Created on August 31, 2025

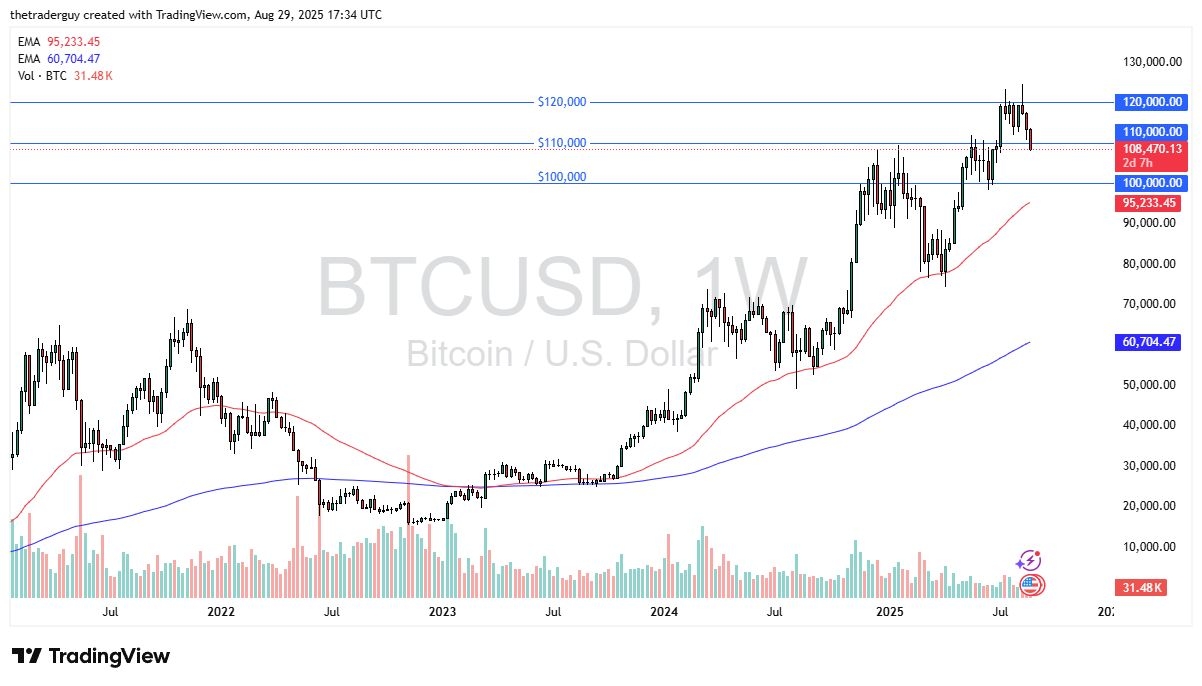

Bitcoin has fallen rather hard during the trading week, breaking below the crucial $110,000 level. This is a large, round, psychologically significant figure, and an area that a lot of people will be paying attention to. The fact that we have broken below it is not a good sign, and the fact that the NASDAQ 100 seems to be falling apart will put quite a bit of negative pressure on Bitcoin as risk appetite is struggling. At this point, it would not surprise me at all to see Bitcoin continue to fall, but I would anticipate that the $100,000 level offering support.

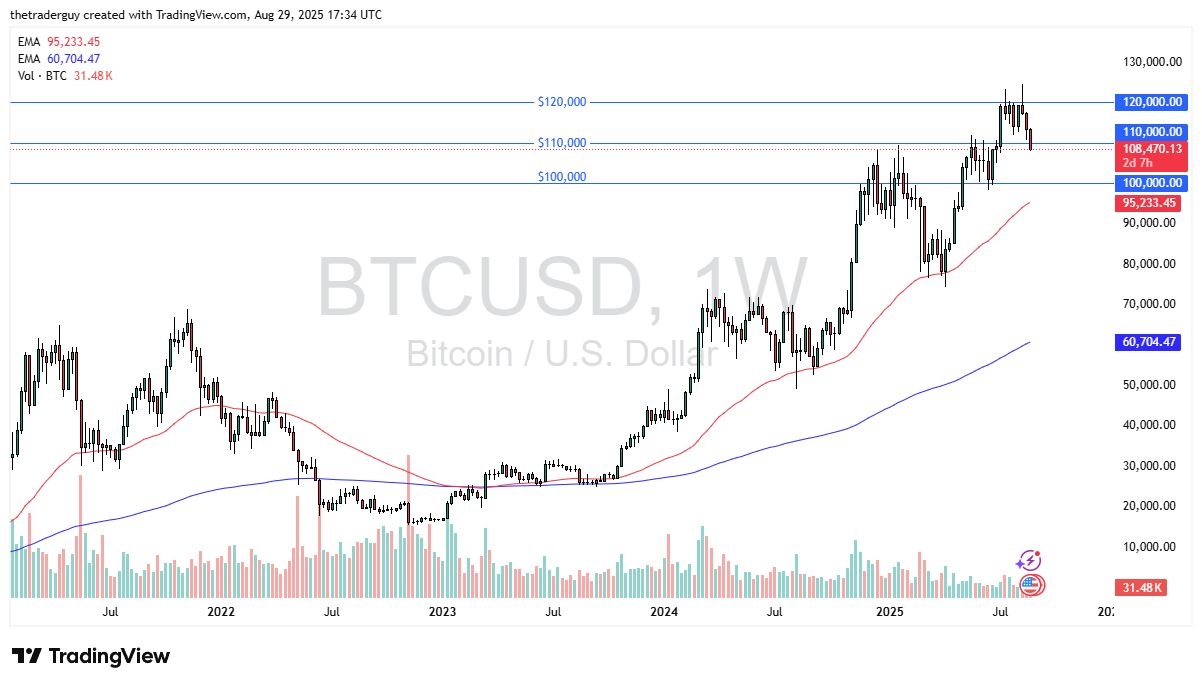

Gold had a very strong week, and as the stock markets fell rather hard on Friday, we have seen gold markets break above the $3500 level yet again, and it looks like we are getting ready to make a move to the upside. Ultimately, short-term pullbacks will continue to be buying opportunities in the gold market, and I don’t have any interest whatsoever in trying to short this market. Quite frankly, gold EE is getting ready to make a move much higher, with a “measured move” suggesting that we get to the $3800 level based on the ascending triangle that’s about to be broken out of.

The German index fell during the course of the week and now finds itself in the middle of the larger consolidation range. The 23,250 level begins the massive support underneath, with the 24,600 level above offering significant resistance. Ultimately, this is a market that will continue to look at sideways action is the most likely of moves, but if we were to break down below the €23,000 level, this is a market that could start to fall apart. Global indices on the whole look weak suddenly.

The US dollar initially rallied for the week but continues to see a lot of noise near the ¥148 level. This has been massive resistance, and it’s hard to ignore the fact that we have formed a couple of shooting stars in a row. While I do believe that we eventually break higher, we have seen interest rates in Japan skyrocket in the thirty-year market, right along with the American bond market. This seems to be helping the Japanese yen in the short term but longer term I believe that the Bank of Japan will get involved, thereby working against the value of the yen. We need to have a daily close above ¥148 level to see this market start taking off again. If we break down below the ¥146 level, then we could drop to the ¥144 level.

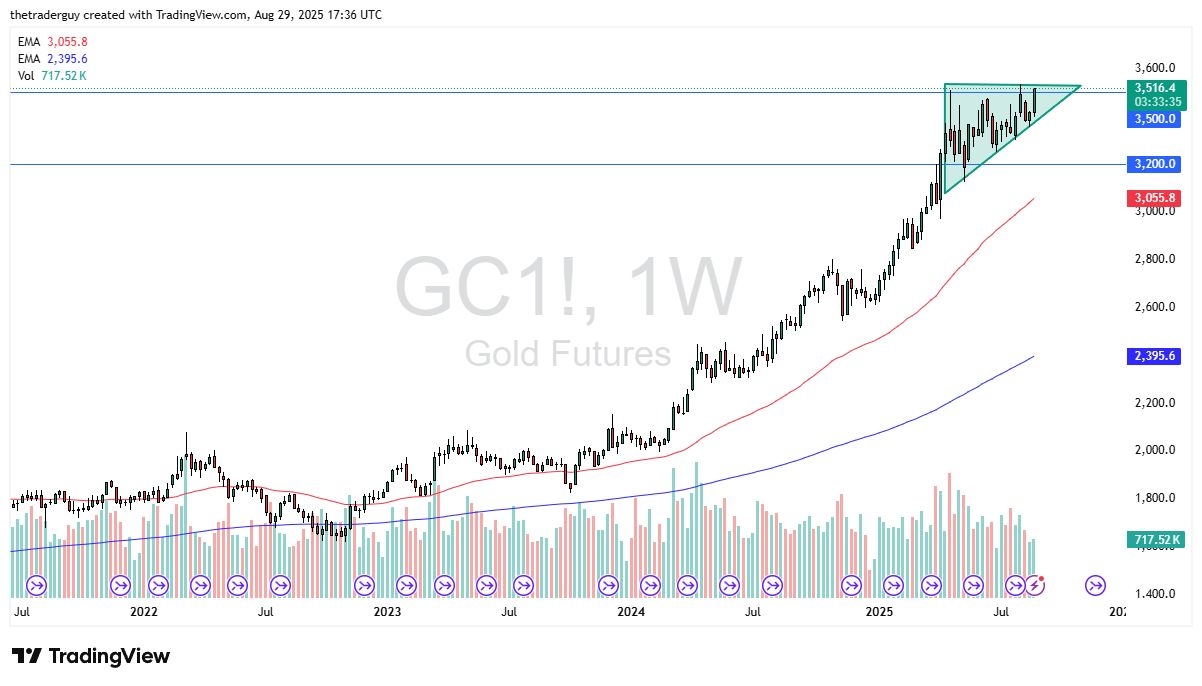

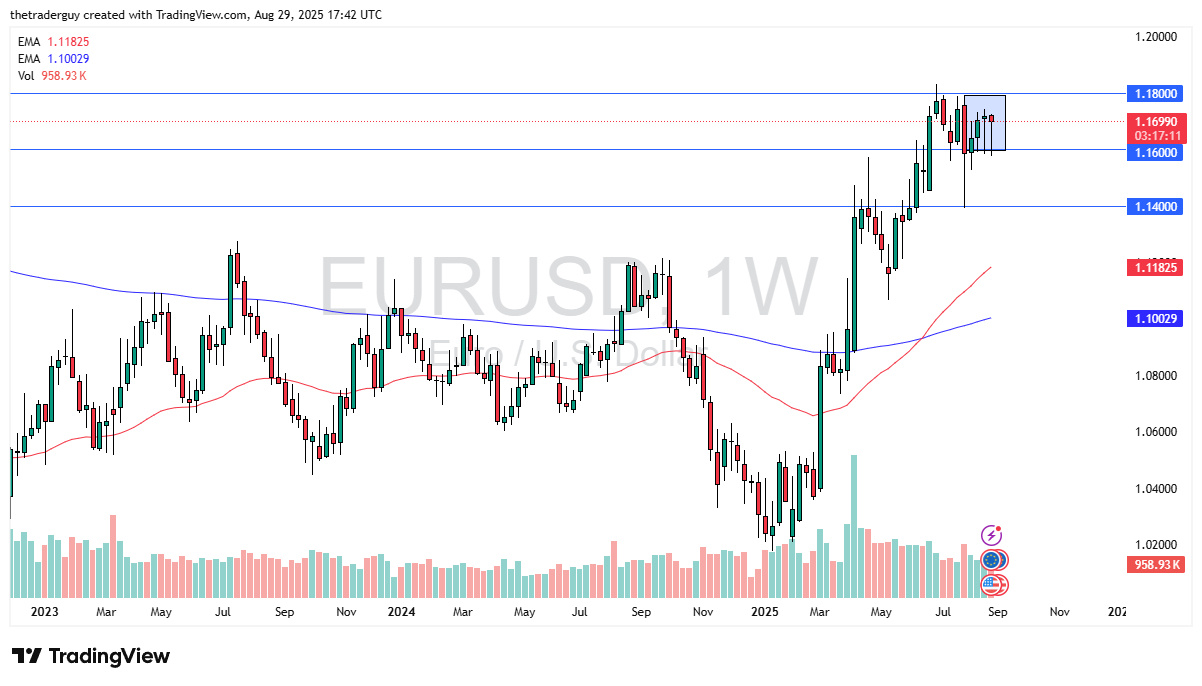

The euro plunged during most of the week, but just as we had seen during the previous week, the buyers came back to lift the market. We are currently in a trading range at the moment, with the 1.16 level underneath offering support, with the 1.18 level above offering resistance. Ultimately, this is a market that doesn’t have anywhere to be, but if we do start to see the US dollar fall apart, a break above the 1.18 level could open up a move to the 1.20 level after that.

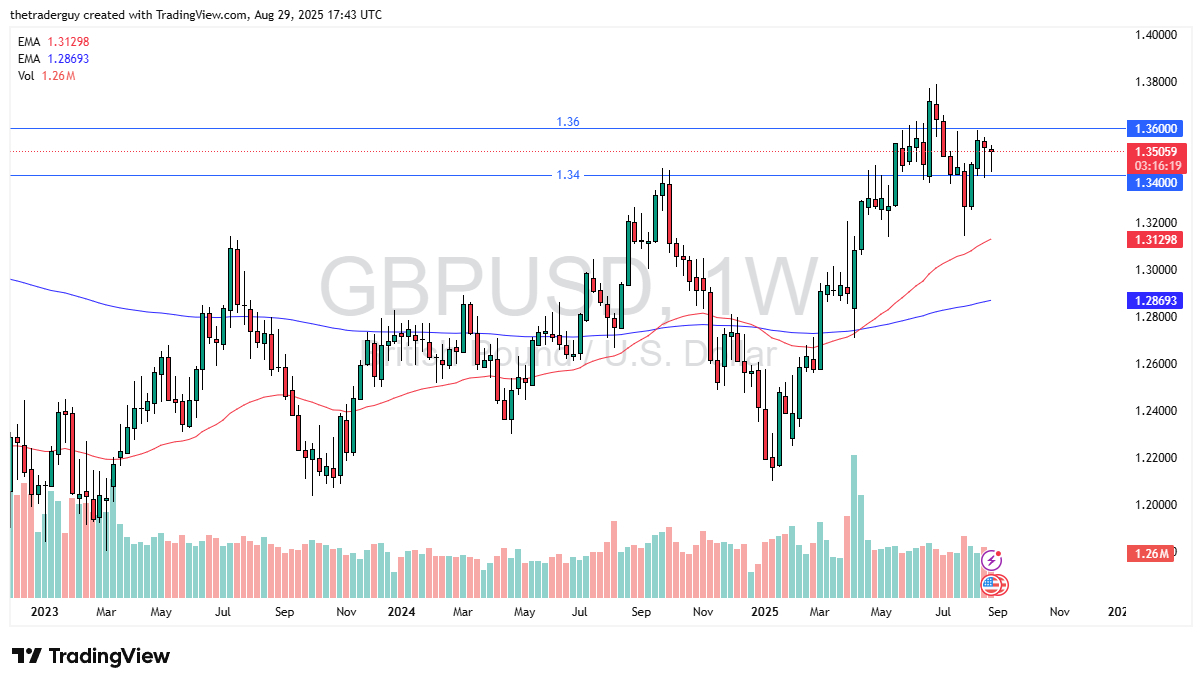

The British pound has done the exact same thing the euro has done during the course of the week, initially falling, but in this case, we are talking about fighting support at the crucial 1.34 level. The 1.36 level above is significant resistance, and we find ourselves right in the middle of this overall consolidation range, and therefore we have to be very cautious about putting a lot of money into work. However, if we were to break above the 1.36 level, that could open up a move back to the 1.38 level.

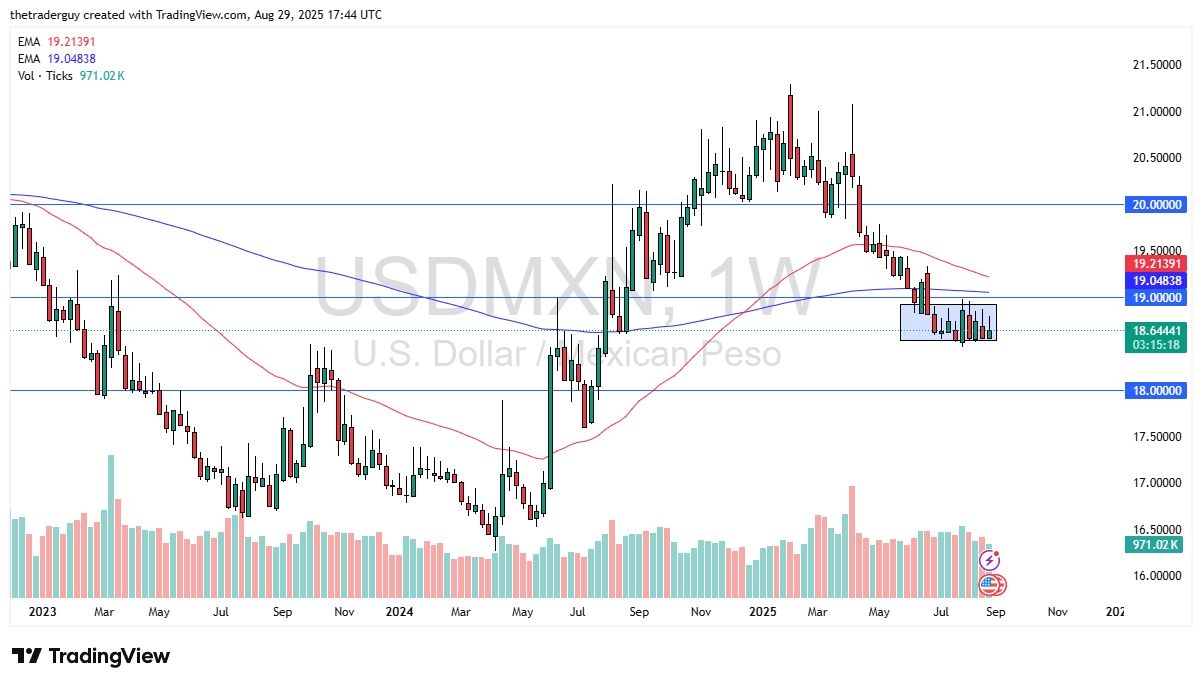

The US dollar rallied during the course of the week again against the Mexican peso, but it’s also worth noting that the wick on the top of the candlestick is lower than the previous ones. Because of this, it looks like we are squeezing down to the downside and trying to break down below the crucial 18.50 MXN level, and when we do it probably sends the US dollar down to the 18 MXN level below, which of course is a large, round, psychologically significant figure, and an area that will attract a lot of headlines. If we can turn around a break above the 19 MXN level, then perhaps we will start to rally again.

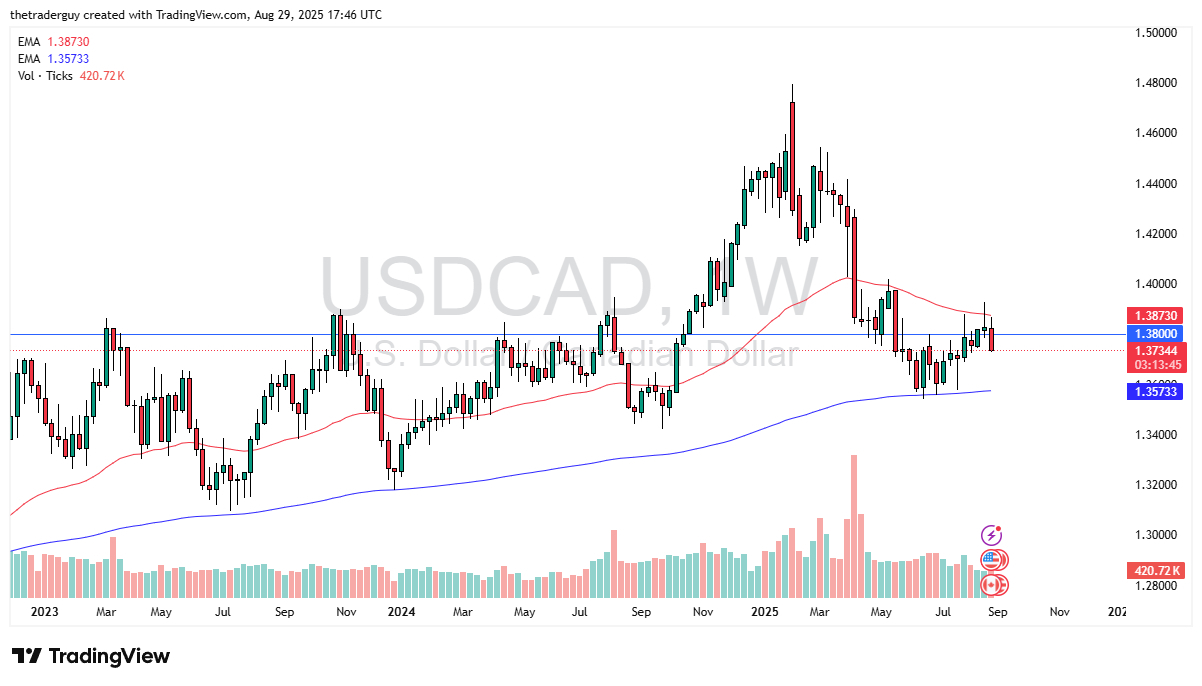

The US dollar initially tried to rally against the Canadian dollar for the week but found a lot of trouble at the 50 Week EMA. We are now below the 1.38 level again, but I do anticipate that we would see a lot of support near the 200 Week EMA, just shy of the 1.36 level. While we may drop from here, I’m not looking for anything major, as despite the fact that the US dollar weaken quite a bit on Friday, the reality is that it still fights moves against it, despite the fact that we have interest rate cuts coming.

The British pound initially tried to rally during the course of the week, but found itself falling rather significantly, hanging around the 1.08 level by the time we closed for business on Friday. This shows a decidedly “risk off” attitude, and therefore I think you’ve got a situation where this pair could find itself dropping back down to the 1.07 level. Rallies at this point in time are going to see trouble at the 1.09 level.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.