sustaining costs hitting a record in 2025, according to Bloomberg.

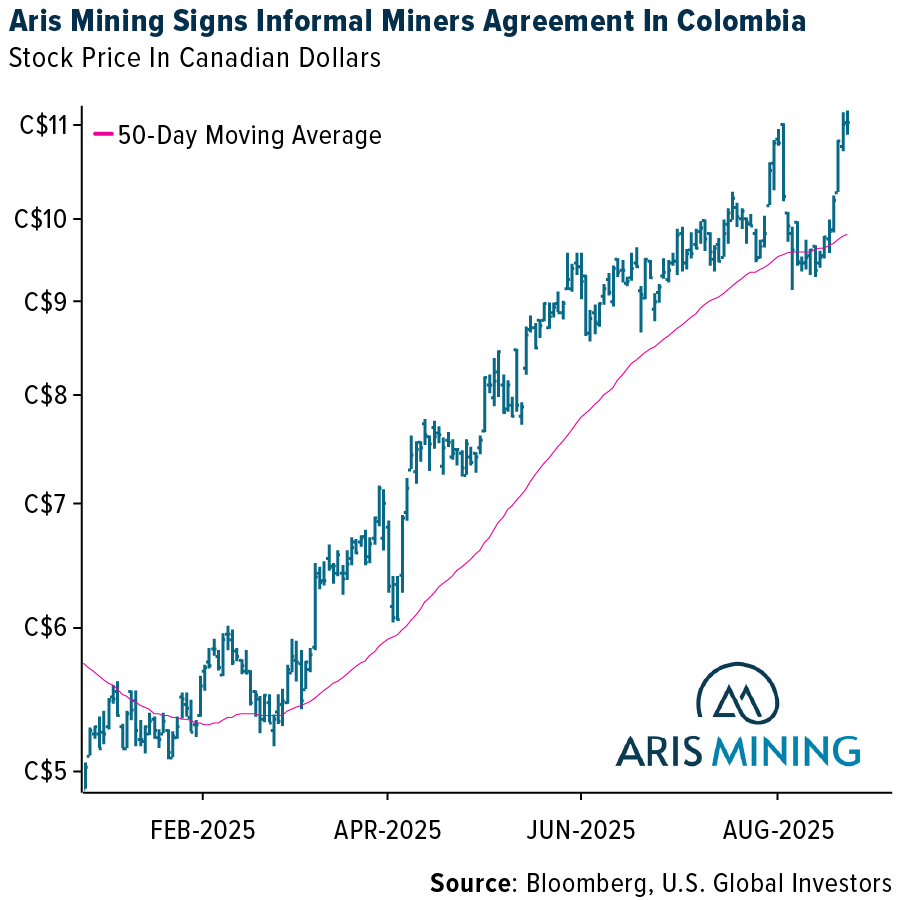

Aris Mining has partnered with 2,500 small-scale miners, who now produce 45% of output from its Segovia mine in Colombia. Instead of evicting them, Aris provides support and buys their gold—offering a more cooperative model than other miners in the region.

Threats

Botswana President Duma Boko has declared a public health emergency and launched a $348 million response plan after a prolonged slump in diamond sales dried up funding for medical supplies. The military is now leading an emergency distribution effort following the collapse of the national medical supply chain, Boko said in a televised address Monday.

Harmony Gold is guiding FY25 EPS to between R21.90 and R25 per share (+18% to +35% year-over-year), missing Bloomberg and Visible Alpha consensus estimates of R28.96 and R32.10, respectively, according to Morgan Stanley.

Hochschild Mining shares fell as much as 20% after cutting 2025 production guidance at Mara Rosa by 60% to 35–45K ounces, down from the original 94–104K target, following plant issues and a six-week suspension.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2025):

Boeing

Alaska Air Group

Copa Holdings

Southwest Airlines

American Airlines

Pernod Ricard

Tesla

Tapestry

Abaxx Technologies

Ramelius’ Resources

Orezone Gold Corp

Harmony Gold Mining

Newmont Mining Corp

Aris Mining Corp

Harmony Gold

Hochschild Mining

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.